Joel Carillet/iStock Unreleased via Getty Images

In no huge surprise, Carnival Corp. (NYSE:CCL) reported a quarter of improving results. The largest cruise line didn’t report a perfect quarter, but the company and the sector continues to head back to more normal times in the travel and leisure sector. My investment thesis is very Bullish on the stock after the dip back towards the COVID lows, which was ill-timed considering the dynamics of the business are far improved now.

Positive Trajectory

As already discussed on previous research on Royal Caribbean (RCL), the cruise line sector reached an inflection point in the Spring with a return to positive cash flows. The companies no longer are heading down a path of burning cash and needing to raise additional funds. The only question now is the level of cash flows leading to debt repayments in the future.

In no surprise, FQ2’22 ending in May was all about the company restarting guest operations and filling up boats. Carnival reported that May quarter occupancy reached 69%, and 91% of capacity was back to cruising in June with strong bookings reported for future periods. During the quarter, the cruise line only averaged available lower berth days (ALBDs) at 74% of total fleet capacity in a sign of how far the business was still from reaching a full recovery until the current quarter.

Similar to the airline sector, the cruise lines are now back to near normal operations with capacity slightly below 2019 levels and ultimately headed higher by 2023. The only question is how packed the cruises will be going forward.

For FQ2’22, revenues were up 50% from the prior quarter to $2.4 billion. Carnival still reported a large loss due to the low occupancy in the quarter and restart of operations on several ships leading to higher expenses without the full revenue benefits.

The company was cash flow positive due to a large $1.4 billion increase in customers deposits for future sailings. The total customer deposits are now $5.1 billion.

Back in 2019, May quarterly revenues were $4.8 billion with customer deposits up at $5.8 billion. Clearly, Carnival still has a lot of work to match 2019 levels in a sign that cash flows still have plenty of upside ahead.

As such, the market shouldn’t spend too much time focused on the past quarter results with Carnival spending most of the period restarting operations. The cruise line has already increased fleet capacity from 74% as an average for last quarter to 91% for the current quarter pushing the cruise line close enough to full capacity to produce solid financials. Similar to the airlines, Carnival should be able to boost occupancy levels with capacity below 100%.

The market sold off the cruise line stocks over the last month on fears of lowered bookings with recession risks perking up. Carnival admitted some mixed view on near term bookings, but the long term picture was strong with these following nuggets in the earnings release or call:

-

Booking volumes for the second half of 2022 sailings, since the beginning of April, have been higher than 2019 levels.

-

Cumulative advanced bookings for the full year 2023 continue to be both at the higher end of the historical range and at higher prices, with or without FCCs, normalized for bundled packages, as compared to 2019 sailings.

-

Currently, we are seeing success for close-to-home cruises, with many sailings achieving occupancy at or above 100%, where guests perceive far less friction than with international embarkations. In fact, our Carnival Cruise Line brand, sailing its entire fleet, is expected to reach nearly 110% occupancy during our third quarter.

A big reason for the improved booking in the 2H of the year and into 2023 are the relaxing of COVID restrictions, both for flying to foreign embarkments and just general testing restrictions for domestic trips. While the market is focused on some of the noise around recent ship occupancy trends, the trend remains tied to far more normalized bookings in the future.

Bargain Bin

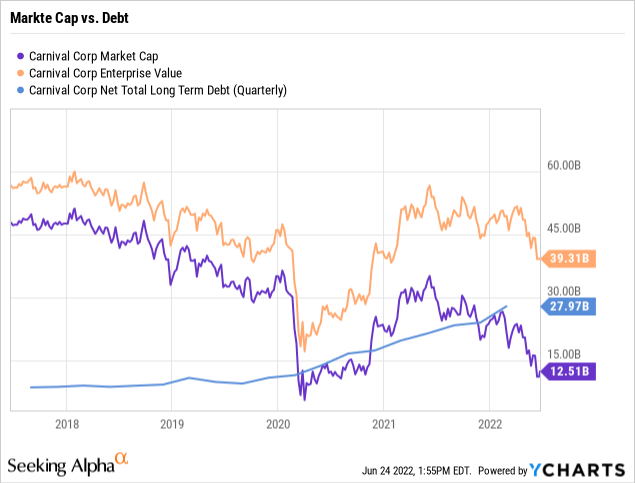

A lot of investors were hesitant to purchase Carnival on the rally during 2021 on valuation fears with the enterprise value topping pre-COVID levels. Due to the higher debt levels and shares outstanding, the market felt cruise line stocks shouldn’t match those prior levels on this key metric.

With the recent dip, Carnival now has an EV of ~$40 billion below the $45 billion level pre-COVID. Investors need to be careful using such a metric because the number doesn’t accurately reflect the financial position of companies with large asset balances acquired via debt.

Carnival ended May with a cash balance of $7.2 billion and a debt position of $35.1 billion leading to a net debt position of $27.9 billion. The company now spends about $400 million on quarterly interest expenses, above the $50 million pre-COVID.

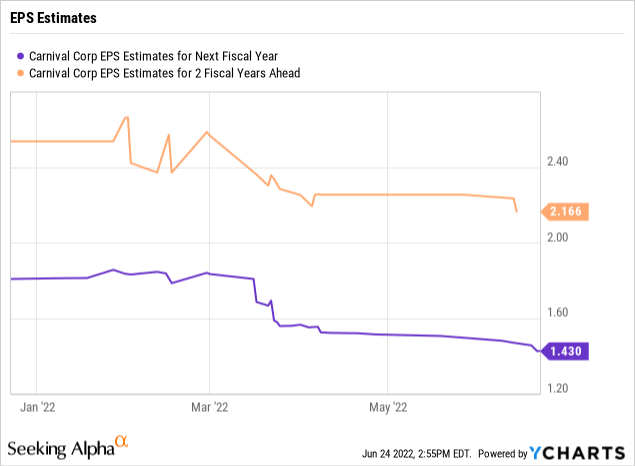

The cruise line has to eliminate a lot of the debt to reduce the interest expenses and boost EPS. Still, the positive indications from the quarterly report appear to set up Carnival to return to the earnings path from a few months ago where 2024 EPS targets were above $2.40 per share.

The stock was trading below $10 and this is all investors need to understand. Carnival trades at only 4x EPS targets still out a year, but more inline with normalization trends.

Remember, Carnival has the potential for a massive boost to EPS by cutting the interest expenses by over $1 billion annually (net interest expenses were only $200 million pre-COVID). With the share count at 1.14 billion shares, the EPS boost from lowering interest costs alone is at least $1.

The additional share count limits the EPS potential to closer to $3.00 in comparison to $4.50 pre-COVID, but the stock trades at only $10 now compared to $50 pre-COVID. The risks of a recession induced slowdown shouldn’t be ignored due to the massive debt levels now, but investors shouldn’t misplace fears when signs of a travel slowdown don’t actually exist due to pent-up demand.

Takeaway

The key investor takeaway is that Carnival remains on a positive trajectory towards a full recovery. The market is too focused on recession fears while pent-up travel demand remains strong.

The cruise line appears poised to recover the majority of their prior business suggesting a much higher EPS ahead, even if it doesn’t match the pre-COVID levels due to higher debt levels and share counts. The stock is just too cheap at $10 with a full recovery insight.

Be the first to comment