One of the interesting things about the coronavirus selloff is whether it is driven by retail investor fear or institutional repositioning. On a few Bloomberg podcasts, I’ve heard a few analysts make this point, and recent fund flows data gives us a complicated picture. On the one hand, retail-investor oriented index funds such as the Vanguard S&P ETF (VOO) and Vanguard Total Stock Market ETF (VTI) have actually seen net inflows over the last month. Lipper Alpha sees net outflows across the board, although net outflows from equity funds declined significantly last week compared to the week of March 4th, indicating that there is not yet selloff momentum among retail investors.

Source: Lipper Alpha Insight

This does not mean the worst is behind us or that retail selloff won’t exacerbate the recent market turn. Arguably, this could indicate that retail investor capitulation may be ahead of us as we await latecomers to sell off.

A key metric to determine how close we are to that inflection point is being largely overlooked: closed-end fund discounts. Because CEFs see their market prices vary from NAV based on market demand, and because CEF investors tend to be income investors who skew more towards averting risk, this is a useful metric to look at throughout this selloff and into the recovery, whether that began on Friday or is still to come.

CEF Insider tracks data on CEF NAV and market price trends, which we can use to assess whether overall discounts/premiums are shifting significantly. A major widening in discounts would indicate we are nearing market capitulation, while relative calm in those discounts would indicate risk-averse retail investors are less behind the selloff.

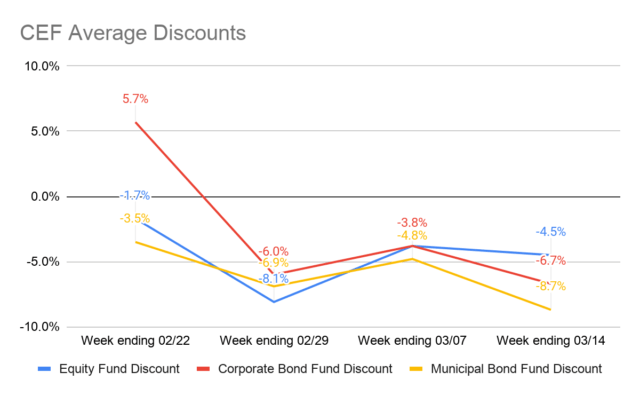

Source: CEF Insider

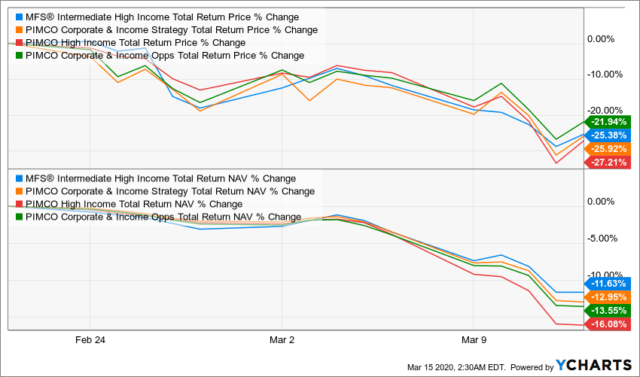

There are a couple of pretty interesting data points to highlight here. First, corporate bond funds traded at a premium in mid-February, largely a result of high premiums for MFS Intermediate High Income (CIF), PIMCO Corporate & Income Strategy (PCN), PIMCO High Income Fund (PHK), and PIMCO Corporate & Income Opportunities (PTY). I’ve warned readers about these funds for years because of their premiums, which means total price returns are likely to massively decline at a sharper rate than total NAV declines in a market panic. This is what happened in the last three weeks.

Their resulting smaller premiums (and, in CIF’s case, discount) are largely responsible for the sharp drop in average discounts over the last three weeks.

In equity funds (note this tracks domestic equity funds and ignores foreign equity funds), a 1.7% discount was unusually small historically speaking, again resulting from the exuberance markets were feeling even weeks after the outbreak began. While 8.1% is a bigger discount than the 4.7% long-term average discount observed by CEF Insider, following Friday’s recovery we are now at about that point, indicating that the CEF market has not yet fully capitulated.

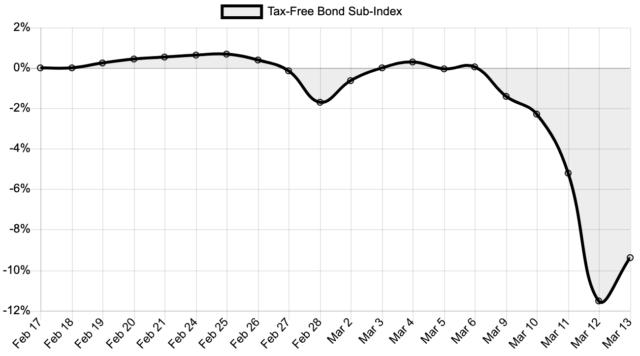

The muni bond data tells us something else. While municipal bonds are somewhat (but not entirely) removed from the economic fallout of a worst-case scenario, that did not save muni bonds from seeing a 4% loss on average, as evidenced by the iShares National Muni Bond ETF (MUB) over the last couple of weeks thanks to coronavirus fears. That triggered intense selling of muni bond CEFs, which underperformed by a substantial margin.

Source: CEF Insider

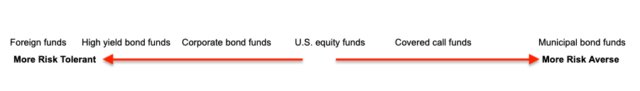

With the CEF Insider Tax-Free Bond Sub-Index showing a 9.6% drop in muni bond prices over the last month, it is safe to say that the most panicked CEF investors are the muni bond investors. This makes sense, as there is a spectrum of risk tolerance between sector CEF investors:

What I believe we saw last week was the first panic of muni bond investors, which followed that of the less risk averse equity and corporate bond fund investors. Arguably, muni bond investors capitulated last week.

While unexpected news of a turn for the worse could mean another capitulation, there is also the chance of unexpected good news causing relief and an improvement in fund valuations. What is important to identify here is that retail investors have to a certain extent taken part of the selloff in recent weeks, and while this could happen again, the sudden and extreme discounts made available in those weeks have become CEF buying opportunities as well as evidence of a chance to just get an index fund at a good value, because the retail investor panic has already begun (thus creating oversold conditions). Things could get oversold again, providing another and possibly even better buying opportunity, but they could not.

In the meanwhile, CEF discounts have told us that the last two weeks have actually been something of a recovery from the initial retail investor freakout – a story that is quite different from what just looking at the S&P 500 over that period would have you believe.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment