winhorse/iStock Unreleased via Getty Images

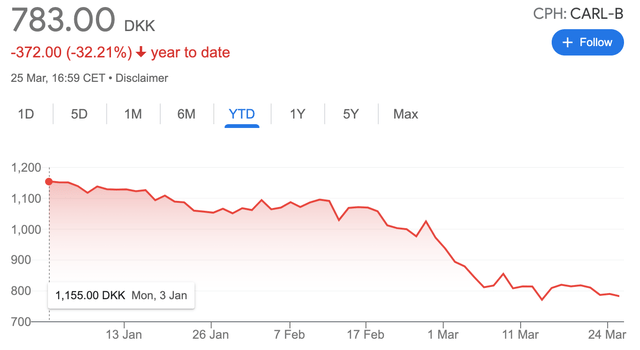

Shares of Danish brewer Carlsberg A/S (OTCPK:CABGY)(OTCPK:CABJF) have fallen sharply this year, losing over 30% of their value amid Russia’s invasion of Ukraine.

In the past, I have had somewhat mixed feelings about the firm. With next to no exposure to emerging markets in the Americas and Africa, it lacks the kind of geographic footprint I’d like to see from an international brewer, and seeing it trade at a premium valuation to the likes of AB InBev (BUD) and Heineken (OTCQX:HEINY) didn’t really make all that much sense to me. Still, credit where it’s due, management has done a really good job improving the underlying story here over the past five to ten years, making the business more profitable while growing earnings and boosting capital returns to shareholders.

Turning back to recent events for a moment, there’s no denying that the outlook has become a whole lot messier, at least in the near term. Carlsberg does have significant exposure to the war in Ukraine – both direct and indirect – and it was already grappling with uncertainty due to significant input cost inflation. Still, these shares have now sold off quite significantly, and the investment case has become a lot more interesting for long-term minded investors.

Relatively Weak Positioning

There are really only a couple of ways for the brewers to generate organic growth: they can increase volume by selling more beer, and/or they can raise their unit prices. It’s obviously a little bit more complex than that, and not all volume growth is created equal: new products that might require different production processes might not generate the kind of fixed cost leverage that boosting existing production would, for example. But by-and-large I think that sums it up reasonably.

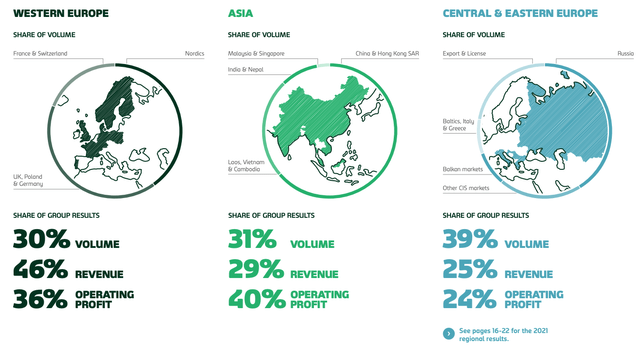

With that, I haven’t been all that thrilled with the company’s positioning versus its listed peers mentioned above. For one, Europe accounts for around 70% of the company’s volume and 60% of its operating profit. Demographics in the region aren’t great (and that’s putting it mildly), while competition is fierce and per-capita consumption is already maxed-out in a lot of those markets.

Source: Carlsberg 2021 Annual Report

On top of that, developed market consumers are increasingly trading up into wines and spirits, further pressuring already anemic growth prospects. With pretty much no exposure to attractive beer markets like Africa – where demographics and per-capita consumption are tailwinds – I do feel that Carlsberg has one of the weaker geographic footprints among the international brewers, with peers AB InBev and Heineken both commanding huge leading market shares in numerous emerging markets.

At the same time, the company is also still a little light on its premium beer offering, which would help out on the pricing front as per above. It is further along in its ‘premiumization’ efforts in Asia than its home markets, though, and further work on that front does at least present a good long-term growth opportunity.

Credit Where It’s Due

While the company does appear to lack significant exposure to long-term industry growth drivers, management does deserve a lot of credit for improving the underlying situation here.

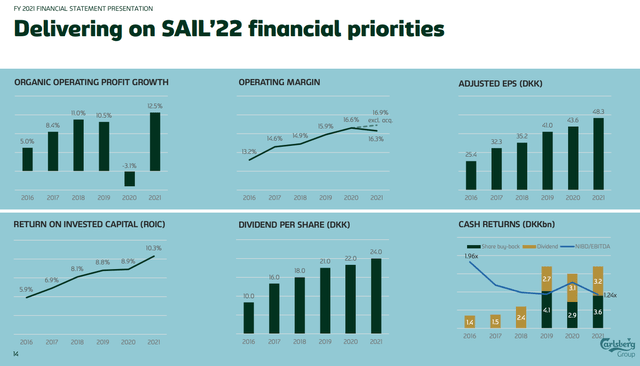

Source: Carlsberg 2021 Annual Report

Cost initiatives and organic growth have driven a big improvement in underlying profitability, with its operating margin up around 300bps over the past five years – bringing it into the mid-teens area and in line with the likes of Heineken. The capital returns story has also improved, with management buying back shares and upping the dividend payout ratio from sub-20% (2012) to its current level of 50%.

Growth-wise, there has been good work on beefing up its Asian exposure, with the company now sporting a leading position in Western China (#1 market share) as well as a decent business in Malaysia (#2 share). Regional profit there has put in a double-digit CAGR in recent years, helping to drive overall company-wide earnings growth.

An Uncertain Near-Term Outlook

Recent events heap further uncertainty onto what was already an increasingly unclear near-term outlook. Qualitatively, the company was guiding quite similar to recently covered Heineken, looking to offset significant input cost inflation with price hikes – possibly at the expense of volumes, which are still a little on the weak side following COVID (reported volume growth looks stronger due to acquisitions).

With operations in both Ukraine and Russia, Carlsberg does have significant direct exposure to the war. In Ukraine, the beer market is probably not functioning at all for obvious reasons. In Russia, the company is undoubtedly facing the same international pressure to exit that most Western companies with operations there are. It has already suspended exports and investment in the country, while also suspending advertising from both the Carlsberg Group and majority-owned local brewery Baltika. The production and sale of flagship and namesake brand Carlsberg have ceased, with Baltika basically being run on a not-for-profit basis (the company has pledged to donate any profits to humanitarian relief efforts).

At the same time, ballooning energy and commodity prices are not going to help with the cost inflation issue, while it may face local COVID lockdown problems in China.

It’s not all bad news, though. There is still latent recovery potential in Western Europe and Asia against COVID-impacted fiscal 2021, and that also applies to the non-Russia/Ukraine part of its Central & Eastern Europe segment (which includes the Baltics, Italy and the Balkans, among others).

A Long-Term Opportunity

Turning the above into concrete numerical predictions is obviously a bit tricky, though discounting the Russian and Ukrainian businesses completely means a circa 9% hit to group-wide operating profit.

Previously, management was guiding for 0-7% annual organic operating profit growth, with the width of that range a sign as to how volatile the situation was. That guidance has now been canned in light of the war, but as a rough guide I think we are looking at a low single-digit decline to earnings this year.

While that does mean that the near-term is going to be a bit disappointing, it’s not like these shares have stayed flat. Indeed, Carlsberg stock is still down over 20% versus its pre-invasion levels, and currently trades for around 16x FY21 EPS. The dividend yield is now over 3% based on the FY21 payout of DKK 24 per share, which I expect to be flat this year in light of the deteriorating outlook.

Longer term, management is targeting 3-5% organic revenue growth, which I think is achievable given historical performance. In turn, that should be good for at least mid-single-digit annualized free cash flow growth given the significant fixed cost leverage in the business. Combined with the 3%-plus dividend yield, this is the most attractive the shares have looked since the COVID sell-off back in early 2020. Buy.

Be the first to comment