CHENG FENG CHIANG/iStock Editorial via Getty Images

The financial numbers in this article are in Canadian dollars unless noted otherwise.

Introduction

“Wow” is what I thought when I saw Canadian National Railway’s (NYSE:CNI) 2Q22 earnings. In the past few weeks, I’ve written thousands of words on struggles in the (mainly United States) railroad industry due to operating inefficiencies, labor struggles, and supply-chain-related struggles. Now, Canadian National came out with tremendous numbers. It saw strong carloads, fantastic pricing, and improved operating efficiencies despite a lower headcount. Moreover, the company confirmed its full-year outlook.

In this article, I will discuss all of these things and reiterate why I believe that Canadian National is the perfect transportation stock for conservative long-term investors and frankly everyone looking for quality long-term investments.

So, let’s get to it!

Some Background Info

Let’s start by highlighting the two biggest factors influencing North American railroads.

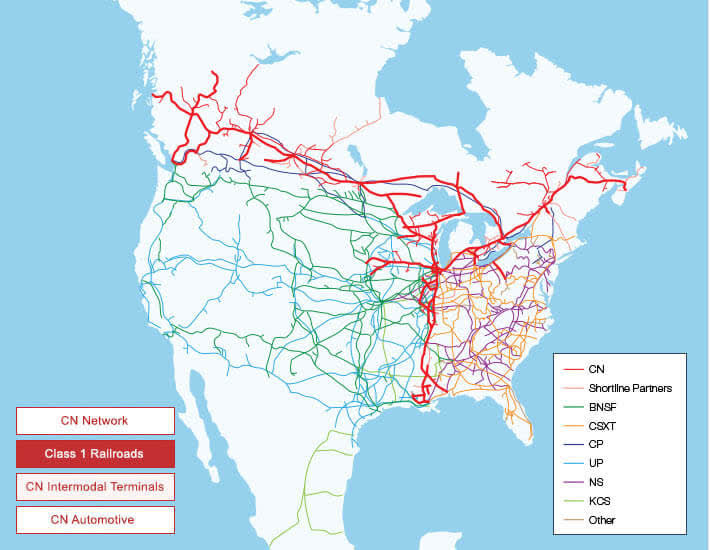

Number one: growth is slowing. Class I railroads connect every economic hotspot and port in North America. While all have certain competitive strengths, they are all dependent on economic growth including consumer health, homebuilding, automotive production, and everything related to that.

Canadian National

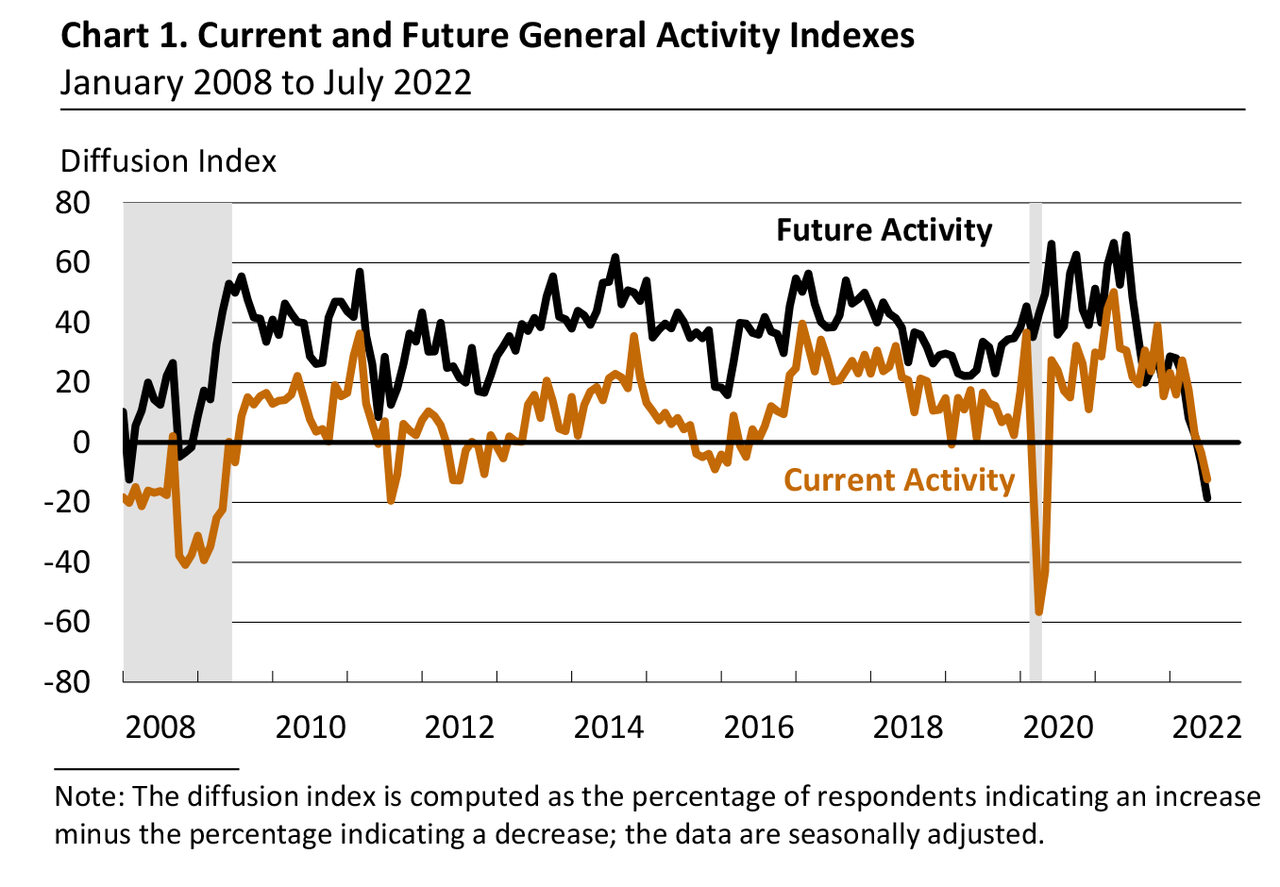

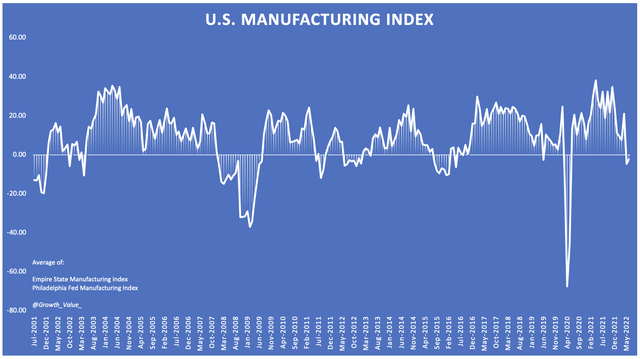

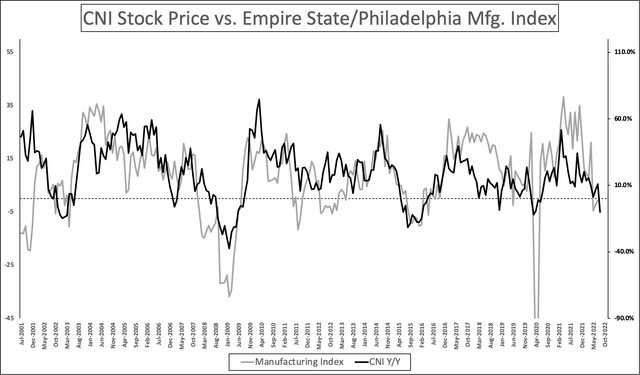

Right now, we’re dealing with poor economic expectations. US manufacturing sentiment is very low as a result of an aggressive Federal Reserve, high inflation, geopolitical issues, ongoing supply chain problems, and other issues.

The most recent ISM Manufacturing report showed that new orders are now contracting, with weakness in employment and backlog of orders.

One of the indicators I used above (to calculate an average) can be seen below. Philadelphia Fed manufacturing activity and expectations have now fallen below 2015 lows.

Philadelphia Federal Reserve

Issue number two does apply to Canadians as well, but to a lesser extent: supply chain and labor issues.

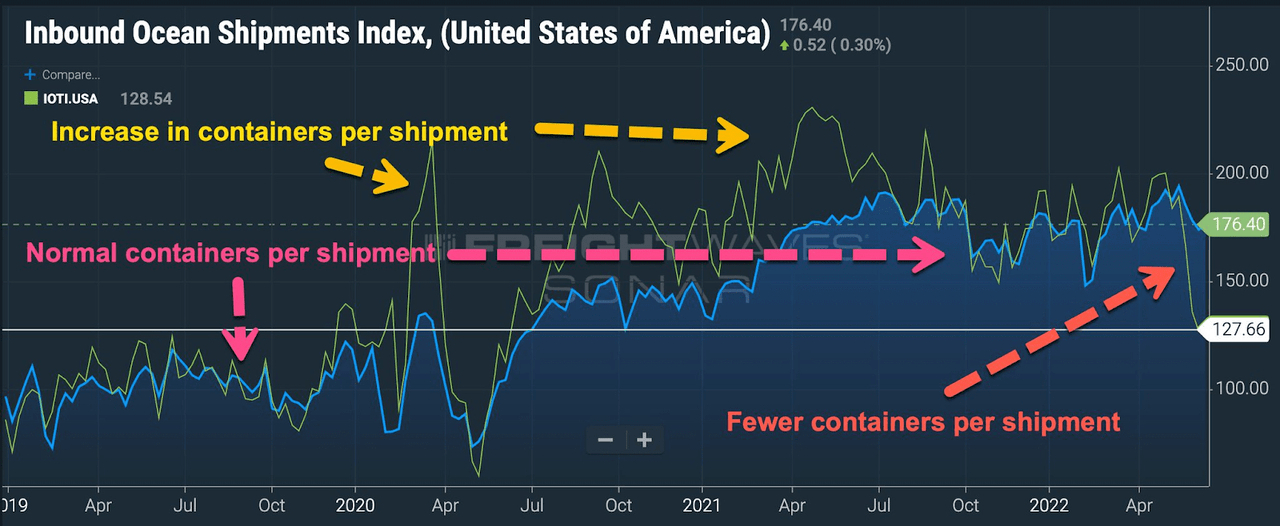

North American railroads are suffering from the supply chain bullwhip effect. In 2020, companies stopped ordering new inventory as they were dealing with significant uncertainty. Then, when the demand came back, they had to accelerate new orders to quickly fill inventories. Back then it all made sense. However, now, economic growth is slowing and companies are sitting on too much inventory (in some cases).

As an example, and according to the chart below, the number of containers per shipment is now quickly dropping.

FreightWaves

On top of that, railroads often cut employment even further after 2020 – along with key equipment – to deal with a lower number of carloads. It made sense back then, but it’s now backfiring as railroads need to bring back employees and equipment, which is doing a number on operating efficiencies.

For example, the CSX Corp. (CSX) operating ratio (the percentage of revenues it costs to operate the railroad) rose from 43.4% to 55.4%.

Union Pacific (UNP) saw a surge from 55.1% to 60.2%.

Moreover, USA-based railroads are in a labor dispute as employees are threatening to strike due to what they believe to be poor treatment and slow wage growth.

I discussed all of these issues in this article.

Canadian National Shines Bright

With all of this in mind, Canadian National did very well in its 2Q22 quarter.

First of all, the company did $1.93 in adjusted EPS, that’s $0.17 higher than expected and 30% higher compared to the prior-year quarter. A record! Revenue rose by 20.6% to $4.34, which beat by $250 million.

Moreover, the company reaffirmed its full-year outlook, which sees 15% to 20% in adjusted EPS growth with $3.7 to $4.0 billion in free cash flow.

Also, the company targets an operating ratio below 60%.

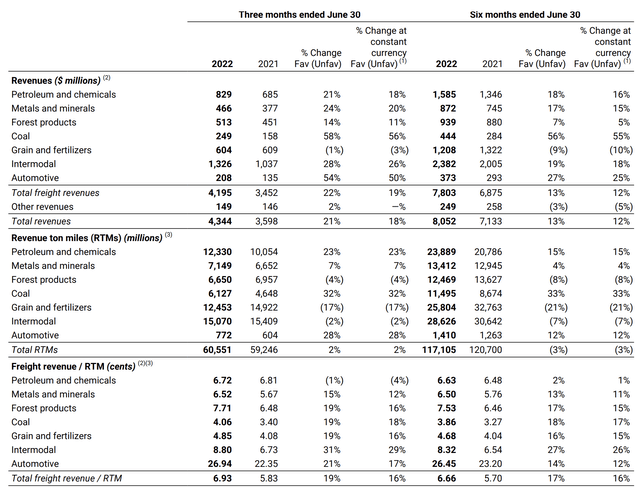

In 2Q22, strength started all the way at the top. While the number of carloads was unchanged, revenue ton-miles increased by 2%. The company saw strength in coal, which I’ve been bullish on due to the ongoing (global) energy crisis, petroleum and chemicals (related), automotive production, and metals.

Grains were lower, which is nothing new as Canadian railroads are still suffering from poor harvests last year. This is expected to change due to better weather conditions (higher yields) and high demand. In other words, that’s a very promising development going into next year. It’s also the reason why Canadian National added 500 more high-capacity hoppers to its grain fleet and 47 new locomotives.

Moreover, the company hired 850 new employees compared to the end of last year (this includes 1Q22).

With that said, strong pricing helped to turn 2% higher RTM into 21% higher revenues. In this case, only grains were down with a mere 1% contraction.

On a constant currency base, revenues were up 18%.

Total operating expenses were also up. However, only by 14%. Labor costs were down 3%. Fuel was up 71% or $380 million as a result of the steep increase in diesel costs this year.

As a result, the operating ratio fell from 61.6% to 59.0%.

In this case, the railroad is becoming more efficient at a time when a lot of peers are doing the opposite. However, bear in mind that Canadian National was less efficient in prior years, which (ironically) is the reason why the railroad is now in a better spot.

This is what the company commented on its operating performance. Note that it sees a very “fluid network”, which is tremendous news in this environment:

Operating performance improved in the second quarter when compared to last year as we emphasize running the railroad to plan. The initial focus was on train departures, and we started at our 4 hump yards in April. And then we turned our attention to our key flat switching yards in May. Since then, we’ve seen solid improvement in our origin on-time train departures, which reached over 90% in June, up 14% from June of 2021. It’s also helped our connection performance, which was up 30% to nearly 80% in June. Clearly, the team has made solid progress on executing to the plan.

To give you a few operating numbers that highlight its operating performance, the company increased car velocity by 4 car miles per day, and dwell time fell from 7.7 hours to 7.2 hours.

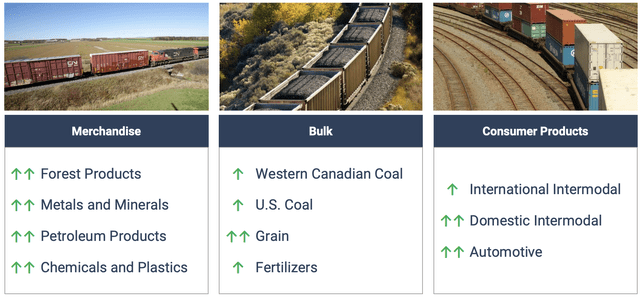

With that said, and with regard to my earlier growth slowing remarks, the railroad is very positive when it comes to expected demand going forward. What railroads like to do is use arrows to indicate what they expect to happen in each segment, and in the case of CNI (or CNR indicating Toronto-listed shares), all arrows are green:

I immediately get behind the comments on bulk. Coal remains in high demand as countries try to mitigate high energy costs. Grains will see a rebound thanks to better harvests, and fertilizer demand is higher than it ever was – this will get even better for the Canadians if energy prices overseas outpace energy price growth in North America.

That said, I believe the company may have to adjust its outlook for merchandise and consumer products. While automotive is coming back due to more available supplies and filled order books, I don’t think intermodal strength will last. The same goes for cyclical products like chemicals and metals, which I believe will weaken going into next year.

This is what the company commented on intermodal:

Domestic intermodal remained strong with no slowdown in demand. International intermodal volumes were down in June as we are metering flows of Western imports destined to Montreal and Toronto to ensure fluidity of terminals as the industry faces driver shortages and full warehouses. We remain focused on yield management with inflation plus pricing on renewals and as well as other surcharges on older contracts for additional storage and services.

And with regard to the aforementioned bigger picture:

We remain confident on our outlook for the balance of the year and are reaffirming our 2022 financial outlook, including adjusted EPS growth in the range of 15% to 20% with an operating ratio that starts with a 5.

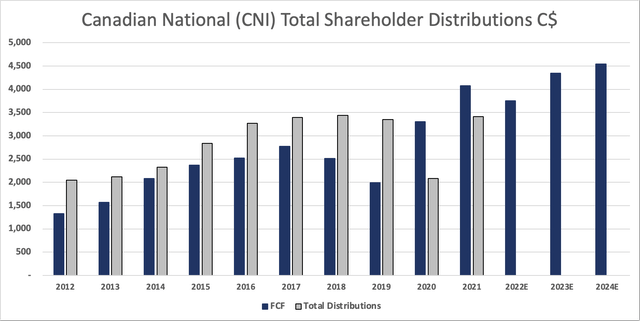

So far, it looks that analysts believe that FCF will come in at the lower range of the company’s own outlook (roughly $3.8 billion). However, after that – and with support from rebounding economic growth – the company should be in a spot to reach $4.5 billion in free cash flow in 2024.

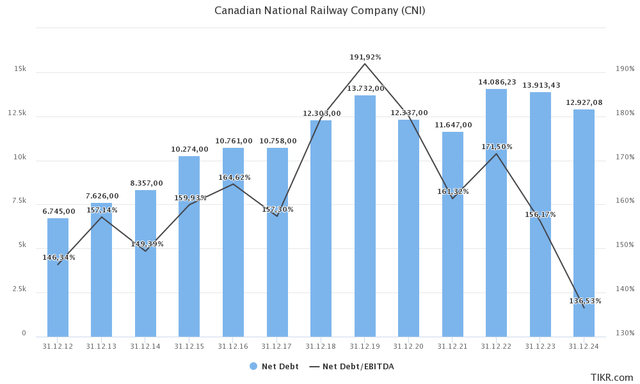

This means there’s more room for higher dividends and buybacks Prior to the pandemic, total distributions used to be higher than FCF, which ended up pushing net debt to $13.7 billion prior to the pandemic. However, even then, the net-leverage ratio didn’t make it above 2.0x EBITDA, which goes to show that the company could still use its balances sheet in a responsible way to boost shareholder returns. Going forward, I expect distributions to remain below FCF.

So, what about the valuation?

Valuation

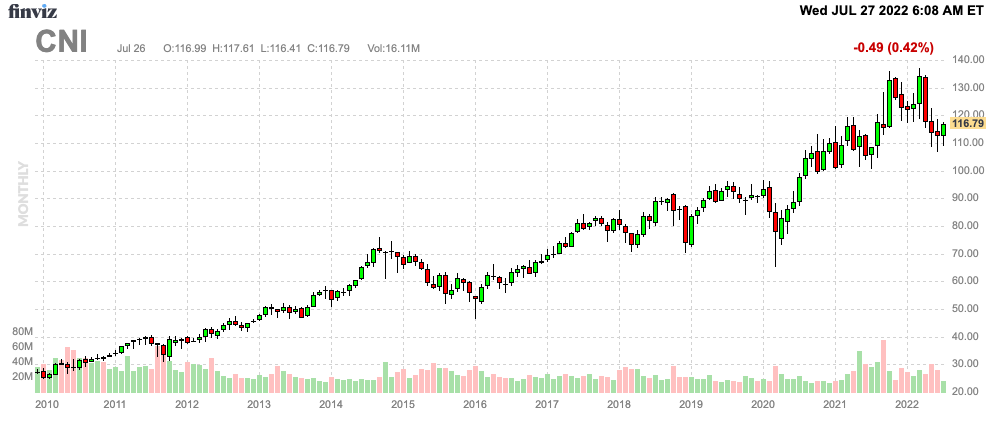

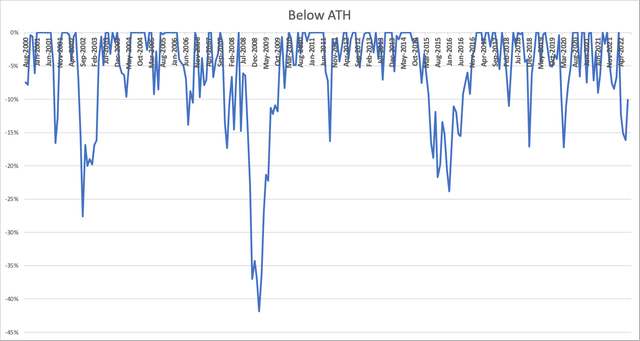

There’s good and bad news. The good news is for current investors as CNI has rebounded. The stock is now 10% below its all-time high, which includes the expected 3% surge after earnings. Hence, the numbers below are based on a $120 stock price in New York. This may be different by the time you’re reading this, but that’s the downside of post-earnings volatility.

Hence, the bad news is that investors have priced in a return of growth. I’m not a big fan of that, I would like this stock to trade lower before recommending it to long-term investors. If economic growth indeed continues to slow in the months ahead, I believe that the stock could encounter more weakness – regardless of its fantastic 2Q22 earnings.

So far, the uptrend is still looking good.

FINVIZ

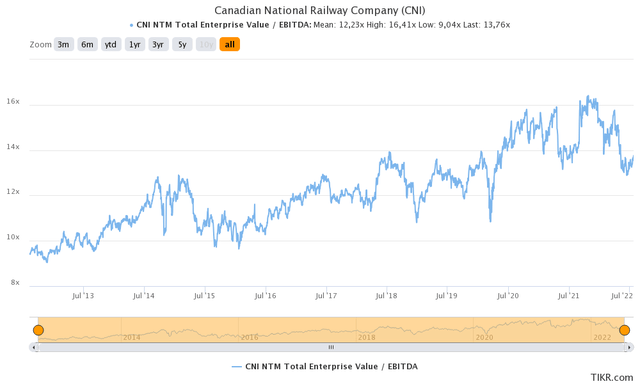

With that in mind, we’re dealing with a $120.5 billion enterprise value based on a $106 billion market cap in Toronto (including a 3% surge post-earnings), $13.9 billion in expected net debt next year, and $640 million in pension-related liabilities.

Using $8.9 billion in expected 2023 EBTIDA, the EV/EBITDA multiple is 13.5. The good news is it’s not overvalued. The post-pandemic surge in valuations has been erased.

The bad news is that it’s not really cheap either.

However, CNI is now trading at a 2.0% dividend yield, it has once again proven to be well-prepared to deal with operating headwinds, and its financials are improving. I stick to everything said in my dividend-focused article last month.

If I did not have significant railroad exposure already, I would likely still be buying shares at these levels. Not a lot, but some. It’s hard to predict where economic growth will go from here. While more downside is likely, I still like the risk/reward for investors planning on holding the stock for at least a decade.

Interested investors should start small and add gradually over time. If the stock continues to decline due to economic developments, investors can average down. If the stock takes off, investors have a foot in the door.

Takeaway

I’m truly impressed by Canadian National’s performance. The company did very well despite industry headwinds. The railroad, which managed the decline in demand in 2020 and 2021 way more conservatively than its (American) peers saw an improvement in its operating ratio in 2Q22, shorter dwell times, and strong revenue ton-miles.

Moreover, the company sees higher growth in every single operating segment. While I believe that headwinds may be worse than expected, I do agree that growth in key segments like agriculture, automotive, and coal is indeed benefiting railroads at a time when it matters most.

The valuation is “fine” – but not cheap or overvalued.

Long-term investors who are interested in buying conservative transportation exposure may want to buy some here. However, as I explain in this article, be careful and add gradually over time.

(Dis)agree? Let me know in the comments!

Be the first to comment