Kativ/E+ via Getty Images

Souring Environment

We see less potential at this time in owning Capital Southwest Corporation (NASDAQ:CSWC) than shares in other business development corporations. Six months ago, we were moderately bullish on CSWC. In a down economy with consumer spending sluggish and sentiment waning, with corporate earnings threatened, and a shaky stock market, retail value investors ought to minimize risks. Hold CSWC if you own shares, but we do not recommend adding any at this time.

Global consumers anguish about high prices for basics. Investor confidence borders on despair. Yet, we do not want to give short shrift to business investments. During the 2007 recession, the Oracle of Omaha, Warren Buffett (BRK.A, BRK.B), was a beacon of hope. Buy businesses, primarily American firms, because it’s foolish to bet against America. He advised, “Have the purchase price be so attractive that even a mediocre sale gives good results.” The Berkshire-Hathaway funds are down only ~4% each over the past year.

Taking Buffett’s advice to heart, we advise retail value investors to consider the potential opportunities of owning business development companies like Goldman Sachs BDC (GSBD), Capital Southwest Corporation, and several others. We wrote about GSBD last week.

Both are closed-end funds that invest in developing mid-level American businesses. The payback comes from higher-than-average dividend yields and the potential for capital appreciation. GSBD is financially sound. It has a $1.7B market cap. The largest shareholder is The Goldman Sachs Group (GS).

CSWC is a lot riskier. The share price dived over the last six months, from $27.66 to $18.12. The company is in debt. It is not very profitable. Its market cap is smaller at $463M. We see less potential for holding CSWC than for GSBD or other BDCs.

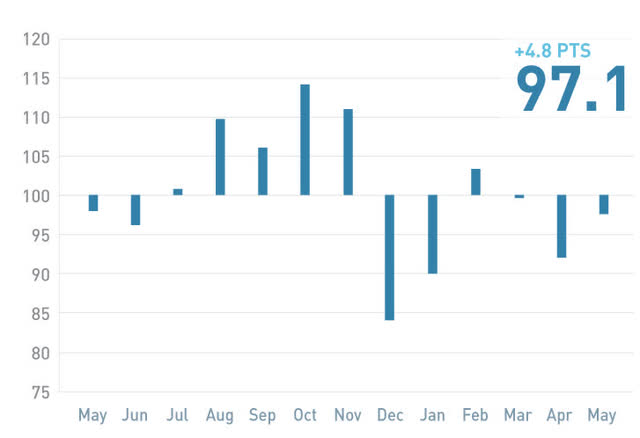

Investor Confidence Global Index on May 25, 2022

Investor Confidence Global Index (statestreet.com/ideas/investor-confidence-index.html)

Company Snapshot

Capital Southwest Corp gives credit and makes private equity and venture capital investments. It targets usually middle-market companies with at least $10M of annual revenue. It does some business with mature companies needing to recapitalize. CSWC avoids start-ups, real estate investing, buyouts, energy exploration, and troubled companies with management turnover.

The portfolio consists mostly of 285 firms in energy services and products, industrial tech, specialty chemicals development, and products. Investments are over $5M to profitable companies.

Positives

Seeking Alpha’s Quant is a Hold Rating. The rating leans towards the buy-side. So long as it pays the 10.6% dividend yield forward, it pays to hold the shares or buy some depending on your risk tolerance.

Dividend Grades

Other positives include:

- CSWC shares have short interest at a low 1.52%.

- SA’s Factor Grades give the stock an A grade for valuation and A- for profitability.

- The company’s P/B Ratio is 1.03; below 3 shows it is reasonably valued, with respect to its assets and liabilities.

- Momentum and growth are sluggish, but the stock’s Beta is only 0.54 well below the volatility of the stock market.

- Revenue increased annually and we forecast Capital Southwest will outperform in this arena. EPS might top 46 cents in the coming August 7th quarterly report; that beats last year’s EPS of 43 cents.

- The dividend has been increasing for six years.

- CSWC produces an 11.3% return on equity in accord with the capital markets industry.

- Corporate insiders own 6.5% of the shares. Less than 25% of the shares are owned by institutions. Insiders bought shares during the last three months.

CSWC last year reported financially positive second, third, and fourth quarters. In Q3, the company had total net assets of $387.3M, cash and equivalents of almost $19M, and total investment income was up 17.2% Y/Y. In Q4 ((May)) ’22, the total investment income rose 20.8% Y/Y. Net assets are topping $420M. Management is not worried about rising interest rates. 98% of its debt assets are in floating rate securities, as are 38% of its liabilities.

Downsides

On the downside, the dividend payout ratio is high, between 97% and 101%. Based on earnings per share the ratio is more reasonable (85%). Hedge funds cut their holdings throughout 2021. The funds decreased their holdings again in the last quarter. CSWC shares are -26.5% over the last year. The price fell precipitously in June ’22 from $22.11 per share to about $18. Other caveats for investors:

- The net profit margin slipped from 74.8% to 52.1% raising our concerns about future profitability.

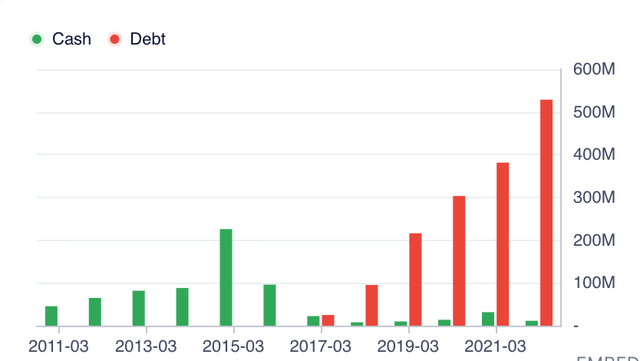

- The debt remains problematic from when we last looked. It is not well-covered by operating cash flow.

- Investor sentiment plummeted with no reason in sight for it to reverse course.

- A host of other measurements leave us worried in this economic climate, particularly the earnings and margins of CSWC’s companies if belt-tightening takes hold.

- Cash-to-debt ratio is high; the equity-to-asset ratio is in the red; the debt-to-equity is negative.

- Earnings declined each year for the past five years.

- Long-term debt is $528.5M and equity is $420.8M making for a high ratio of 123% that has increased over the past five years.

Cash to Debt at Capital Southwest (gurufocus.com/stock/CSWC/summary#financials)

Last Penny

Folksongs are filled with despair and hope. Much of the talk about America’s economic footing and prospects for the stock market are of the same tone and tenor. In a stronger and healthier economic environment, CSWC might be a potential opportunity for retail value investors. They could collect a great dividend yield that beats inflation and makes money if the shares pop into the low to mid-$20s. But global consumer sentiment and investor sentiment are troubled. Presently, we do not believe the downsides to owning CSWC are worth the potential upside. Hold ‘em if you own ‘em but the purchase price of CSWC shares is not appealing, yet.

Be the first to comment