SimplyCreativePhotography/E+ via Getty Images

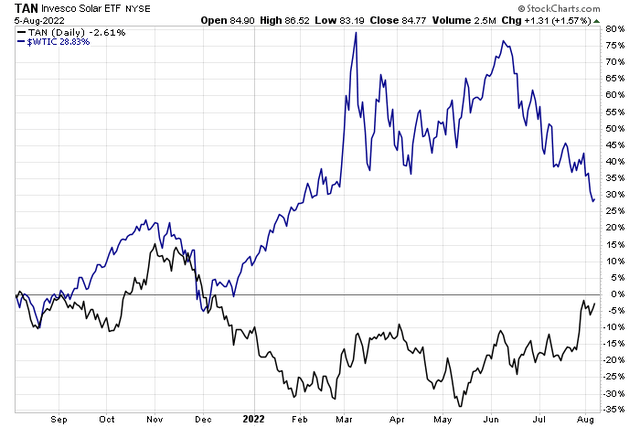

Solar stocks continue to catch a bid even with oil prices selling off. As WTI dips its toe under $90, bullish industry news came out of Capitol Hill last month. While the Inflation Reduction Act targets domestic alternative energy producers, money appears to be moving into both U.S.-based and international solar stocks.

One-Year Chart: Invesco Solar ETF (TAN) & WTI Crude Oil

According to The Wall Street Journal, Canadian Solar (NASDAQ:CSIQ), Inc. engages in the manufacture of solar photovoltaic modules and provides solar energy solutions. It operates through the Module and System Solutions (MSS) and Energy segments. The MSS segment involves the design, development, manufacture, and sales of solar power products and solar system kits, and operation and maintenance services. The Energy segment comprises primarily of the development and sale of solar projects, operating solar power projects, and the sale of electricity.

The Ontario, Canada-based $2.5 billion market cap company in the Semiconductor & Semiconductor Equipment industry features a lofty P/E ratio of 31.7 times last year’s earnings its Q2 earnings release is on tap. The solar firm’s earnings growth rate over the past five years has been stellar at +28%, according to Fidelity Investments.

CSIQ’s price-to-sales ratio is just 0.3 right now, per Koyfin Charts data. That is well below the median over the past five years.

Canadian Solar: A Depressed P/S vs History

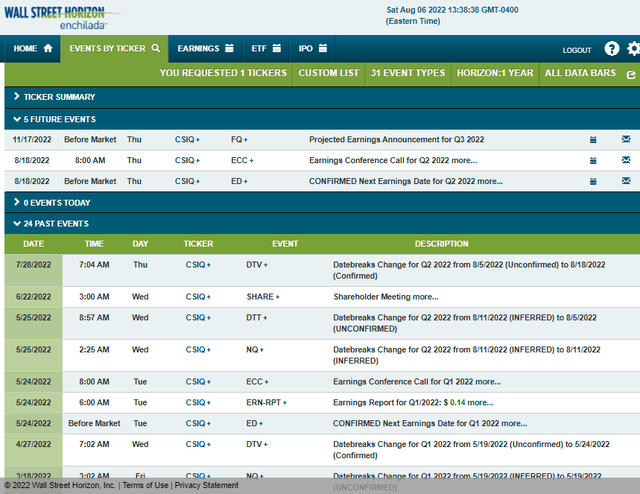

Wall Street Horizon shows a confirmed second-quarter earnings date of Thursday, August 18, BMO with a conference call to follow.

CSIQ: Corporate Event Calendar

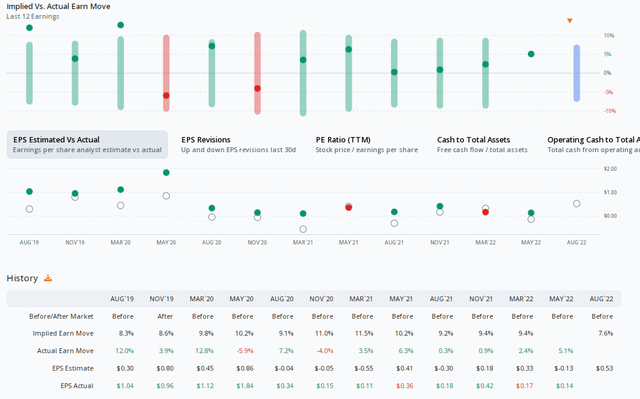

Options data from ORATS shows that traders expect just a 7.6% move in the stock following its quarterly numbers. That’s below implied share price changes from recent quarters. Moreover, the at-the-money straddle has not paid off during many other earnings reactions. Analysts expect $0.53 of EPS which would be a significant increase from 2Q21’s $-0.30.

Improving Earnings And A Decreased Share Price Swing Expectation

The Technical Take

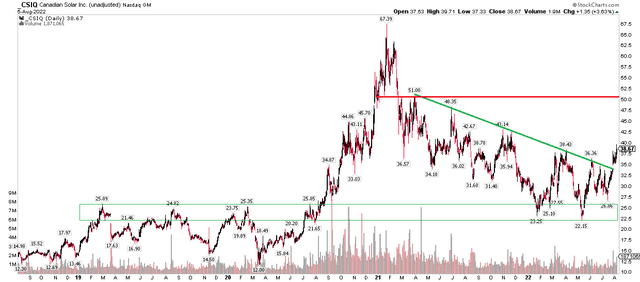

So, CSIQ looks cheap ahead of its earnings date next week. And the options market is not expecting as big of a move as the historical trend. But what do the charts say?

Shares broke out above a key downtrend resistance line in late July around the IRA news. There was heavy volume on the stock’s breakaway gap up to $36. Last Friday, the stock closed up big in a down market – again with significant volume. With the technical breakout and bullish price and volume action, it looks like CSIQ is poised to go up. I see $50 in play – that was a significant area in late 2020 through the first half of 2021.

Downside support is in the low-mid $20s after making a bullish rounded bottom this year.

CSIQ Four-Year Chart: Bullish Breakaway Gap On Volume

The Bottom Line

Canadian Solar appears bullish to me. The valuation is reasonable given its growth and a technical breakout support higher prices from here. Traders might even consider putting on a long options position based on somewhat low implied volatility ahead of CSIQ’s Q2 report.

Be the first to comment