Canopy Growth (CGC) recently announced changes to its global operations that all but signals the end of its international cannabis dream.

Canopy Growth 2018 Internation Footprint

The retrenchment, which skipped its still fledgeling European operations, has seen Canopy exit South Africa and cease cultivation activity in Colombia. Further, the closure of the company’s 1,000-acre hemp farm in New York and the shutting down of its indoor facility in Saskatchewan will see the record of C$700-800 million as a pre-tax charge in its fiscal 2020 fourth quarter.

Canopy’s expansion, largely driven by ex-CEO Bruce Linton, was meant to transform the company into a global cannabis giant from its humble beginning farming cannabis in a former Hershey’s chocolate factory in Smiths Falls, Ontario. However, there was always a high level of uncertainty over the actual size of this market as explored in my first article on Canopy Growth.

The looming vast international market about to be dominated by the fast and first-moving Canadian licensed producers was always central to the cannabis investment proposition. The world was the prize and Canopy Growth was going to take it. And now, just over six years from Canopy’s proxy IPO via a reverse takeover, the reality could not be starker. Further, the Canadian market has stalled meaning commentary that once praised the country for trailblazing a trend that the world was set to follow, now solemnly asks how it all went wrong.

How It All Went Wrong

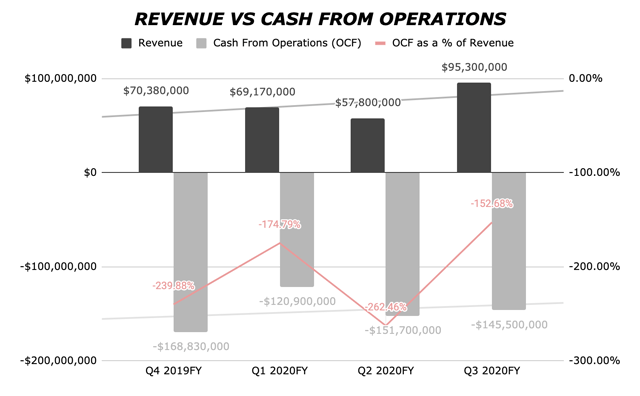

While the third quarter of Canopy’s 2020 financial year saw revenue of $95.3 million, up from $57.8 million in the previous quarter, cash from operations continued on their negative trajectory.

The aggregate value of Canopy’s negative cash from operations over the last four quarters now stands at $587 million, more than twice the combined value of its revenue over the same period. Further, This Works and BioSteel contributed 22% of revenue during the third quarter, both businesses unrelated to cannabis. BioSteel was also acquired at the start of the quarter, meaning a direct quarter-over-quarter revenue comparison cannot be made.

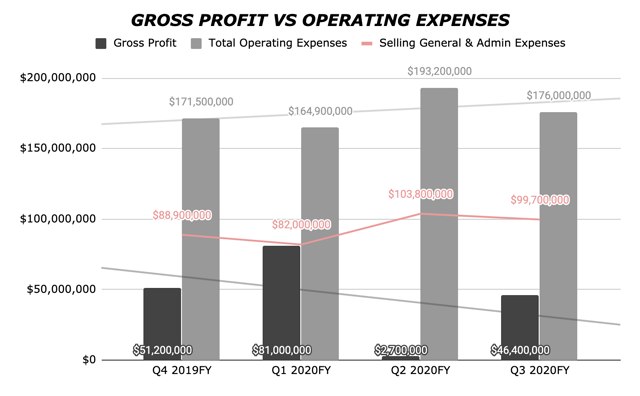

The important figure is the now established trend of unprofitability. Simply growing revenue with no corresponding improvement in underlying profits conveys poor near term prospects. This has stemmed from SG&A expenses that have remained unusually high, with SG&A for the most recent quarter 1.85x times revenue generated in the same period.

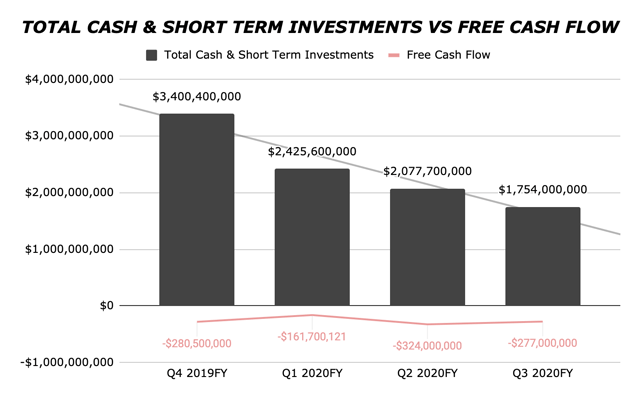

Canopy Growth now finds itself in a position where its cash reserves have declined from $3.4 billion in Q4 2019 to $1.75 billion as at the most recent quarter. However, and perhaps the sole reason for maintaining a long CGC position, the company’s current rate of cash burn means it has more than a year and two-quarters of cash left. This cash reserve has already allowed Canopy to weather the cannabis cash crunch. It will be critical in the upcoming COVID-19 induced economic recession.

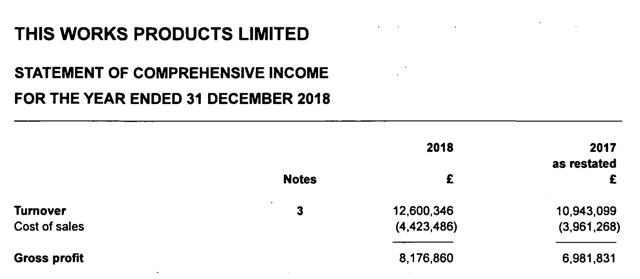

From Canopy’s third-quarter earnings call, international revenue made up 35% of total revenue during the quarter. While management failed to break down international non-cannabis revenue during the call, this can be estimated using filings by ThisWorks with Companies House, the United Kingdom’s registrar of companies.

Quarter-over-quarter revenue for ThisWorks grew organically by 42%. Assuming revenue for the previous quarter of £3.15 million, ThisWorks’ contribution to total revenue during the most recent quarter was likely around £4.5 million. This is $5.85 million using the GBP/USD exchange rate at this time and would adjust international revenue from 35% of total revenue to 29%. The MD&A adds further detail, with international cannabis revenue forming just 15.10% of total revenue, down from 23.61% in the preceding quarter.

With the international market not being able to offer a near term saviour, Canopy’s future outlook will be greatly influenced by the rollout of Cannabis 2.0. While legal as of October 17 of last year, the market has been slow to roll out with brick-and-mortar locations in Alberta, Ontario and Quebec not having the related cannabis edible products available for sale until mid-January.

Here Is To The Future

Canopy’s cannabis dream did not end because increasingly fewer people consumed cannabis. The opposite is true with recent reports of an unprecedented surge in cannabis sales that happened ahead of Canada’s lockdown. The dream ended because of the large international market that was required to support its expansion and valuation simply never materialized.

I would be remiss to not mention the impact of overzealous predictions on the size of the international TAM pumped out by analysts in inflating this dream. On the back of this, valuations and ambitions rose too much too quickly.

The retrenchment of Canopy’s international footprint was always going to be the result of an initial expansion driven by euphoria. Fervent dreams of a cannabis world influenced actual business operations and lead to a series of confusing acquisitions. The impact of this has been high operating expenses, a balance sheet inflated by goodwill and intangibles, and material cash burn. Addressing this has meant a great unwinding of an international footprint, effectively ending the cannabis dream.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment