nurulanga/iStock via Getty Images

I last addressed CEL-SCI (NYSE:CVM) in 02/2022’s “CEL-SCI: No Rush Here“. At the time I concluded:

Given the lack of any discernible progress or guidance on when to expect a filing for Multikine with the FDA, I now rate it charitably as a “sell”….

This article updates the situation with its Q1, 2022 earnings release and its newest slide presentation (the “Presentation“).

For those new to CEL-SCI, it is a clinical stage biotech focused on one key product, Multikine. I will not burden this article with a rehash of Multikine’s development. The Presentation slides 3-6 provide excellent overview of Multikine and its underlying rationale.

CEO Kersten has led CEL-SCI through thick and thin for nearly three decades

CEL-SCI’s CEO Geert Kersten started with the company in 1987; he took over as CEO in 1995. Certainly, he more than any other has faced down its multiple recurring challenges. His training is in law and finance, so his contributions have been managing CEL-SCI.

CEL-SCI has tested his mettle as a manager lurching from crisis to crisis during its journey of developing Multikine as marketable product which requires FDA approval. This has not been easy. Roadblocks have arisen from the very start.

Right off the mark following its 07/1994 filing of its Multikine IND application, the challenges started rolling in. In 12/1994 it got hit with a clinical hold “pending receipt of additional data and modifications to the Company’s manufacturing process”.

There is no one time frame that fits all cancer drugs to shepherd them through clinical trials. One rule of thumb that works for a variety of situations is 10-15 years. CEL-SCI’s as yet incomplete journey, from its initial IND filing in 1994 now to 2022 and counting, speaks to challenge upon challenge enduring well beyond 15 years.

They hit again and again. It was readying its phase 3 trial for head and neck cancer back in 2008. Then the financial crisis upset its plans. It got its trial, NCT01265849 started in 2010. Next, with its trial underway, its CRO flubbed its enrollment. Subsequently CEL-SCI got vindication when it won its arbitration against the offending CRO.

Throughout the process it had to satisfy the FDA. In 09/2016 the FDA issued a partial clinical hold on its Multikine trial. As CEL-SCI was working on lifting the partial hold, the FDA upgraded it to a complete hold which it finally lifted in 08/2017.

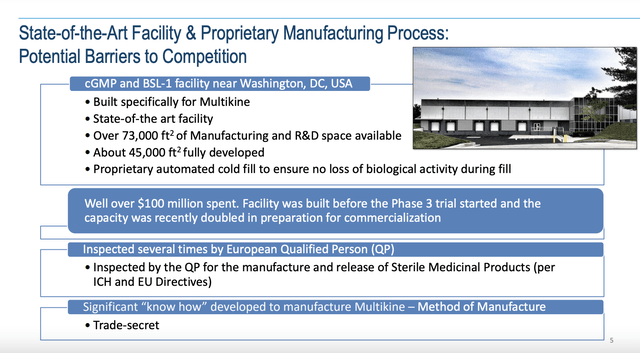

CEO Kersten has anticipated one potential roadblock which first appeared back in 1994. CEL-SCI has gone “all-in” to assure that it could meet the strictest standards of Multikine production at a commercial scale as shown below:

Multikine production facility (cel-sci.com)

If Multikine gets FDA approval and succeeds as a therapy, this facility will be lauded as “visionary”. On the other hand, if no such approval comes it will likely be sold at significant loss.

CEO Kersten so far has met all challenges and is still fighting. His biggest challenges still lies ahead. When will CEL-SCI file its BLA? Will the FDA accept it for filing? Will the FDA issue a marketing authorization for Multikine? These are seminal challenges that will control CEL-SCI’s investment merit.

The challenge for CEL-SCI shareholders has been to retain value in their investment

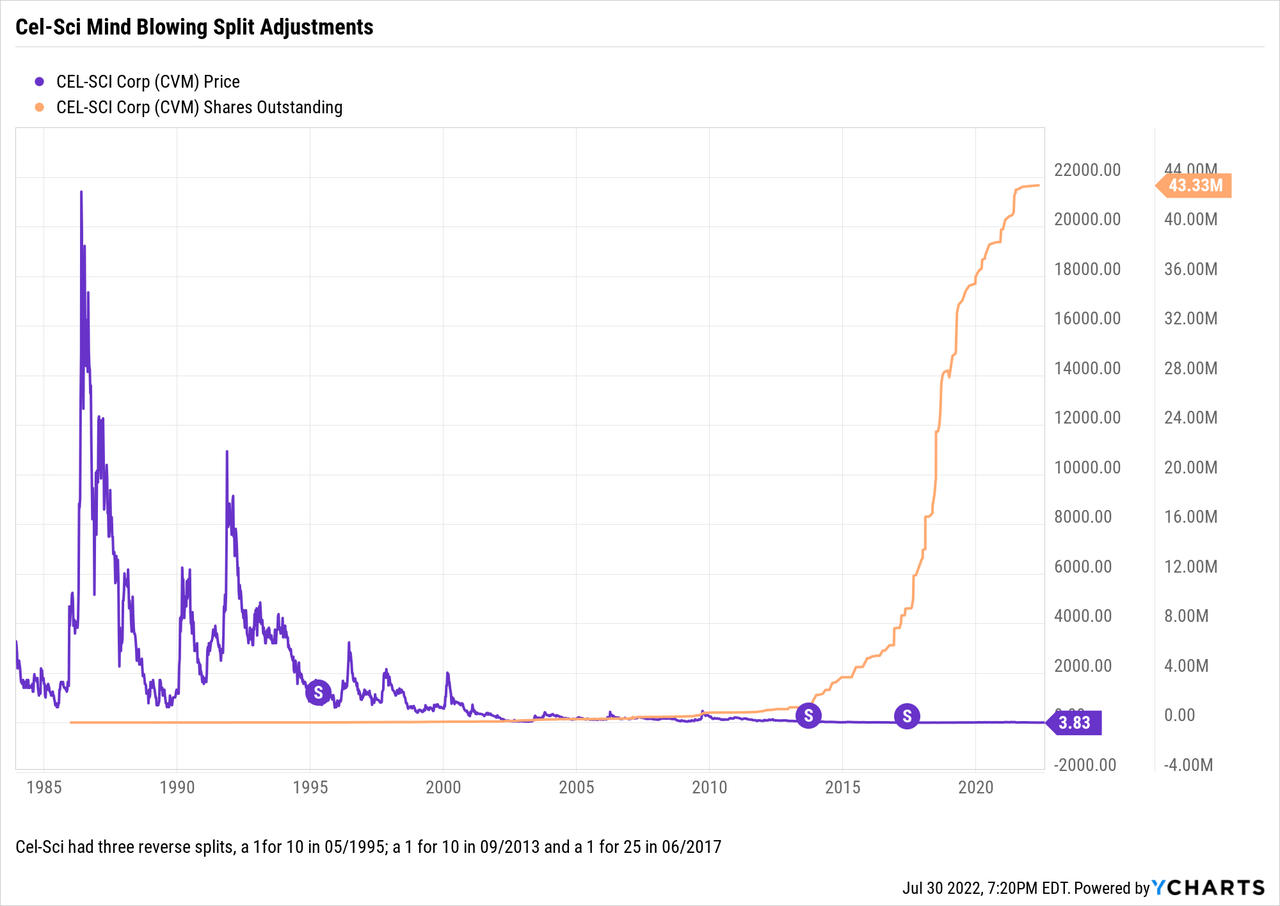

The market has not been kind to CEL-SCI as it has struggled to develop Multikine. Its share trajectory shown below has been dishearteningly and consistently downbeat:

The reverse splits have savaged shareholders’ share count. A shareholder with 50,000 shares in 08/1995 had his share count knocked to 5,000 in the first 1 for 10 split. The second, 1 for 10 cut the 5,000 shares to 500; and the granddaddy 1 for 25 cut the 500 shares back to a mere 20 shares.

Let me rush to say that splits in and of themselves do not reduce a holder’s percentage ownership in the company. I have previously discussed in some detail that reverse splits can occur for various reasons. In checking the SEC filings and other records, it is apparent that CEL-SCI’s reverse splits in 1995, 2013 and 2017 were intended to keep its share price above a level where they would be attractive for shareholders.

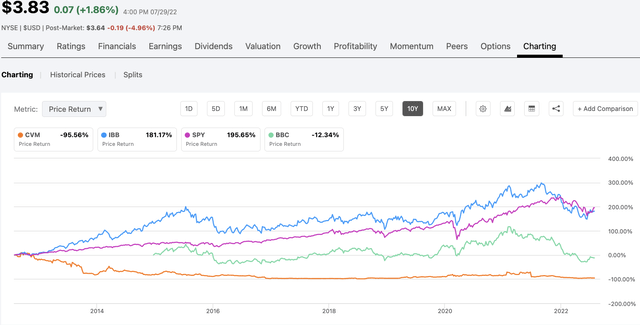

From a total return basis over the last 10 years CEL-SCI has been a terrible dud, by whatever metric you choose, as shown by the chart below:

total return chart (seekingalpha.com)

The chart is interesting, not just as to CEL-SCI but as to the broader biotech universe. If we measure the broad stock market by the SPDR S&P 500 Trust ETF (SPY) over the last 10 years we see a rosy picture with >195% total return. Over this 10 year period $10,000 invested in SPY has jumped to $19,500.

As for an investment in the broader biotech universe reflected by the iShares Biotechnology ETF (IBB), the return has been a lesser, but still respectable >188%. Those who settle for the dicier clinical trial biotech sector as reflected by Virtus LifeSci Biotech Clinical Trials ETF (BBC) have had to settle for a return of (~12%); note that with its inception date of 12/2014, BBC has not been in existence for a full 10 years.

CEL-SCI shareholders who invested $10,000 in CEL-SCI over the last 10 years have lost 95% of their $10,000 which has dropped to $500. The challenge for CEL-SCI shareholders has been to play its ebbs and flows, buying low and selling high. Experience has shown that such market timing is a highly risky.

In the next section I will discuss CEL-SCI’s future prospects for those hoping to make up their losses with future gains.

CEL-SCI’s finances should not impede its near term operation

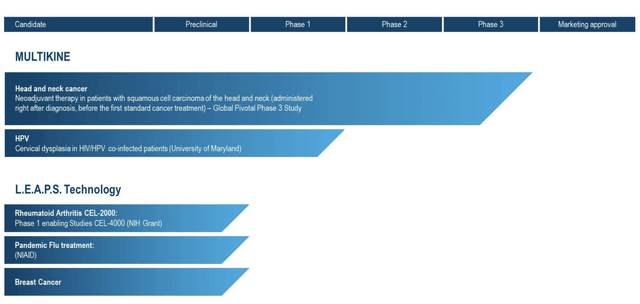

When it comes to CEL-SCI, the story focuses exclusively on Multikine. It does not have, and has never had, much of a pipeline. As I write on 07/31/2022, its website pipeline below consists of Multikine and its preclinical L.E.A.P.S. technology:

CEL-SCI pipeline (cel-sci.com)

As a preclinical therapy, its L.E.A.P.S. Technology is unlikely to impact its current price over any near term time frame. This limited focus has helped CEL-SCI to keep it costs in check. CEL-SCI’s latest 10-Q reports its accumulated deficit as $436,802,510. This is a hefty sum, but not so surprising when you consider that it reflects CEL-SCI’s decades long development of Multikine including its manufacturing plant.

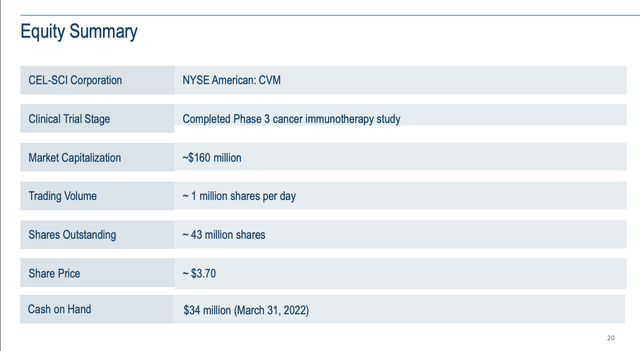

As for CEL-SCI’s current finances, they are sufficient for its current operations. The Presentation includes the following “Equity Summary” slide which is its only slide with any financial data:

cel-sci.com

Its cash on hand of $34 million as of 03/31/2022 is on the low side. It would be of greater concern for many clinical stage biotechs who have more going on than does CEL-SCI.

CEL-SCI’s operating loss for its most recent quarter was $9.6 million and for its most recent 6 months was $18.4 million. Its actual:

Net cash used in operating activities was $7.5 million for the six months ended March 31, 2022 which represents a decrease of $1.2 million compared to the six months ended March 31, 2021.

CEL-SCI’s current cash balance appears adequate for its near term needs. That raises the question is “near term” sufficient? The answer depends entirely on how long and how costly CEL-SCI’s next phase turns out to be.

CEL-SCI’s future depends on the FDA’s treatment of Multikine

This is a hard one to pin down. Section 8, titled “Multikine Pre-BLA Meeting” to an 09/2021 ten part exclusive CEL-SCI CEO interview, could provide just the information we need.

A Pre-BLA meeting is an important step along the path of filing for a marketing application for Multikine with the FDA. A request for the meeting should be filed 4 months prior to the anticipated BLA submission. In the referenced interview, Gersten sidestepped any discussion of when CEL-SCI might hold the meeting.

He acknowledged the meeting was important and reviewed the data required for such a meeting; then, instead of addressing CEL-SCI’s plans, he veered off-subject to praise Multikine and excoriate the shorts:

I fought the lies of the shorts before we had data because the outcome was uncertain and we only had a theory. Now we have 5-year survival data in an indication with an unmet medical need with no safety issues. I do not feel the need to defend our data anymore. We have achieved something amazing and we have a clear path to pursue FDA approval.

A “clear path to the FDA” is almost an oxymoron these days. In CEL-SCI’s case it is not the pressing question. The pressing question is, when? Investors have no way of assessing the situation until CEL-SCI advances its situation beyond its current entirely provisional state.

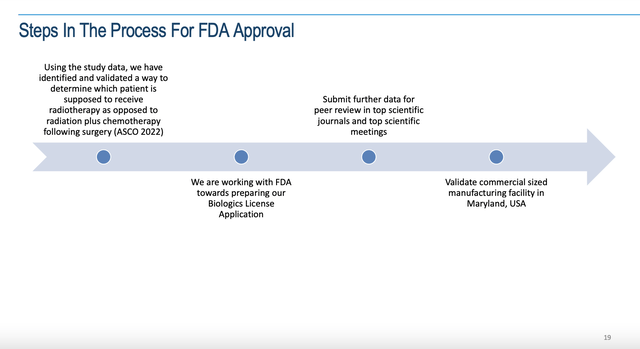

The Presentation includes a slide addressing the status of matters with the FDA as follows:

Multikine and the FDA (cel-sci.com)

Unfortunately, this slide is unhelpful in terms of actionable information. It offers nothing on timing for a pre-BLA meeting which would be meaningful information rather than “[w]e are working with FDA towards preparing our Biologics License Application”.

Conclusion

Unfortunately, CEL-SCI does not hold earnings calls. As a result it does not provide color on its operations which can help in understanding its true situation. Its earnings press releases are very much bare bones when it comes to financial data and timing. Its latest report includes no projections or guidance whatsoever.

I regard CEL-SCI as too risky for anyone other than a day trader. At this stage CEL-SCI should have clarified where it stands with the FDA in terms of filing, or at least preparing its request, for a pre-BLA meeting. CEL-SCI still has the following challenges before it:

- it must prepare and file its pre-BLA meeting,

- it must hold its pre-BLA meeting,

- if the meeting is successful, it must file its BLA,

- the FDA must accept the filing and establish a PDUFA date,

- the FDA must issue its marketing authorization for Multikine with its necessary label.

If and when CEL-SCI accomplishes the foregoing, its next challenge will be to launch Multikine. That is an entirely different process which presents an entirely different set of challenges.

I am skeptical that CEL-SCI can successfully navigate this gauntlet. I question whether it can organize the data from its 10-year string of clinical trials in a way acceptable to the FDA. As such, I am on the sidelines on this one.

Be the first to comment