Christian Petersen/Getty Images News

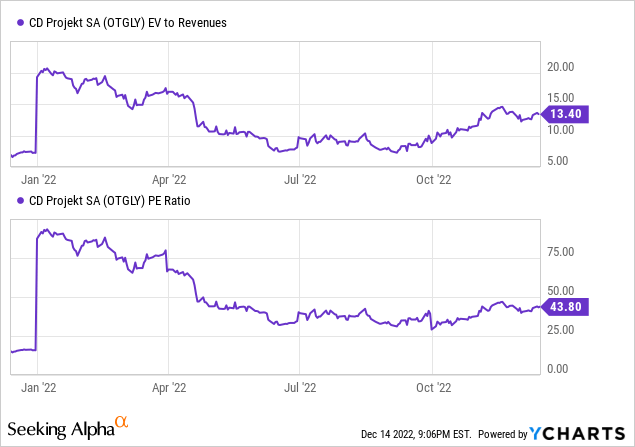

Poland-based video game developer CD Projekt (OTCPK:OTGLY) continues to lean on its latest AAA game title, ‘Cyberpunk 2077’ (CP77), with another quarter of record net profits. This time around, the sales result was helped by the 1.6 update, as well as interest from the hit Edgerunners anime series. While bulls will be encouraged by the upbeat sales result, CD’s hit-driven business model could suffer in the next year or two from the lack of any blockbuster releases in the short-term pipeline. In the mid to long-term, the pipeline is demanding, led by new games within the Witcher saga (code-named Sirius, Polaris, and Canis Majoris); if recent launch delays are any indication, however, I would be hesitant about underwriting CD’s ability to meet the ambitious release schedule. The stock isn’t cheap either at the current low-teens EV/Sales and >40x earnings multiple, so any guidance disappointments could drive a de-rating. Pending better visibility into improved execution and the ability to balance the development of multiple AAA franchises, I remain neutral here.

CP77 Momentum Continues, But For How Much Longer?

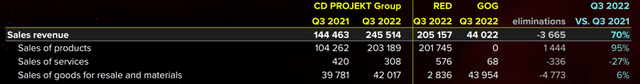

CD posted strong Q3 product revenue growth at +95% YoY, mainly due to the incremental contribution from update 1.6 to CP77. Another key driver was the hit anime series Edgerunners on Netflix (NFLX), which also boosted unit sales of Cyberpunk for the quarter. While management stopped short of quantifying the sales impact post-Edgerunners, they did disclose that as of Q3, over 20m copies of CP77 have been sold YTD. While this seems impressive at first glance, the prior disclosure that ~18m copies were sold as of April this year implies only ~2m copies sold over the Q2/Q3 period.

That said, CD might be onto something with Edgerunners – management is keen to explore the potential synergies from expanding the franchise beyond the video game format, so expect more developments across different media formats going forward. Still, the CP77 sales boost in H2 2022 is unlikely to sustain into next year, in my view. As the transitory boost from the patch 1.6 release and ‘Edgerunners’ normalizes, the only near-term revenue driver from here is the final CP77 expansion due next year. Beyond that, the revenue cycle for the franchise is likely nearing an end, and with the next in-house ‘Witcher’ installment only due in 2026 or later, it’s hard to see what fills the gap in the meantime.

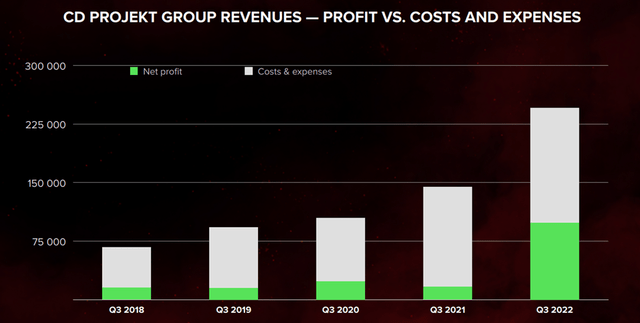

Elevated Costs Weigh On Profitability

While sales outpaced consensus estimates, CD fell short at the EBIT line despite accelerating QoQ. Higher SG&A costs were the key issue, as the company continues to grow its employee headcount on a net basis for the year. While management cited sufficient talent available to continue developing future projects, the planned ramp-up of its new Boston-based gaming studio, ‘The Molasses Flood’ post launch of the CP77 Phantom Liberty expansion could see more headcount additions ahead. With CD also planning to implement a new employee incentive scheme to improve retention and attract talent, shareholders will likely have to bear some of the burden via dilution from share-based compensation.

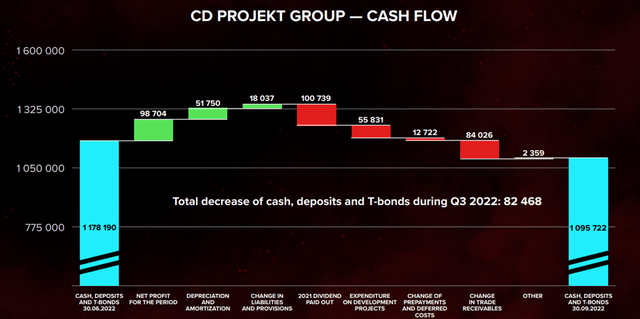

The net profit result was more resilient than expected, though, helped by a lower effective tax rate and increased net financial income. Operating cash flow was also up on a weak Q2 but down on a YoY basis due to a one-off increase in receivables; as this should reverse next quarter, I wouldn’t read too closely into this working capital outflow. Offsetting this was lower capital expenditures on new projects, which helped cushion the impact on net cash. Backed by a strong cash position, though, there is more than enough capacity to support the modest dividend.

Executing An Ambitious AAA Pipeline

Going forward, CD’s focus will turn to the Witcher universe, where the company announced three new game additions (code names Sirius, Polaris, and Canis Majoris) to be published within a six-year period. If successful, this would certainly be bullish for the stock. That said, the plans look a tad too ambitious – publishing multiple AAA titles related to its current IP while also introducing a new ‘Witcher’ trilogy is far beyond what the company has taken on thus far.

To ease the burden, CD will outsource some of the work, with Sirius to be handled by acquired gaming studio ‘The Molasses Flood’ and Canis Majoris to be developed by Polish studio ‘Fools Theory.’ While outsourcing should help with the timelines, whether CD can maintain its top-notch gaming quality is a key concern, particularly given its track record of predominantly in-house development. Plus, development at this scale will likely require significant project expenditure, increasing the funding risks. In the meantime, navigating the revenue gap as CP77 sales wind down in the next year and the 2027-2035 period, when the vast majority of these launches are due, will be challenging.

Fade The Rally

Having deservedly underperformed YTD, the recent CD stock price rally following October’s strategy update may be overdone. Yes, the market cap is down to pre-CP77 levels despite significantly higher revenues; but the execution missteps and elevated development costs have offset much of the positives. While the sizeable cash position should insulate against any funding risks, for now, management’s ambitious pipeline, comprising multiple AAA games within the ‘Witcher’ universe through 2035, is a concern. If CD’s execution track record on CP77 is any indication, penciling in delays and cost overruns seems prudent at this point. Plus, without specific release timelines and limited visibility into the project economics thus far, it is hard to gauge the value accretion potential from these new games. With the stock screening expensively on almost all fundamental metrics, I am keeping a neutral rating.

Be the first to comment