PonyWang

Cardlytics, Inc. (NASDAQ:CDLX) is a company at an early stage aimed at 30% long-term annual growth. Like all other disruptive companies, large unexplored market opportunities are clearly there, but the journey will be bumpy. In the current market sentiment, any problems and weaknesses (I think every business has some) will be exaggerated. In some cases, extreme pessimism offers opportunities to test real bottoms.

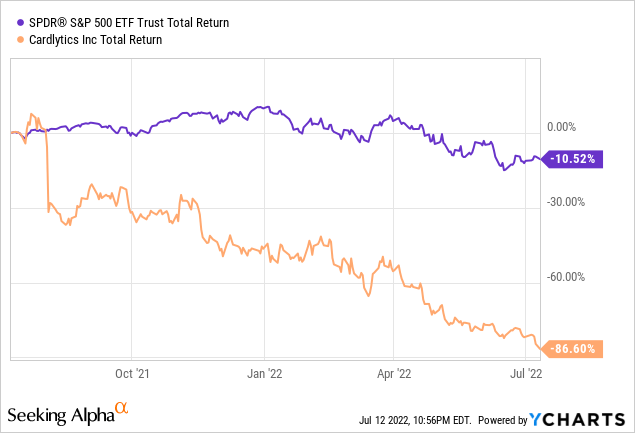

As the chart below shows, the stock has dropped 33% in the last 5 days and 87% in the last year. I think CDLX is a low-risk but high-uncertainty stock. There are several concerns that investors need to watch out for closely. My last article listed my bull cases of CDLX. Here I will share some of my thoughts on things that need to be fixed for CDLX going forward.

Problems with the measurement

Any great advertising platform needs to be excellent in ad buying experiences, bidding, targeting, and measurement. I think CDLX’s bank interface and targeting capability are not bad given the help of bank transaction data. No platform is perfect. However, there are improvements needed in measurement. Since banks are very stringent on what data CDLX can use out of banks, it is almost impossible to conduct Multi-touch attribution models which are widely used by other platforms (e.g., Google (GOOG, GOOGL), Facebook (META), Pinterest (PINS)). Without multi-touch attribution models, CDLX advertisers will have difficult times understanding the contributions of CDLX since customers will also see ads from Facebook, Google, and others. Therefore, advertisers often don’t feel confident distributing large budgets to CDLX.

Difficulties to scale

As different banks will have different technologies, data protocols, and MOUs in their contract with CDLX. There are still lots of inefficiencies in CDLX’s analytical processes. Ad campaigns still need manual assistance on data approvals and consumer targeting. If an advertiser wants to test pilot campaigns 30 times, CDLX will be very stressed to accommodate that. The newly established self-service cloud systems are supposed to address this. However, the results are still unclear.

CDLX’s strength is also its weakness

What CDLX is really good at is lift studies. It is a pre-post experiment with people exposed and not exposed to CDLX ads. If people exposed show a higher increase in sales, CDLX will be able to statistically prove its contributions. This is a very solid methodology.

However, lift studies usually take a longer time to conduct (several months) which becomes the main barrier for lots of customers. People want to know the effectiveness of their platform quickly, not after several months. This is why CDLX can only be an alternative advertising platform for big players like Walmart (WMT) or Target (TGT). These large corporations do upfront commitment of their advertising budget and rarely shift, they like stability and predictability. They prefer traditional vendors like Google and Facebook because they understand those platforms.

CDLX is new, unknown, and has no multi-touch attribution. Advertisers have to test a lift study to learn the effectiveness which takes a long time to figure it out (several months). So nobody will spend a big budget on CDLX at first until it builds a reputation as a legitimate player in the space. Trust is the key in this case. This is why CDLX is not for everybody and it takes time to fully adaption.

So most big companies only will spend low expectation experimental money (alternative advertising) for CDLX like 5%-10% of digital marketing. Once that money is spent, CDLX may have to compete with their core spending on Google or Facebook which is very hard. For small local businesses, that experimental spend could be higher (20%). But CDLX has no capacity to take small advertisers yet until they figure out automation and self-service platforms. Facebook has like 10m advertisers, and Pinterest is about 100k. CDLX can only take several hundred after 10 years of business growth.

The good news is the digital ad market is 200B in the US, if CDLX can get 5% for the alternative advertising budget, that is 10B, which is still very big. CDLX needs to speed up!

Poor personalization because of limited offers and designs

In the last 12 years, CDLX hasn’t changed its title wall UI/UX that much. There are still no visual attractions for its brands at all. The introduction content of deals is limited and their personalization is very basic. These have been known issues for a while and shouldn’t be difficult to fix. I conjectured that the management focuses too much on their onboarding with banks and has not put these items on their priority list yet.

Banks are stubborn

Banks are highly scrutinized and regulated. They are always worried about security, reverse engineering, and customer targeting. They don’t want any data coming out of their system. Because if there is a data breach of personal financial info, that will be a total disaster. So the pace of moving data across systems is slow. For example, the Ad server which CDLX has been pushing for a couple of years now and still got delayed. The agreement with Bank of America (BAC) has also been delayed multiple times and finally got signed recently. Moreover, engaging 170+ million MAU from banks is not easy. Since CDLX’s offers can only be seen at the bottom of bank apps, only about 20% of the 170+M MAUs are true CDLX users.

Figg acquisition by Chase

Figg, a competitor of Cardlytics, was acquired by Chase (JPM) on July 1st. I think this is one of the major reasons behind the recent panic sells of CDLX. Chase has a seven-year deal with CDLX. This acquisition poses some questions about Chase’s desire to renew the current agreement in 2025 since Chase already has the Figg assets to build in-house capacity to replace CDLX. However, Figg runs different card-linked rewards with CDLX at a smaller scale. We need to wait and see more details of this deal to truly understand its impact.

The bottom line

The above-mentioned challenges are not unfixable. CDLX is proactively working on them. The new self-service platform and cloud-based Ad Server will speed up the automation process. The recent acquisition of Bridg, Dosh, and Entertainment absolutely makes CDLX stronger. More SKU offers, local deals, and customer data outside of bank systems will help CDLX achieve tremendous scale and defend its leading position for the long term.

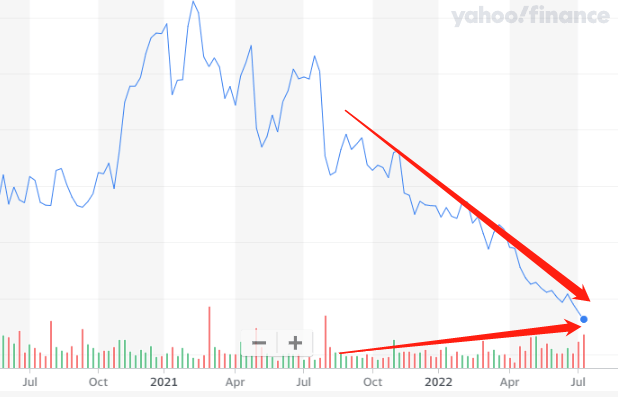

The chart below shows a cumulation of volumes as the price goes down. There is lots of selling, but buyers are also acquiring shares where I see lots of conflicting opinions at the price level here. Investing in CDLX requires us to take some calculated risks and more due diligence. As of right now, I see the management is heading in the right direction except for macro headwinds that cannot be controlled.

CDLX price and volume (Yahoo Finance)

Be the first to comment