I’ll keep this article and introduction short. The ClearBridge Energy MLP Fund (NYSE:CEM) and the ClearBridge Energy MLP Opportunity Fund Inc. (NYSE:EMO) are trading at uncharacteristically high discount rates of 47% and 44% respectively. Discount rates are somewhat likely to narrow in the coming days, as they have for other funds in several other occasions, and investors could significantly profit if they indeed do so. Consider a short-term trade of these two funds.

Discount and Premium Rates – Analysis and Context

I’ve been keeping track of discount and premium rates for MLP CEFs for the past couple of days. Due to significant market volatility, and as many of these funds are thinly traded, discount and premium rates for these funds have seen wild swings basically every day, sometimes reaching into the double digits. Traders should be able to leverage these discounts into profitable short-term trades by investing in heavily discounted CEFs, and profiting from narrowing spreads and discounts. Some of these trades have yielded double-digit shareholder returns in the past few days, somewhat independent of underlying market and industry conditions. Let’s take a look at a couple of examples.

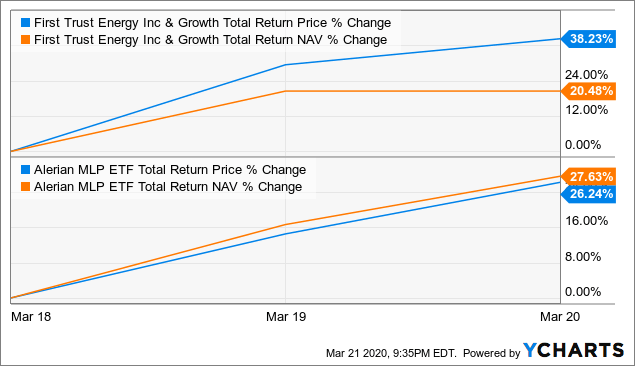

Example 1: First Trust Energy Income & Growth Fund (FEN)

FEN had an uncharacteristically large discount to NAV of 18% this past March 18, the largest discount rate in the fund’s entire history.

FEN’s shareholders have seen massive 38% returns since, vastly outpacing underlying NAV returns, or broader industry performance. Simply put, discounts narrowed, and shareholders profited:

Data by YCharts

Data by YCharts

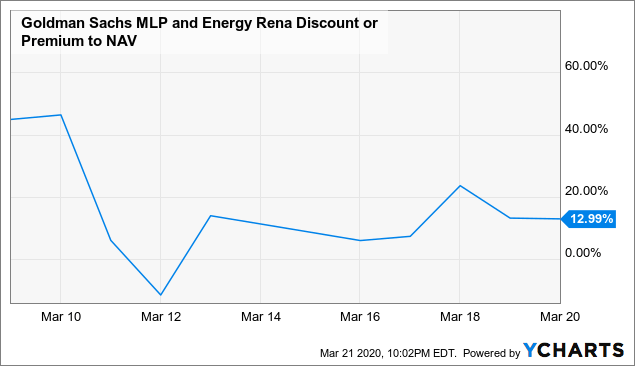

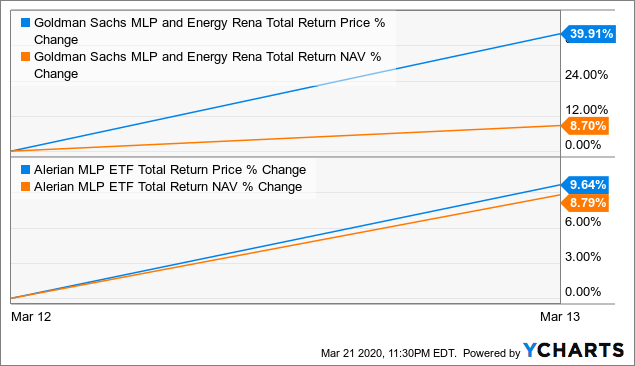

Example 2: Goldman Sachs MLP and Energy Renaissance Fund (GER)

GER had an uncharacteristically high discount rate of 12% during March 12. The fund’s investment managers had misstated NAV values in the days before, and investors dumped the stock once more accurate, and lower, figures were presented:

Data by YCharts

Data by YCharts

GER’s shareholders saw returns of 40% the next day, vastly outpacing both underlying NAV returns and broader industry performance. Once again, discounts narrowed and shareholders profited:

Data by YCharts

Data by YCharts

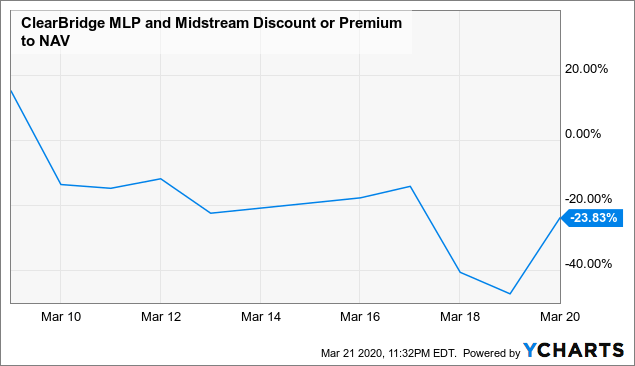

Example 3: ClearBridge Energy MLP Fund

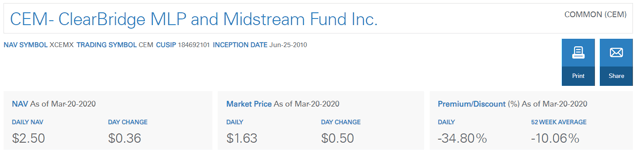

CEM had a whopping 47% discount to NAV this past March 19, highest in the fund’s history, and one of the largest discounts I’ve personally ever seen:

Data by YCharts

Data by YCharts

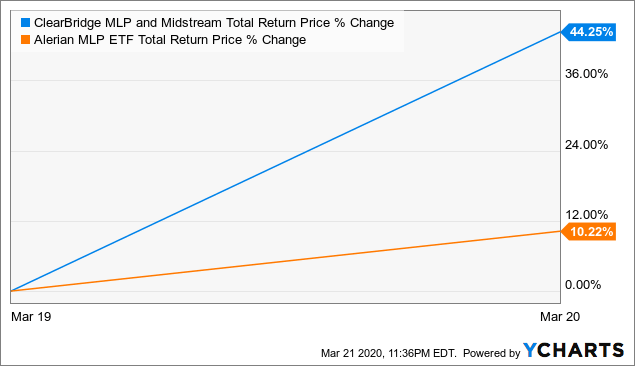

CEM’s shareholders saw returns of 44.25% the next day, vastly outpacing both underlying NAV returns and broader industry performance. As with FEN and GER, discounts narrowed and shareholders saw some very hefty profits:

Data by YCharts

Data by YCharts

(Source: CEM Corporate Website)

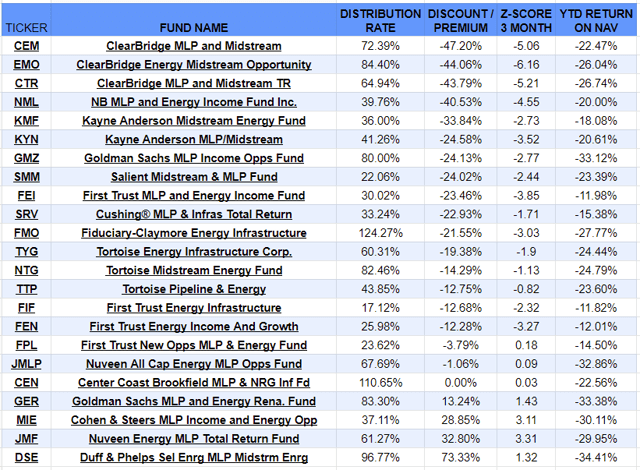

In my opinion, and taking into consideration the above, short-term trading in heavily discounted MLP CEFs could very easily net traders double-digit daily returns. Due to this, I decided to see which of these CEFs currently offer the largest discounts, results are as follow:

(Source: Cefconnect.com)

I think that both CEM and EMO are reasonable trading opportunities as they both trade at very sizable discounts to NAV, are reasonably large funds with $115M and $78M in AUMs, and generally see sensible levels of volume and liquidity. Both funds also offer completely unsustainable, patently ridiculous, distribution rates of 72% and 84%, respectively. At these levels, the funds are rapidly liquidating themselves, usually a bad sign. In this particular case, however, self-liquidations are somewhat of a positive, as assets would be sold and distributed to shareholders at NAV, effectively narrowing the fund’s discount.

Conclusion – Consider Short-term Trading CEM and EMO

Short-term trading of heavily discounted MLP CEFs has generated significant shareholder returns in the past and will, I believe, continue to do so in the future. Interested readers should consider a short-term investment in CEM and EMO to possibly profit from narrowing discounts. Traders should also use appropriate limit orders, as these funds are somewhat thinly traded.

Traders should also consider monitoring some of these CEFs for further trading opportunities. I’ve personally seen funds trading at unsustainable discounts and premiums in the past few days, and seen, in real time, how these discounts and premiums narrow, causing double-digit shareholder returns or losses in the matter of hours. Trading opportunities abound.

As a final point, all of the securities and trades mentioned in the article are of very high risk and only appropriate for less risk-averse investors. Retirees, income investors, and those with little trading experience or the ability and the stomach to withstand double-digit swings in their returns in a matter of hours should invest or trade elsewhere.

Thanks for reading! If you liked this article, please scroll up and click “Follow” next to my name to receive future updates.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment