JHVEPhoto

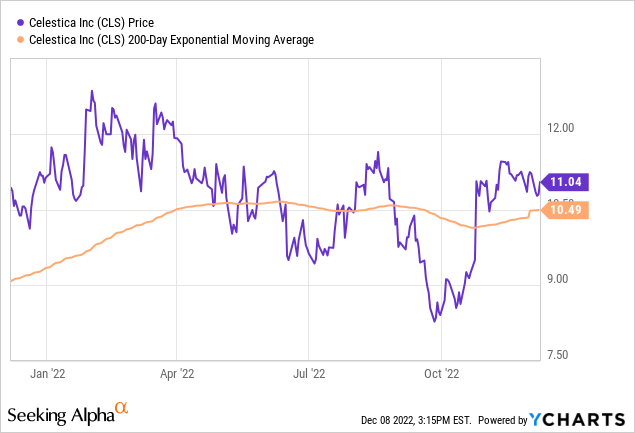

At the height of market fears, Celestica (NYSE:CLS), an electronics manufacturing services company, bottomed at a 52-week low of $8.21. After posting a strong third quarter that beat expectations, investors bid shares higher on its upward guidance. Although the stock is up by around 35% from its low, shares are still mispriced.

Celestica has a combination of improved component availability and stronger demand tailwinds. Investors who lost money in other holdings might sell those stocks. They are already selling CLS stock after the Q3 report.

This is a mistake.

Celestica has more upside than converting its strong backlog to revenue.

Strong Q3/2022 Results

Celestica posted revenue rising by 30.6%, led by a 30% rise in Advanced Technology Solutions. ATS’s operating margins improved to 5.0%, up from 4.3% last year. Similarly, Connectivity & Cloud Solutions revenue also grew, up by 32%. CCS segment margin was 5.2%.

Celestica earned 52 cents a share on a non-IFRS measure. Non-IFRS free cash flow fell to $7.4 million, down from $27.1 million last year. The company increased its working capital investments strategically. This has no impact on management’s aim of returning half of its adjusted FCF to shareholders.

It will invest the other half into the business, strengthening its long-term prospects.

Markets are further mispricing Celestica’s prospects for 2023. The company has a few investments in working capital. This will improve component availability. Revenue in future quarters will grow as Celestica enjoys stronger demand dynamics.

Quant Grades and Fair Value

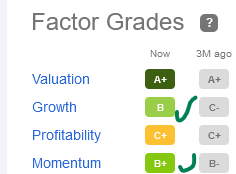

In the quant score provided by Seeking Alpha Premium, Celestica’s growth score improved from a C- three months ago to a grade of B:

Seeking Alpha premium

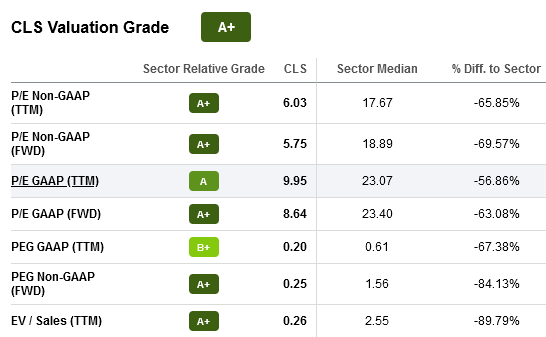

Although the momentum score increased, it merely reflects CLS stock performance over various periods (from three months to one year). The company’s deep value will shield investors from downside risks:

SA Premium

As shown above, Celestica’s price-to-earnings multiples are lower than the sector median. Its enterprise value-to-sales ratio is nearly 10 times below the median.

Expect the company to fulfill its backlog orders in the year ahead. This results in higher earnings. Value investors will not ignore the performance. Still, Celestica needs to post another strong quarter that exceeds its Q4 forecast.

Above: Celestica stock will find support at its 200-day moving average at $10.49.

In Q4 2022, the company expects a loss of 15 cents to 21 cents a share. It has to account for the amortization of intangible assets and stock-based compensation in the quarter. Therefore, chances are better that its Q1/2023 results will exceed expectations.

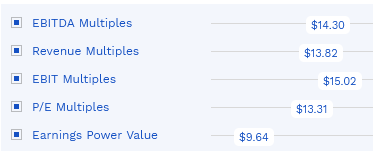

Celestica guided investors to a 2022 revenue outlook of between $7.08 billion to $7.23 billion. Its mid-point growth is between 27% and 43%. Applying this forecast, investors may employ any financial model to come up with a fair value. In the table below, finbox.com users modeled Celestica’s value with various models based on multiples:

finbox

I would build a 5-year discounted cash flow EBITDA exit model. This enables readers to assume a high discount rate to account for unknowns ahead. Based on the following metrics below, the stock has an upside of around 32% or a share price of $14.29:

|

Metrics |

Range |

Conclusion |

|

Discount Rate |

10.8% – 9.8% |

10.30% |

|

Terminal EBITDA Multiple |

4.2x – 6.2x |

5.2x |

|

Fair Value |

$11.56 – $17.12 |

$14.29 |

|

Upside |

6.7% – 58.0% |

31.90% |

In a neutral scenario, revenue growth would stall between fiscal 2023 through 2026 as shown below. Despite the modest growth, CLS stock still has room to beat analyst estimates.

|

(USD in millions) |

Input Projections |

|||||

|

Fiscal Years Ending |

21-Dec |

22-Dec |

23-Dec |

24-Dec |

25-Dec |

26-Dec |

|

Revenue |

5,635 |

7,269 |

7,663 |

7,943 |

8,102 |

8,264 |

|

% Growth |

-2.00% |

29.00% |

5.40% |

3.70% |

2.00% |

2.00% |

|

EBITDA |

280 |

363 |

383 |

437 |

446 |

455 |

|

% of Revenue |

5.00% |

5.00% |

5.00% |

5.50% |

5.50% |

5.50% |

Risks

The stock’s fair value target depends on customers maintaining their backlog order levels and increasing demand. Chief Financial Officer Mandeep Chawla said that customers could always be hoarding products to navigate through a constrained environment.

Celestica accumulated around $600 million of inventory on its balance sheet. That way, it will meet customer demands. Celestica customers take on the working capital liability risks.

Stock market participants and economists are bracing for an economic slowdown. This implies that demand would weaken or growth would slow down. Fortunately, Celestica did not see customers cancel orders in the last quarter.

Conclusion

Investors cannot deny that the macroeconomic headwinds are a risk for the stock market. After they took some profits recently, CLS stock valuations are attractive. Unlike beaten down, widely-held technology leaders still trading at P/E multiples in the 19 times to 20 times range, Celestica is at half of that.

The electronics firm is not immune to a sell-off. If the stock falls to $10.00 or lower, investors should consider building a position at a comfortable discount.

This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment