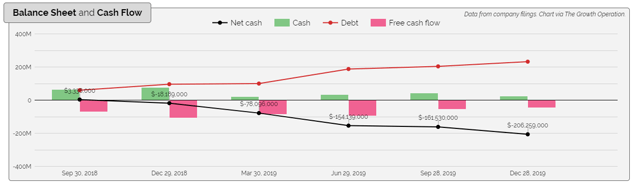

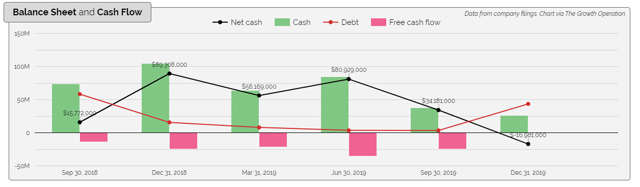

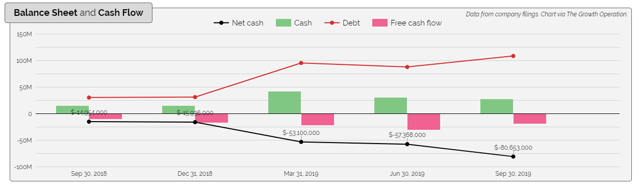

None of these cannabis companies have had a single free cash flow positive quarter since the second quarter of 2018. Source: The Growth Operation U.S. Cannabis Company Comparison.

Cash is Limited

Cannabis companies in the United States are in a difficult situation. Cannabis is federally illegal, leading to very high effective tax rates due to 280E taxation. Because of how these taxes are calculated, even unprofitable companies are paying hefty tax bills. These costs and ramp-up costs force most cannabis companies to rely on capital markets for funding.

Capital markets are much less willing to extend credit today than they were a year or two ago. Back then, cannabis stocks were flying high and could raise money via equity raises or debt offerings relatively easily, with companies like Green Thumb (OTCQX:GTBIF), Harvest Health (OTCQX:HRVSF), and MedMen (OTCQB:MMNFF) each securing nine-figure debt offerings.

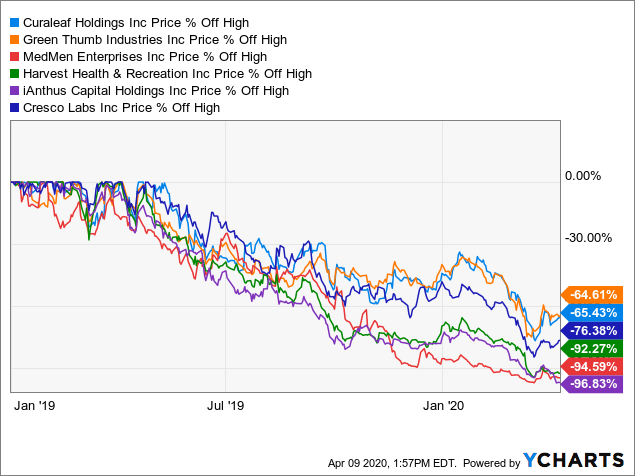

Data by YCharts

Data by YChartsToday, those markets have largely dried up. Cannabis stocks have been on a year-long tumble with most U.S. cannabis names down two thirds or more from their peaks last spring. While cannabis sales have climbed, investors have been disappointed with slowing growth, poor profitability, poor results in Canada, and limited movement on cannabis legalization efforts.

“I think, what it’s going to be, is that those with capital will be OK. But those who need it… it will be interesting,” (former Canopy Growth CEO Bruce Linton) said.

Debt investors also have backed down from funding cannabis companies so aggressively in light of these declines and doubts about the future profitability and legalization of the industry. The COVID-19 pandemic may put a further dent in capital markets as other industries- with much better histories of profitability – also will be seeking capital and may be more attractive clients for lenders.

With that in mind, it may be worth looking at U.S. cannabis companies to see which ones have capital to last during this crisis – which companies may be OK and for whom it may be “interesting.”

Okay… or interesting?

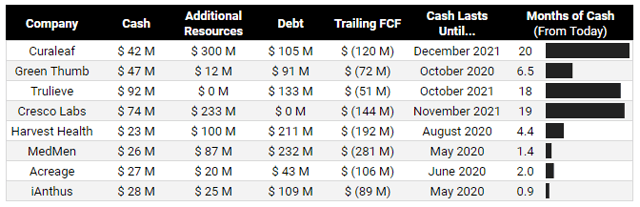

U.S. cannabis companies have varying levels of cash, with some companies having only enough cash to last for a few months based on historical cash burn rates. Source: Author based on company filings.

Curaleaf (OTCPK:CURLF) ended their fourth quarter with $42 million of cash and $105 million of debt. During the past 12 months, Curaleaf had a free cash flow burn rate of $120 million per year. This suggests that the company could last for only three months without drawing additional capital.

After the quarter, Curaleaf closed on a $300 million debt facility in January with 13% interest which matures in January 2024. If the $300 million in that facility is included, Curaleaf has enough capital to pay for ongoing cash burn for nearly three years, or until about December 2021 given the maturities of their other debt.

Green Thumb (OTCQX:GTBIF) ended their fourth quarter with $47 million in cash and $91 million in debt. During the past 12 months, Green Thumb had a free cash flow burn rate of $72 million per year. This suggests that the company could last for about six months without drawing additional capital. Green Thumb hopes to become FCF positive in 2020, which would allow them to operate indefinitely without capital infusions.

After the quarter, Green Thumb has closed two sale-leaseback transactions with Innovative Industrial Properties (IIPR). These facilities were sold for proceeds of $3 million and $9 million, with another $45 million allocated for improvements to the properties. With that capital included, Green Thumb has enough capital to pay for its ongoing cash burn until about October 2020.

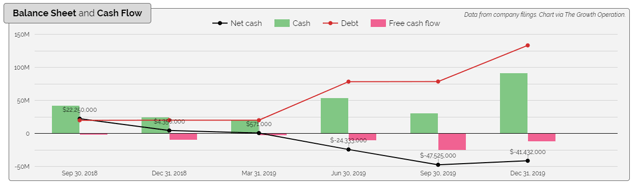

Trulieve cash, debt, and cash flow. Source: The Growth Operation Cannabis Company Dashboard.

Trulieve (OTCQX:TCNNF) ended their fourth quarter with $92 million in cash and $133 million in debt. During the past 12 months, Trulieve had a free cash flow burn rate of $51 million per year. This suggests Trulieve has enough capital to pay for its ongoing cash burn until about October 2021.

Cresco Labs (OTCQX:CRLBF) ended their third quarter with $74 million in cash and no debt. During the past 12 months, Cresco Labs had a free cash flow burn rate of $87 million per year. This suggests that the company could last for ten months without drawing additional capital.

After the quarter, Cresco Labs has been very busy. Among other transactions, the company sold properties to IIPR for $33 million and $11 million, established an at-the-market equity offering to raise up to ~$39 million (C$55 million), sold property to GreenAcreage for $50 million, and closed on a $100 million senior secured credit facility. Cresco Labs also acquired Origin House, which itself has a trailing FCF burn of ~$57 million (C$80 million).

With that capital and additional cash burn included, Cresco Labs may have enough capital to pay for its ongoing cash burn until about November 2021. However, given the number of transactions involved here, that figure is speculative and we will learn more when Cresco Labs reports fourth quarter results on April 27.

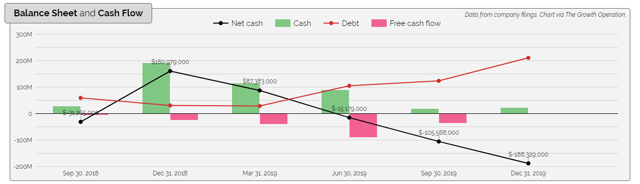

Harvest Health cash, debt, and cash flow. Source: The Growth Operation Cannabis Company Dashboard.

Harvest Health (OTCQX:HRVSF) ended their fourth quarter with $23 million in cash and $211 million in debt. During the past 12 months, Harvest Health had a free cash flow burn rate of $192 million per year. This suggests that the company could last for about one and a half months without drawing additional capital.

After the quarter, Harvest Health raised capital by issuing $41 million in debt and raising $59 million by selling shares. With that capital included, Harvest Health has enough capital to pay for its ongoing cash burn until about August 2020.

MedMen cash, debt, and cash flow. Source: The Growth Operation Cannabis Company Dashboard.

MedMen (OTCQB:MMNFF) ended their fiscal second quarter (ending Dec. 28, 2019) with $26 million in cash and $232 million in debt. During the past 12 months, MedMen had a free cash flow burn rate of $281 million per year. This suggests that the company could last for about one month without drawing additional capital.

After the quarter, MedMen raised $20 million selling equity, raised $12.5 million in a heavily-dilutive debt deal that I have previously written about, and hopes to raise $54 million selling cannabis assets in Arizona and Illinois. Provided that MedMen can close those sales, the company has enough capital to pay for its ongoing cash burn until about May 2020.

MedMen also has a further $137.5 million in debt tranches from Gotham Green Partners (“GGP”) which would give the company capital to operate through about November 2020. However, unlike the other capital listed above, the sale in Arizona and the future tranches from GGP are not assured as this cash is not yet in MedMen’s hands.

Acreage Holdings cash, debt, and cash flow. Source: The Growth Operation Cannabis Company Dashboard.

Acreage Holdings (OTCQX:ACRGF) ended its fourth quarter with $27 million in cash and $43 million in debt. During the past 12 months, Acreage had a free cash flow burn rate of $106 million per year. This suggests that the company could last for about three months without drawing additional capital.

After the quarter, Acreage announced a very complex $100 million funding deal which potentially gives them access to that capital but only if some fundraising conditions are met. This includes raising capital through private loans and selling warrants in order to offer security for an institutional loan, possibly coming from Canopy Growth (CGC) and/or Constellation Brands (STZ). The company closed on $20.2 million of that facility, borrowing $22 million primarily from insiders as collateral for the complex transaction.

Including the capital Acreage has received, the company has enough capital to pay for its ongoing cash burn until about June 2020.

iAnthus cash, debt, and cash flow. Source: The Growth Operation Cannabis Company Dashboard.

iAnthus (OTCQX:ITHUF) ended its third quarter with $28 million in cash and $109 million in debt. During the past 12 months, iAnthus had a free cash flow burn rate of $89 million per year. This suggests that the company could last for about four months without drawing additional capital.

After the quarter, iAnthus defaulted on its loan obligations and provided an updated capital picture: As of March 31, 2020, iAnthus had debt obligations of $159 million. Given the cash burn rate and other transactions, I estimate that iAnthus has around $9 million in cash on hand:

| Cash | Item |

| $ 27.9 M | Cash, September 30, 2019 |

| $ 36.2 M | Debt from GGP, Dec 2019 |

| $ (10.8 M) | Repay Stavola trust debt, Jan 2020 |

| $ (22.3 M) | Trailing FCF burn per quarter, Q4 |

| $ (22.3 M) | Trailing FCF burn per quarter, Q1 |

| $ 8.7 M | Estimated cash, March 31, 2020 |

Source: Author’s estimates based on company filings.

The largest wild-card in this estimate is iAnthus’ continuing cash burn rates. Given their limited capital, the company may have saved money in the fourth and first quarters and limited cash burn to less than their previous average. However, if these estimates are correct, iAnthus has enough capital to pay for its ongoing cash burn until about May 2020.

Thoughts

Much of this analysis is approximate, and many of these companies are actively cutting costs and conserving capital to outlast their past run-rate cash burn limits. That said, it appears that several of these companies will need to raise funds or improve their cash flow quickly to avoid potential capital issues including defaulting on debt.

Longer term, all of these companies need to work toward becoming free cash flow positive. That will be difficult while these companies are aggressively expanding by opening more stores and acquiring other cannabis operators to move into new states. This will be especially difficult given onerous 280E taxation and because it is illegal to transport cannabis across state lines–eliminating benefits of scale that might otherwise be possible.

Until these companies can turn the corner to FCF profitability, they will all be at the whims of capital markets. Cannabis investors should be aware of the risks that this entails and may want to keep an eye on their holdings’ balance sheets to make sure that management are good stewards of investors’ capital.

Happy investing!

Make better cannabis investments with better information

The Growth Operation is the largest community of cannabis investors on Seeking Alpha. During difficult market conditions, our active chat room and daily news updates help investors make sense of the rapidly-evolving cannabis market. The Growth Operation also includes interactive data, illustrating market sales trends and highlighting companies with best-of-breed financial performance.

Disclosure: I am/we are long TCNNF, GTBIF, CURLF, MMNFF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment