shironosov/iStock via Getty Images

Understanding what stage of the business cycle a company is in is always important when investing in cyclical companies. There are many companies that have cyclical business models that have been good long-term investments, but business cycles are getting shorter as interest rates are manipulated and fiscal policies can create growth cycles that aren’t sustainable and sell-offs in cyclical companies can often be significant.

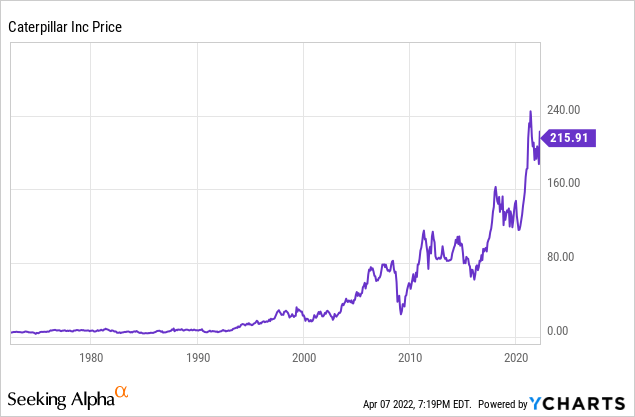

Caterpillar (NYSE:CAT) has been one of the more cyclical companies in the S&P 500 for some time, with the stock going on huge runs, but also experiencing sharp selloffs.

Well, Caterpillar was a top performing company prior to 2008, the stock has also been very volatile over the last 14 years, with the stock selling off hard multiple times over the last decade and a half. Caterpillar sold-off hard in 2008 after the financial collapse, the stock also sold off nearly 20% in 2018, and then sold-off hard in 2019 as well.

Caterpillar’s stock has been on a huge run since early 2019, when the stock traded at just $119 a share. Today the stock trades at nearly $216 a share.

The company’s earnings have been strong during the recent 3 year run up in the stock, but there are also a number of signs that many of the Caterpillar’s main divisions and most important end markets are slowing down, and the stock looks overvalued at the current share price using a number of metrics.

Caterpillar recently reported fourth quarter earnings of $2.69 a share with revenues coming in at $13.8 billion, beating expectations of $2.23 a share and $13.2 billion in revenues. Full year sales and revenues in 2021 were $51 billion, up 22% from $41.7 billion. However, even the report had strong numbers on the surface, there were a number of warnings signs that many of Caterpillar’s core divisions will likely slowdown moving forward. The company did not issue forward guidance as part of the management’s standing policy of not issuing full fiscal guidance for the upcoming year.

Caterpillar gets around 94% from the company’s construction, resource, energy, and transportation businesses. Most of the remaining business is from finance related operations. Nearly 43% of Caterpillar’s revenues came from the company’s construction industry segment, and 40% of revenues were from the energy and transportation business. Caterpillar gets just less 50% of the company’s construction revenues from North America, with nearly 40% of the construction segments revenues coming from emerging markets and the Asia Pacific region, and around 10% from Latin America. Caterpillar gets nearly 35% of the company’s resource division revenues from North America, 35% of the revenues from this division come from the Asia Pacific region, 15% of the revenues from emerging markets, and 15% come from Latin America.

A Picture of Mining (Caterpillar homepage)

The two most important drivers of Caterpillar’s construction business right now are the residential and nonresidential construction markets within North America. The North American construction business represents about 20% of Caterpillar’s overall revenues right now. Caterpillar saw 40% year-over-year growth in North American construction industry revenues from 2021 to 2022. Not surprisingly, this level of growth is not likely sustainable, and there are signs that these construction markets are beginning to slow down this year.

Caterpillar talked about the slowdown they are seeing in nonresidential construction in the company’s most recent earnings report, with the CEO Jim Umpleby saying that, ” … nonresidential demand continued to improve at a slower pace.” The $1 trillion dollar infrastructure bill should provide some boost to nonresidential construction markets later this year, but most of the infrastructure spending is likely to be spread out over a long period of time.

There are also signs of a slowdown in residential construction markets within the US and North America. New housing starts slowed significantly in the fourth quarter of 2021, with new housing starts falling 1.6% in September from previous months and permits for new housing fell as well. This data is adjusted for season factors. Housing listings were also up nearly 17% year-over-year in April, but housing listings prices were up just 8.6% in October. Bidding wars on homes being bought also dropped late in 2021 to 59% of home sales from 75% earlier in the year. Mortgage applications were also at the lowest level seen since early 2020, and homes listed for sell are last much longer on the market as well.

There also signs of a slowdown in the real estate and construction industries of China and India as well. There have been significant recent downgrades to growth expectations in both China and India. China is already seeing growth slow from just over 8% last quarter, to under 5% this quarter. Growth estimates for 2022 in India have recently fallen significantly from 6.7% to 4.6% as well on inflationary concerns and the likelihood of more restrictive monetary policies in that country.

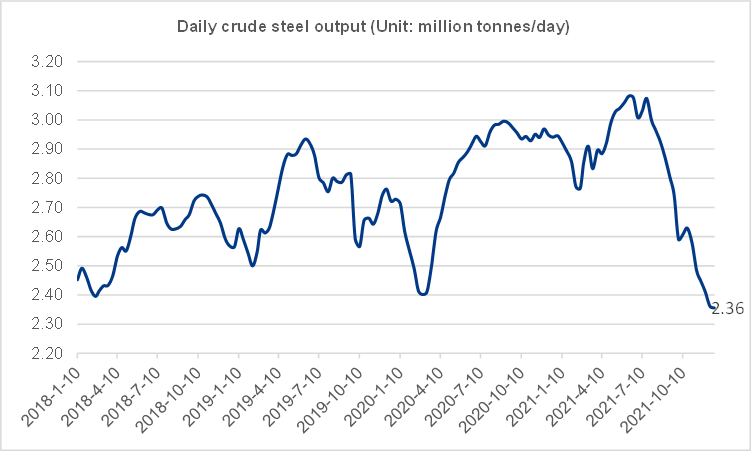

China spent massively on construction and infrastructure projects during the Pandemic between 2020 and 2022, but Chinese construction spending has fallen significantly in recent months, as we can see with Chinese demand for steel plummeting. Caterpillar talked about see Chinese demand for the company products moderating in the last earnings call as construction spending in the world’s second largest economy fell. The company expects sales in China to be soft moving forward as well.

A chart of Chinese steel demand (mysteel.net)

Caterpillar has benefitted from price inflation in the company’s resource division, but high energy costs have commodity costs have also put pressure on the company’s margins by raising freight costs, and high energy costs have made starting new mining projects more difficult as well. Caterpillar saw margins fall in the fourth quarter of 2021 primarily because rising energy prices causing freight costs to rise.

Caterpillar CEO Jim Umpleby said on the company’s recent earnings call, “On the other hand, our margins were lower than we expected, primarily because of two factors. First, freight costs were higher than expected due to inflationary pressures as well as our decision to increase the use of premium freight to meet as much customer demand as possible.” Caterpillar saw adjusted operating margins come in at 13.7% but 2021, but fourth quarter margins were at just 11.4%, with margins deteriorating more than the company expected at the end of 2021 even adjusted for seasonal factors.

The company is also trading at historically high valuations using a number of metrics. Caterpillar has on average over the last 5 years traded at 5.6x forward book value and 1.8x forward sales. Today the company’s shares trade at nearly 7x book value and over 2x sales. Caterpillar also today trades at 15x forward cash flow, well above the 5-year average of this company of 13x forward cash flow. Caterpillar is a very cyclical company, and the stock currently trades at 18x forward earnings estimates even though analysts are expecting single digit revenue growth in 2023. If Caterpillar’s growth slows even modestly, multiple the company trades at should contract and the stock would likely sell-off significantly from current elevated levels.

Caterpillar’s stock has been on a huge run over the last 3 years, but there are signs of a slowdown in both North American and Asia. Caterpillar has a strong management team, but the company’s earnings are highly cyclical, and if construction markets continue to slow in Asia and North America, Caterpillar could see earnings growth slow quickly. Well, Caterpillar trades at a premium to most companies in the industrial sector for a reason, the stock also trades at a significant premium to historical averages as well. Inflation may be here to stay for some time, but there are multiple signs that growth is selling both in the US and abroad, and many of Caterpillar’s most important markets are likely in late parts of the business cycle.

Be the first to comment