FG Trade/E+ via Getty Images

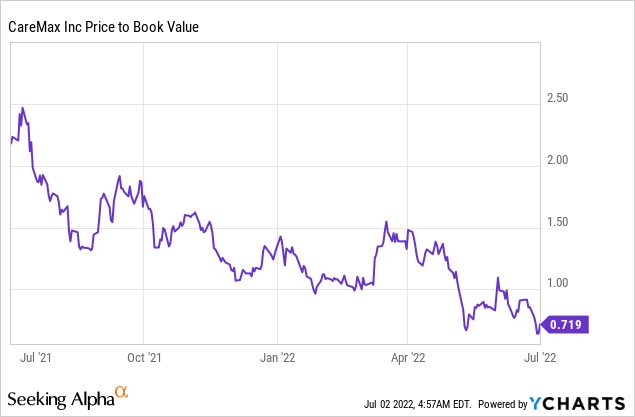

CareMax (NASDAQ:CMAX), a value-based care provider to seniors, looks set to further capitalize on secular tailwinds in the Medicare Advantage global capitation primary care space with the addition of the Medicare VBC (“value-based care”) business of Steward Health Care System. Financially, the c. $135 million purchase price and steady EBITDA generation ($110-115 million projected by fiscal 2025), as well as the aligned incentives (performance-linked earnout), make this a compelling deal for shareholders. Strategically, acquiring Steward also widens CMAX’s MSO (“Managed Services Organization”) membership, significantly accelerating the path to profitability via operating leverage as the company expands its revenue base. With growth funding needs also accounted for with a new credit line and CMAX’s industry-leading MLR (“medical loss ratio”) intact, I see plenty of upside to the shares at the current c. 0.7x P/Book valuation.

A Closer Look at the Steward Health Care System Acquisition

CMAX recently announced the acquisition of the Medicare VBC business of Steward Health Care System. As part of the deal, CMAX will provide a c. $25 million cash consideration and 23.5 million Class A shares (equivalent to c. 21% of Class A shares outstanding pre-deal), which implies a c. $135 million total consideration. Steward shareholders also have the option of an earnout of additional CMAX Class A shares – a scenario that could see its current shareholders owning a sizeable c. 41% of outstanding Class A shares. The earnout would, however, be dependent on the conversion of 100k Medicare lives to value-based risk arrangements while maintaining an 85% MLR ratio for consecutive quarters.

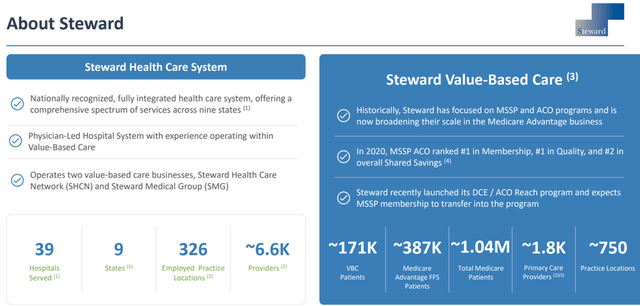

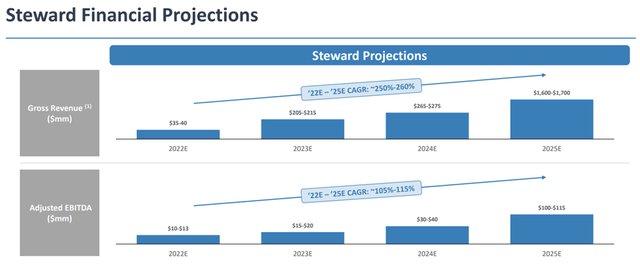

Post-acquisition, CMAX will be the exclusive value-based MSO for Steward’s Medicare Network, comprising 170k VBC beneficiaries and 1.8k providers to Steward’s healthcare programs. The patient breakdown is as follows – 112k from MSSP (“Multipurpose Senior Services Program”), 50k from MA (“Medicare Advantage”), and 9k from DCE (“Direct Contracting”). At close, this would imply a total of over 200k beneficiaries and over 2k providers across ten states for CMAX, with new states reached including Arizona, Pennsylvania, and Texas, among others. While the incremental revenue contribution stands at only $35-40 million/year under the current shared-savings accounting, the targeted conversion of 100+k lives to MA capitation would produce a considerably larger $1.6-1.7 billion revenue opportunity by fiscal 2025. As things stand, the transaction is expected to close in H2 ’22.

Financially Attractive Deal Terms

Relative to the projected fiscal 2023 EBITDA of $15-20 million, the initial c. $135 million consideration amounts to a 7-9x EV/EBITDA multiple. But Steward’s EBITDA projections are guided to ramp up further. From $10-13 million in fiscal 2022 and $15-20 million in fiscal 2023, the acquired assets are guided to generate an impressive $100-115 million of EBITDA by fiscal 2025 (implying a 100+% CAGR). As such, using the base case medium-term projection would imply an undemanding c. 1x EV/EBITDA valuation. Importantly, the Steward EBITDA projections also reflect additional operating expenses to professionalize membership and, therefore, will fully accrue to CMAX. Similarly, the expected revenue growth seems realistic as they are mainly driven by the conversion of MA partial risk and MA Fee-for-Service contracts into MA full-risk contracts.

Worth noting, however, that Steward shareholders stand to gain an additional c. 20% equity stake if the company can successfully convert 100k members to at-risk VBC arrangements post-acquisition and sustain an 85% medical expense ratio for consecutive quarters. This could entail considerable equity dilution ahead for CMAX shareholders, but as the dilution is tied to the material improvements in the EBITDA profile of CMAX, shareholders likely come out with meaningful accretion anyway.

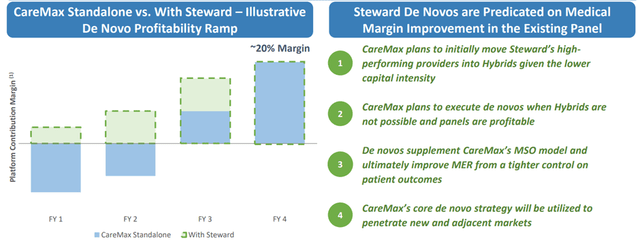

Longer-Term Growth Ambitions Boosted by New Credit Line

With the acquisition of Steward assets, CMAX will not only gain entry into new markets but also the opportunity to reprioritize clinic builds around MSO density, focusing on overlap with strategic partners like Elevance Health (ELV) and privately-owned Related. The focus on patient density is a key positive for newbuild economics, as it reduces the initial cash burn and allows for better complementarity between new clinics and the company’s overall MSO growth. Longer-term, the hope is that CMAX identifies more high-performing providers and transitions them to owned clinic/hybrid models. As the transition would allow for a higher impact on patient health outcomes through ancillary services with more touch points, success here could be massively accretive to the overall business.

Supporting its growth plans will be the new c. $300 million credit facility comprising a c. $190 million initial term loan and a c. $110 million delayed draw term loan. Relative to the existing $120 million term loan, the credit line should drive considerable net cash proceeds in the upcoming quarter, subject to an initial effective interest rate of c. 10%. The funding raise will come as welcome news to shareholders considering the pending rate hikes and the fact that CMAX had fully utilized its prior revolver capacity. As the new agreement provides management with sufficient balance sheet firepower to accelerate center growth according to plan, CMAX has a clear runway to reaching FCF positivity in the years ahead.

Final Take

Overall, acquiring Steward Health Care System assets screens as a very favorable deal for CMAX shareholders. The $135 million purchase consideration is well-covered by the balance sheet, while the aligned incentives and addition of $110-115 million of EBITDA generation by fiscal 2025E make good sense. Strategically, the widened MSO membership post-deal should also accelerate the path to profitability as the company expands its revenue base and enhances the margin profile.

And over the long run, the CMAX growth runway looks attractive as the company continues to benefit from secular tailwinds in the Medicare Advantage global capitation primary care space, considering its outsized exposure to the Medicaid/Medicare-eligible population. With funding risk also limited following the new credit line, I remain upbeat on CMAX’s shares at the current c. 0.7x P/Book valuation.

Be the first to comment