Nataba

Note: All amounts discussed are in Canadian Dollars and stock prices refer to the prices on the TSX.

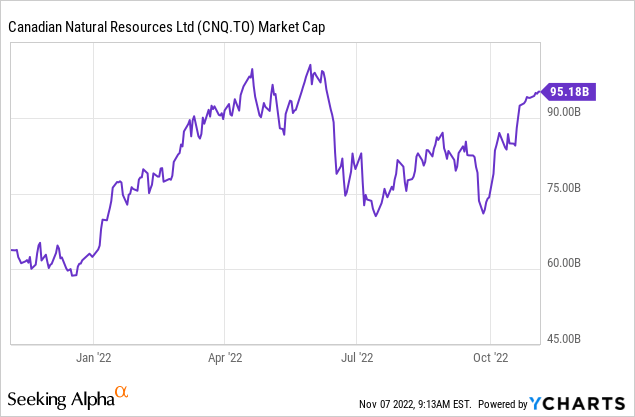

When we last covered Canadian Natural Resources (NYSE:CNQ), we called it a dividend aristocrat in the making. The stock has benefited from tailwinds of a higher commodity complex and delivered multiple quarters of impressive results. We take a fresh look at the company in light of the recently released Q3-2022 results and see if an investment case can be made today.

Q3-2022

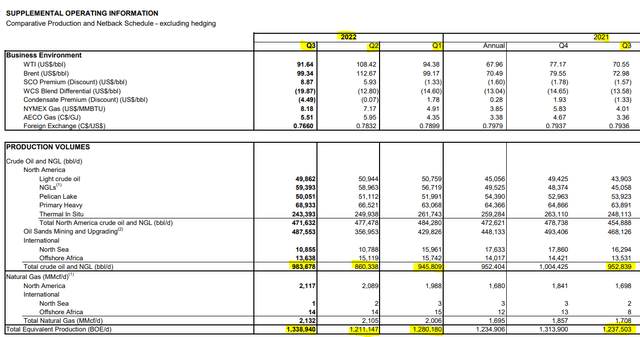

CNQ delivered a record 1.33 million barrels of oil equivalent a day of combined oil and natural gas production in Q3-2022.

This was 2% ahead of the extremely strong fourth quarter of 2021 and over 8% ahead of Q3-2021. While both oil and natural gas production levels rose, we saw a bit of downgrading in the components as oil production was up only 3.2% and the lower BOE-priced natural gas rose almost 25% year over year.

The production volumes also came as the pricing environment for both oil and natural gas was far stronger than in the third quarter of 2021. West Texas Intermediate was about 30% higher vs 2021 while AECO and Henry Hub natural gas prices more than doubled relative to last year.

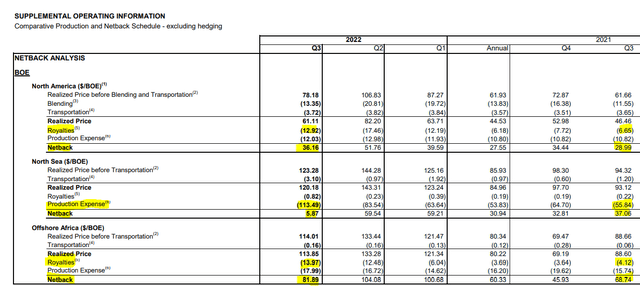

CNQ’s netback jumped as expected, but numbers were a bit lower than one would have expected just going by the sheer move in production volumes (base costs remaining fixed) and commodity pricing. There were a few reasons for this. The most important one is that royalties are paid on a sliding scale, and they increase rapidly when prices move above a certain threshold. For example, in its North American segment, royalties almost doubled year over year per barrel, even though overall prices did not move anywhere close to that on a percentage basis. In Africa, royalties more than tripled on its small production base.

Another detractor from the results was the netback from North Sea Production. The output here has been struggling for some time and the 35% drop in volumes alongside burgeoning costs made for a $5.87/barrel netback. This netback is quite instructive to look at when Europe talks about increasing or deploying windfall profit taxes. When netbacks fall from $37 to about $6, despite prices rising, one has to wonder what exactly they are trying to tax. A lot of those fields are in steep declines and need a lot of capital to keep production flat. Windfall taxes will likely not accomplish that.

CNQ also suffered from two separate outages in its Horizon and Scotford oil sands facilities. Unplanned outages are rare for CNQ and unlikely to repeat too often in the future.

Cash Flow King

CNQ is on track to produce $20 billion in cash flow this year. With prices holding strong right into November, there’s little downside to this number. This operating cash flow should be viewed in context of $4.6 billion of capital expenditures and a total dividend of about $5.0 billion to its shareholders. The $5.0 billion estimated payout includes the special dividend with Q2-2022 results.

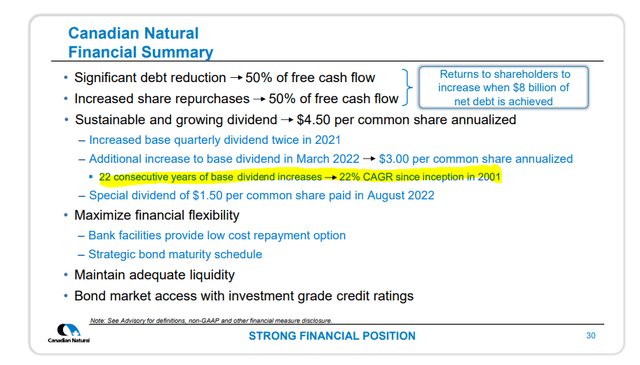

The financial position of the Company is very robust and net debt is targeted to decrease rapidly with significant free cash flow generation allowing for incremental returns to shareholders, as such the Board of Directors has declared a special cash dividend on its common shares of C$1.50 (one dollar and fifty cents) per common share.

Source: Seeking Alpha

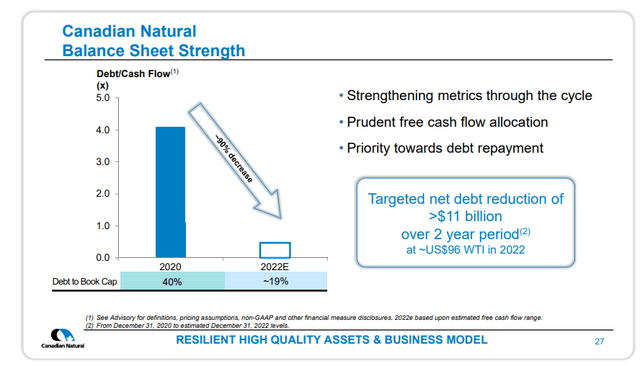

It also includes the 13% dividend increase in the Q3-2022 dividend, and we think another 5% increase for Q4-2022. While delivering those big dividend hikes, CNQ also has been rapidly deleveraging its balance sheet using the excess cash.

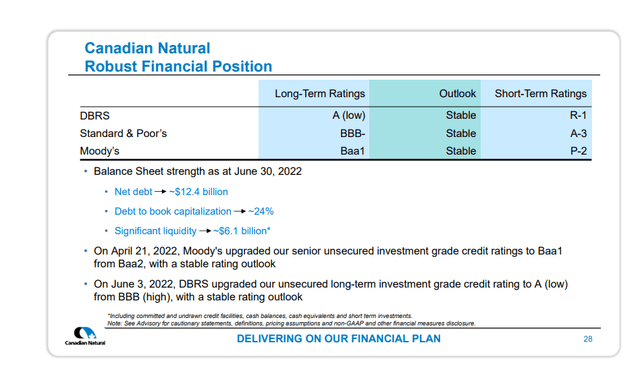

This has got it two credit upgrades in 2022, and we think the ratings are still incredibly low relative to the company’s strength.

We think at a minimum, CNQ’s ratings should be on par with Imperial Oil’s (IMO) AA-. Regardless of where the rating agencies put this company, the market obviously knows what the company can deliver, and it has no issues accessing the capital markets.

Valuation and Return Profile

CNQ is an easy case to make as an investment, if you accept that the current high commodity price environment is here to stay. After all, if $20 billion can be produced consistently, that leaves $10 billion in free cash flow after capex and after that massive dividend. We get a 10% plus free cash flow yield after those two are subtracted.

That sounds great, but just to put the other side of the equation here, CNQ did not produce even $10 billion of total (not free) cash flow in 2018, 2019 or 2020. So, there’s a commodity price exposure here, and investors need to know that even a resilient company like CNQ will drop hard if we are wrong about being bullish on the complex.

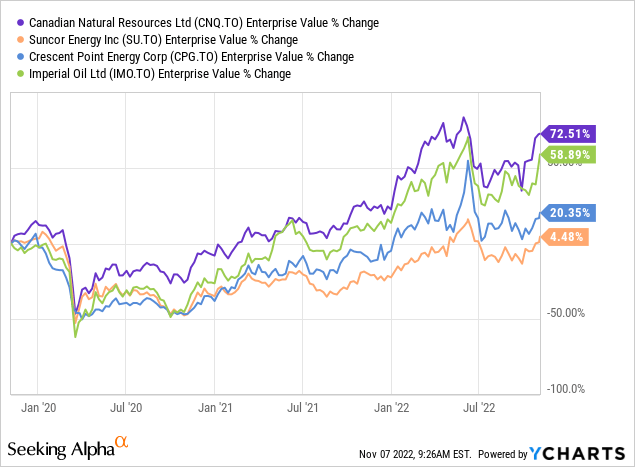

The second aspect here is the relative valuation, and it’s here that CNQ suffers a bit more. All energy companies have done well in this price environment. Debt paydown has been a priority for most. Looking at enterprise value, which adjusts for changes in debt levels, we can see that the market has really, really rewarded CNQ, perhaps at the expense of some others.

Some of this premium is deserved. Suncor Energy Inc. (SU) shot itself in the foot with the rather unnecessary dividend cut during COVID-19. But even adjusted for that, can we really want to buy CNQ at 1.5X EV to EBITDA multiples higher? This becomes an even bigger concern if you have a relatively bearish slant on natural gas relative to oil.

Verdict

We’re not going to put a sell rating on a company which has delivered at this rate in all environments. Twenty-two years of a growing dividend at a 22% compounded rate is, well, unmatched.

Of course, that’s unlikely to be matched going forward as the math gets troublesome with larger numbers. Nonetheless, we think a 3%-5% dividend growth should be the minimum you will get.

CNQ is the king if you think that the commodity bull market is just getting started. It also remains one of the few companies that can prove bullish price prognostications wrong by continuing to deliver big production increases. At present, we do not own the stock, as we think there are better relative values there. But this high-class performance is finally getting recognition, and we are now just three years away from the official dividend aristocracy.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment