Jean-Luc Ichard/iStock Editorial via Getty Images

Introduction

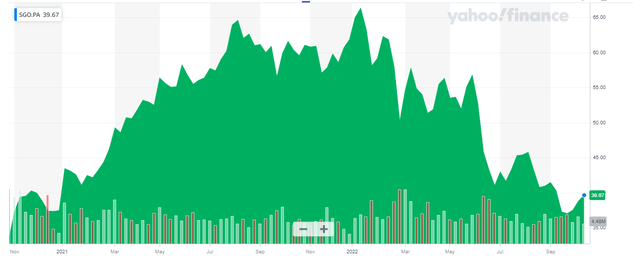

A lot has happened since I last discussed Saint-Gobain (OTCPK:CODGF) (OTCPK:CODYY), a French conglomerate with a history of almost four centuries. In these past 4.5 years we experienced the COVID lockdowns, the brief economic improvement only to be hit by decade-high inflation numbers right now. Despite these headwinds, Saint-Gobain performed quite well in the first semester and the free cash flow remained very strong so I wanted to have a look at the company’s performance and financial situation as the share price is currently trading about 10% lower than in 2018.

As Saint-Gobain is a French company, its listing on Euronext Paris is the best way to trade in the company as it definitely is much more liquid. The ticker symbol in France is SGO, and the average daily volume is 1.1M shares. The current market capitalization is approximately 20B EUR. As the company reports and trades in euro, I will use the EUR as base currency throughout this article. Saint-Gobain has published an excellent 54-page presentation which you can consult here to get a better understanding of the company and its divisions.

Surprisingly strong results in the first half of the year bode well for the rest of this year

Although Saint-Gobain’s fate is closely related to the situation of the world economy as the company is one of the most important producers and distributors of construction materials and applications for the automotive industry (like windows), the performance in the first half of this year was actually stronger than I had anticipated. While I didn’t dare to buy the stock once the war in Ukraine started, I decided to keep a closer eye on the financial performance as the share price is currently trading 40% below its 52 week high of 67.12 EUR per share.

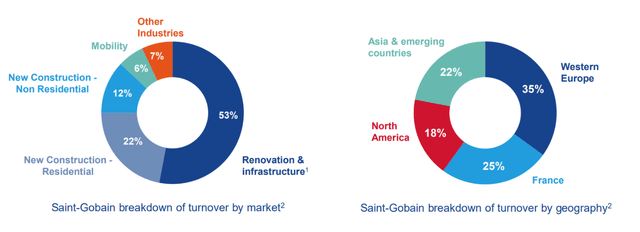

Saint-Gobain Investor Relations

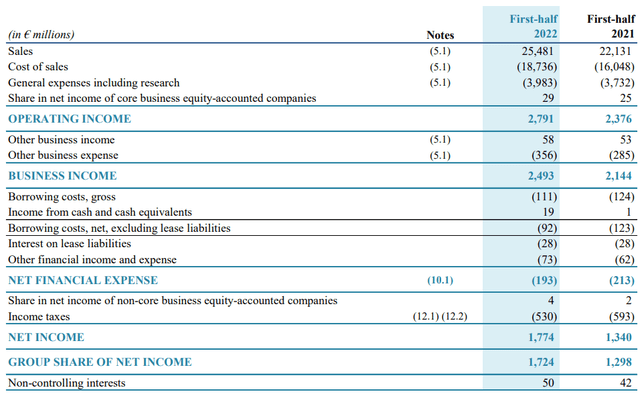

The total revenue in the first semester increased by approximately 15%, and the entire revenue increase was caused by organic growth and that’s pretty impressive. And while the COGS increased by in excess of 15% (which explains the boosted revenue as Saint-Gobain was passing on the higher operating expenses to its customers), the other ‘general expenses’ increased by just 7% and this helped to push the operating income higher by about 20%, to just under 2.8B EUR.

Saint-Gobain Investor Relations

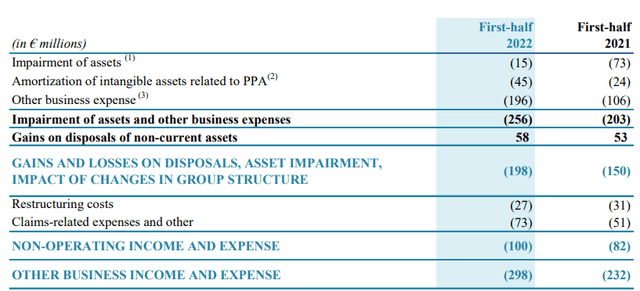

The other expenses increased somewhat (from 232M EUR to 298M EUR) and these expenses include impairment losses, amortization expenses and acquisition-related expenses. On top of that, there are some restructuring expenses and claims-related expenses as well.

Saint-Gobain Investor Relations

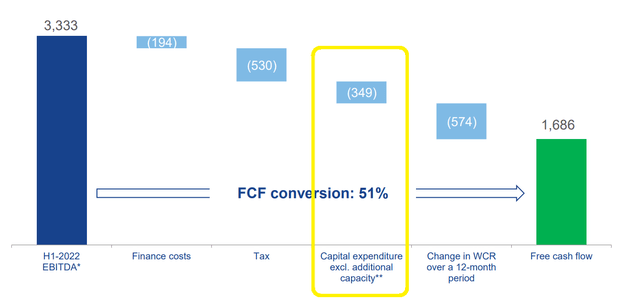

The net interest expenses decreased as well and despite recording a total tax pressure of 530M EUR, the reported net income came in at 1.77B EUR. About 50M EUR of this amount was attributable to non-controlling interests, which means the net income attributable to the shareholders of Saint-Gobain was 1.72B EUR. This resulted in an EPS of 3.34 EUR based on the average share count of just under 517M shares. The net share count as of the end of June came in at 520M shares which means the EPS based on the current share count was 3.31 EUR per share. Pretty strong considering the stock is trading below 40 EUR per share.

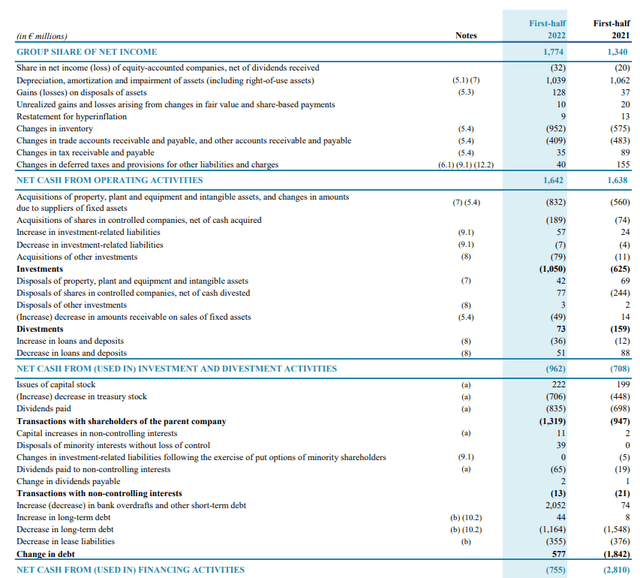

I already noticed in 2018 Saint-Gobain tends to be a strong performer on the cash flow level and H1 2022 wasn’t any different. The reported operating cash flow was 1.64B EUR but this included a working capital investment of approximately 1.3B EUR (mainly related to a seasonal build-up of inventory levels). This means the operating cash flow before changes in the working capital was approximately 2.9B EUR.

Saint-Gobain Investor Relations

From that result we still need to deduct the 355M EUR in lease payments. This means the adjusted operating cash flow in the first half of the current financial year was approximately 2.55B EUR. That’s an increase of more than 20% compared to the 2.08B EUR in H1 2021.

As you can see in the cash flow statement above, the company spent about 832M EUR on capital expenditures. This would indicate the free cash flow result was approximately 1.7B EUR (which would be pretty good, but keep in mind the majority of the 832M EUR in capital expenditures was actually spent on growth as growth investments doubled compared to H1 2021.

The image below shows the sustaining capital expenditures in the first half of the year

Saint-Gobain Investor Relations

This means the underlying sustaining free cash flow in the first half of the year was 2.2B EUR and divided over 520M shares, that’s approximately 4.13 EUR per share after also deducting the cash flow attributable to non-controlling interests. The free cash flow result is higher than the reported net income due to the fact the sustaining capex and lease payments of 704M EUR are lower than the 1.04B EUR in depreciation and amortization expenses. Looking at the full-year perspective, I expect a free cash flow result of approximately 3.5B EUR.

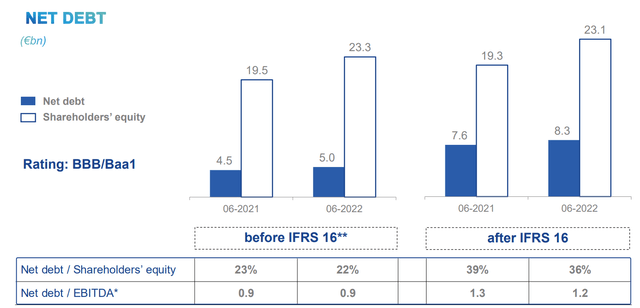

As of the end of June, the net debt came in at 8.3 BEUR, representing just 1.3 times the underlying EBITDA.

Saint-Gobain Investor Relations

And while Saint-Gobain has divested numerous assets over the past few years, the company is still looking at bolt-on acquisitions. The company closed the Kaycan acquisition for which it paid about $820M or about 8 times EBITDA after taking the anticipated $30M in synergy benefits into consideration. And SGO also closed the GCP acquisition in the third quarter of this year. That deal was originally announced in December 2021 when Saint-Gobain announced an all-cash offer of $32/share for a total value of $2.3B. The deal was originally worth 2B EUR but as the USD strengthened versus the Euro in the past year, the final price tag will be approximately 15% higher in Euro.

GCP was anticipated to generate $170M in EBITDA this year, but Saint-Gobain also expects to generate $85M in annual synergy benefits further down the road which means it is paying approximately 8.8 times the EBITDA including synergy benefits.

These two acquisitions closed in the third quarter and as they were all-cash acquisitions we should expect the net debt on Saint-Gobain’s balance sheet to increase by the end of this year. That shouldn’t be an issue as the strong cash flow generation will immediately help to reduce the net debt from next year on while the attributable EBITDA from the acquisitions will also help to keep the debt ratio at an acceptable level.

Investment thesis

The company’s first semester was much stronger than I had anticipated as the sustaining free cash flow exceeded 2.2B EUR. While that is great, I would still like to see how Saint-Gobain performed in the third quarter of the year and what its anticipations are for the fourth quarter as I can imagine the visibility isn’t great.

Despite spending in excess of 3B EUR on acquisitions in the past few months, I think the balance sheet is and will be fine and the bond market appears to agree with me. The 2032 bond with a 2.625% coupon is currently trading at 85.6% of the par value, implying a yield of 4.45%. That is a mark-up of less than 150 base points to the French government bond yield for the same period.

I currently have no position in Saint-Gobain but I am keeping very close tabs on this one.

Be the first to comment