Sky_Blue/iStock via Getty Images

Note: This report was previously shared with members of Value Investor’s Edge.

CPLP Overview

I published a piece on Capital Product Partners L.P. (link) around a year, ago. A lot has happened since then, so I’ve decided to publish an update on the company. For starters, the company divested both the “CMA CGM Magdalena” and the “Adonis” (resulting in gains on sales of $47M, or close to $2.40/sh) and used proceeds to fund its expansion into the LNG carrier segment, leading to the acquisition of six vessels, which have already been delivered.

Management recently decided to increase the dividend by 50%, from the previous $0.10/sh to $0.15/sh. I would usually consider a 50% payout increase as a very positive development, but I was expecting an increase to closer to $0.20/sh, whereas share repurchases have also been lower than expected.

However, I believe CPLP remains very cheap, both from an operating cash flow standpoint, as well as from a net asset value point of view, and the company should provide attractive returns going forward. However, due to being a Limited Partnership, concerns over corporate governance remain.

The Current Fleet

CPLP’s fleet has changed significantly since the onset of the pandemic, given the divestment of the “CMA CGM Magdalena” and the “Adonis”, the acquisition of three older 5,100 TEU vessels for $40.5M, and the acquisition of six LNG carriers, which was completed recently.

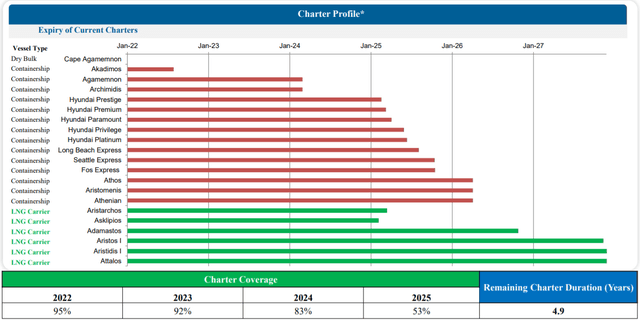

The current fleet and associated charter coverage can be seen in the image below and underpins the stance the company usually takes regarding charter coverage, with all vessels (except the sole bulker, the Capesize Akadimos) trading under long-term charters with strong counterparties.

CPLP’s Q4 earnings presentation

The sole bulker is an obvious divestment candidate since it finished its previous (massively above-market) 10-year charter at $39,250/day, and CPLP’s management team has reiterated they view it as a non-core asset. Per the latest conference call commentary, it seems they were in discussions to dispose of the vessel during last summer, but as asset valuations fell and liquidity in the second-hand market dried up, they ended up keeping the vessel. However, a sale in the medium-term seems rather likely (more on this below).

The three 2008-built 5,100 TEU vessels acquired early in 2021, namely the “Long Beach”, the “Seattle Express”, and the “Fox Express” are all chartered out to Hapag-Lloyd under five-year time charters at a negligible $12,300/day, whereas the charterer also holds a two plus one-year extension options at $17k/day. These vessels generate negligible free cash flow in the current environment, but the deal was well structured and is set to generate decent returns on investment even if the vessels are outright scrapped when they come off-charter in mid-2025 (assuming the options are not exercised).

The only vessel with near-term exposure on CPLP’s fleet is the “Akadimos”. The vessel comes off-charter later this year, but the charterer holds an option to extend the contract to April 2023 (and given current market dynamics it is a virtual certainty it will be exercised). Keep in mind a vessel like the “Akadimos” (2015-built, 9,300 TEU) could potentially achieve a 3-year charter of above $95k/day (per Clarkson’s) in current market conditions, although CPLP’s management would most likely go for a longer-term charter (possibly of around five years) while forward fixing the vessel, which would most likely imply a discount (closer to the $65k-$75k range). Furthermore, per Clarkson’s, a 5-year-old 8,800 TEU can be sold for $150M, which would not be a bad outcome either (although management stated in the Q4 earnings conference call they would prefer to keep operating the asset at this time).

CPLP’s fleet is virtually fully fixed for 2022, with the “Agamemnon” being the sole vessel trading in the spot market. Charter coverage for 2023 is also very significant, with only one vessel coming open, with two additional vessels rolling-off charter in 2024 and a further eight expected in 2025 (if no extension options are exercised). How the containership charter market will hold up in 2024 is anyone’s guess, but the strategy to expand into the LNG market to secure future cash flows seems like a wise idea to bridge the potential gap into a weaker containership market, since by then, containership leasing rates will almost assuredly be below current levels.

The LNG Acquisitions

As mentioned before, CPLP pushed hard into the LNG market, acquiring six assets from its sponsor, all of which were chartered out to strong counterparties including Cheniere, BP, and Engie. Overall, CPLP acquired the six assets at an average price of $203.8M per vessel, chartered out at an average rate of $69,823/day.

The acquisitions were conducted in two batches, with CPLP acquiring three LNGCs in each. The first one was announced on August 31st for total consideration of $599.5M. The transaction was financed with $147.1M from cash in hand (mostly from the sale of the “Magdalena” and the “Adonis”), the issuance of $15M worth of shares to Marinakis, CPLP’s sponsor (at a price of $13/sh), $10M in “interest free, non-amortizing Sellers’ credit repayable within 12 months”, and the assumption of $427.4M in financing that was already in place at a blended cost of LIBOR + 264bps. The vessels acquired were the “Aristos I”, the “Aristarchos”, and the “Aristidis I”.

The second batch of acquisitions was announced alongside Q3 earnings, on November 4th, and CPLP agreed to spend $623M for three LNGCs. This second round of acquisitions was financed by the issuance of a €150M Senior Unsecured Bond ($167.9M) on the Athens Exchange, by the assumption of $439.4M in financing already in place, and the remainder by cash on hand ($15.7M).

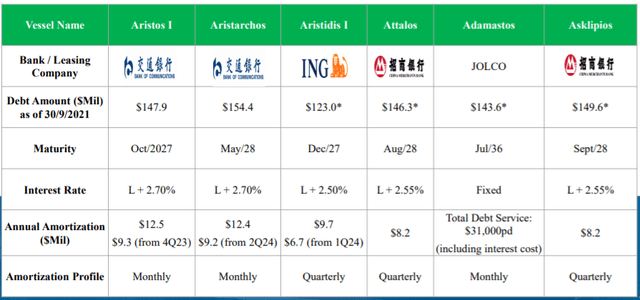

The outstanding facilities on all the LNGCs can be seen in the image below (note that the “Attalos”, the “Adamastos”, and the “Asklipios” were the vessels acquired during the second round of acquisitions).

CPLP’s Q3 earnings presentation

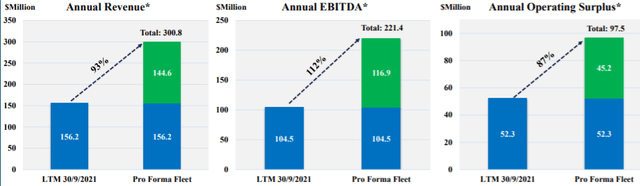

CPLP’s management touted the transformative nature of the deals, while also displaying a significant increase in annual operating surplus, which is a proxy to distributable cash flow, or cash flow after mandatory debt repayment (management’s calculation is based on several assumptions which can be found in the Q3 presentation). Management guided for a 93% increase on annual revenues, a 112% increase in annual EBITDA, and an 87% increase in annual operating surplus once the LNGCs were fully delivered. Furthermore, note that most of these revenues and cash flows are fully locked-in, with 2022 total contracted revenues amounting to $289.4M (with the difference to the $300.8M laid out in the image below being most likely attributable to the bulker).

CPLP’s Q3 earnings presentation

However, these calculations have a notable caveat, namely that they are not taking into consideration the repayment of the Greek bond, amounting to €150M, or $167.9M at the time of the offering. The bond does not have an annual amortization profile and comes due as a lump-sum at maturity.

Given the vessels are chartered out at an average rate of $69,823, total revenues for the year should amount to around $153M (assuming 365 days). Assuming operating expenses and proportionate G&A amount to around $13k/day, we are looking at close to $28.4M in costs, and we also need to deduct interest and debt amortization costs.

Interest expenses should amount to around $22.4M (assuming US 3-month LIBOR at 0.50%) excluding the “Adamastos”, which pays interest and debt amortization at a fixed rate of $31k/day. Annual debt amortization amounts to $51M, to which we must add the interest and debt servicing costs for the “Adamastos”, of $11.3M/year. Therefore, total interest and debt servicing costs for the first year should amount to around $84.4M.

Overall, I expect around $40M in FCF before we take into consideration the repayment and interest costs of the €150M Senior Unsecured Bond, which matures in five years. Since management has ultimately hedged the bond at a 3.66% interest cost, interest expense will amount to around $6.1M (assuming $167.9M outstanding), whereas proportionate annual amortization for the amount would equate to $33.6M (but keep in mind this is a non-cash adjustment, since the bond comes due at maturity). In fact, when calculating the operating surplus for Q4, management decided to allocate $8.5M to “an additional non-cash reserve that our Board has decided to set aside in view of the bond that we issued in Q4-21”.

Therefore, when adjusted for the repayment of the bond, the contribution from the LNG acquisitions will be negligible in the near-term. However, management estimated operating surplus from the LNG vessels at $45.2M, which even if it does not include interest payments on the bond (in the presentation it is not clear it does), is higher than my estimates.

Keep in mind that when including the €150M bond as debt for the acquisition of the LNGCs, CPLP managed to lever up the assets to close to 85%, since the company committed $177.8M in equity versus $1,225.5M in total expenditures (the equity portion being composed of $147.1M in cash for the first batch, $15M in shares, and $15.7M in cash for the second batch).

Note that from early-24, free cash flow will skyrocket as the mandatory amortization from the first batch of acquisitions decrease from the current annual $34.6M to closer to $25.2M, for a $9.4M boost on FCF. Additionally, note that debt outstanding will be significantly lower for the fleet, also leading to higher FCF as interest costs will be lower ceteris paribus.

Overall, these are exceptional assets, but the positive contribution to FCF will be meagre in the near-term due to the high leverage management has aimed for. However, as debt is repaid, significant equity will be built, even more so due to the front-loaded debt amortization. Interestingly, amortization requirements will be lower as containership vessels come off-charter, possibly one offsetting the other, underpinning that management has been thinking for the long-term with these deals, although at a high opportunity cost, since share repurchases would have accreted more shareholder value due to the discount to NAV the company was trading at.

Strong Financial Position

Prior to the push into the LNG sector, CPLP was sitting in an enviable financial position, with low leverage relative to asset values and very manageable maturities, more than covered by operating cash flows.

The LNG acquisitions have been mostly financed with debt, as outlined above, which has weighed on leverage levels, decreasing the discount the company was trading at relative to gross asset value, since they expanded the fleet at 100% EV/GAV, diluting the discount they were trading at relative to the same metric and to NAV. However, the LNG acquisitions come with long-term charters attached, and therefore I’m not (initially) concerned by this higher leverage.

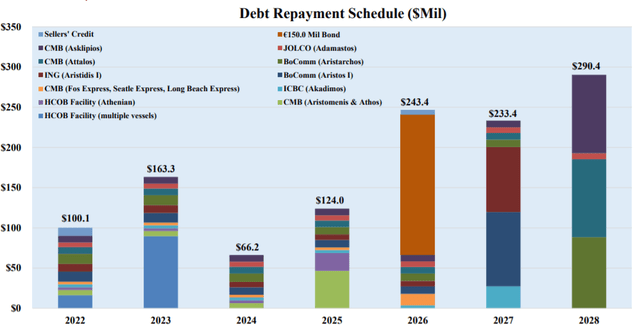

As can be seen in the image below, CPLP has a manageable maturity schedule. The increase in amortization requirements from 2022 to 2023 is attributable to the maturity of the HCOB Syndicate Facility, with a balloon payment of $73.5M. This facility is secured by several containerships, which have increased significantly in value due to the containership run, and management mentioned during the Q4 conference call (transcript) that they “not only expect this refinancing to be very straightforward, but also to be a potential lever for additional liquidity”.

CPLP’s Q4 earnings presentation

CPLP managed to issue a very attractively priced unsecured bond in the Greek market, issuing €150M maturing in 5-years at 2.65%. However, management subsequently decided to hedge FX risk, increasing the total cost to 3.66%, which is still extremely attractive for unsecured debt for a company with CPLP’s characteristics.

However, the bond did add several covenants.

- Net debt/Market value adjusted total assets ≤ 0.75.

- Adjusted EBITDA/Net interest expense ≥ 2.0.

- The need to maintain a €100k fixed amount in the DSRA (debt service reserve account).

- “50% of any Guarantor’s cash disbursements, to any of its’ unitholders (e.g., dividends) exceeding 20mn USD p.a., capped to 1/3 of the par value of the Bonds outstanding. When Guarantor’s market value adjusted net worth (MVAN) < USD300mn then the difference between the MVAN and the USD300mn should be passed on to the DSRA (capped to 1/3 of the par value of the Bonds outstanding)”.

The financial covenants per are manageable, but the covenant related to dividend distributions arguably puts a cap on the distributions to be paid by the company since it makes dividend distributions above $1.00/sh more onerous, forcing the company to increase its restricted cash balances (however, it is not clear whether “cash disbursements to any of its unitholders” does or does not include share repurchases).

Keep in mind the bond will be callable starting in year three at a 1.5% premium to par value, which decreases to 0.5% above par in year four, and to no premium in year five.

Forward Growth Via Dropdowns

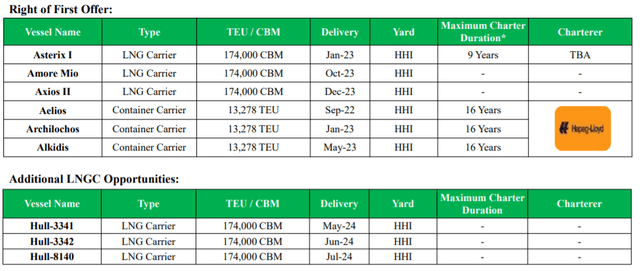

CPLP has not finished its fleet expansion, and I expect further acquisitions by late-22 and early-23. As can be seen in the image below, CPLP has a right of first offer on three LNG carriers and three containerships, whereas the sponsor (Capital Maritime) also has an additional three LNG vessels on order, which also look like attractive dropdown candidates.

CPLP’s Q4 earnings presentation

CPLP has provided very little information regarding the charters to Hapag Lloyd, as well as no information whatsoever on the charter on the Asterix I, but in Q4’s conference call, Mr. Kalogiratos, CPLP’s CEO, mentioned that between the three containerships and the LNG carrier they would expect to generate around $60M in annual EBITDA.

Furthermore, he also disclosed he expected the dropdown to require between $140M and $160M in equity (although the purchase price would most likely be notably higher considering the amount of debt they can potentially secure due to the long-term nature of the attached charters).

The $140M-$160M could potentially be covered by operating cash flows during 2022 plus the sale of the bulker and freeing up liquidity from the refinancing of HCOB facility, which matures in 2023. Per Cleaves Securities, a 10-year-old Capesize currently has a value of around $30.3M, whereas a 15-year-old asset would be valued at closer to $19.5M. Therefore, a 12-year-old Capesize like the “Agamemnon” (2010-built) currently has an estimated value of around $26M (using straight line depreciation). The Capesize is generating strong cash flows in the current environment, but considering the need for equity capital (and as mentioned before), a sale seems rather likely.

However, for the remaining five LNGCs, which CPLP’s management has been clear on their intention to acquire, they will require more equity than they can internally generate, meaning they will most likely require outside funding, be it a preferred issuance or a second bond in the Greek market (on top of secured debt on the vessels).

I estimate the equity portion required for each LNG carrier dropdown to vary from $60M to around $70M, meaning that for the remaining five LNGCs, we could be looking at total equity requirements of between $300M and $350M. Operating cash flows could cover up to $100M, but it is clear the company will require additional capital to finance the additional push.

Conclusion

CPLP has completed its initial push into the LNG sector, acquiring six ultra-modern carriers with associated long-term charters. The dropdowns have been achieved with minimal equity issuance, but FCF from the acquisitions will be low in the near-term once adjusted for the repayment of the bond.

CPLP is a Limited Partnership, with associated weaker protections for common unitholders. Share repurchases would have been more accretive than fleet expansion due to the discount the company was trading to NAV and to GAV. However, management has decided to take a different approach, by expanding the fleet and securing additional long-term cash flows. I’m not against growth per se, but when the common equity is trading at a 65%+ discount to NAV (current NAV is estimated above $50/unit), there is no growth program more attractive than share repurchases! Nevertheless, the LNGC acquisitions do have some benefits, rejuvenating the fleet while providing a bridge to what can be weaker markets in the containership sector.

As an investor, I would like to see increasing dividends from CPLP, and although the dividend was just raised by 50% from the previous $0.10/sh to $0.15/sh, the payout remains a minimal portion of free cash flow. As outlined before, I do not expect an additional raise in the near-term, since management will focus on acquiring assets from its pipeline, but share repurchases should continue (since they are very accretive at current pricing).

Evangelos Marinakis, has been recently increasing its position in the company, and now holds 3.89M shares, or 20% of the outstanding. I view this as a vote of confidence from the sponsor, and although interests remain not fully aligned, it is always good to see serious insider buying.

Overall, CPLP remains a deep value pick in the containership sector. The discount to NAV and to GAV provides a margin of safety, whereas the company is also trading at very low multiples to operating cash flow generated by long-term charters.

Be the first to comment