Kwarkot/iStock via Getty Images

After a pretty boring second half of 2021 in REITland, 2022 has gotten pretty fun. REITs have been dropping and dropping faster over time.

I had this article ready to go, expecting to sell one thing and buy a REIT today (Monday). But the market laughed at my plans and took a hard dive. I forewent my purchases and redid the graphics. Oh, well.

About a month ago, I looked at which REITs were down substantially in Putting Rockets On Launchpads. With the additional drop and its speed, one might characterize some REITs as falling knives.

Value investors love catching falling knives. Momentum investors shiver in terror when they appear. The title here shows which approach I favor. Of course, some falling knives should be left alone.

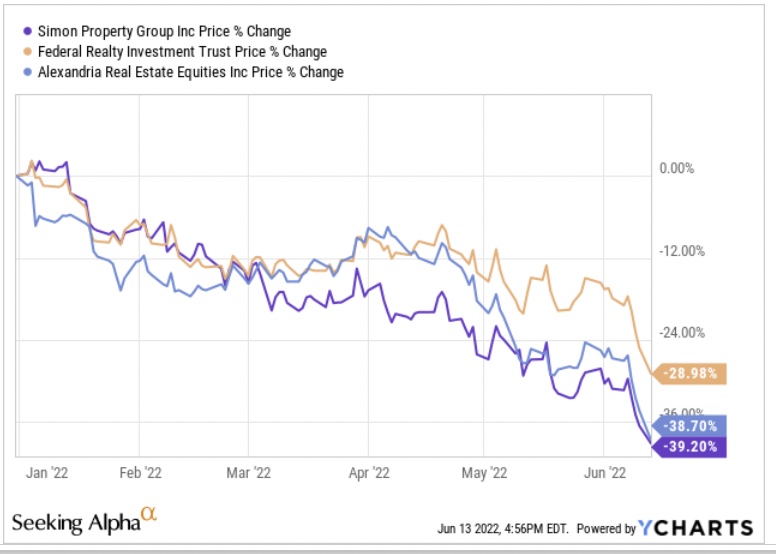

Take a look at the price action for these three REITs with credit ratings of BBB+ or A-:

YCHARTS

Remember that REITs are landlords with tenants, not businesses with clients or customers. Also remember that the value of a REIT is based on its long-term cash flows, not just on what is happening now.

For the REITs that are down a lot, the market is predicting a significant reduction in long-term earnings and/or earnings growth. There is a lot of variability across REIT sectors, but for mid-range numbers, a 10% drop in REIT revenues creates a 25% drop in the best measure of earnings. (This measure is Adjusted Funds From Operations, or AFFO, discussed by me at length here.)

A 10% drop in revenues does not mean that tenant earnings dropped 10%. It means that 10% of the tenants stopped paying rent. And for that to be fully reflected in the price of the REIT implies that there will be no replacements for those tenants.

This expectation makes little sense to me for the REITs shown above. We will look at some others shortly.

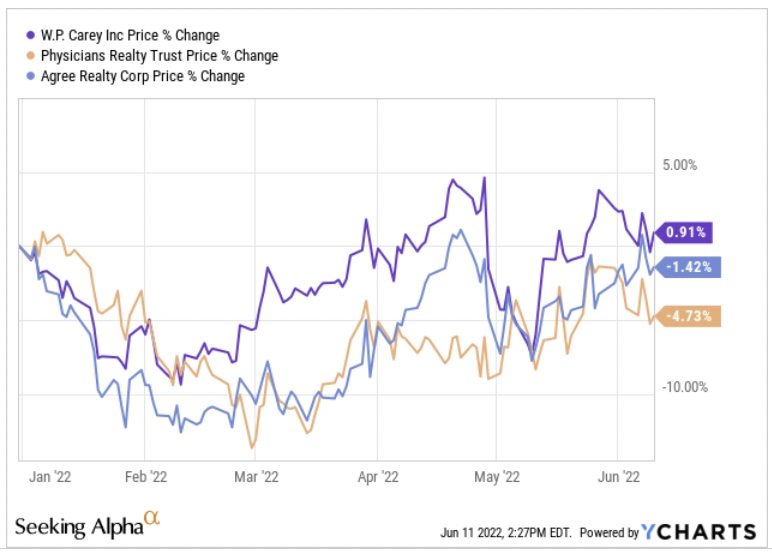

If the market was dropping for all REITs and all stocks, then one might suppose the cause to be an adjustment in discount rates. There may be some of that going on, but that seems unlikely to explain the graphic above because other REITs are immune for no good reason, as shown here:

YCHARTS

Which REITs Are Down The Most?

The above considerations motivate another look at REITs ordered by their drop in price. For this purpose, I again use the REIT/base tabulation of more than 90 REITs, combined with some financial functions in Excel. This leaves out nearly 100 smaller REITs, which we do not consider here.

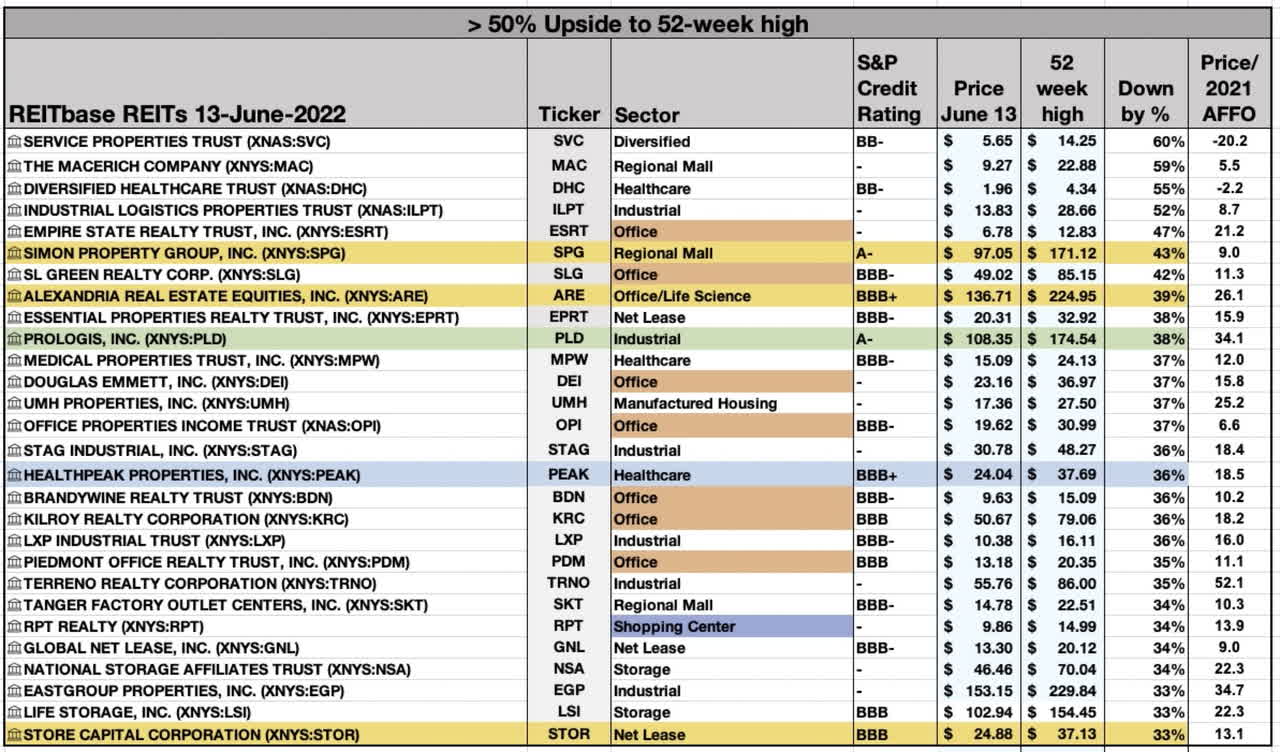

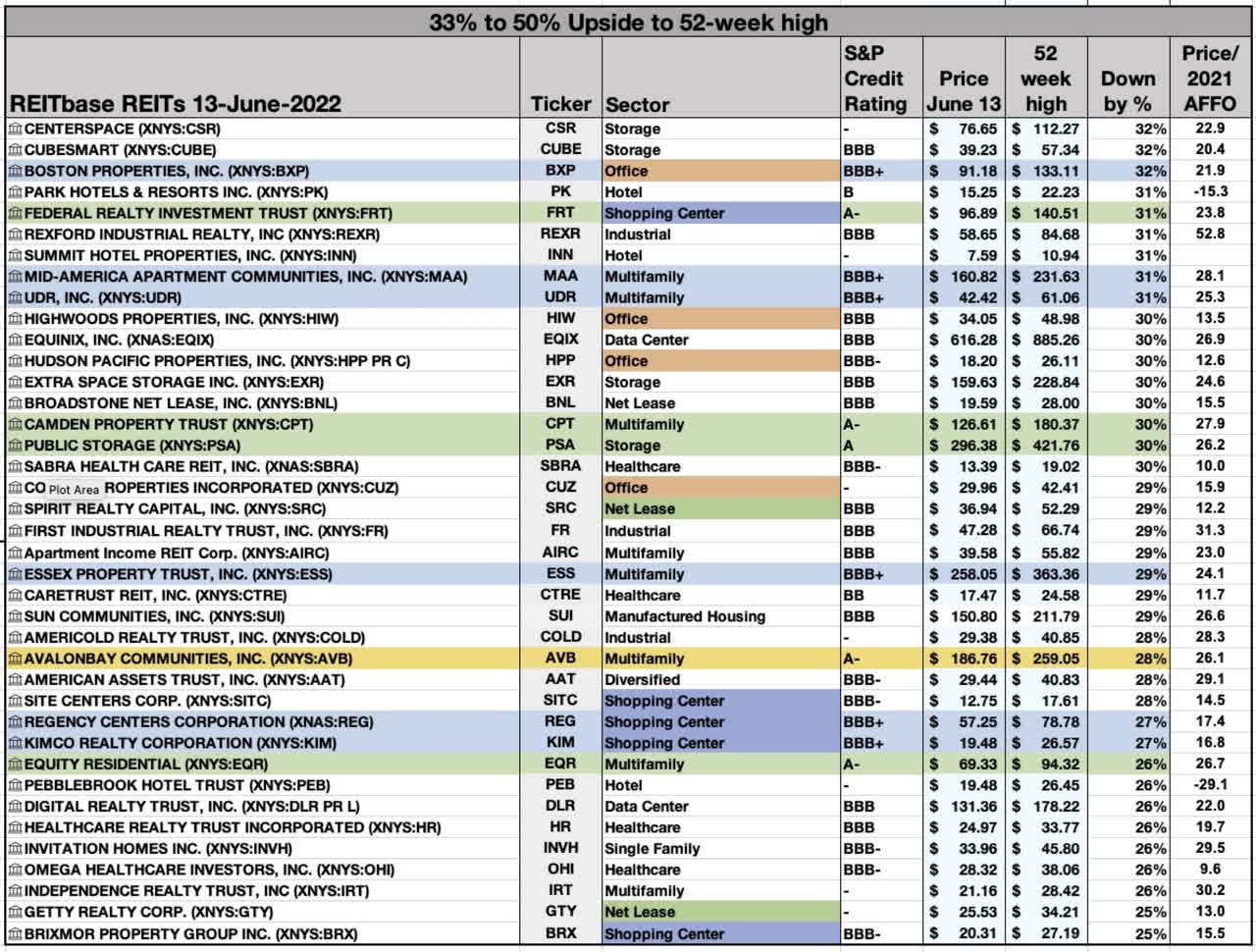

A REIT that has dropped 33% or more has 50% or more upside to recover in price. Here is a list of that group based on prices at the close on July 10.

RP Drake

Here, from left to right, you see the REIT, its ticker and sector, its credit rating from S&P, the June 11 price, the 52-week-high, the percentage by which it is down in price. The final column shows the ratio of current price to 2021 AFFO from REIT/base.

As always, such a simple screen is only a place to start research. Please don’t buy anything based only on this table. Here follow a few thoughts on some of these REITs. Feel free to ask me about others in the comments.

The two REITs in rows shaded gold are in my portfolio, which is relatively concentrated. My most recent look at Simon Property Group (SPG) was published last month for members of High Yield Landlord.

SPG is priced today for negative growth. Yet last week they announced multiple new growth initiatives, in a press release SA did not choose to cover. I’m just hoping the price drops at least another 10% before beginning its recovery, since that will take it past my next buy point.

Our members will soon see a workup on Alexandria Real Estate (ARE). Alexandria needs detailed, careful analysis. Part of the value of ARE lies in the Venture Capital business of Alexandria, which is why the P/AFFO is so high.

The third REIT here with a very high credit rating is Prologis (PLD), shown in the row shaded green. The industrial, logistics-oriented sector reminds me of the late 1990s, when unending and explosive increases in bandwidth were thought to be needed. Today, it is thought that unending and explosive increases in logistics facilities will be needed.

In my view, that sector will implode when e-commerce and logistics stop exploding, and I cannot predict when that will be. PLD is likely a good buy here, but my re-entry into the sector will come after we’ve seen an economic crash in it.

The other REIT shown above that is in my portfolio, with a rating of BBB, is STORE Capital (STOR). I have studied them in depth. In my view, STOR never reached full value last year, so the upside to fundamental value is even higher than that to the 52-week-high.

The market seems to have bought nutty the idea that any tenant without an investment-grade credit rating is not credit-worthy, even if they do not have the enormous size necessary for such a rating. My most recent article on STORE is here; it is a Very Large holding for me.

Some of this group likely deserve to have dropped in price. One for which that seems likely to me is Office Properties Income Trust (OPI). Their portfolio has lots of single-tenant office buildings on short leases, which is not where anyone should want their money.

Which REITs Are Down A Lot?

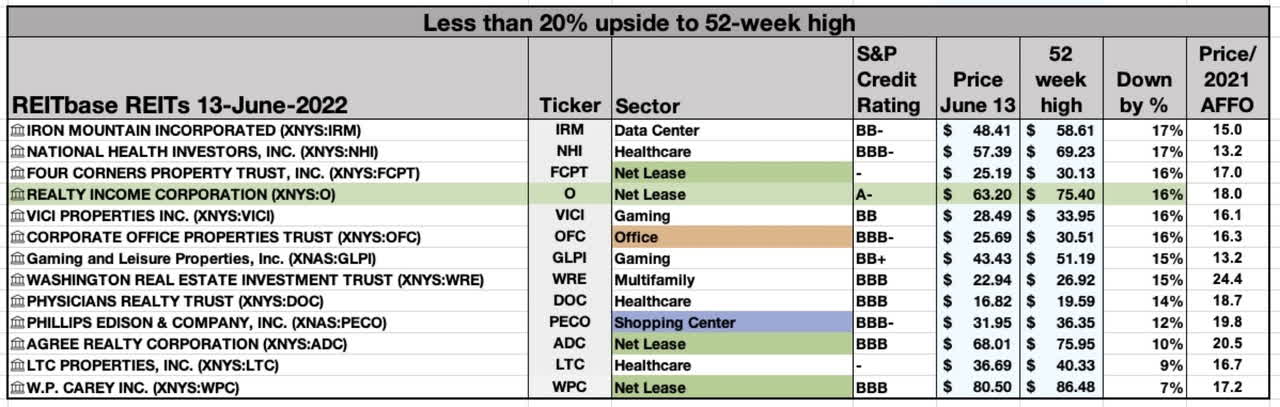

Here, in the same format, is the REIT/base list of REITs sorted for those with an upside to their 52-week high of 33% to 50%. This group has increased a lot in size in the past month, as the median REIT on their list has dropped 29% and so has 41% upside.

RP Drake

In this group, we see four more REITs with a credit rating of A or A-, of which I own AvalonBay (AVB). As to the others, my view is that Public Storage (PSA) and Camden Property Trust (CPT) ran too far last year. My own holdings of CPT were sold to add to those of AVB last fall.

The REIT that is getting attractive to me here is Federal Realty Investment Trust (FRT), a rock-solid REIT that made me good money in the last cycle. They may well end up again in my portfolio, especially if they drop a bit more.

The 6 REITs with a credit rating of BBB+, shown in rows shaded light blue, certainly also deserve consideration.

Which REITs Have Stayed High?

The list of REITs that have fallen least is also of interest. Here, it is, in the same format.

RP Drake

Here, again, we see a range of credit ratings. The market has very much sorted REITs quite strangely here.

If you own any of these, and especially anything on the bottom half of this list, this gives you an opportunity. You can sell it and buy a REIT of the same fundamental quality that has enormously larger upside.

Other than perhaps for tax-related reasons, there is little point in owning the bottom half of this group today. Even more, there is no point in buying them now unless you see very substantial upside to fair value from the current 52-week high. This will not stop the usual suspects for several of these REITs from writing articles that advocate their purchase now.

Takeaways

My hope is that you find this sorting of quality REITs useful in two ways: first, for assessing current and potential investments now and, second, in deciding where to do further research.

Times like the present are when you can make money on the buy with REITs. To my mind, this is the best way to increase your long-term gains out of the REIT sector.

Be the first to comment