jetcityimage/iStock Editorial via Getty Images

By Valuentum Analysts

Too bad gasoline isn’t $2.25/gallon anymore like the picture above, but that doesn’t mean we should get sidetracked from Casey’s General Stores (NASDAQ:CASY) solid fundamentals. For those that don’t know Casey’s, it operates a chain of convenience stores that include fuel stations and pizza shops. These stores are located in 16 US states across the Midwest. Since opening its first store in Boone, Iowa back in 1968, Casey’s has built up its operations to include over 2,400 store locations. We like the scale that Casey’s has and view its growth runway quite favorably.

Overview

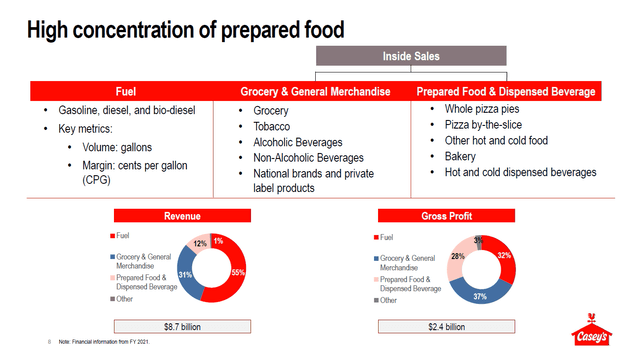

The company generates revenues by selling fuel, groceries, general merchandise, prepared food, and beverages. During the fiscal year ended April 2021, Casey’s generated over half of its revenue from ‘fuel’ sales followed by ‘grocery & general merchandise’ and ‘prepared food & dispended beverage’ sales. However, its gross profit mix paints a much different picture. Grocery & general merchandise sales represented over one third of its gross profit, fuel sales represented just under one third of its gross profit, and prepared food & dispended beverage represented a bit under one-third of its gross profit for the fiscal year ended April 2021.

Casey’s generates the majority of its revenue from fuel sales, though its gross profit mix is much a different story. (Casey’s – March 2022 IR Presentation)

It is important to keep in mind just how important prepared food, namely its pizza operations, are to Casey’s and its bottom-line. The company is effective at pulling customers to its stores as it offers plenty of essential goods (including fuel, milk, bread, eggs, and various household items such as paper towels) and popular discretionary goods (including alcoholic beverages, tobacco products, soda, and various prepared food items like pizza and sandwiches). Casey’s has its own private label products including soda, chips, coffee, juice, jerky, and much more. There is a lot going on here, and we appreciate Casey’s focus on differentiating its operations from its competitors.

Financial Update

Casey’s reported in March 2022 its third quarter earnings for fiscal 2022 (period ended January 31, 2022). The firm’s ‘inside same-store sales’ grew by 7.6% with strong growth seen at its grocery and general merchandise same-store sales (up 7.7%) and prepared food and dispensed beverage same-store sales (up 7.4%).

Its ‘inside margin’ stood at 39.4% in the fiscal third quarter (down ~20 basis points on a year-over-year basis as inflation took its toll), with its grocery and general merchandise margin growing by ~170 basis points year-over-year to reach 32.0% while its prepared food and dispensed beverage margin declined by ~260 basis points year-over-year to reach 58.0%.

The company’s GAAP revenues exploded higher 52% year-over-year in the fiscal third quarter, keeping the impact rising fuel prices have on its top-line performance. Its GAAP diluted EPS grew by 64% year-over-year to hit $1.71 in the fiscal third quarter. Casey’s is firing on all cylinders and adeptly navigating inflationary pressures, supply chain hurdles, labor shortages, and the competitive environment it operates in.

During the first three quarters of fiscal 2022, Casey’s generated $308 million in free cash flow and spent $38 million covering its dividend obligations. We appreciate the company’s stellar cash flow generating abilities, though its net debt load is quite sizable and stood just under $1.7 billion at the end of January 2022 (inclusive of short-term debt). In our view, Casey’s can manage its balance sheet obligations going forward given its nice free cash flows. As of this writing, shares of CASY yield a modest ~0.7%.

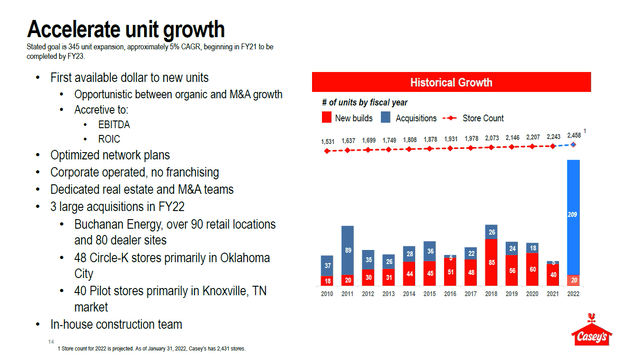

Casey’s acquired Buchanan Energy in May 2021, which owned Bucky’s Convenience Stores. This move strengthened the firm’s position in the Midwest by adding 92 new stores to its operations (including 24 in Nebraska and 56 in Illinois) along with a dealer network covering 81 stores that involves fuel supply agreements. Additionally, there were some land parcels included in the purchase that can be used to support future growth activities. Casey’s paid roughly $580 million to buy Buchanan Energy.

In June 2021, Casey’s closed on the purchase of 48 Circle-K stores in Oklahoma for about $36 million (according to its Fiscal 2021 Annual Report). Circle-K is owned by the Canadian firm Alimentation Couche-Tard Inc. (OTCPK:ANCTF). Acquisitions and organic growth opportunities are being utilized to further extend the reach of Casey’s. There is ample room for Casey’s to continue growing, particularly in states it has yet to establish a store in.

Casey’s has steadily grown its store count in recent years. (Casey’s – March 2022 IR Presentation)

Strategic Goals

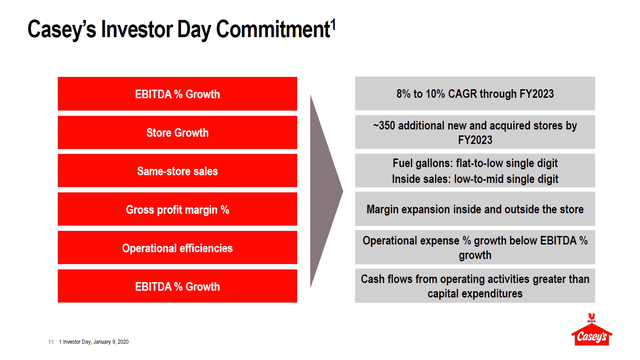

In January 2020, Casey’s laid out ambitious goals through fiscal 2023 though the coronavirus (‘COVID-19’) pandemic created a lot of turbulence here. The company is delivering on its promise to grow its store count while ensuring it remains comfortably free cash flow positive, and its inside same-store sales have grown robustly of late. Casey’s has done a solid job so far maintaining its strong margins, though inflationary pressures remain substantial.

A look at the medium-term goals Casey’s laid out in January 2020. (Casey’s – March 2022 IR Presentation)

Valuation Analysis

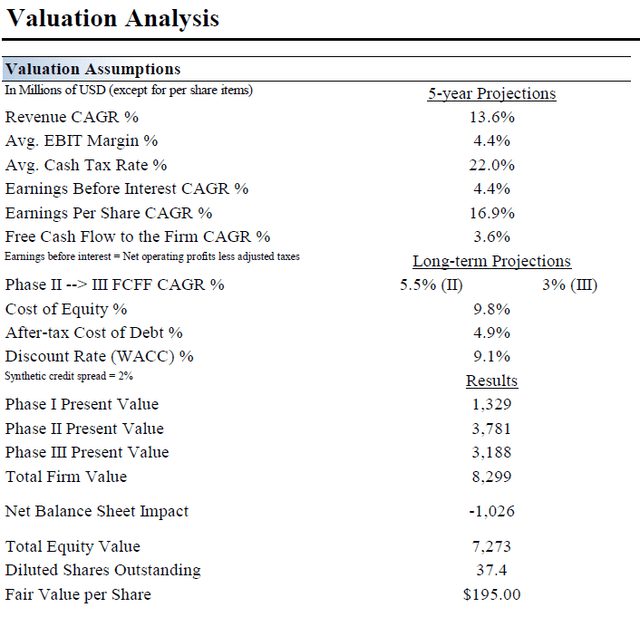

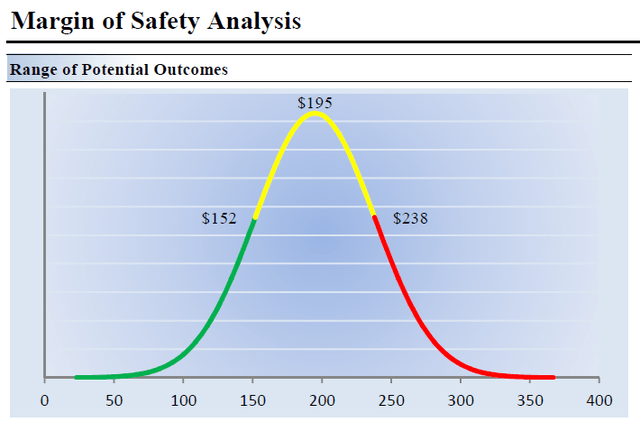

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. Under our “base” case scenario, we value Casey’s at $195 per share with ample room for upside should the company exceed these forecasts.

An overview of the key valuation assumptions we used in our base case scenario covering Casey’s. (Valuentum Securities)

Although we estimate Casey’s fair value at about $195 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values. In upcoming graphic down below, we show this probable range of fair values for Casey’s General. We think the firm is attractive below $152 per share (the green line), but quite expensive above $238 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

The top end of our fair value estimate range for Casey’s sits at $238 per share. (Valuentum Securities)

Concluding Thoughts

We like Casey’s and its business model is intriguing. The company is a strong free cash flow generator home to meaningful capital appreciation potential, and its dividend program offers incremental upside. Casey’s is facing sizable headwinds, but so far it has done a tremendous job growing its same-sales and preserving its margins. For investors looking for resilient retail exposure in uncertain economic times, it’s hard not to like Casey’s. It’s on our radar.

Be the first to comment