ljubaphoto

Investment summary

Whilst there are numerous selective opportunities in healthcare right now, this report illustrates that Cano Health, Inc. (NYSE:CANO) displays a loose affinity to the kind of equity premia that investors are paying a premium for in FY22. With various challenges to bottom-line growth abundant, it’s not unreasonable to expect CANO’s lack of profitability to extend until FY24. It also has a negative tangible book value and thus makes evaluating corporate value increasingly difficult. With the culmination of factors discussed here, we rate CANO neutral.

Q2 earnings cadence accelerates

Second-quarter revenues were up more than 100% YoY to $689 million but narrowed sequentially from $704 million in Q1 FY22. The result also came in behind consensus estimates by ~$23 million. The differential was attributed to a decrease in Medicare advantage and Medicaid capitated revenue per-member-per-month (“PMPM”) volumes. Downsides here stemmed from the flow of new patients (who have less diagnoses by definition) and contract conversions to the non-risk label. Despite this, management tips PMPM to come in at ~$250 million this year.

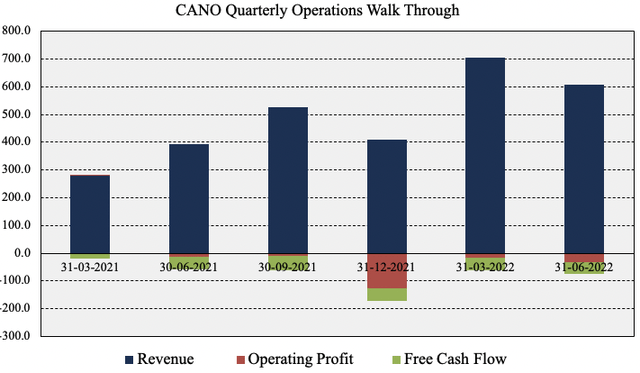

Exhibit 1. Seasonality is apparent in CANO’s operating model; however, top-bottom line growth continues to face headwinds for further growth

Data: HB Insights, CANO SEC Filings

Revenue volumes were underpinned by an ~80% YoY spike in members to nearly 282,000 at the Q2 exit. In Q2 FY21, it had 155,000 members. The mix of members last quarter was split 44% Medicare advantage, 14% Medicare direct contracting entities (“DCE”), 25% to Medicaid whilst the rest were from the Medicare affordable care act (“ACA”). It’s important to grasp this breakdown especially when thinking of projecting future cash flows and/or income from the company.

Meanwhile, the company saw a 600bps tailwind to its medical cost ratio (“MCR”) with the MCR narrowing to 82.6% from 88.6% the year prior. Ex-DCE, then MCR was another ~200bps lower at 80.6%. The DCE segment is profitable for the company and is one to keep an eye on, even if it is early days yet. This is chiefly due to it being such a capital light business thereby adding an effective multiplier to margins versus other business segments. Nevertheless, further reductions in MCR are a bullish weight for the investment debate. CANO projects a full-year MCR DCE of 93%. It also expects FY22 total MCR to fall between 78-79% as it predicts MCR “in the second half will be significantly lower than the total MCR in the first half…[t]his is primarily driven by normal seasonality in medical costs and cost recoveries.”

The main challenges CANO fostered last quarter were expense related, in-line with broad market/macroeconomic trends. For instance its direct patient expense was ~7.6% of quarterly turnover, whereas it saw a 260bps headwind at the SG&A line – and that’s excluding stock-based compensation of $31 million for the 6 months to June 30 (up from $3.7 million YoY). Meanwhile, non-GAAP EBITDA was below expectations at $29 million and lent CANO an EBITDA margin of 4.3%. Operating margins were compressed due to weakness in its DCE business. It now projects non-GAAP EBITDA of ~$200 million for the full-year, down from previous guidance of $230-$240 million.

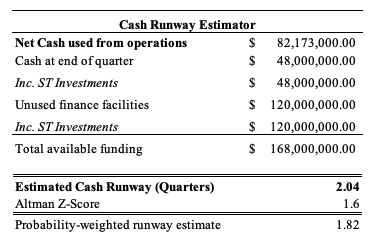

It also burnt ~$82 million in cash for operations, chiefly to maintain adequate working capital and liquidity buffers. It also had an additional $120 million in undrawn facilities from its credit revolver and held $890 million of net debt. As seen in the table below, without an increase in the cadence of CFFO conversion, the company is at risk of burning though available cash. To offset this, CANO says it has realized ~$38 million of Medicare risk adjustment payments, and it forecasts this to be $130 million for the full year.

Exhibit 2. Estimated cash runway from Q2 FY22 cash burn, looks to be at risk unless can drive income higher

Data: HB Insights Estimates

Guidance upgrade in-line with wider sector

Management foresees Q2’s challenges unravelling in the back end of FY22, and projects membership to be in the range of 300,000–305,000. This is a ~300bps upward revision from previous guidance. On this, CANO estimates FY22 revenue between $2.85–2.9 billion, whilst MCR is tipped to expand to ~79% at the upper end, an increase of ~150bps.

It also forecasts EBITDA in the range of $200 million, itself a substantial decrease from previous estimates of $230–$240 million. Segmentally, it expects its medical centres to remain at a bolus of 184–189. Moreover, it is forecasting ~$60 million in stock based compensation, but capital expenditures of just $40-$60 million.

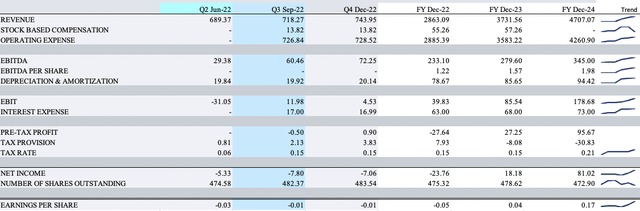

Comparatively, we estimate FY22 revenue of $2.86 billion, with this stretching up to $3.7 billion in FY23, as seen in Exhibit 4. We also see profitability at the bottom line in FY23 with EPS of $0.04, coming off a $0.05 loss in FY22. In this vein, on our modelling (ceteris paribus) FY23 looks to be a year of inflection for the company.

Exhibit 3. CANO Forward Operating Income Estimates – FY23 looks to be a key year for the company

Data: HB Insights Estimates

Valuation

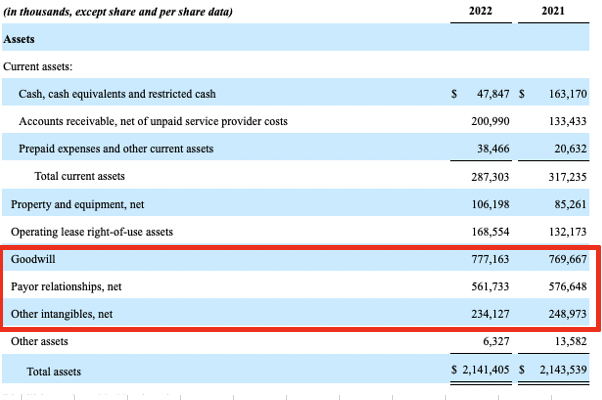

Shares are trading at a premium at 3.47x book value and are priced at 1.02x forward sales. Looking at tangible book value, however, and we see some differences, in that it has a negative tangible book value when adjusting for non-cash assets like goodwill and intangibles. Let’s also not forget the $31 million in stock-based compensation for H1 FY22. As seen in Exhibit 5, the company’s intangible book value totals more than $1.57 billion, of 73% of its entire asset base. Consequently, the company has a negative tangible book value of $732 million, in line with longer-term averages.

Exhibit 4. Intangibles, goodwill, etc. make up more than 73% of CANO’s asset base

It’s therefore difficult to get a clean measure of corporate value and to estimate if we’re paying a fair and reasonable price.

Data: CANO 10-Q, Q2 FY2022

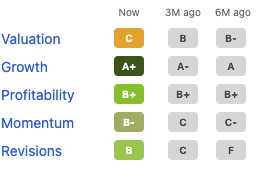

The stock is also rated below average in terms of valuation from Seeking Alpha’s quantitative factor grades, as seen below. The trend has actually decreased with the alphabetical scale sliding to a ‘C’ from a ‘B’ last quarter (‘A’ being the best, ‘D’ being the worst). Valuations are therefore unattractive for the stock and we aren’t confident on estimating the company’s future cash flows given the myriad of factors impacting its top-bottom line. Nevertheless, we believe there are more compelling value opportunities elsewhere.

Exhibit 5. Quantitative factor grading of valuation supports view that valuations are a hurdle yet to be overcome

Data: Seeking Alpha, NYSE:CANO

In short

Despite a period of growth at the top line, challenges still remain for CANO to advocate it as a buy. The investment debate is marred with headwinds and macroeconomic crosscurrents are a weighting factor as well, in terms of cost inflation and turnover.

Valuations are also unsupportive in the investment case and based on the culmination of factors discussed in this report, we estimate there are more compelling opportunities of value to be found within the healthcare universe. Rate neutral.

Be the first to comment