kemalbas/iStock via Getty Images

Introduction

Our short-term credit markets are suddenly fragile, teetering every time they are challenged as interest rates return to higher more normal levels. Regulation-induced withdrawal of traditional bank intermediation and broker-dealer market making support for credit markets has weakened. These pre-Crisis sources of market stability are apparently obsolete.

To prevent a market-wide collapse, a secondary market response is needed. The markets should exploit the fact that the remaining high-volume trading of debt instruments is now concentrated in inventory-light virtual debt markets.

Through retail investor-oriented exchange trading, virtual credit markets can be buttressed ultimately building capital, an important consequence of their success.

The poorly understood virtual markets – Eurodollar futures and when issued on-the-run Treasuries – are the primary remaining source of credit market liquidity because their liquidity does not depend on dealer inventories or bank intermediation.

Once grounded in exchange-listed trading, a new higher volume of virtual debt can become the most important source of short-term capital formation. Capital formation would be the direct result of virtual market settlements, if markets are designed to settle with retail-investor-friendly exchange-designed debt issues. Exchange-designed markets would meet retail investor needs, expanding retail investor commitment to capital formation that existing illiquid corporate debt market issues cannot attract.

The threatening credit market environment

As interest rates begin their upward course into a more normal relationship with equity yields, the liquidity of debt markets is being assaulted on three sides: Fed withdrawal from credit markets, reduced market-making by broker-dealers, and the loss of LIBOR – once retail investors’ primary source of short-term debt market access.

The Fed. As the Fed begins to sell off its Covid-inspired assets, withdrawing reserves from the banking system and raising the policy rate, concern for liquidity in the market for short-term credit grows. See here and here.

Dealer inventories. Analysts’ focal point in assessing short-term credit market liquidity is post-Financial Crisis regulation. These regulations introduced the supplementary leverage ratio increasing the capital regulated banks must carry for a given inventory of securities. The regs increase the cost of carrying inventory, reducing price support from market-makers. In the spot markets that trade inventory, less market-maker support has meant greater interest rate volatility.

The loss of LIBOR. Debt, with its many heterogeneous issues, can never produce a liquid market unless these market instruments are redesigned to perform the function once performed by banks in the deposit market. Banks, by diversifying their asset portfolios and issuing a single homogeneous form of debt to support them, created a liquid spot market that summarized market-wide credit conditions in a single homogeneous deposit rate – LIBOR. LIBOR can only be successfully replaced by a debt market that performs all LIBOR’s existing functions.

The liquidity myth

The lost liquidity in short-term debt markets is usually attributed to declining support for short-term markets by broker-dealers. But the idea that skittish dealers are the primary source of illiquid debt markets ignores the belated rise of inventory-free liquid virtual debt markets.

The two most liquid markets for short-term debt in post-Financial Crisis markets are the on-the-run market for Treasuries and Eurodollar futures markets. The distinguishing characteristic of these markets is that neither is supported by an inventory of securities.

In other words, if a short-term debt market is not based on dealer inventory, transferring risk and return from buyer to seller without transferring an asset, the capital needed to participate in a liquid asset-free market is dramatically reduced.

Virtual debt – the avenue to short-term market liquidity

Virtual financial instruments create their own internal liquidity, transferring risk and return without resort to dealer inventories since they trade an asset yet to be created. This makes virtual instruments the prime candidates for a post-Financial Crisis market for the building of short-term capital.

Moreover, instead of absorbing capital to support market-making, these virtual markets can create new corporate capital when they are settled by the listing exchange. To build new capital, an avenue of egress from virtual markets can be exchange-created by settling virtual long positions with exchange-designed retail-investor-friendly debt issues.

A successful virtual market would generate its own demand for an exchange-created supply of short-term debt – this new capital can then be transferred to corporations. In other words, a virtual market may go beyond the needs of risk managers and other traders to create a major source of the productive short-term capital that contributes to corporate value creation.

The coming increase in corporate short-term debt

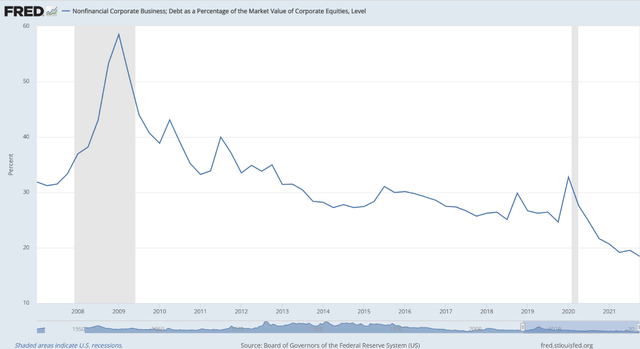

Providing easy credit market access to retail investors will become critical in coming years. Corporations’ balance sheets are skewed toward equity due to investor disinterest in the then-minuscule yield on high-grade corporate debt. The graph below shows the current debt/equity ratio.

Declining debt/equity ratio (FRED – St. Louis Fed)

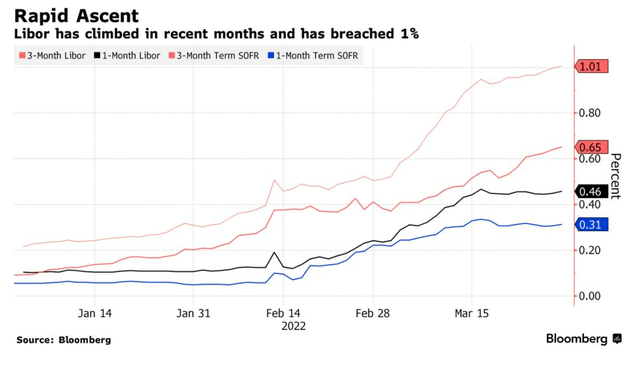

The relative yield of corporate debt compared to that of equity is rapidly improving in response to the Fed’s cutback in credit provision. The graph below shows the current premium to investment in Treasury debt is almost a third of the deposit rate.

Growing Treasury – risky debt basis (Bloomberg)

But the Eurodollar futures market is scheduled to be delisted at the end of 2022, despite current active trading in settlement months after the planned delisting of Eurodollars. Eurodollar futures and its inadequate replacement, SOFR, are the only liquid instruments in short-term debt presently available to retail investors.

Futures markets have proven vulnerable to market events outside their control

The most important source of retail access to short-term credit markets – LIBOR’s futures version, Eurodollars – ended because of a weakness common to all major extant futures markets. Eurodollar futures prices are dependent on a spot price, LIBOR, generated outside futures markets’ control. Thus, when regulators outlawed the LIBOR spot market index, the world’s most liquid futures market was killed with a stroke of the regulatory pen.

LIBOR futures were both the anchor of the retail credit market, and the primary means of retail access to short-term credit markets. The destruction of LIBOR along with the decline of dealer market-making in short-term debt have placed short-term credit market investment further out of the reach of retail investors.

SOFR failure to meet market needs

What will replace LIBOR in futures trading? The futures markets have already spoken. Three-month secured overnight financing rate (SOFR) futures volume nears that of Eurodollar futures, at least in the nearby months.

But 3-month SOFR futures fail to meet the needs of market risk managers in two ways.

- SOFR futures look backward. SOFR is a moving average of previous daily weighted averages of repo yields. It does not forecast as LIBOR did.

- SOFR is a Treasury-collateralized rate. It doesn’t reflect changes in the market assessment of corporate credit risk as LIBOR did.

The market might welcome an alternative that repairs SOFR flaws.

Building a sturdy gateway to the short-term risky debt market

The death of LIBOR provided market builders with two lessons. First, any index of short-term markets should itself be a transparent market yield. Second, any new futures market should control its fate by building an exchange-controlled spot market that settles the associated futures contracts.

Two pricing requirements for debt instruments that provide retail investors with a reliable replacement for LIBOR:

- Forward-looking market yields. Of the two shortcomings of SOFR, the easiest to repair is the backward-looking aspect of SOFR futures. The Treasury market has multiple forward-looking liquid term instruments that could form the basis for liquid futures contracts if futures contract specifications could be designed to meet the Treasury’s requirements.

- A credit risky yield. The characteristic of LIBOR that is most difficult to replace is its reliable provision of a market estimate of corporate interest rate risk. Two modifications of any successful LIBOR replacement are forced by the evolution of the short-term credit markets. First, the markets must look past bank debt. Bank deposits as a source of broad market funding have been curtailed by regulators’ impediments to issuance of wholesale deposits. Second, the corporate unsecured credit market does not provide a homogeneous representative short-term yield. A new instrument with summary characteristics is needed.

In short, the loss of a deposit-based index left the credit markets with an inadequate replacement.

Requirements for new short-term debt markets for retail investors

- Insulation of the market from retail participants’ credit risk.

- A single market price equally accessible to retail investors and market insiders.

- Margin requirements at the minimum necessary to cover intraday price changes.

- An exchange-created settlement vehicle that regulators accept.

A two-market solution to the lack of retail investor access is proposed here. These two markets would meet the four requirements for a robust liquid debt market listed above.

A virtual market for three-month Treasuries

The most easily created exchange-traded virtual debt market is a 3-month Treasury market that provides retail access to government securities dealers’ on-the-run 3-month Treasury market. How would this market work?

I introduced the concept of a virtual Treasury market for retail investors in my most recent article, here.

By listing the virtual Treasury as a futures market, the management of retail credit risk is given to the listing exchange. This step assures that three of the requirements for a successful retail investors’ market – credit risk management, a market that treats retail and wholesale orders alike, and minimum margin requirements – are met. The remaining issue, satisfaction of the Treasury’s requirements, could be met in consultation with the Treasury and the Fed.

The first adjustment that existing futures contracts would need to conform to Treasury trading is that the Treasury futures would need to meet the Fed’s requirement that trading await the Treasury announcement of its issue. To conform to this requirement, a Treasury futures contract would be listed in the week between the announcement and the Fed’s issuance of the new 3-month bill.

This adjustment reduces the forward trading window to one week, for settlement on the Treasury’s issue date. Pricing would then conform to the when-issued convention.

This market, if successful, would further expand the relative importance of the Treasury yield curve, providing a market index that looks forward, a great improvement on SOFR’s three-month futures contract that is constructed in arrears.

A virtual market for retail investor credit risk management

The second new virtual market is for trading of exchange-issued three-month corporate debt. Creation of this market requires capabilities no futures exchange has yet.

To build a virtual market that meets the need for corporate borrowing lost as banks withdraw from the wholesale market, a virtual instrument would back its exchange-issued debt with a diversified collection of corporate unsecured commercial paper. As with bank deposits, diversification across many corporations will produce a homogeneous debt instrument that, like LIBOR, prices only market-wide risks.

This instrument could trade the standard March – December cycle as do Eurodollars. It could also list an additional Treasury-market-friendly weekly spot issue as well, to provide retail traders with access to the commercial paper-Treasury basis.

Conclusion

Concern for weaknesses in short-term markets should be followed by plans to improve the situation. Handwringing does nothing to protect the process of capital investment of retail savings.

The markets are aware that the old pre-Crisis road that savings traveled to create new capital is no longer adequate to support the coming traffic. Banks have withdrawn from wholesale deposit-based intermediation. Dealers have curtailed their market-making activities in OTC debt markets.

This article describes a way to replace the path from savings to wholesale bank deposits to new corporate credit. It relies on the reality that market-based intermediary exchanges are replacing the role that banks and securities dealers once performed.

Be the first to comment