Joe Raedle

Thesis

We updated investors in our pre-earnings article on Carvana Co. (NYSE:NYSE:CVNA) that CVNA had likely staged its long-term bottom, despite worsening macro headwinds and a high level of pessimism. Since then, CVNA has staged a remarkable post-earnings momentum spike that exceeded our price target, as it rose more than 100% following our article. However, knowing that such rapid surges are often unsustainable, we also urged investors who capitalized on its long-term bottom to take profit and cut exposure.

CVNA has given back most of its recovery from its June/July lows, but is still up nearly 30% from our previous update. The company seems on track to continue its operating leverage gains, despite falling used-auto retail prices. Investors should note that Carvana also benefits from better wholesale prices, which would improve its gross profit per unit (GPU). Therefore, it mitigates the impact of lower retail average selling prices (ASPs) as management aims to regain its $4.5K GPU target.

Notwithstanding, we deduce that CVNA’s valuation seems more well-balanced now. Despite the deep pullback from its August highs, we don’t suggest investors pull the buy trigger on CVNA at the current levels, as Carvana still needs to prove its operating model is sustainable. Therefore, we urge investors to be generous with their margin of safety, given Carvana’s unprofitability and near-term headwinds.

Accordingly, we revise our rating on CVNA from Speculative Buy to Hold. However, investors should note that we postulate that CVNA is likely at a near-term bottom. Therefore, investors looking to cut exposure can consider doing so at the next rally.

Carvana’s Q2 Showed That It Could Execute Well Against Near-Term Headwinds

Used auto prices have continued to fall through August after the release of Carvana’s Q2 earnings card. As a result, the Manheim Used Vehicle Value Index fell MoM in August, even though it remains higher on YoY comps. Accordingly, “the non-adjusted price change in August was a decline of 2.6% compared to July, leaving the unadjusted average price up 5.9% year over year.”

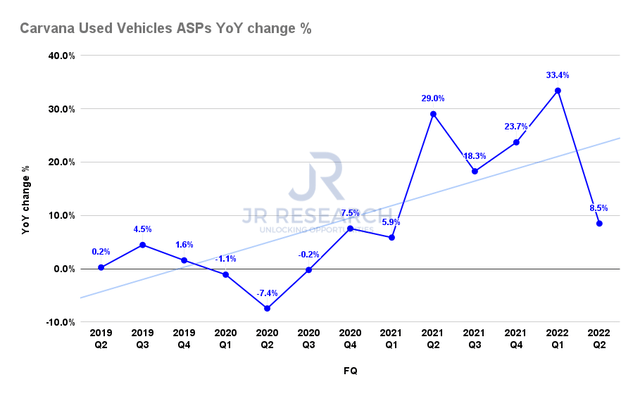

Carvana retail ASPs YoY change % (Company filings)

As seen above, Carvana’s retail ASPs growth fell markedly to 8.5% YoY in Q2, down from Q1’s 33.4%. However, its GPU growth improved on a QoQ basis, as management highlighted it remains committed to improving operational efficiencies while also benefiting from more constructive wholesale pricing.

As a result, Carvana has mitigated the impact of lower ASPs growth, which is expected to fall further, given worsening macro headwinds and challenging comps against FY21. In addition, it also helps address the affordability challenge, which coincided with a better-than-expected improvement in consumer confidence in August. Therefore, we posit that Carvana has sufficient levers in its business model to deal with lower ASPs impacting its GPU.

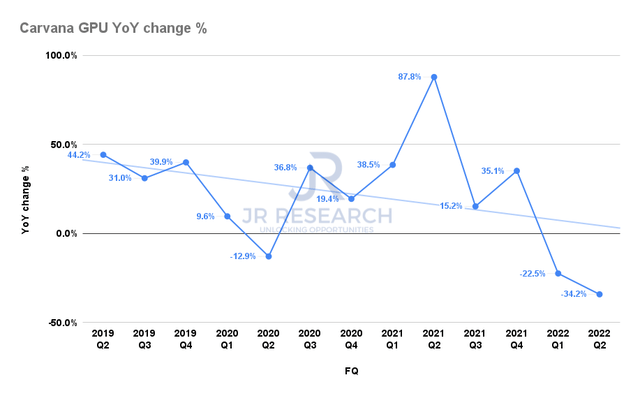

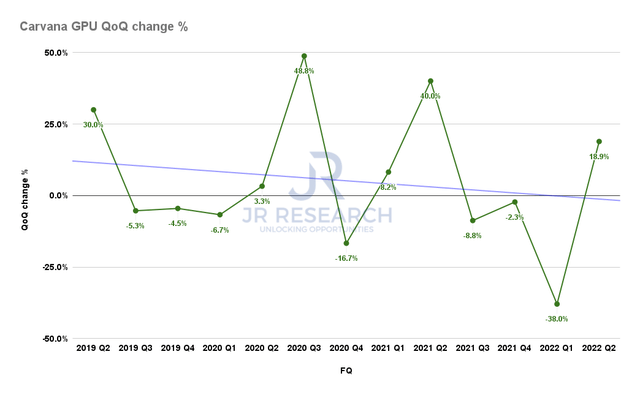

Carvana GPU YoY change % (Company filings) Carvana GPU QoQ change % (Company filings)

As seen above, Carvana’s GPU growth increased by 18.9% QoQ, even though it fell 34.2% YoY in Q2. Therefore, we surmise that the market had anticipated a reacceleration in QoQ GPU growth, as CVNA consolidated robustly in June/July. Management also remains steadfast in continuing its focus on delivering efficiencies than growth in the current climate, even if it means sacrificing some volume growth in the near term.

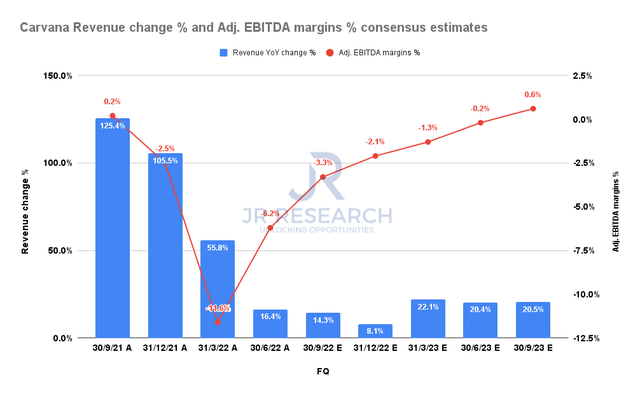

Carvana revenue change % and adjusted EBITDA margins % consensus estimates (S&P Cap IQ)

The consensus estimates (bullish) indicate that Carvana’s unprofitable model should continue to gain operating leverage rapidly even though its revenue growth should bottom out only in Q4. Investors should continue to expect near-term headwinds in volume growth that could hinder CVNA’s near-term growth cadence.

CVNA’s Valuation Is More Well-Balanced

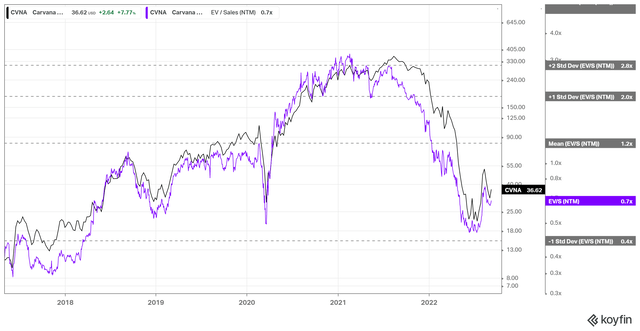

CVNA NTM revenue multiples valuation trend (koyfin)

The massive battering brought CVNA’s valuation “to its knees” at its June/July lows, near the one standard deviation zone below its all-time NTM revenue multiples mean. Coupled with our internal fair value estimates, we were confident that CVNA was reasonably valued, even when we applied an aggressive hurdle rate.

Even though CVNA remains well below its mean at the current levels, we urge investors to be generous in their margin of safety, given CVNA’s unproven profitability. Also, investors should note that CVNA’s valuation had never exceeded its mean before the pandemic-induced craze. Hence, we believe that CVNA has been materially de-rated.

Is CVNA Stock A Buy, Sell, Or Hold?

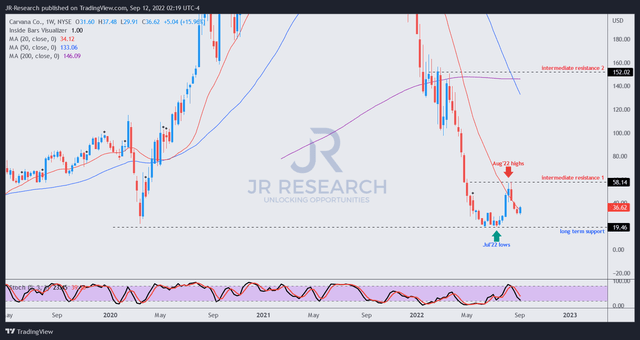

CVNA price chart (weekly) (TradingView)

CVNA’s massive momentum spike has been digested markedly from its August highs. Therefore, CVNA could potentially form a bottoming process at the current levels, coupled with oversold momentum indicators.

However, we urge investors to assess our thesis of a more well-balanced valuation and Carvana’s unproven profitability.

We revise our rating from Speculative Buy to Hold.

Be the first to comment