gguy44/iStock via Getty Images

Introduction

Capital City Bank Group (NASDAQ:CCBG) is a Florida based bank holding company doing business as the Capital City Bank. As this is a relatively small player in the Florida market, there appear to be plenty of potential bolt-on acquisitions for Capital City to pursue.

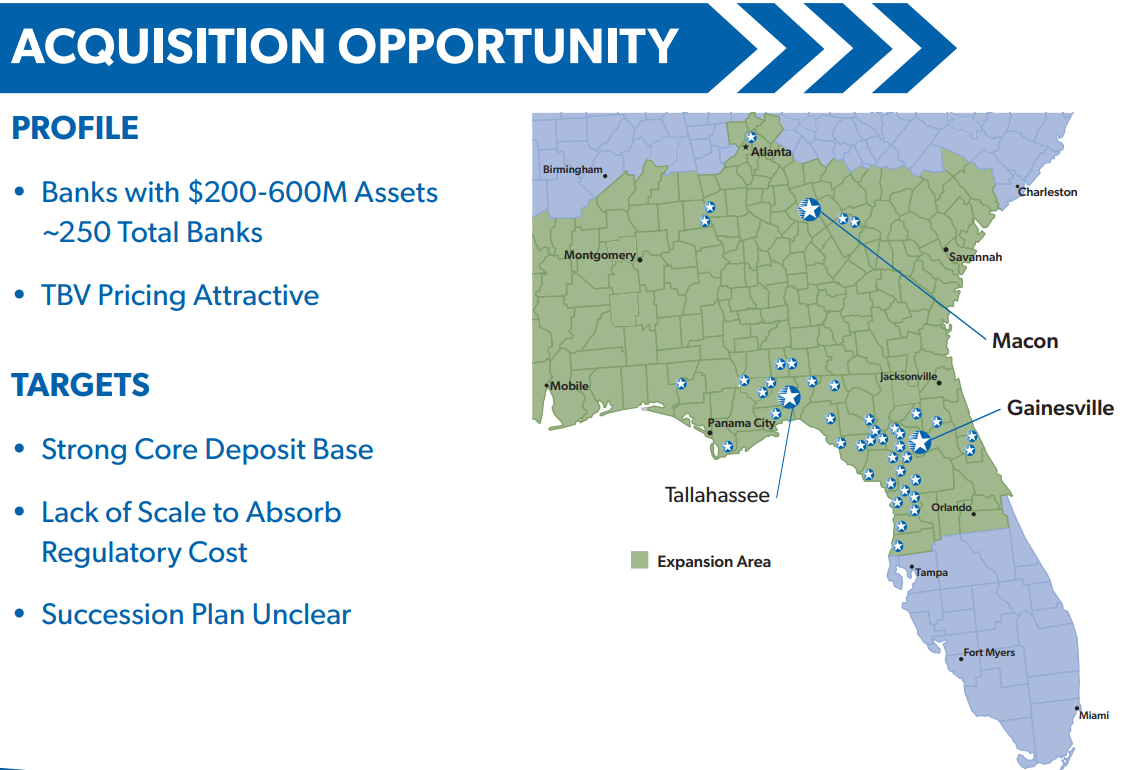

CCBG Investor Relations

As shown in its presentation, the bank is targeting the smaller local banks with 200-600M USD in total assets on the balance sheet. Considering Capital City had a total balance sheet size of $4.35B, smaller acquisitions should be easy to digest and allow for Capital City to create economies of scale while targeting banks with a specific loan book profile.

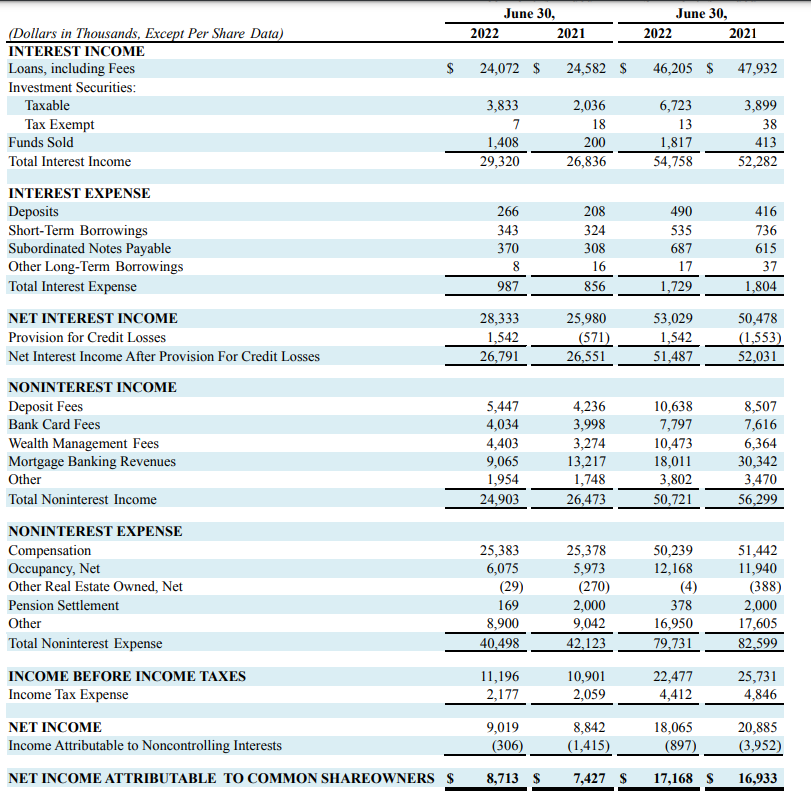

Keeping the damage to the book value limited in the first semester

The gradual increase of the interest rates is also slowly hitting Capital City’s bottom line. During the second quarter, the bank saw its total interest income increase from $26.8M a year ago to $29.3M in the second quarter of the current financial year while the total interest expenses increased by just $0.13M. The combination of both resulted in a net interest income of $28.3M, up from the just under $26M in Q2 last year and substantially higher than the sub-$25M result in the first quarter of this year.

CCBG Investor Relations

The bank also kept the net non-interest expenses relatively stable compared to the second quarter of last year: the net non-interest expense came in at just over $15.5M in Q2 of this year, which is pretty much unchanged compared to last year’s result. That’s encouraging as the mortgage banking revenue fell by in excess of 30% due to lower volumes, but fortunately, the deposit fees and wealth management fees mitigate the impact.

This resulted in a pre-tax income of $11.2M after taking the $1.5M in loan loss provisions into account and that’s about $0.3M higher than in Q2 last year, despite recording a reversal of loan loss provisions of almost $0.6M last year. A good result indeed, and after deducting the net income attributable to minority shareholders, the net income attributable to Capital City’s common shareholders was $8.7M which works out to be $0.51. The total EPS in the first half of the year was $1.01. While that’s only one cent higher than the EPS in H1 2021, keep in mind Capital City recorded a loan loss provision of $1.5M this year while it was able to unwind in excess of $1.55M in provisions in the first half of last year.

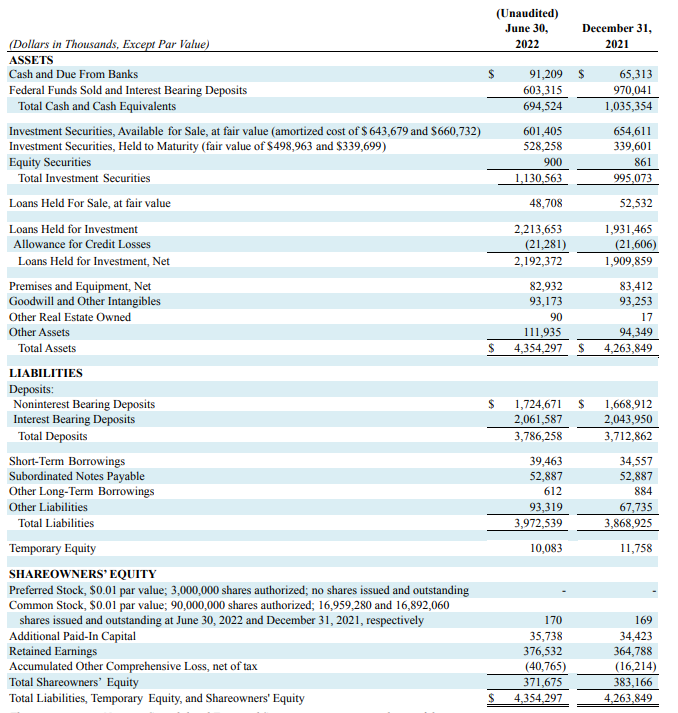

One of the most interesting features of Capital City’s balance sheet is the very high exposure to cash and securities. Of the $4.35B in assets, almost $700M is held in cash, with an additional $1.13B invested in securities. This means that in excess of 40% of the balance sheet has been invested in liquid assets. And that includes the unrealized loss on securities available for sale in the first six months of the year as higher interest rates are reducing the market value of securities.

CCBG Investor Relations

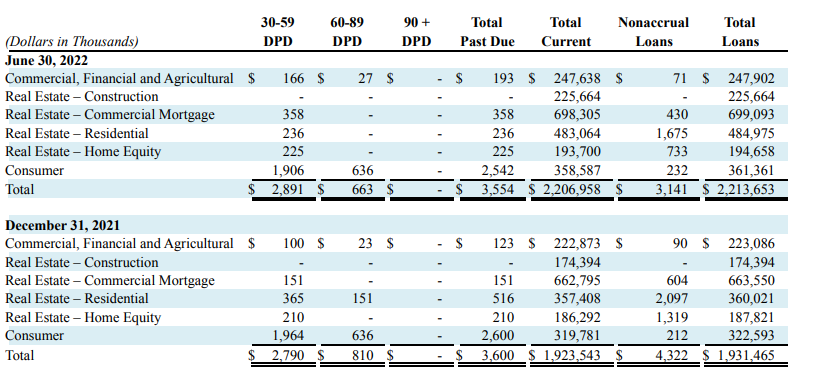

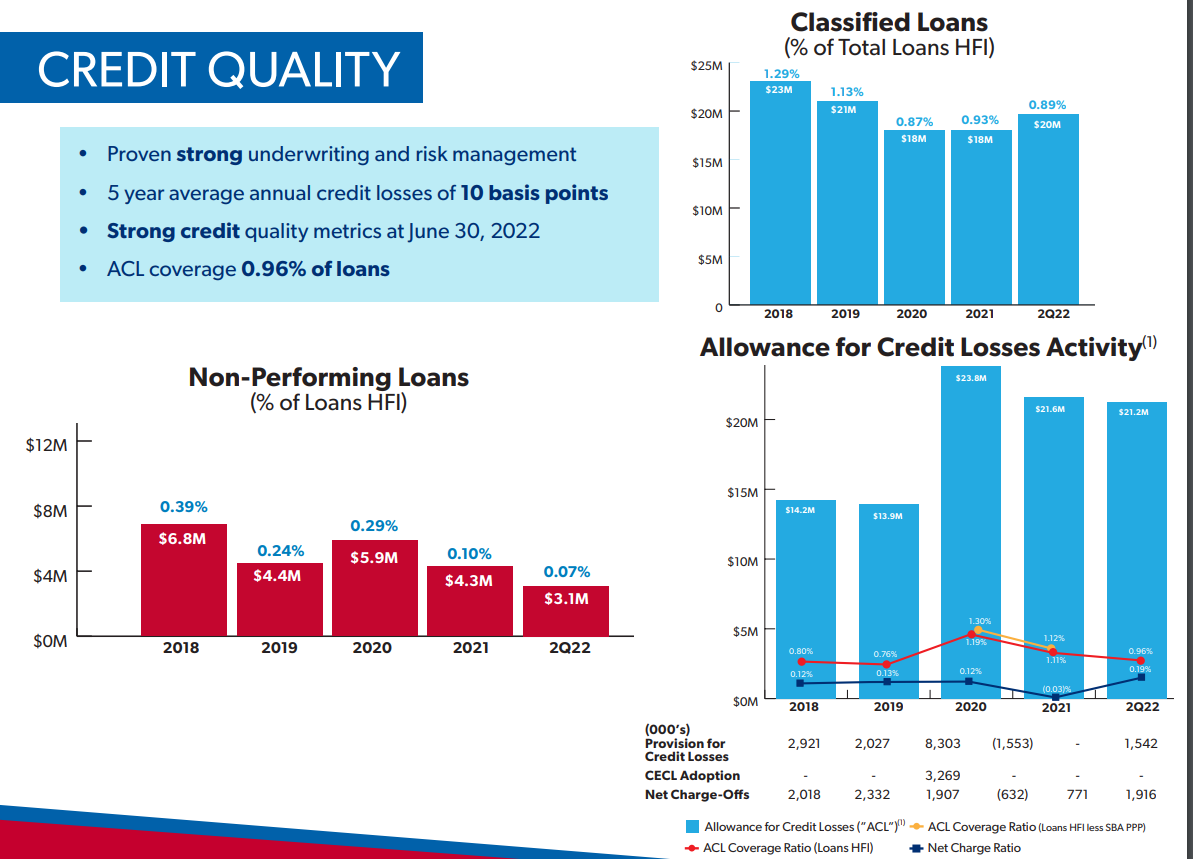

Looking at the $2.2B loan book, the break-down is interesting as well, as this Florida-based lender isn’t overweight in any of the categories. Sure, the commercial mortgage exposure is higher than the other asset classes on the balance sheet, but it’s clear CCBG is focusing on having exposure to diverse asset classes. It is too bad the LTV ratio of the real estate loans wasn’t disclosed, but looking at the low amount of loans past due and non-accrual loans, it looks like Capital City has a good grip on its loan book.

CCBG Investor Relations

As of the end of June, the total amount of non-accrual loans was $3.14M while an additional $3.55M of the loans were classified as ‘past due’ of which about 80% was less than two months past due. Interestingly, it’s mainly the residential loans and home equity loans in the non-accrual category as they account for almost 80% of the total non-accrual loans. As these are backed by real estate assets, the potential loss for the bank should be pretty low. And with in excess of $21M in loan loss provisions set aside for sour loans, the bank already has a cushion in place for a soft landing in case the loan book worsens.

CCBG Investor Relations

Investment thesis

Although the bank has a history of a strongly performing loan book (the average annual credit losses are just 10 basis points which is just over $2M per year based on the current size of the loan book), I would have liked to see a few more details on the loan portfolio and the LTV ratio.

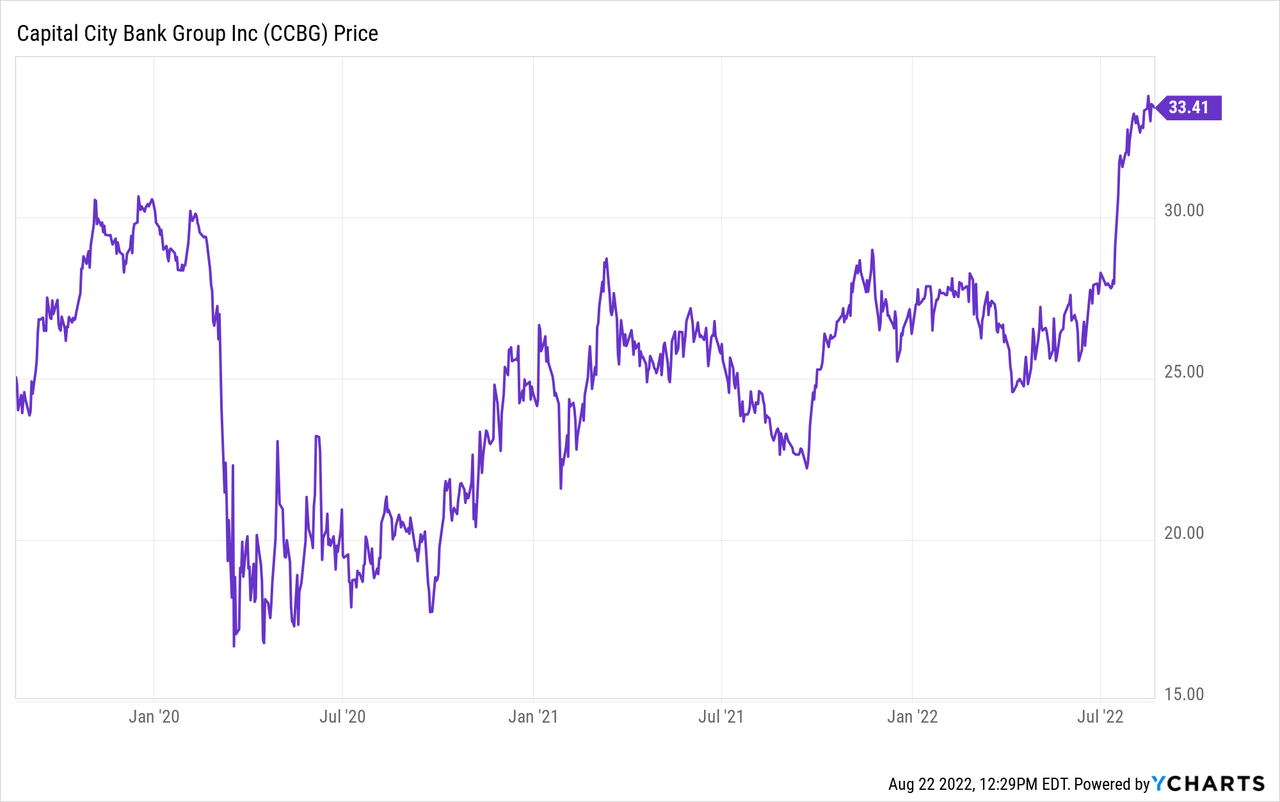

That, in combination with a relatively high P/E ratio of in excess of 15, a low dividend yield of less than 2% and a premium of just over 100% to the tangible book value per share made me pass on initiating a long position in this stock. While I am happy to see the strong historical loan loss performance and while I understand the bank is in an excellent position to be a consolidator in the Florida banking space, I’m afraid the train has left the station without me and I will have to wait for a better entry point.

Be the first to comment