tdub303

Transcript

Stocks have rallied as markets price in a Fed pivot on rate hikes soon.

We don’t think this rally is sustainable for 3 reasons:

1) The economic restart is sputtering

The economic restart is sputtering, and we don’t see a Fed pivot until next year. This will be a drag on growth. Company earnings expectations, at least as of yet, do not factor in this slowdown.

2) Spending shift to hit stocks

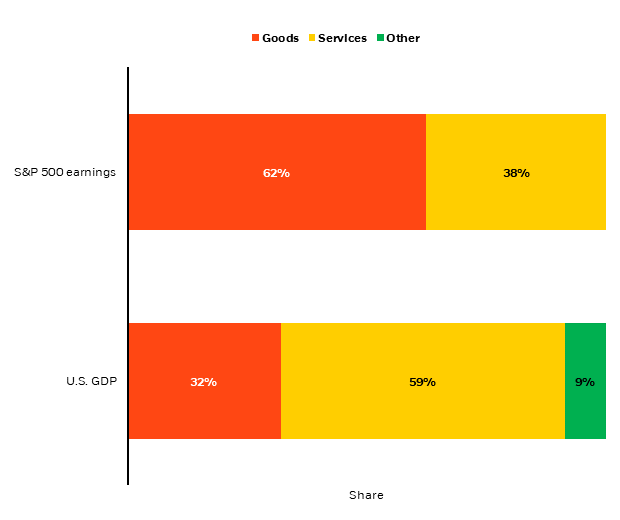

Secondly, we see the shift in spending from goods to services. This can hurt stocks.

That’s because [the] majority of earnings in the S&P 500 is tied to goods.

3) Not a typical business cycle

And finally, in our view, we’re not in a typical business cycle. Just look at the labor market.

Labor supply has been a key production constraint, as we’ve said before. We think higher wages will help the labor market normalize but will put pressure on company earnings.

In this new volatile regime, we prefer quality firms with strong pricing power.

While we’re broadly underweight developed market equities on a tactical basis, at least until the Fed pivots, we like selected healthcare and energy stocks. We shy away from tech for now but see strategic opportunities.

___________

Stocks are rallying as markets believe inflation is waning and the Fed will slow hikes soon. We don’t think the rally is sustainable. Why? We see the Fed hiking rates to levels that will stall the economic restart. Corporate earnings may weaken more as consumer spending shifts and profit margins contract. This is not a typical business cycle, so we expect differentiated regional and sectoral effects. The risk of disappointing earnings is one reason we’re tactically underweight stocks.

Good for whom?

Goods And Services Split For U.S. Economy And S&P 500 Earnings (BlackRock Investment Institute, with data from Refinitiv Datastream and U.S. Bureau of Economic Analysis, August 2022)

Notes: The chart shows the breakdown of S&P 500 earnings and U.S. GDP into goods and services. S&P data uses analyst earnings estimates for full-year 2022, and groups S&P 500 sectors into goods and services, excluding financials and energy. GDP data is based on 2022 Q1 and Q2. The “other” category includes new physical structures.

The pandemic and unique restart of economic activity brought about a massive re-allocation of resources. During the pandemic, consumer spending shifted to goods and away from services. That propped up goods producers’ earnings. That’s changing, in our view. Goods demand is weakening. Overstocked inventories, from retailers to semiconductor firms, are evidence of that. Meanwhile, spending is returning to services. This shift could hit stocks. Why? Earnings tied to goods are expected to make up 62% of S&P 500 profits this year, versus 38% tied to services. See the top bar of the chart. In addition, the stock market isn’t the economy. Goods accounted for less than a third of the U.S. economy in the first half of this year. See the bottom bar. This means a boom in services doesn’t power S&P 500 earnings as much as it does the economy.

Today’s labor market also shows we’re not in a typical business cycle. The labor shortage has been a key production constraint after many people left the workforce during the pandemic. We think higher wages would help normalize the labor market by encouraging workers to return and incentivizing employees to stop hopping jobs for more pay. On the flip side, higher wages also ratchet up companies’ costs and pressure margins. These spending and labor dynamics are unfolding as the restart itself sputters. In Europe, the energy shock amid Russia’s invasion of Ukraine will likely trigger a recession later this year, as we said in “Taking Stock Of The Energy Shock.” The restart is stalling in the U.S. as it bumps into production and labor supply constraints, and we believe U.S. activity is now set to contract.

Earnings view

What does all this mean for earnings? S&P 500 earnings growth has essentially ground to a halt, we calculate, if you exclude the energy and financial sectors. That’s down from 4% annualized growth last quarter, Bloomberg data show. What’s more, we believe analyst earnings expectations are still too optimistic. There are huge differences between sectors. High oil and gas prices have led to record profits for energy companies. We see these trends persisting for now. The reason: the West is aiming to wean itself off Russian energy and needs other suppliers. In the long run, high prices and profits could be eroded by the march toward decarbonization. The U.S. Senate passed a bill, called the Inflation Reduction Act, that is likely to shake up the sector. It calls for green energy infrastructure investments and tax benefits to incentivize the transition to net-zero emissions.

Investment implications

What are the investment implications of a weaker earnings outlook? Stocks have rallied as markets price in hopes the Fed will pivot soon. But we’re not chasing the rally. Why? First, market expectations for a dovish pivot are premature, in our view. We think a pivot will come later, as the Fed is for now responding to pressure to tame inflation. Second, we see the market’s views on earnings as overly optimistic. Spending returning to services, slowing growth and looming margin pressures pose risks.

Our bottom line: We are cautious in the short run but are staying invested. We tactically prefer investment-grade credit over equities because we think it can weather a slowdown that equities haven’t priced in yet. We remain underweight most DM equities on a tactical basis until we see clear signs of a dovish central bank pivot. We like selected healthcare and energy stocks. We are cautious on tech stocks for now due to their sensitivity to higher rates. We do see strategic opportunities in tech and in healthcare, as they’re set to outpace carbon-intensive sectors in the energy transition. Within sectors, we prefer quality firms with the ability to pass on higher costs, stable cash flows and strong balance sheets.

Market backdrop

Stocks marched higher after markets priced in a slowing Fed hiking cycle on softer-than-expected U.S. CPI inflation. We don’t think the equity bounce is worth chasing. We see inflation persisting and settling above pre-Covid levels. We believe the Fed will remain susceptible to “the politics of inflation,” a chorus of voices demanding it tame inflation. Our bottom line: The latest inflation reading isn’t enough to spur the Fed pivot we’ve been waiting for to lean back into stocks.

We’re watching U.S. industrial production and retail sales to see how quickly activity might be slowing. Consensus forecasts see U.S. industrial production improving in July but retail sales cooling for the same month. UK CPI inflation is likely to show a continued increase after the Bank of England revised up its expected peak to above a 13% annual rate earlier this month. Persistently high natural gas prices are likely to keep fuel and power costs elevated.

Be the first to comment