Antonio Masiello/Getty Images News

Investment Thesis

Celsius Holdings (NASDAQ:CELH) is an energy beverage drink company that is achieving remarkable growth rates due to the shift towards a healthier lifestyle, its growing product portfolio, and expanding distribution footprint as a result of its direct-store-delivery (“DSD”) model via premier distributors. However, despite the exceptional execution, I believe its high valuation makes this a poor investment for now.

Accelerating Growth Rates

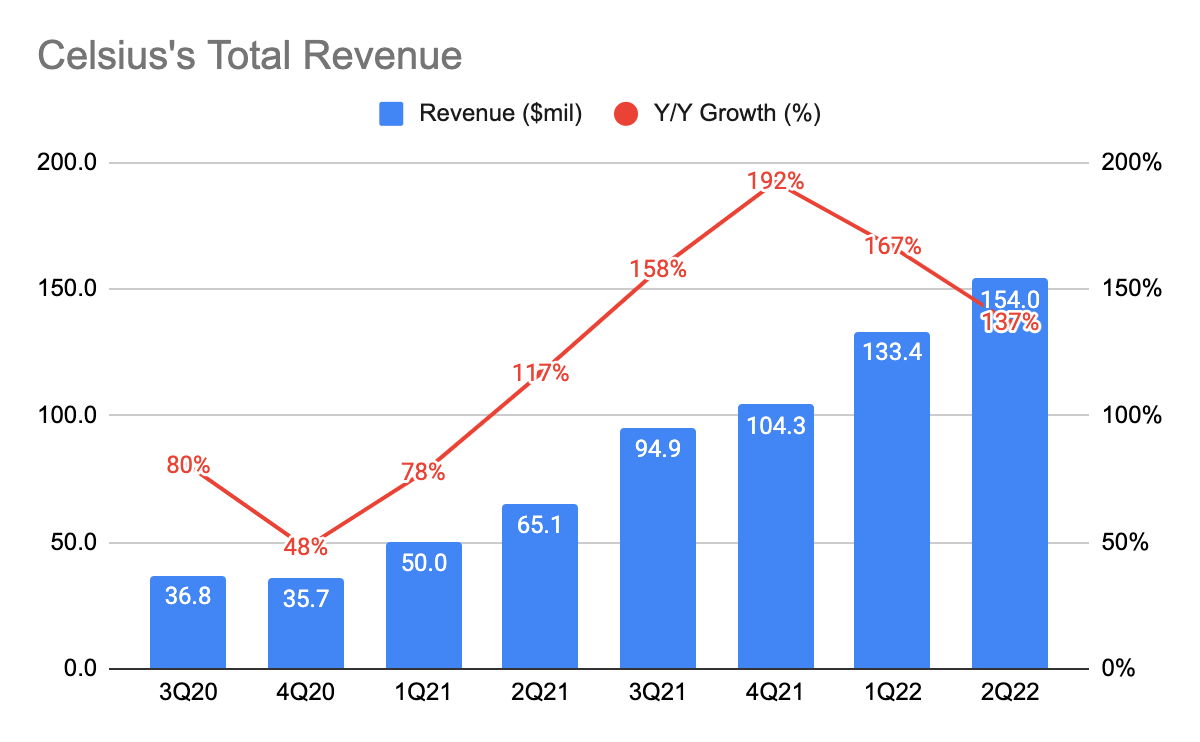

Celsius Holdings Quarterly Report

Celsius’s growth has been mind-boggling since its transition from a wholesale direct model to a DSD model as its revenue accelerated from 80% Y/Y growth from 3Q20 to 137% in 2Q22. In the past, their products were selling too quickly and they could not get them restocked in time via a wholesale direct model. Using a DSD model solves lots of issues as the company is working with premier distributors such as MillerCoors, Big Geyer, and more recently, PepsiCo (PEP). These distributors helped to expand Celsius’s in-store presence by making its products visible on retailers’ shelves, and importantly, eliminating the out-of-stock issue. This ultimately helps the company to scale very quickly with little to no bottlenecks. Here’s what the management has to say in the 2Q20 earnings call:

“Continue to work with key retailers to flip them over from a wholesaler direct model to the DSD partners. Just due to the velocity, we’re seeing better in-stocks, better placements, better execution, Celsius is just turning at such a high rate we really need that additional touchpoints at retail”

Aside from the DSD model, the growth was also driven by other factors such as its growing product portfolio and customers adopting more products, and the shift towards a healthier lifestyle puts the company as a favorable brand for consumers looking for healthier options.

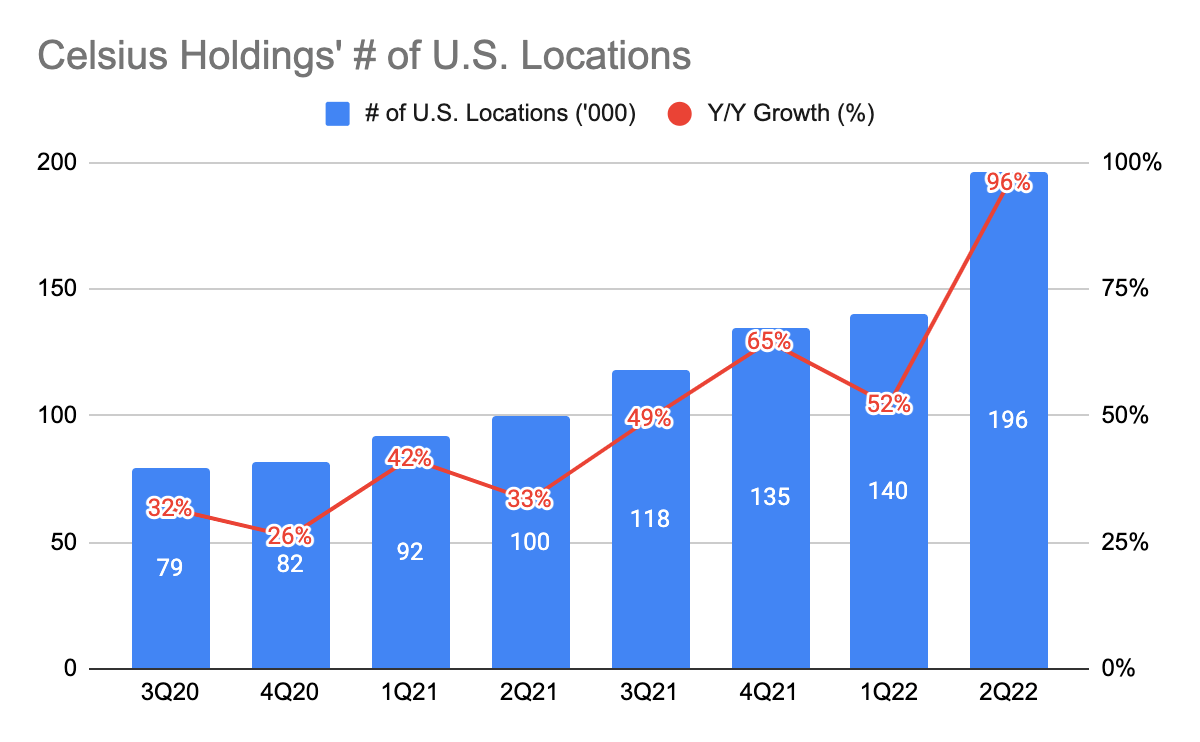

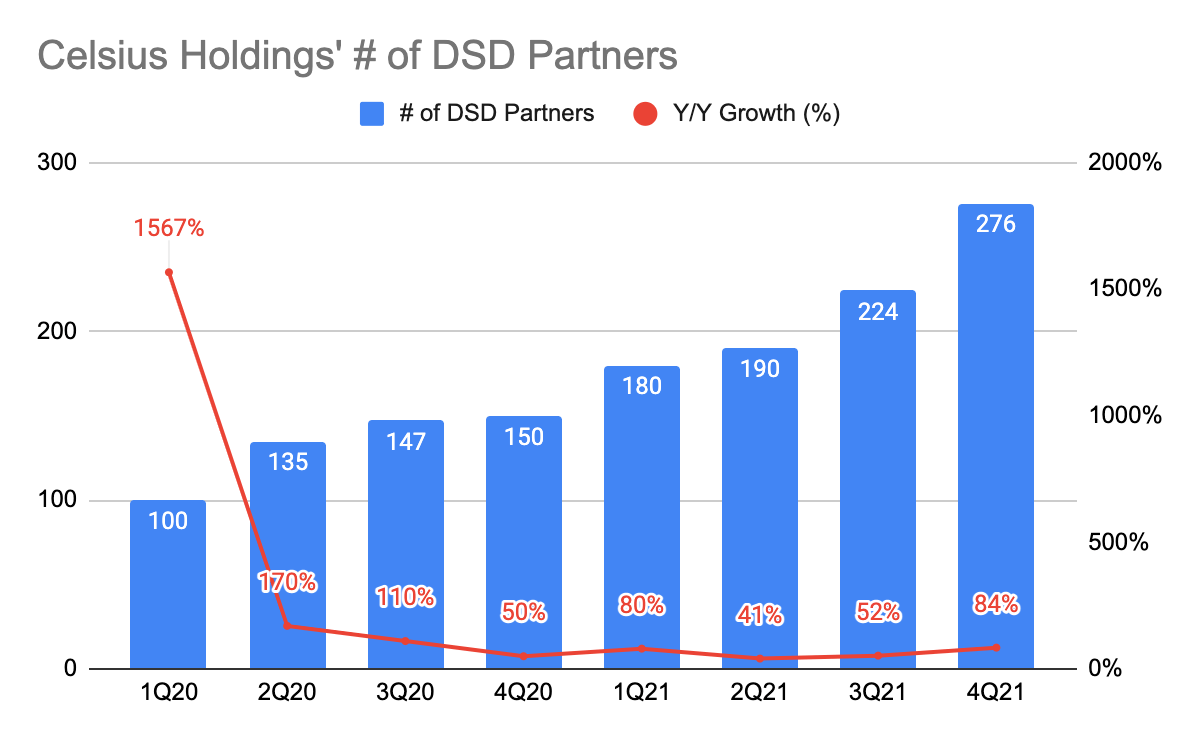

Celsius Holdings Quarterly Report/Press Releases/Earnings Transcripts Celsius Holdings Quarterly Report/Press Releases/Earnings Transcripts

Over time, the number of premier distributors grew very quickly to 276 in 4Q21 (it stopped reporting the figures afterward), and the DSD model has resulted in an acceleration in the number of U.S. locations with its growth peaking at 96% Y/Y in 2Q22.

This shows how quickly Celsius is growing its presence in the U.S. and it speaks to the importance of having premier distributors. As Celsius’ presence continues to enlarge, it will become an increasingly essential partner to these distributors due to its large sales volume, and this means that distributors may likely prioritize its products on retailers’ shelves.

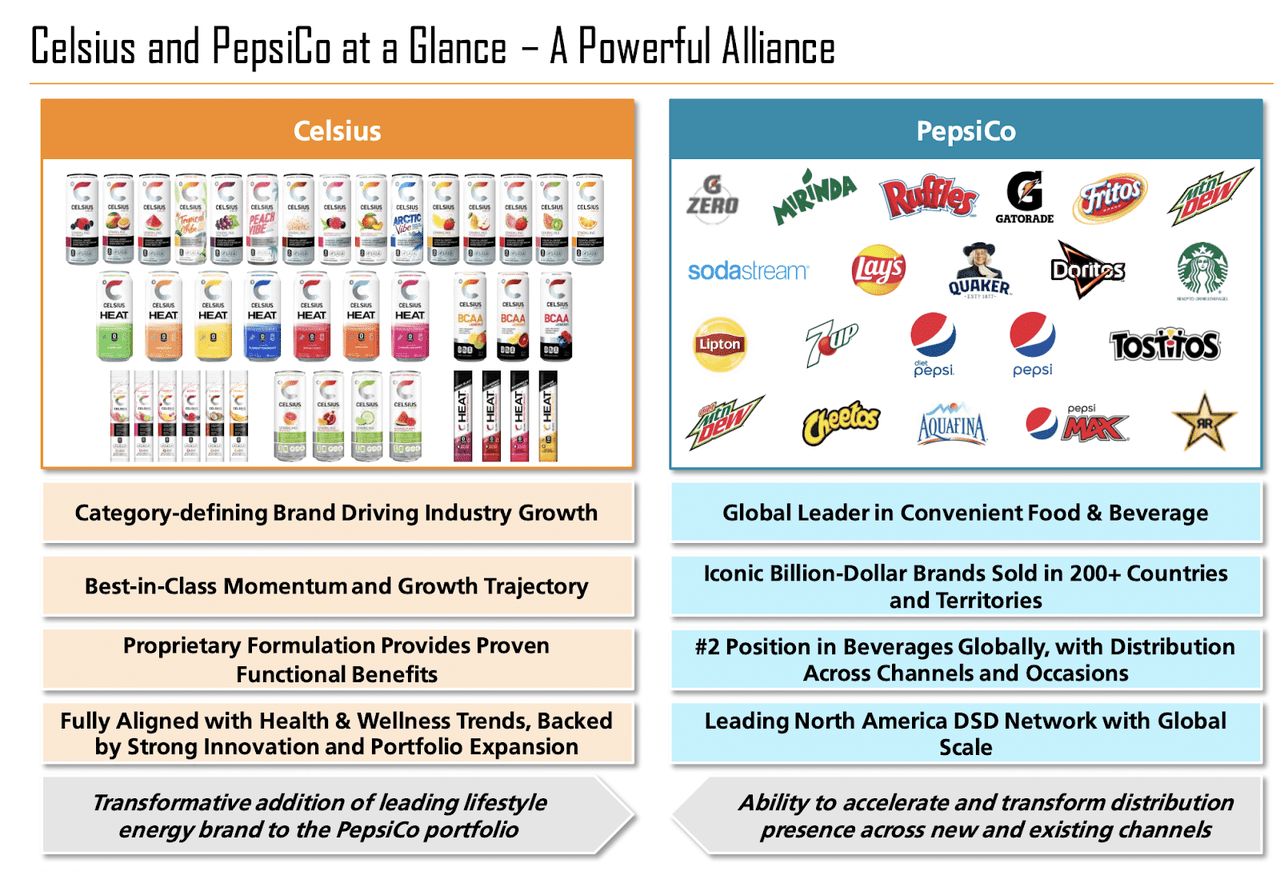

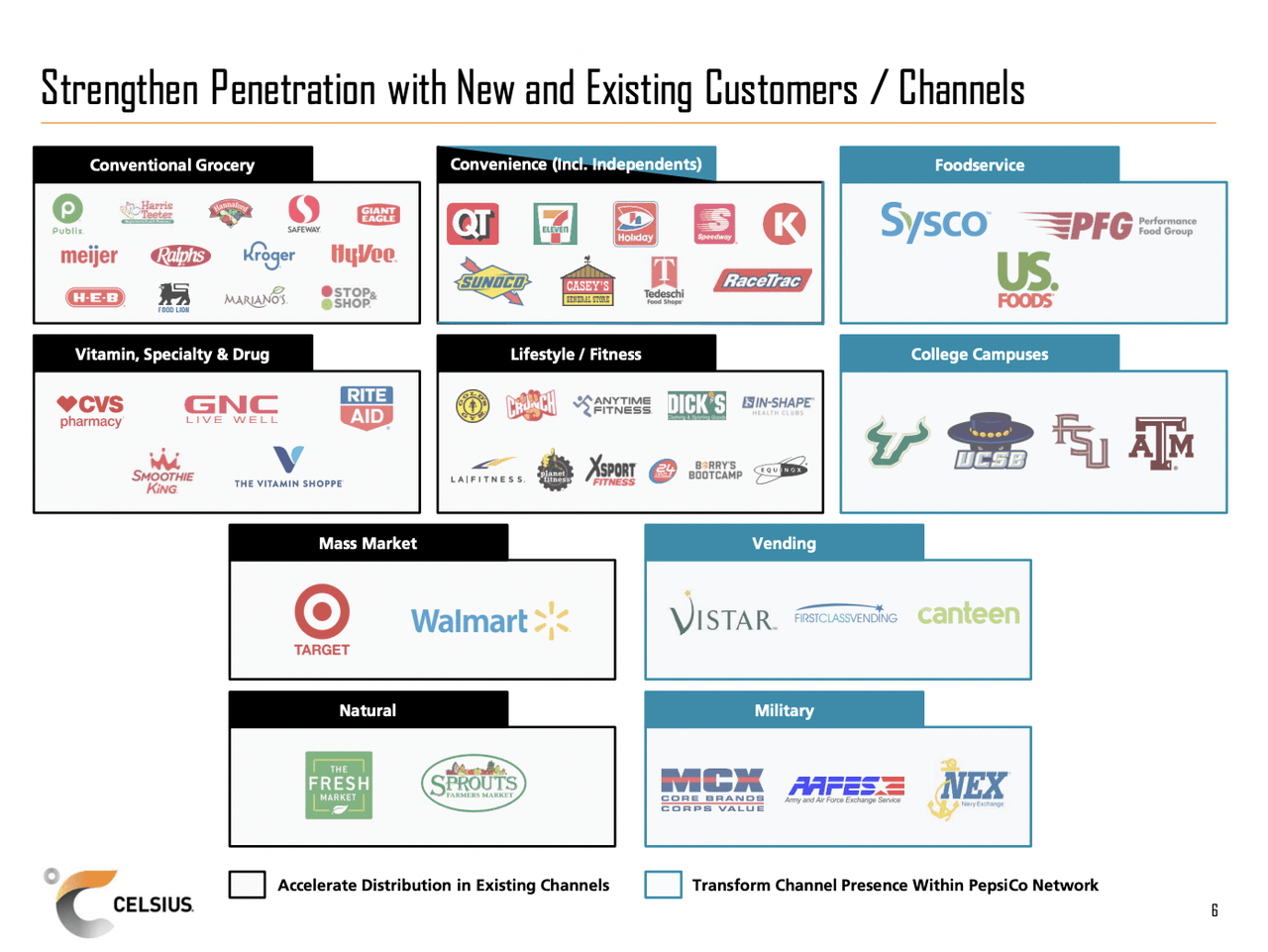

Celsius Holdings-PepsiCo Investor Presentation Celsius Holdings-PepsiCo Investor Presentation

More recently, as most investors would’ve already known, Celsius and PepsiCo announced a long-term partnership agreement. It is clear that PepsiCo’s distribution advantage is the key to why Celsius has decided to pursue this deal. Moreover, securing this agreement with PepsiCo enables Celsius to further penetrate both the existing channels and tap into new channels.

The twin engine of Celsius’s powerful brand and the instrumental role that premier distributors play will accelerate its market share. And in my view, PepsiCo receiving equity may indicate that they are confident in Celsius’s growth trajectory, and having a stake in the company allows them to benefit from future share price appreciation. Overall, this is a win-win partnership.

Profitability

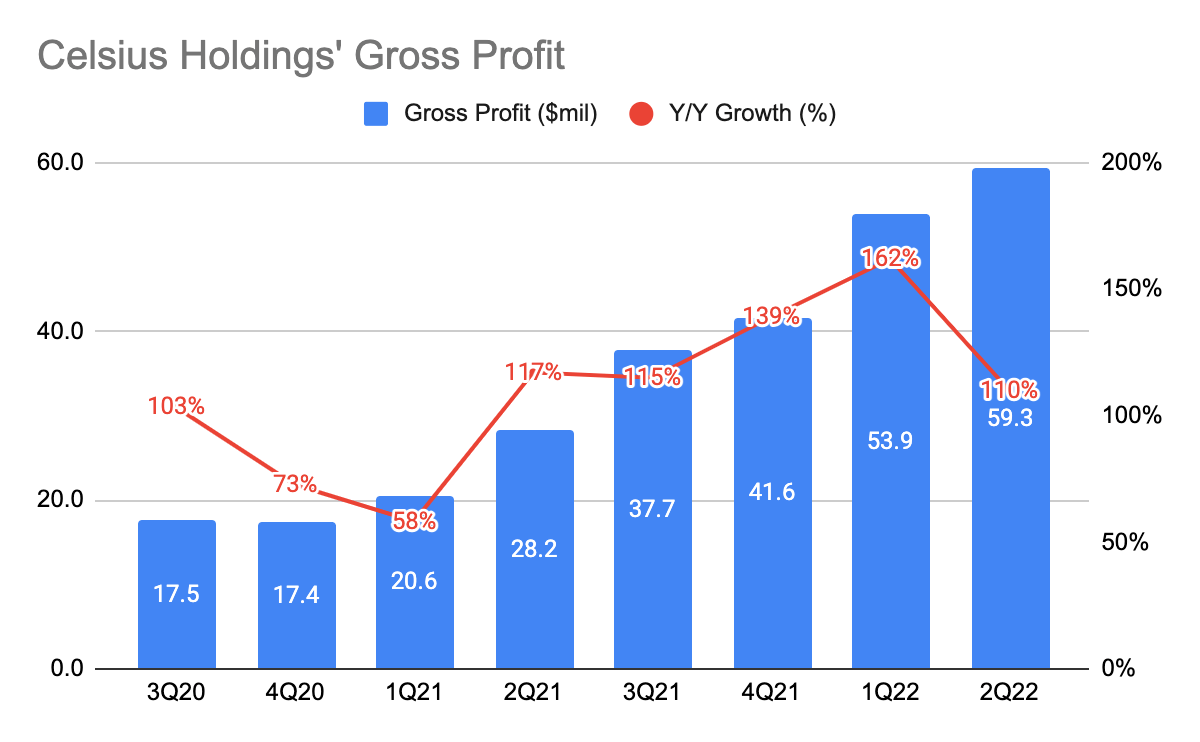

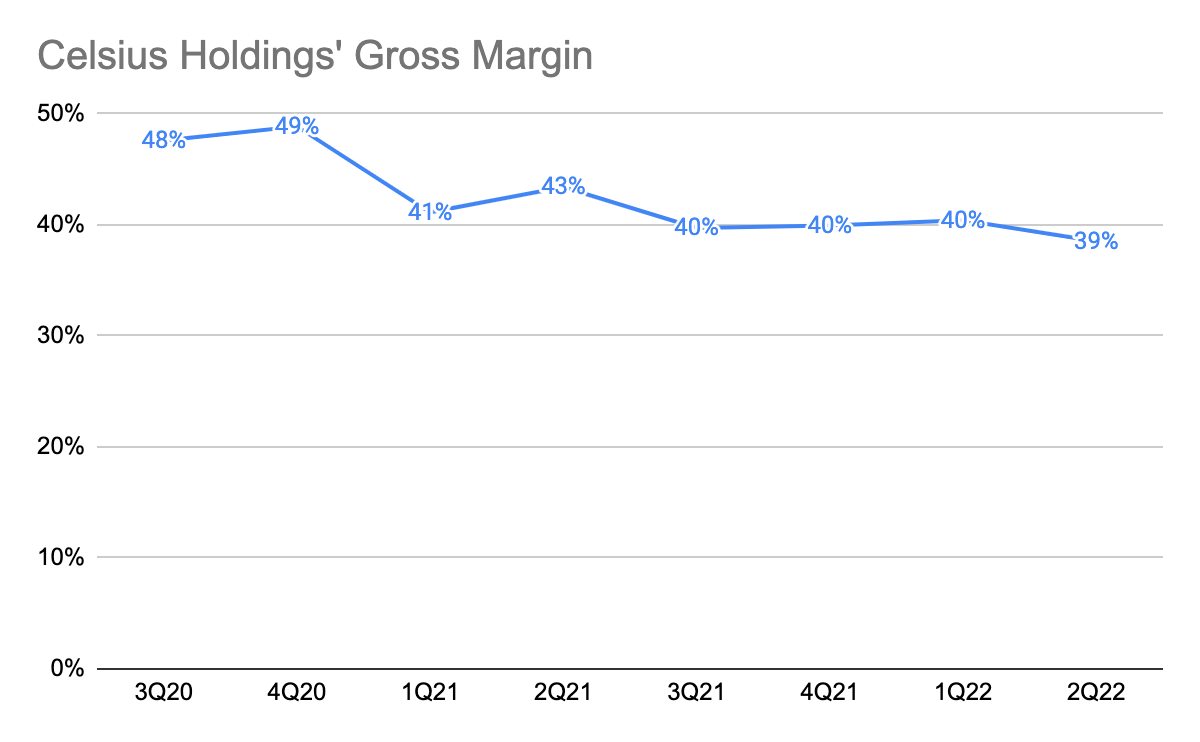

Celsius Holdings Quarterly Report Celsius Holdings Quarterly Report

(Source: Celsius Holdings Quarterly Report)

Its gross profit dollars also have been growing quickly with increasing revenue, although, the gross margin has been declining over time. This is primarily due to the higher can prices, and other factors including lower-margin club channel sales, and inflation in the supply chain in relation to higher freight costs, which are not exclusive only to Celsius, but to the entire beverage industry. However, gross margins are expected to resume to 40% by 4Q22.

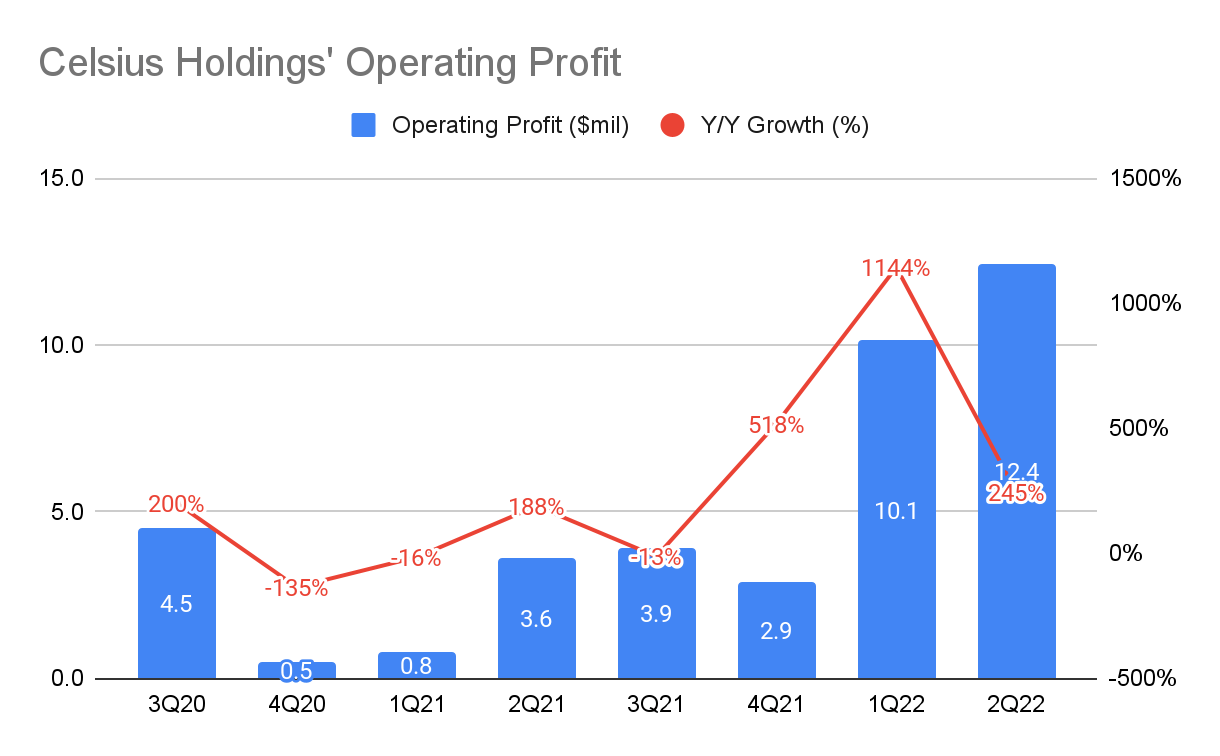

Celsius Holdings Quarterly Report Celsius Holdings Quarterly Report

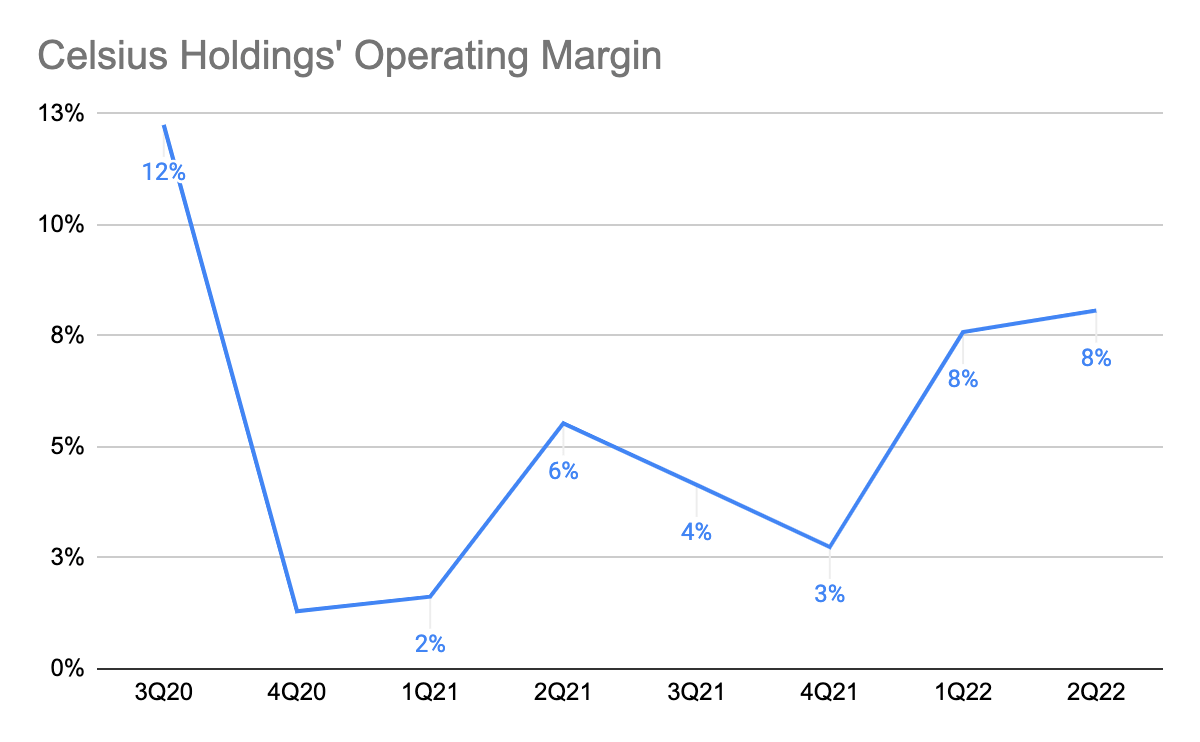

Celsius is extracting strong operating leverage as its operating profit is growing much faster than its revenue growth. As a result, its operating margin has improved from 6% in 2Q21 to 8% this quarter. Keep in mind this is despite the lower gross margin, and this also indicates that they have great operating efficiency.

Valuation

Author’s Image

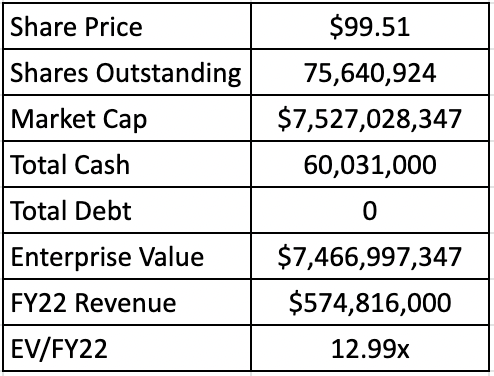

While the management is executing exceptionally, the only issue I have is its high valuation. Without doing a discounted cash flow valuation, we can attempt to find out the current multiple the market is demanding.

Since 2Q and 3Q are seasonally stronger quarters for the company, we can annualize its 1H22 revenue which gives us FY22 revenue of $574 million. Using its current enterprise value of $7.5 billion, this gives us a multiple of 12.99x. Its peers such as Monster Beverage (MNST) and Coke (COKE) have an LTM multiple of 7.28x and 0.81x, respectively. It seems like the market is assigning a premium to the company compared to its peers.

Let’s go a step further. Its current FCF margin is 14% as of 2Q22, and assuming this stabilizes, the FCF multiple is rough 92x (12.99x / 14%). In my view, this seems like a seemingly high multiple to pay, even though, the company has a higher growth rate. This is something for investors to take note of.

Conclusion

The management has been executing brilliantly for the past consecutive quarters after its transition to a DSD model. Since then, its store counts have been growing rapidly, customers are adopting more of its products, and consumers are increasingly shifting to healthier options. And its focus on operating efficiency has also resulted in strong operating leverage. While I do acknowledge its remarkable growth rates, I cannot justify the expensive multiples that the market is demanding, and thus, I see this as the biggest risk for the company.

Do you agree with my views? Let me know in the comment section below!

Be the first to comment