Rena-Marie/iStock via Getty Images

Overview

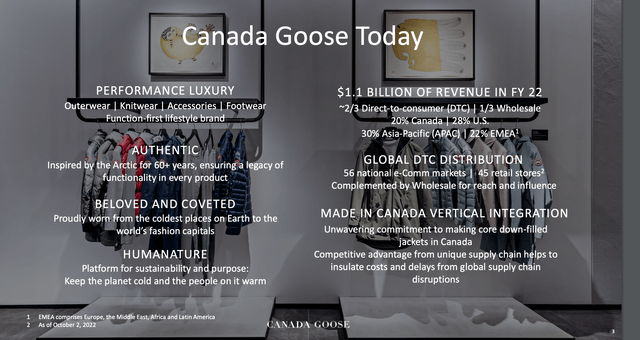

Along with Moncler (OTCPK:MONRF), Canada Goose (NYSE:GOOS) is one of two global luxury brands focused on outerwear. The company primarily sells high-end parkas and jackets ($1,000+ price point) with ~50% of revenue coming from North America (split between US and Canada). 2/3 of revenue comes from direct sales (Canada Goose stores & e-commerce) with the bulk of the remainder coming through high-end department stores. Over time GOOS plans to expand direct sales (discussed below).

Overview (Investor Presentation)

Growth Engine

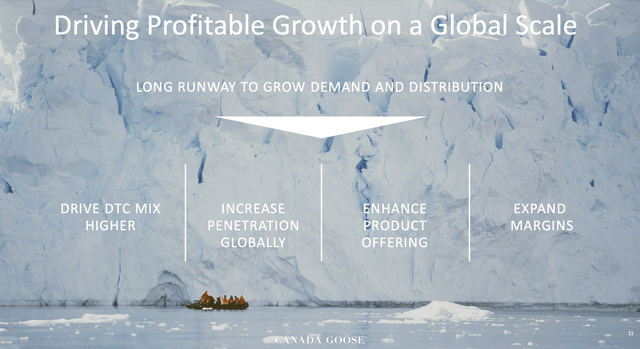

GOOS has a simple framework for growth centered around increasing direct distribution (sales through own stores and e-commerce), expanding geographically (particularly in Asia/China) and broadening its product offering beyond outerwear. In addition to parkas and jackets (75-80% of revenue), today GOOS’s product includes sweaters, accessories, and footwear. The aforementioned growth strategy is similar to the path followed by its main competitor Moncler (which has total sales ~2x the size of GOOS).

Growth Roadmap (Investor Presentation)

As we sit today, GOOS operates just 45 of its own stores which compares to over 200 for Moncler suggesting an ample runway for future growth. Sales from direct sales carry higher margins than those made through 3rd parties (i.e. selling in Bloomingdales or Niemen Marcus). Today direct sales represent 2/3 of total revenue – over time the company expect this to trend beyond 75% which should drive gross and operating margins higher.

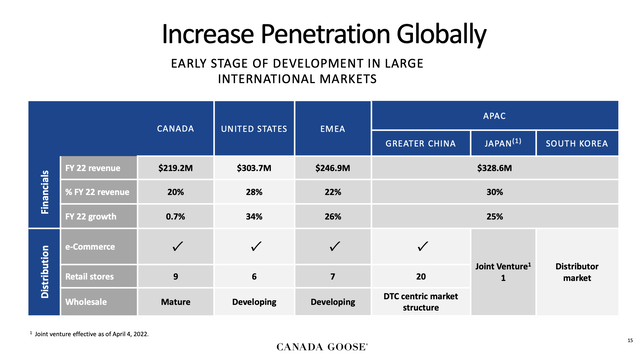

Moving forward, we will see the company open new stores in luxury shopping destinations throughout the globe. As you can see below, the GOOS is under-represented in markets outside North America.

Revenue by Geography (Investor Presentation)

It is worth noting that luxury goods tend to benefit from price increases (in excess of inflation) over the long term. Unlike most products which have a normal elasticity of demand (people demand more of them as the become cheaper), the cache of luxury goods tends to increase with price. Importantly, GOOS has been careful not to discount too aggressively during slowdowns to protect its brand image.

Current Results

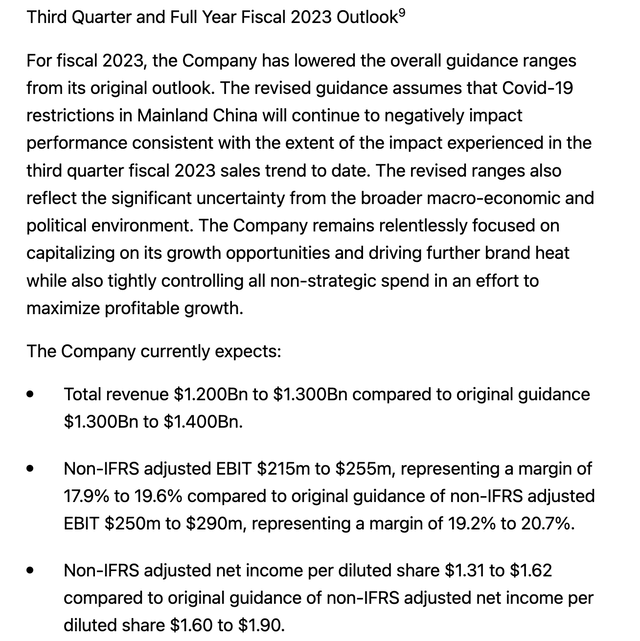

2022 results to-date have been disappointing though the company is still seeing low 20s constant currency revenue growth. As shown below, GOOS tempered full year expectations:

Full Year Guidance Lowered (2Q22 earnings release)

GOOS is not immune to weaker economic conditions pressuring consumer spending (impacts the aspirational customer more than the core luxury customer). In addition, GOOS has suffered from COVID shutdowns in China. China has been one of the main growth engines for global luxury goods companies over the past decade. Continued weakness in the macroeconomy in general and China specifically remain a risk factor going forward.

Valuation and Conclusion

GOOS trades at an undemanding 16.2x 2022e EPS (with 2022e EPS reflecting lowered guidance) and less than 14x 2023e EPS. Given the company’s strong brand and growth potential, this seems too cheap. For reference, competitor Moncler trades at ~25x 2022e EPS (and 21x 2023e EPS) and many global luxury goods companies trade between 20-25x earnings. Assuming a 20-22x P/E multiple on 2023e estimated earnings, this implies GOOS has 47-60% upside.

I see GOOS as being a reasonable investment prospect here given the meaningful discount to its primary competitor and likelihood of continued growth over the next five years.

Be the first to comment