gorodenkoff/iStock via Getty Images

Investment Thesis:

I am assigning Cano Health (NYSE:CANO) a strong buy rating and a price target of $9 based on a DCF analysis. Cano is currently trading at $2.35 representing a 74% discount to my price target and 284% upside potential.

Q3 Earnings

Cano Health’s Q3 earnings were disappointing, missing revenue estimates and lowering 2022 guidance for revenue, medical centers, adjusted EBITDA, and MCR. The earnings call also didn’t really inspire confidence as Cano will end the fiscal year in a net borrowing position and didn’t provide guidance for 2023. Cano Health sold off sharply following an earnings call that highlighted refinancing risk, operational risk, and revenue driver volatility. The miss was largely driven by 9% lower PMPMs from Q2 due to new members. New members dilute gross margins on both revenue and cost of revenue. They haven’t had the necessary medical encounters in order to complete risk score adjustments so they generate less revenue. They also enter with higher acuity because they haven’t been in the Cano pipeline: so they may have undiagnosed conditions, they may not be receiving proactive treatments, and they have a higher proportion of branded medication, leading to more hospital and outpatient visits and a higher cost of care.

I believe that the negative sentiment surrounding Q3 earnings and Cano in general has been overblown. While Q3 highlighted the risks, it was more indicative of normal growing pains and it didn’t introduce any new risks. We all knew that Cano was in a tight cash position and that they were going to need to sacrifice some growth for free cash flow. This isn’t to say that Cano is going to continue to grow organically, as CEO Marlow Hernandez stated ” Our medical center membership can more than double without a single additional exam room.” Cano is adjusting to market conditions, it utilized cheap debt to grow rapidly and now as the cost debt is rising Cano is shifting to focus on free cash flow profitability and earnings quality. To achieve this, Cano is trimming underperforming affiliates for Medicare Advantage and Medicaid, deactivating underperforming ACO Reach providers, and are leveraging market penetration and care differentiation to negotiate more favorable payer contracts.

Operations and Execution

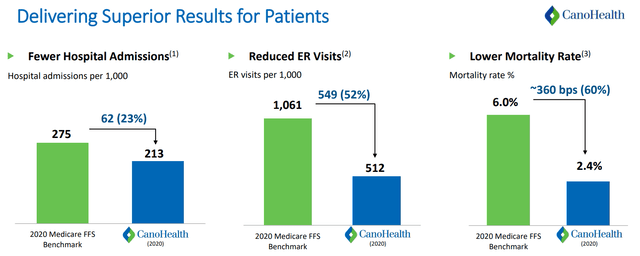

The business is simple at its core, Cano will generate long-term shareholder value if it improves patient health outcomes, decreases medical costs over time, and expands capacity to accommodate more patients. Cano has a proven track record of achieving these results. As you can see in the graphic below, Cano’s value based care platform has led to significantly better health outcomes for their patients compared to the fee-for-service plan.

Cano Health Investor Day Presentation 2022

Their approach has enabled them to achieve a HEDIS score (The Healthcare Effectiveness Data and Information Set) of 4.7/5 versus the national average of 4.16/5. Based on Cano’s internal metrics, they have a Net Promoter Score (NPS) of 82 meaning they have exceptional patient satisfaction. This has allowed Cano to attribute 61% of enrollment to no direct marketing spend. Cano has improved patient outcomes while boasting strong patient satisfaction and they have shown that they can cut medical costs at the same time.

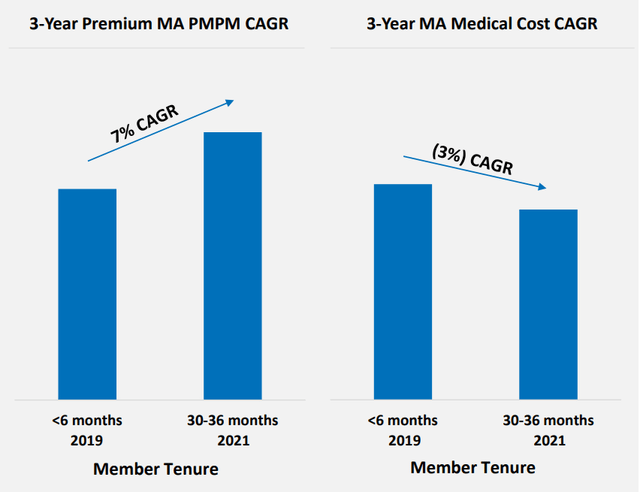

Cano Health Investor Day Presentation 2022

The graphic above shows the gross margins improvements that Cano achieved with a 26,000 patient cohort from H1 enrollment in 2019 through the end of 2021. During the Q3 earnings call CEO Marlow Hernandez stated that “retention rates, engagement scores, net promoters, all that performing very well and consistent with our historical” and that “existing members are performing as expected.” To me this is indicative of growing pains with rapid expansion and performance lag and I expect results to normalize in the future. Cano Health is on track to achieve 85.27% revenue CAGR, 85.34% member CAGR, and 72.95% medical center CAGR from 2018-2022. Through a combination of being a de-Spac, stalled buyout rumors, and disappointing Q3 results and guidance investors have lost sight of Cano’s value.

Valuation

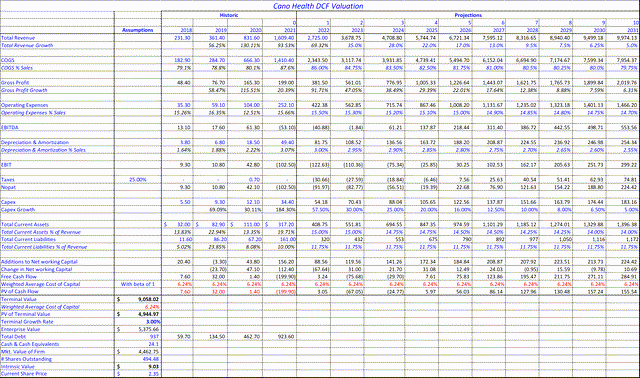

I chose to value Cano Health using a 10-year DCF model. I know that it is almost impossible to achieve accurate assumptions on that far of a timeline, but I wanted to allow ample time to capture Cano’s growth before perpetuity growth assumptions. My goal was to provide a simple, conservative, and realistic model of Cano’s free cash flow based on historical performance, guidance, and industry trends.

Assumptions

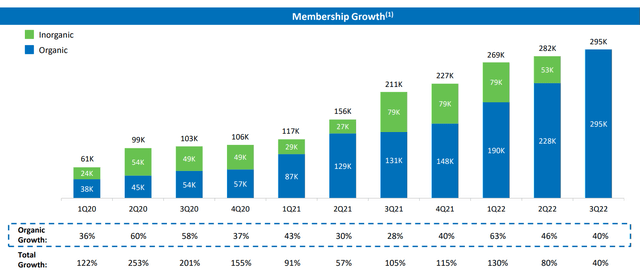

Starting with top line projections, obviously Cano is in a tight cash position and growth in the immediate future is likely to be primarily organic. I based 2022 revenue of $2.725 billion on Q3 guidance of full year revenue of $2.7 billion to $2.75 billion. For 2023 to 2031 I have revenue increasing at a decreasing rate from 35% in 2023 down to 5% in 2031. Below is a graphic from Cano’s Q3 slides that breaks down Cano’s membership growth between organic and inorganic growth and suggests support for 35% organic growth in 2023.

Cano Member Growth (Cano Q3 Earnings Slides )

Cano’s 2022 Investor Day Presentation states that Cano is targeting 20% long-term organic growth, my revenue estimates from 2021 to 2031 have a 10-year CAGR of 20.01%.

In my model, cost of revenues includes both direct patient expense and third-party patient expense. Gross margins are subject to revenue mix and growth, but I generally kept them in-line with their historical results and projected them to increase at a decreasing rate. Gross margins will continue to improve as Cano achieves more market penetration, supplier power, economies of scale, synergies, network optimization, and as new patients are fully onboarded.

Operating expenses are largely salaries and benefits, as marketing costs remain low. In Cano’s 10-Q they state ” we anticipate that these expenses will decrease as a percentage of revenue over the long term” so I modeled operating expenses to decrease at a decreasing rate from 15.5% in 2022 to 14.7% in 2031. Cano also states in their investor presentation that their goal is to achieve a long term adjusted EBITDA margin of 15%. My model has Cano’s EBITDA margin a 5.6% in 2031. Again, my goal was to show that Cano is undervalued using conservative and attainable projections. I also didn’t add back stock-based compensation as Cano does for their adjusted EBITDA calculation. This is to show the true cost to investors; even still I left a large margin for error in my expense projections.

CapEx for Cano is fairly straightforward, in Q3 earnings CFO Brian Koppy disclosed that maintenance capex per site is $50,000. This is pretty minimal and CapEx moving forward will be focused on adding more capacity. I modeled depreciation and amortization to grow with a high degree of correlation with CapEx. I kept assets and liabilities as a percent of revenue at steady rates based on historical percentages as I didn’t want to assume changes to the capital structure. I also chose not to add back non-cash items such as stock-based compensation because I wanted my model to represent the true costs to investors.

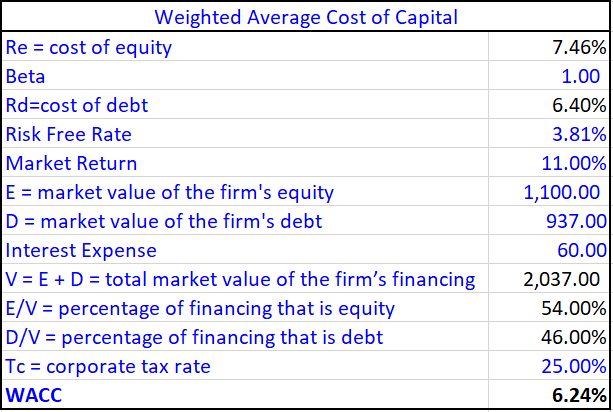

To calculate Cano’s weighted average cost of capital (WACC), I used the capital asset pricing model (CAPM). I used the 10-year Treasury yield as the risk free rate and 11% for expected market return because the S&P 500 has averaged a 10.7% CAGR since its inception 1957. I also used a baseline beta of 1 so that I didn’t artificially under or over value the company. Cano’s beta is currently significantly under 1 and this could artificially inflate the value of Cano. According to NYU Stern, industries within the healthcare sector have an average beta at or slightly below 1. I also used a baseline effective tax rate of 25%; based on my assumptions I calculated a WACC for Cano of 6.24%.

WACC Calculation

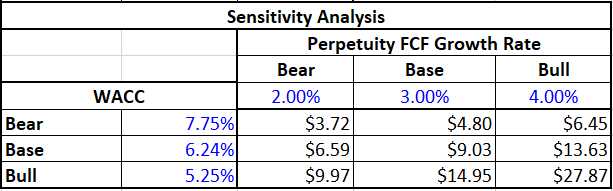

The image below is a two-factor sensitivity analysis for Cano’s WACC and perpetuity growth rate.

Cano Sensitivity Analysis

I conservatively used 3% perpetuity growth for the base case and 4% and 2% for the bull and bear case. According to Centers for Medicare & Medicaid Services (CMS) national health spending is expected to grow at an average of 5.1%, Medicare at 7.2%, and Medicaid at 5.6% from 2021 to 2030. For WACC sensitivity analysis, I used 7.75% for the bear case and 5.25% for the bull case. Assuming the same capital structure, the bear case could be a scenario where Cano’s cost of debt increases to 8% and the risk-free rate falls to 2%. The bull case could be if the risk-free rate rises about 5% and cost of debt falls to 5.5%.

My model projects a market value of Cano at $4.462 billion divided by 494.48 million shares outstanding to arrive at an intrinsic share price of $9.03.

Buyout Rumors

Cano has been the target of buyout rumors amidst consolidation in the primary-care industry, with CVS Health Corporation (CVS) and Humana (HUM) being pegged as the primary suitors. In September, The Wall Street Journal reported that CVS and Humana were in serious talks to acquire Cano sending the stock up 32% intraday and a 10-month peak of $9.64. On 10/17/22, it was reported by Dealreporter that talks had broken down between CVS and Cano sending shares down 42% intraday, an additional 7% the following day, and general weakness since. On the Q3 CVS earnings call, CEO Karen Lynch said:

We will continue to evaluate our options on primary care. And as I said, we believe that we need to do M&A and we continue to evaluate those options in the marketplace.”

CFO Shawn Guertin also echoed the sentiment of a Morgan Stanley (MS) note:

“At our current valuation, an M&A deal is likely less accretive than share repurchase. Having said that, for the right strategic deal, we could opt to use the balance sheet capacity we still have even after these enhanced levels of share repurchase.”

Humana has a right of first refusal with Cano, which will pose an obstacle to a potential buyout. There is still certainly a possibility that a buyout comes and potentially from suitors that haven’t yet been mentioned. It is worth noting that private equity is sitting on $975 Billion in dry powder and Cano will look enticing at its current levels. I wouldn’t invest in Cano expecting a buyout, but it should be viewed as an ancillary benefit to ownership.

Be the first to comment