TU IS

Investment Thesis

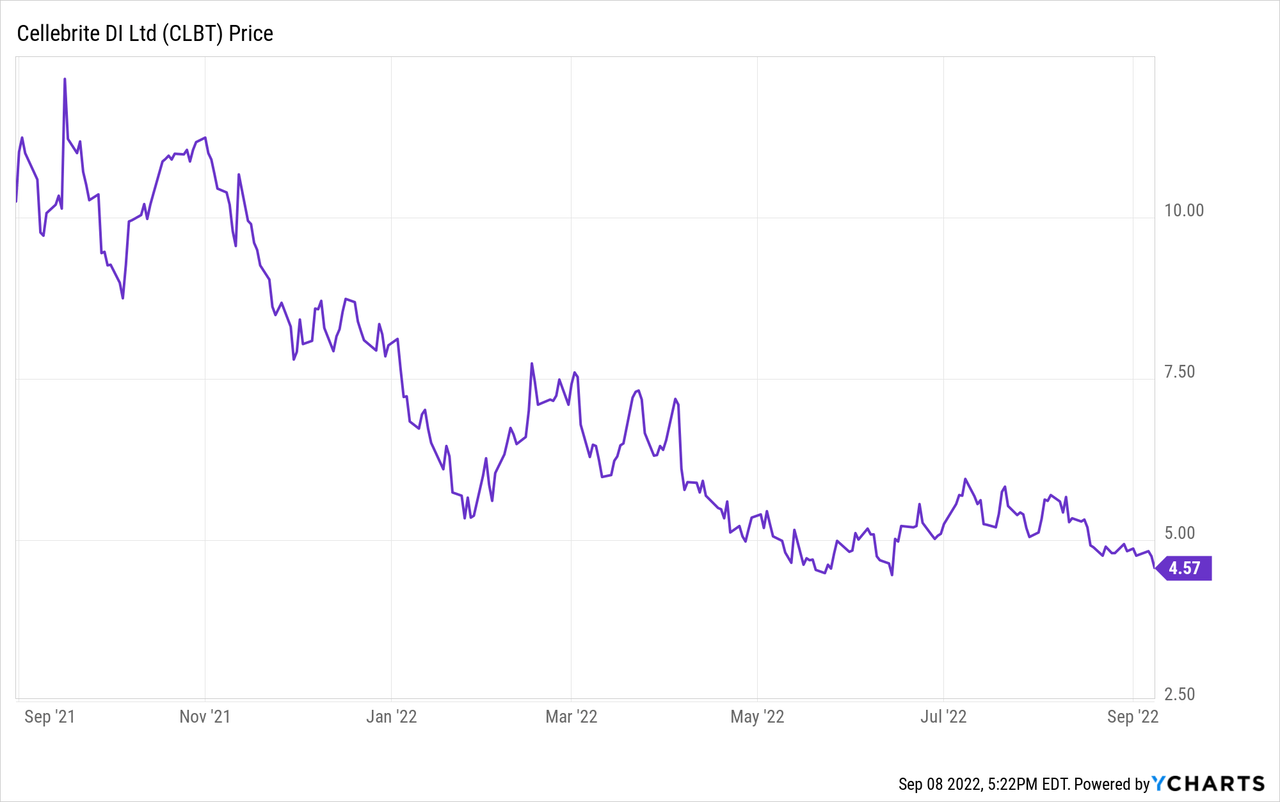

Cellebrite (NASDAQ:CLBT) went public last year via a SPAC merger with TWC Tech Holdings II. Since its IPO, the company’s share price has been trending downwards as it got caught in the broad market sell. It is now trading at $4.00, down over 60% from its all-time high. The current price point appears to be attractive as the company’s fundamentals remain intact. It is operating in a niche industry that benefits from major secular tailwinds. Cellebrite is also transitioning from a listening company to a SaaS company, which will I believe will improve monetization and lift its valuation. The current valuation remains compressed while subscription revenue continues to show resilient growth. Therefore I rate the company as a buy.

Overview

Cellebrite is an Israeli-based company founded back in 2000. The company is a market leader in the digital intelligence space. It partners with public and private organizations to transform how they manage digital intelligence in investigations. The legacy investigative progress is slow and inefficient. A lot of tasks are done manually and data are scattered everywhere, making analyzing and management very tough. As the number of cyber crimes continues to increase, organizations are now seeking better technologies.

Cellebrite is tackling this problem with a comprehensive digital intelligence software platform. The platform offers fast and automated data capturing from digital sources, quick data analysis through advanced AI, and collaborative dashboards for in-sync management. For instance, its collect & review solution allows investigators to bypass security and extract data from different digital sources such as apps, media, messages, and locations. Currently, 100+ North American Federal accounts including the FBI, CIA, and 68 out of the Fortune 100 are using Cellebrite’s solutions.

Growth Opportunities

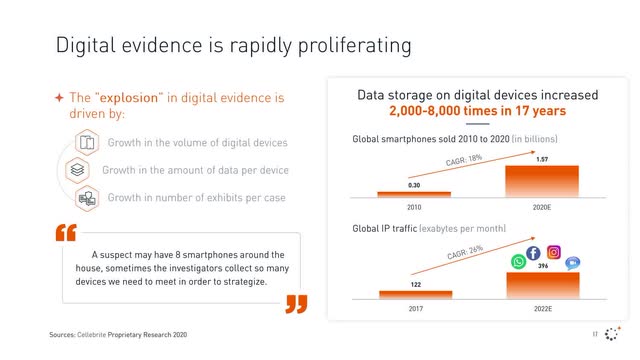

While digital intelligence is a relatively niche industry, the TAM (total addressable market) is actually quite large. According to Cellebrite, the total TAM for the company in 2023 is estimated to be around $15 billion, up from $12 billion in 2021. The analytics, processing, and management segment represent a $10.8 billion market, while the collect and review segment represents a $4.2 billion market. The increase in TAM is largely driven by digital transformation and the increase in digital evidence and cyber crimes.

There is now a much larger volume of data floating around as the number of digital sources and devices increased significantly in the past decade. The complexity and variety of the data are also making access and investigation really hard. Growing data sets require better fusing and analytic capabilities. While increasing complexity in cases also requires better collaborative tools and management. These problems combined result in the need for a more efficient software platform. I believe the number of cyber crimes will continue to increase and the importance of digital evidence will only become more significant, which will provide a strong catalyst for future TAM expansion.

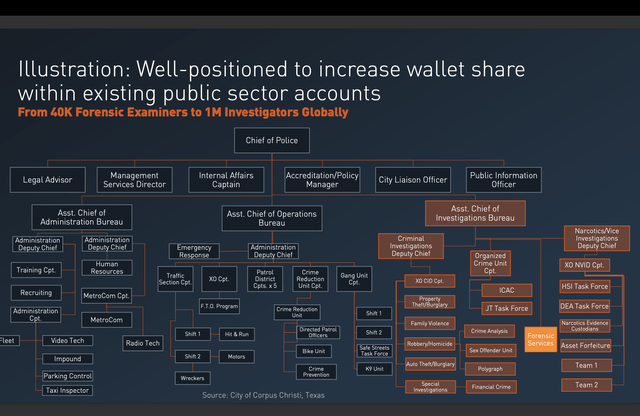

Another growth opportunity is increasing the wallet share among existing customers. A lot of customers are currently only using one or two products within the platform, which presents a great opportunity for the company to sell additional solutions to them. The success of this upselling strategy is shown in the company’s strong net retention rate. As more and more new services and solutions are being introduced, I believe existing customers’ spending will continue to tick up.

Yossi Carmil, CEO, on increasing wallet share

Our focus remains on significantly increasing our wallet share within our existing customers. We continue to deliver strong growth and best-in-class NRRs by selling more solution and expanding into more buying centers or user groups within our existing customers.

While Cellebrite focuses mainly on the public sector, the private sector also presents a huge growth opportunity. The company’s platform is now being used to solve internal digital incidents and investigate suspicious employee data. The adoption rate is broadening as more use cases are being introduced. The addressable market for the price sector alone is forecasted to be $1.6 billion in 2023.

Financials and Valuation

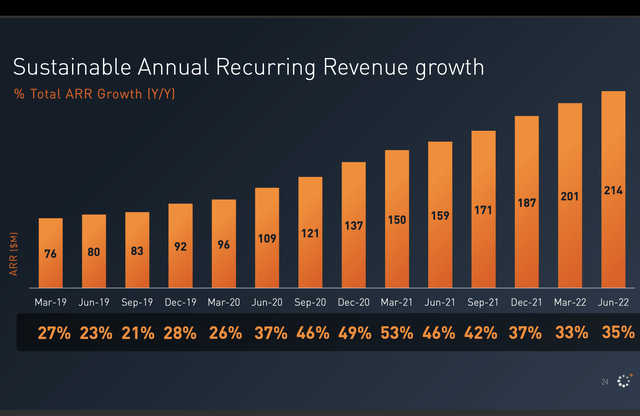

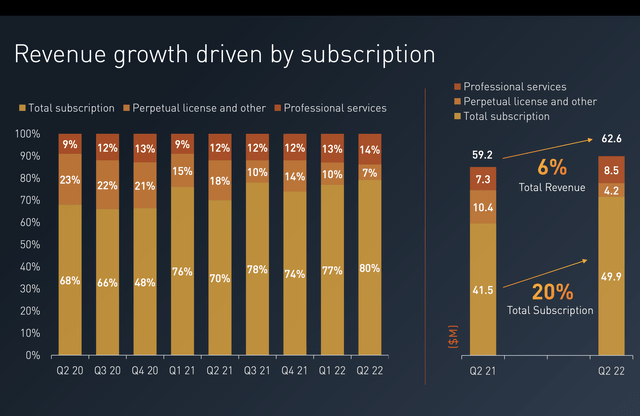

Cellebrite reported its second-quarter earnings in August and ARR growth continues to be the highlight of the quarter. As the company continues its progress to shift from a license-based model to a SaaS-based model, licensing revenue is dropping significantly while subscription revenue continues to ramp up. The transition is likely to weigh on near-term total revenue growth but should boost customers’ lifetime value over time.

Yossi Carmil, CEO, on second-quarter results

We continue to see a healthy market in adoption of digital intelligence solutions. This enabled us to continue delivering robust ARR growth and consistent high retention rates. The faster than planned transition from perpetual to subscription which resulted in a short-term impact to our results, but ultimately creates a potential long-term incentive to increase customer spending. The need to address the massive growth in digital evidence and to modernize the investigation process, combined with our commitment to continue to provide law enforcement agencies with the broadest, deepest and most innovative Digital Intelligence suite of solutions, gives us confidence in our long-term success, growth and profitability”

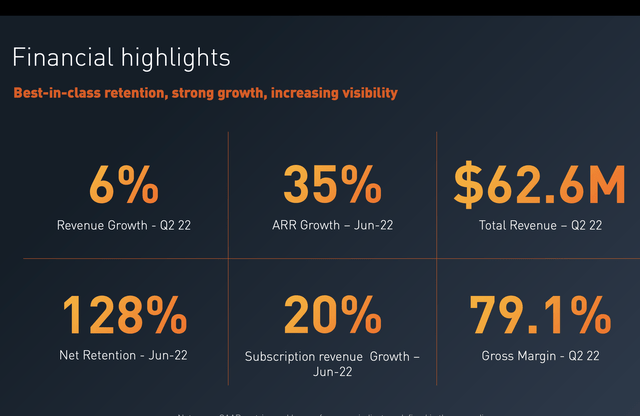

The company reported revenue of $62.6 million, up 6% YoY (year over year) from $59.2 million. Perpetual license revenue for the quarter was $4.2 million, down 59.6% YoY from $10.4 million. Subscription revenue was $49.8 million, up 20% YoY from $41.5 million. Total subscription revenue now accounts for 80% of total revenue, compared to 70% a year ago.

ARR (annual recurring revenue) continues to see solid growth, up 35% to $214 million. The growth is driven by strong commitments from existing customers, with the dollar-based net retention rate standing at 128%. The company is also successfully landing larger deals. It closed 29 deals valued at 500k+in the quarter, the highest number ever. Gross profit was $49.5 million, with a gross profit margin of 79.1%.

The bottom line declined during the quarter, largely due to heavy spending on R&D and S&M in order to capture further market opportunities. R&D expenses increased 27.9% from $15.4 million to $19.7 million, while S&M expenses increased 34.6% from $18.5 million to $24.9 million. This resulted in operating income flipping from $8.2 million to negative $(5.6) million. Operating cash flow also went from $13.9 million to negative $(4.1) million. Adjusted EBITDA for the quarter was $0.7 million, representing an adjusted EBITDA margin of 1%. I am not too worried about profitability at the moment as I believe growth should be the first priority. Despite a huge bump in expenses, cash burn remains very minimal, accounting for only 6.5% of its quarterly revenue. The company’s balance sheet is also very strong, with $140 million in cash and no debt. This gives management a lot of flexibility to further invest in growth or even pursue M&A activities.

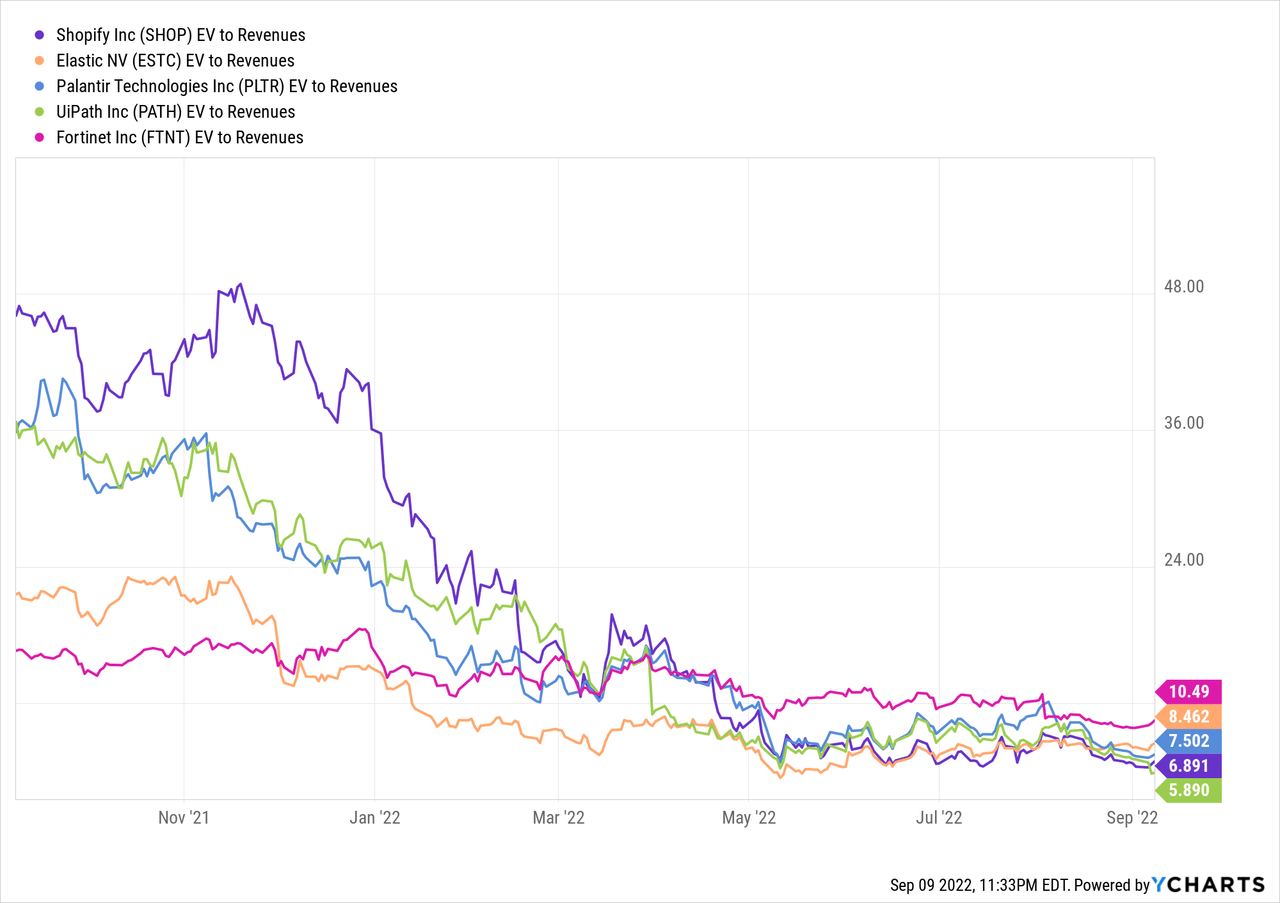

Cellebrite is currently being valued as a licensing company in my opinion. The market is overlooking its transition into a SaaS business which will significantly improve the company’s financial performance. While the current revenue growth rate appears to be low, this is largely due to the drop in licensing revenue dragging down overall revenue. ARR growth remains very strong at 35%. Using the forecasted ARR this year the company is now valued at around 3 time EV/recurring revenue, which is very cheap. From the chart below, you can see that most SaaS companies with 20%-30% growth are trading at an EV/sales ratio of around 5-10, significantly higher than Cellebrite. The company’s margin is also top-notch at over 80%. As the transition to SaaS continues, margins are likely to see a strong boost. I believe when the market starts to value Cellebrite as a SaaS company, it will see a significant uplift in multiples.

Conclusion

In conclusion, I believe the current share price presents a good buying opportunity for Cellebrite. The company is operating in a unique industry with a huge and growing TAM. It is benefiting from the tailwind of digital transformation and the increase in digital evidence and cyber crimes, resulting in higher demand for digital intelligence solutions. It is also seeing other growth catalysts such as increasing wallet share among existing customers and increasing adoption from the private sector. The company is seeing very strong ARR growth as it continues its transition into a SaaS business. The current valuation is cheap when considering the growth rate and the transition is being discounted. Therefore I rate Cellebrite as a buy.

Be the first to comment