Justin Sullivan/Getty Images News

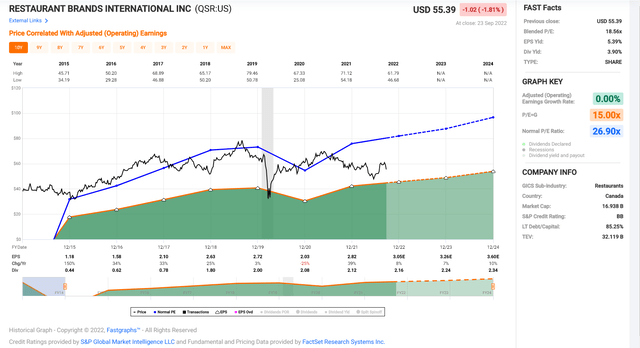

Just over two months ago, I wrote on Carrols Restaurant Group (NASDAQ:TAST), noting that the valuation didn’t offer enough margin of safety. At the same time, Restaurant Brands International (QSR) was trading at its cheapest levels in years. It was the far more attractive way to get exposure to Burger King/Popeye’s, given that it has a fully-franchised model and exposure to two other iconic brands (Firehouse Subs, Tim Hortons). Since then, TAST has declined by more than 22%, and QSR has outperformed by 3100 basis points. This can be attributed to Restaurant Brands International’s [RBI] strong Q2 beat, with better than expected results at Tim Hortons.

Carrols Restaurant Group (Company Presentation)

Unfortunately, for Carrols, it was another tough quarter, with the company reporting an adjusted net loss driven by continued pressure from commodity/wage inflation. While RBI’s system hasn’t been immune from inflationary pressures, its fully-franchised model, which is more inflation-resistant, and aggressive buyback program have helped it to enjoy annual earnings per share growth. Although 2023 should be a better year for Carrols as it works hard on new initiatives and with beef costs potentially peaking, I still don’t see enough margin of safety at current levels. Hence, I wouldn’t be in any rush to buy the stock at $1.65.

Q2 Results

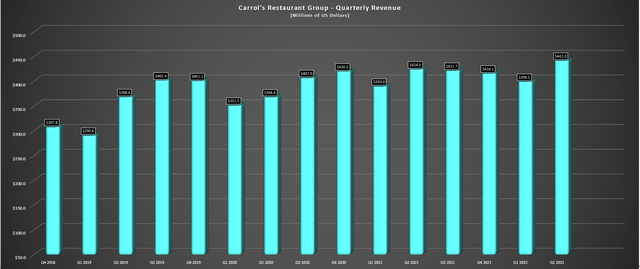

Carrols Restaurant Group (“Carrols”) released its Q2 results last month, reporting quarterly revenue of $441.9 million, a 4% increase from the year-ago period. From a same-restaurant sales standpoint, Burger King reported 2.8% growth and continued to outperform the US system. In comparison, Popeye’s reported 2.0% growth, outperforming the US system, but lapping very easy year-over-year comps. From a two-year stacked growth standpoint, same-restaurant sales for Burger King came in at an impressive 15.4% (Q2 2021: 12.6%), offset by Popeye’s, which saw negative two-year same-restaurant sales despite taking price, with many brands struggling to hold the line on traffic.

Carrols – Quarterly Revenue (Company Filings, Author’s Chart)

Overall, these were satisfactory sales results, especially considering the tough comparisons, with the industry lapping a tailwind from stimulus payments in Q1/Q2 2021 and having multiple major headwinds this year: soaring gas prices, higher mortgage costs, and rising grocery prices. Unfortunately, while sales were slightly better than expected, profitability continued to suffer, impacted by rising commodity costs and wage inflation. This was evidenced by Carrols’ cost of goods sold jumping to 31.9% and labor costs increasing to 33.8%.

Given the higher costs, adjusted EBITDA and restaurant-level adjusted EBITDA declined to $15.1 million and $34.6 million, respectively. These were quite unfavorable relative to $29.3 million and $47.9 million in the year-ago period, with restaurant-level adjusted EBITDA margins dipping to 7.8% vs. 11.3%. This led to an adjusted net loss in the period of $8.9 million, down from quarterly net income of $16,000 in Q1 2021. To combat these inflationary pressures, the company plans another modest price increase in September, with menu pricing set to remain at high single-digit levels on a year-over-year basis.

So, what’s the good news?

While the headline numbers weren’t pretty, the company appears to continue to work on initiatives to turn its results around, which include the following:

- raising the bar on operational excellence related to the guest experience

- improving productivity/improving turnover by motivating team members

- turning around the most challenged locations using best practices

The company appears to have made solid progress on the first initiative, with drive-thru wait times below 2020/2021 levels. Meanwhile, the company noted that it is seeing applicant flow improve, which could be related to the sharp increase in wages vs. pre-pandemic levels and the more challenging macro environment, which is pushing some back to work in the industry vs. staying home. Carrols noted that it expects to see some of the progress shine through in future results, even if it wasn’t evident in the Q2 results, which didn’t quite meet expectations, resulting in a sharp decline in the stock.

Industry-Wide Outlook & Headwinds

If we look at the industry, traffic declined sharply year-over-year this summer, with consumers getting hit from every angle, with soaring gas prices being the straw that broke the consumer’s wallet. Fortunately, gas prices have fallen sharply from their highs above $5.00/gallon, and even if rising grocery prices, higher mortgage payments, and the reverse wealth effect are headwinds, I would expect these to be a larger issue for casual dining brands, and less so quick-service restaurants and pizza.

Burger King Menu Offerings (Company Website)

This is because quick service restaurants and pizza tend to benefit in recessionary environments, with most consumers unable to stop ‘treating’ themselves but instead settling for trade-down options. Meanwhile, quick-service and pizza are very high from a convenience standpoint without breaking the bank, which certainly benefits Carrols, with two quick-service brands: Popeye’s and Burger King. Finally, while all restaurants are raising prices to combat wage/commodity inflation, quick-service brands might be able to get away with this easier, given that average checks are lower, making it less noticeable. Lastly, even in cases where average checks are similar, consumers save on tips at quick service.

To summarize, while the macro backdrop is difficult, I believe brands like Tim Hortons, McDonald’s (MCD), Taco Bell (YUM), Domino’s Pizza (PZZA), Burger King, Popeye’s, Wingstop (WING), and several others should be able to weather the storm quite well, even if they index more towards less affluent consumers. Hence, if I wanted to be long the restaurant space, the safer area to go fishing is in these stocks vs. their casual dining peers, especially with valuations becoming more attractive for names like Domino’s Pizza and Yum Brands.

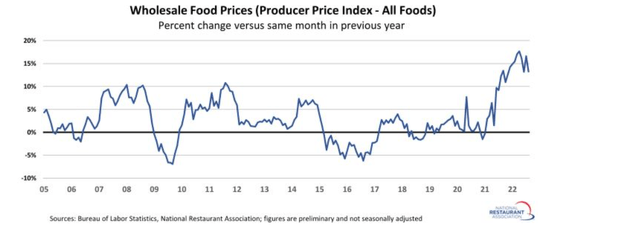

Wholesale Food Prices (National Restaurant Association, BLS)

From a margin standpoint, one theme in Q2 was that applicant flow appears to be improving, which could help to pull down labor costs a little, given that there should be a reduction in overtime/bonus pay to properly staff restaurants. Meanwhile, from a commodity standpoint, costs remain high, but some brands appear confident that costs for some commodities have peaked. Carrols noted that labor and commodity costs appear to have stabilized at this higher level, while beef has begun declining: one of its highest input costs. Assuming this trend continues, beef costs should finish the year at $2.55/lb. to $2.60/lb., down from a peak of $2.90/lb., a major help from a profitability standpoint.

To summarize, while some of the negativity surrounding the restaurant space makes sense, especially for casual dining, which could be hurt by trading down or simply eating at home, it’s possible Q2 marked near the worst for quick-service given the combination of peaking commodity costs and traffic headwinds from higher gas prices. Therefore, while Carrols’ stock has been killed, down 80% from its 2021 highs, the optimism in the prepared remarks makes sense, though a return to the highs for gas prices would certainly derail this view. Let’s take a look at the valuation:

Valuation & Technical Picture

Unfortunately, while Carrols is down sharply from its highs, it’s the case of a turnaround story with a valuation that still leaves much to be desired. This is because the stock is currently trading at ~12x EV/EBITDA, only a slight discount from its historical average. Meanwhile, from an earnings standpoint, the company continues to post net losses per share, with no return to positive annual EPS currently in sight. Given its weaker balance sheet (~$510 million in debt, finance lease liabilities), I don’t see the company in the same position as others to take advantage of their weak share price to buy back stock.

Meanwhile, from a risk standpoint, the S&P 500 (SPY) remains in a cyclical bear market, and in this environment, smaller-cap stocks can be a much higher-risk bet, lacking strong institutional support. This does not bode well for Carrols, which is not active in the open market, defending its share price, and doesn’t benefit from large funds accumulating the stock during weakness, given its lower liquidity. So, while the valuation may be more reasonable after an 80% decline, I continue to favor names like RBI, which trades an attractive valuation and can use this weakness to boost long-term earnings per share growth (3.2 million shares repurchased in Q2 alone).

QSR Historical Earnings Multiple (FASTGraphs.com)

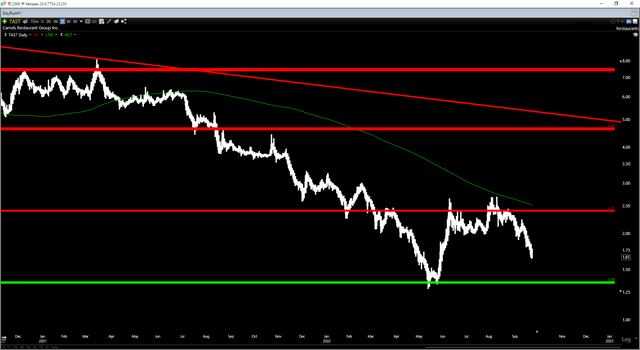

Meanwhile, from a technical standpoint, TAST trades below its key moving averages and has multiple resistance levels stacked overhead. The next resistance level comes in at $2.05 – $2.40, suggesting that this could be a ceiling for the stock over the next several months. Although this does represent a meaningful upside from $1.65, the best place to buy turnaround stories is at support or on undercuts of support, and support doesn’t come in until $1.35. So, if I did want to bet on TAST, the better reward/risk bet would be buying at $1.35, where the reward/risk would be more attractive from a swing-trading standpoint.

Summary

Assuming beef costs continue declining and wage inflation decelerates, Carrols could have a much better two years ahead (2023/2024), and the stock might finally be able to hammer out a meaningful bottom. However, in a volatile market environment, I prefer to bet on mid-cap/large-cap companies that are paying me to wait (high dividend yields), generate significant free cash flow, or have a story that’s so compelling that they simply can’t be ignored. Given that Carrols doesn’t fit this criterion, I continue to favor other names, like Restaurant Brands International below $54.00, or in different sectors, Agnico Eagle (AEM) below $45.00. That said, if TAST were to decline below $1.35 before November, I would consider the stock for a short-term trade.

Be the first to comment