shironosov/iStock via Getty Images

Thesis

We published our last article on Caterpillar (NYSE:CAT) about 1 month ago, entitled “Caterpillar And Our Patience Test. Hold”. We analyzed why CAT has shown up on our radar, and as you can also guess from the title, why we still urge potential investors to be patient and not pull the trigger yet. As commented in the article,

We will remain patient. We see several uncertainties unfolding in the near future, which could trigger a correction and create better entry points. At the same time, the valuation is still above the historical average.

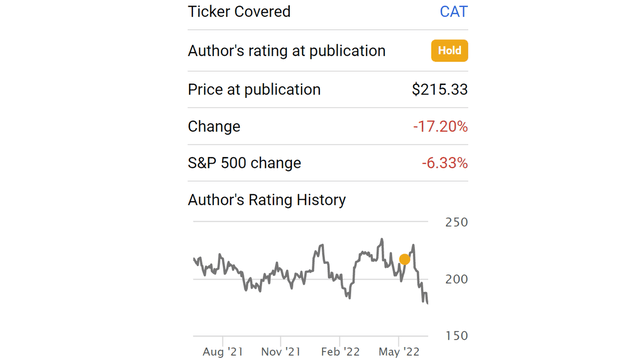

Indeed, the stock price has corrected by more than 17% since that time as you can see from the following chart, compared to the 6.3% correction suffered by the overall market.

In this article, we will analyze some new developments since then, particularly, its recent announced dividend raises, and its expanded share repurchase plan. As you will see, our final verdict is still “hold”. These positive fundamentals, combined with the sizable price correction, have made the stock closer to our buy zone. But valuation is still above average and leaves little margin of safety.

Dividend raises

CAT has been committed to shareholder returns in the long term. For example, it has returned to shareholders a total of $1.4B in 1Q 2022 alone through dividends and share repurchases. And it is a Dividend Aristocrat, an elite group of stocks that has been raising dividends consecutively for more than 25 years.

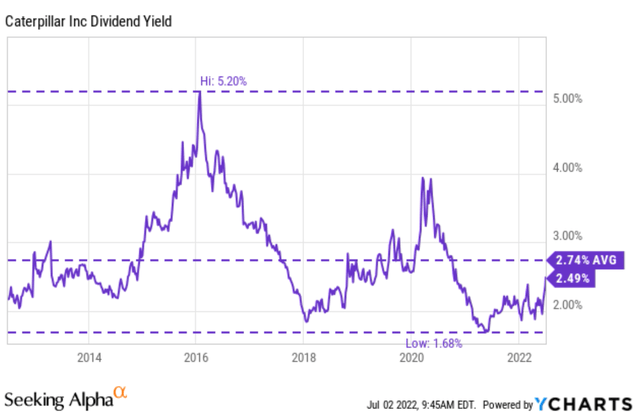

The stock has recently announced another dividend increase. It declared a $1.20/share quarterly dividend, an 8.1% increase from the prior dividend of $1.11. At the current stock price level, this raise brings its FW yield to 2.69%, a quite attractive level. To put things under historical perspective, the dividend yield for CAT has fluctuated in the past between 1.68% to 5.2% with an average of 2.74%. Therefore, its current dividend yield is getting really close to the historical average (only below it by 5 basis points, and I view such a small difference within the margin of uncertainty).

Besides dividends, the company is also a consistent buyer of its own shares. And it expects to return substantially all ME&T free cash flow over time to shareholders as discussed immediately below.

Seeking Alpha CAT earnings report

New stock buyback plan

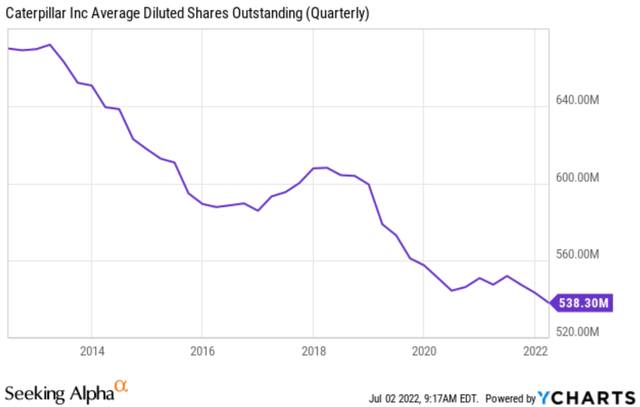

CAT has been consistently (and quite aggressively) buying back its own shares, which is never a bad sign for investors. As you can see from the following chart, its share count stood around 660M shares at the beginning of the decade. And now it has only 538 million shares outstanding. This translates into a 19.6% reduction of its outstanding shares in the past decade.

Looking forward, it expects to keep returning ME&T free cash flow to shareholders through sizable share repurchases.

It started its previous prepurchase plan in 2019 with a total size of $10B. And its board just announced an expanded share repurchase program to $15B thanks to its robust sales growth, expanded addressable market, and strong financial position. The details can be found in this report, and the highlights are quoted below (slightly edited and emphases added by me):

- At its Investor Day, its board approved a new $15B stock buyback authorization effective August 1, as the company expects higher long-term sales growth.

- It achieved Investor Day targets for adjusted operating profit margin, generated strong ME&T free cash flow, and expects higher long-term sales growth as the energy transition expands its addressable market.

- As an example, its mining machines should see increased demand from companies mining for metals and minerals that are needed to make more electric cars, and the company is “competitively advantaged to capture that growth.”

Based on its current closing price, this $15B buyback program reduces the outstanding share count by another 84M shares, or more than 15.6% of its current outstanding shares. Such a sizable repurchase at a near fair valuation would be highly accreditive to shareholder returns.

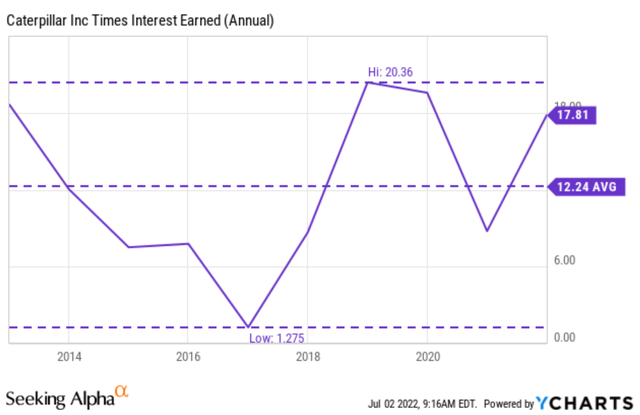

Besides the robust sales growth and expanded addressable market, such a large share repurchases program is also supported by its strong financial position as you can see from the second chart below.

Its financial strength is currently near a peak level in a decade in terms of its interest coverage ratio. In the past decade, it has earned on average 12.2x of its interest expenses and the peak level was near 20.3x. Currently, it is earning 17.8x of its interest expenses, only slightly below its peak level. At 17.8x interest earned, it only requires about 5.6% of its earnings to service its debt, learning ample flexibility for the firm to continue increasing dividend distribution and engage in share buybacks.

Valuation and expected returns

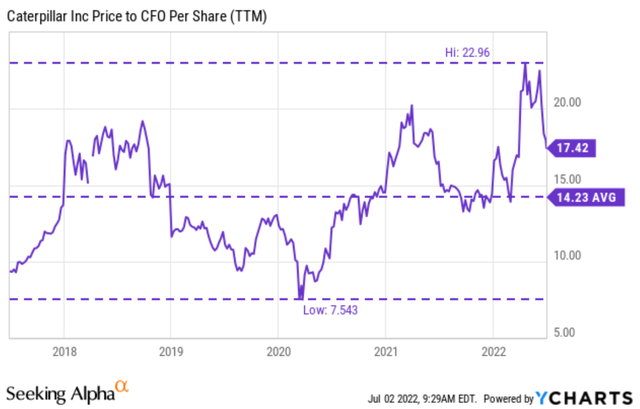

Finally, valuation. The following chart shows its valuation in the long term. As you can see, in terms of price to CFO ratio, its valuation has fluctuated between a bottom of 7.5x to a peak near 23x. The long-term average is 14.2x. And currently, it is valued at 17.4x times its CFO, about 22% above its long-term historical average. As to be elaborated in the next section when we discuss risks, such a valuation premium together with some of the uncertainties ahead are our main considerations to stay on the sideline for now.

Finally, also note the extreme volatility in its valuation, largely due to the correlation of the stock with commodity prices.

Final thoughts and risks

CAT’s stock price has been corrected by more than 17% since we wrote about it for the last time. In the meantime, there are some new positive developments in business fundamentals. It has announced an 8% dividend raise and also an expansion of its share repurchase to $15B. The combination of the price correction and these positives developed has made the stock closer to our buy zone.

However, we see a few concerns and will remain on the sideline for now. First, there is no margin of safety in terms of valuation. Even considering the dividend raises, its FW yield is 2.69%, still slightly below its historical average of 2.74%. In terms of price to CFO multiples, it’s now trading at ~17.4x, about a 22% premium compared to its historical average and not cheap in absolute terms either.

Besides the valuation risk, another risk is the uncertainty of the commodity market. As you can see from the last chart, its valuation fluctuated in an extremely wide range from as low as 7.5x to as high as 23x driven by commodities. And as commented by its CEO Jim Umpleby in the latest earnings report, there is a possibility that the demand from oil and gas customers has already peaked.

Oil and gas customers do continue to display capital discipline. However, we are encouraged by the improvement in orders for both recip and solar. As I mentioned earlier, those products tend to have longer lead times.

Be the first to comment