Airubon/iStock via Getty Images

Canadian Solar Inc. (NASDAQ:CSIQ) just reported Q3 earnings, and while there are some extraordinary temporary tailwinds that are boosting earnings, specifically FX effects, growth is solid nonetheless. The business strategy shows that management is in tune with what is a compelling position in capital markets. The carve-out plan is going to go very slow due to administrative slowdowns in China, but the strategy around their development/utility renewable business should demand some multiple expansion.

Canadian Solar is seeing a burgeoning pipeline, and now it’s just a matter for the projects to waterfall into completion and start generating ROI. With potentially high ROICs interacting with ample investment opportunities, the conditions for value creation are here. CSIQ looks good.

Business Updates From Canadian Solar Q3 Earnings Call

While we’ll get into the financial performance later which showed growth and rising profitability, there are a couple of key details disclosed by management in today’s conference call.

- There are dozens of companies ahead of CSIQ with a similar profile that are all in limbo as far as the Chinese regulatory process goes for IPOs. CSIQ is looking to carve-out IPO their CSI Solar business which sells solar modules and products to OEMs and to retail customers. This is the less exciting business for us, so this carve-out option looks like a reasonably good one for the company to raise some money, involve strategics and to then focus on their utility/development style business. The problem is that it’s going to take some more time for this IPO to be complete. They are low in the list and nothing is moving due to administrative slowdowns from COVID-19 lockdowns. Apparently it’s not specific to the CSI case, as higher priority members of the waiting list for regulatory view are also in limbo.

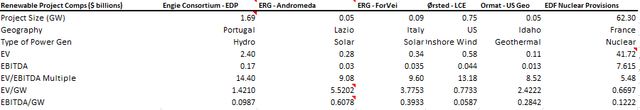

- The business strategy around the global energy business is being reiterated. Develop and then partially sell projects while retaining minority stakes. We like this model. It allows for PE-style rotations of the portfolio into markets, and then for the company to be paid to wait on utility economics from any of its held assets. Moreover, developer ROICs in the renewable development space have earned pretty phenomenal multiples in the past. In particular, we look at Ørsted (OTCPK:DNNGY), which does offshore wind and once had an astronomical multiple. It continues to get really good economics on its developments. More similarly ERG (OTC:ERGZF) in Italy which focuses on solar developments also has a higher multiple than the current CSIQ multiple. With utility markets being good right now in terms of electricity price, the pipeline should liquidate into cash producing assets that are going to yield very well. With the pipeline growing substantially for the energy production and energy storage assets, things are looking pretty good.

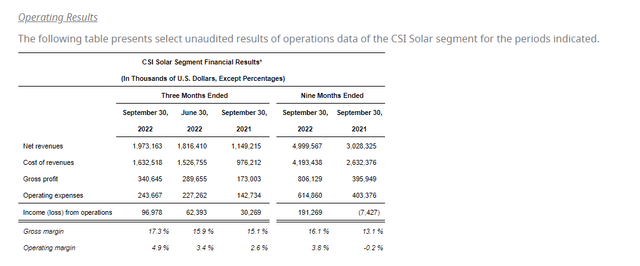

CSIQ Financials

Gross margin far exceeded the guidance of 15-16.5% for Q3, with an 18.8% achievement. While this is partially because the freight costs are finally coming down a bit, the main reason for it is FX. The dollar’s appreciation is causing its cost base which is primarily Chinese manufacturing to come down relatively compared to ASPs which are dollar denominated in a greater proportion, although there is also some topline FX headwinds. This is interacting with a particularly strong performance from CSI Solar which is the segment that is more China and RMB exposed on the cost side.

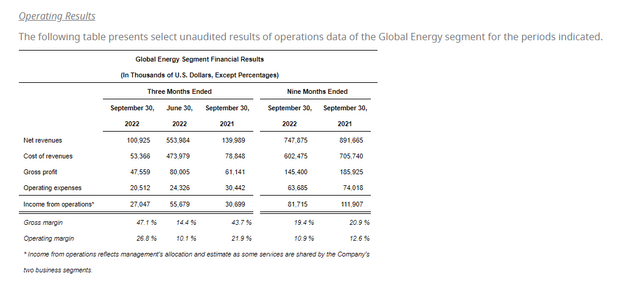

Besides very meaningful scale to help achieve margins, FX effects also favored this business which grew in the mix against the energy segment. The energy segment fell slightly sequentially on the timing of milestones being hit in major projects.

Nonetheless, there were major closes that delivered YOY performance. In particular, the nearing of operational completion of the Crimson Storage project, which is a battery storage project in California, helped boost results. Projects like these also accentuate other elements of these segment’s economics that we like. CSI will be providing operational and maintenance support on an ongoing basis to Crimson which will support the capacity of the grid while also retaining a 20% share in the project.

Bottom Line

CSI Solar is seeing growth and should be an attractive issue for the Chinese stock market. CSI Energy is seeing major pipeline build both in storage and energy generation.

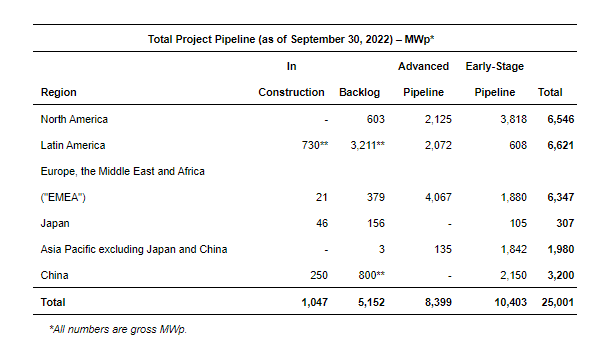

Solar Generation Pipeline (Q3 PR 2022)

If you take the pipeline above for the solar generation projects that they are developing, the value of these completed assets could be large.

ERG’s solar developments were valued at a 3.7x multiple per GW, which could value the current pipeline at many tens of billions. Of course, it will cost cash to deliver these projects. Presuming 20% development ROIs there should be substantial value creation of $18.5 billion or so in asset value accounting for cash outflows. This does not take into account time discounting. Assuming projects development length of several years, this comes down to about $10 billion.

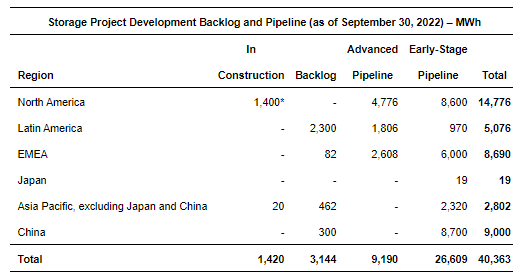

Battery storage is a less valuable pipeline. We don’t have comps, but it’s mainly for enhancing low-capacity factors of renewable installations. Suppose a 25% growth in capacity factors as a consequence of having storage solutions in the same grid, the value could be pretty substantial. Could be valued at about $4 billion considering that ratio and the relative size of the pipeline. More of the storage pipeline is earlier stage, so maybe there should be an additional discount considering that.

Storage Pipeline (Q3 2022 PR)

A lot of execution needs to go into this, but still, the value of these pipelines are more than 2x the current CSIQ EV and that’s just considering the CSI Energy segment. CSI Solar still has value too.

These comps may be tenuous, so it should be enough for investors to consider that there is a lot for the company to do. Ørsted is a developer/owner and trades at over 10x EV/EBITA. CSIQ is currently 6.93x. Offshore wind has different economics than solar to be sure, but ERG trades at a similar 10x valuation. Arguably, CSIQ has more of a sink for high ROIC development, so the scope of value creation could be even higher than those comps. Indeed, they are running at negative free cash flows for now, reflecting this more intense investment phase for the company compared to comps which are more mature.

Nonetheless, we see upside for CSIQ, especially as cash flows will grow on top of potential growth of the multiple, even if the USD appreciation effects to reverse. Canadian Solar Inc. looks rather interesting indeed.

Be the first to comment