raw206/iStock Editorial via Getty Images

Last month, Pennsylvania Real Estate Investment Trust (NYSE:PEI) (NYSE:PEI.PB) (NYSE:PEI.PC) (NYSE:PEI.PD) posted strong operating results for the fourth quarter of 2021. However, the overleveraged mall REIT once again failed to complete any meaningful asset sales, so it didn’t make progress on its key priority of debt reduction. As a result, PREIT’s common and preferred shares have continued to march lower.

Indeed, while improving NOI and other operating metrics is important, PREIT must significantly reduce its debt load to have a realistic shot at refinancing its credit agreement when it matures in late 2023.

Achieving the necessary level of debt reduction will be tough. Yet it is not as far-fetched as PREIT’s stock price seems to imply. That gives PREIT stock (and particularly the preferred shares) multibagger potential if the company succeeds in refinancing its debt, albeit with a high risk of substantial loss if PREIT can’t complete enough asset sales over the next 18 months or market conditions prevent refinancing.

NOI recovers faster than expected

Since the post-pandemic recovery in mall traffic began, I have expected PREIT’s NOI to return to 2019 levels by 2023. Based on the company’s strong Q4 performance, that projection now appears conservative.

Excluding lease termination revenue, same store NOI surged 52.5% year over year last quarter, recovering from a pandemic-induced slump in 2020. In absolute terms, NOI reached $62.2 million in Q4 ($61.6 million excluding lease termination revenue). That compares to $63.2 million in Q4 2019 ($62.2 million excluding lease termination revenue). Thus, total NOI recovered to within 2% of where it stood in Q4 2019, and within 1% when lease termination revenue is excluded.

For the full year, NOI totaled $200.5 million ($195.8 million excluding lease termination revenue). This remained down more than 10% from 2019, when PREIT posted NOI of $227.7 million ($226.2 million excluding lease termination revenue). However, most of the shortfall relative to 2019 came in Q1.

While the NOI recovery didn’t move in a straight line, there was a clear trend back towards 2019 levels over the course of 2021, as PREIT filled vacancies, temporary rent concessions expired, and percentage rent billings increased. Here’s how NOI excluding lease termination revenue compared to 2019 in each quarter:

|

Period |

2019 Result |

2021 Result |

Change |

|

Q1 |

$56.3 million |

$37.1 million |

Down $19.1 million |

|

Q2 |

$54.4 million |

$51.3 million |

Down $3.1 million |

|

Q3 |

$53.4 million |

$45.8 million |

Down $7.6 million |

|

Q4 |

$62.2 million |

$61.6 million |

Down $0.6 million |

Data source: PREIT quarterly supplemental filings. Table by author.

The writeoffs of Q1 2021 will not repeat in 2022 and beyond. Furthermore, actual and leased occupancy for non-anchor space at PREIT’s malls both improved by approximately 3.5 percentage points between March 31, 2021 and the end of the year. As a result, the NOI recovery will continue in 2022. There’s a good chance that total NOI will reach 2019 levels this year, excluding the impact of any potential sales of income-generating assets.

Asset sales coming into focus

Investors have been understandably disappointed about PREIT’s asset sale campaign thus far. The “dispositions” section of the REIT’s 2021 annual report mentions just three asset sales, with combined net proceeds of roughly $5 million. (See p. F-22) Asset sales of this magnitude are immaterial compared to PREIT’s $2.25 billion debt load. PREIT’s debt actually increased slightly during 2021.

This could be about to change, though. Whereas PREIT’s long-term goal of selling excess land to multifamily developers will take years to fully execute (due to the need to secure entitlements and anchor consents), management is also targeting deals that can be completed relatively quickly. Late last year, CEO Joe Coradino announced an ambitious goal of selling $120 million of assets by mid-2022.

I’m skeptical that PREIT will hit that number by June 30, but 2022 is still likely to be a much better year for asset sales than 2021.

Most notably, PREIT recently signed an agreement to sell Exton Square Mall (its last remaining non-core property) for $27.5 million. While the sale price is a bit lower than I had hoped, it represents a roughly 4% cap rate on the property’s 2021 NOI, reflecting the value of the underlying land.

An empty corridor at Exton Square Mall. (Image source: Author.)

PREIT also aims to sell the Whole Foods store at Plymouth Meeting Mall as a separate parcel and complete a new round of outparcel sales. For reference, PREIT sold the Whole Foods store at Exton Square Mall for $22.1 million in early 2019 and sold various outparcels to Four Corners Property Trust (FCPT) between late 2019 and mid-2020 for a combined total of $28 million.

Additionally, PREIT has received entitlements for its first multifamily land sale. That deal (at Moorestown Mall) is set to close in May. The sale price appears to be roughly $8 million, based on disclosures made during PREIT’s 2020 bankruptcy case. (See p. 798) Several other multifamily and hotel land sales could realistically close in the second half of 2022.

In other odds and ends, PREIT recently redeemed preferred equity it received from a previous asset sale for $2.5 million. Lastly, it is on track to sell an anchor box at Valley View Mall (a property it returned to the lenders) for $2.8 million during Q2.

What about Fashion District Philadelphia?

One reason why PREIT stock has plunged in recent weeks despite its strong Q4 results is that its annual report included a going concern warning.

PREIT has guaranteed half of the $194.6 million term loan for Fashion District Philadelphia, its joint venture property with Macerich (MAC). The loan includes a 9% minimum debt yield covenant effective June 30. The JV doesn’t expect to meet this covenant. (Based on data from PREIT’s Q4 supplemental, the property appears to have generated less than $14 million of NOI last year, compared to the $17.5 million needed to comply with the loan covenant.)

NOI will likely improve over the course of 2022, now that food and entertainment tenants (which make up a big chunk of the rent roll) are on a firmer footing. Additional lease-up as the property heads towards stabilization in 2023 should also help. But in the meantime, PREIT and Macerich will be required to reduce the loan balance to meet the 9% debt yield covenant by midyear. PREIT will be unable to do so under the terms of its credit agreement.

While this is an unfortunate situation, it is not likely to push PREIT into bankruptcy. One possible solution would be for Macerich to lend money to the joint venture, as it already did in late 2020. Another option would be for PREIT to hand over its stake in the property to Macerich in return for the latter assuming all of the JV’s debt (and perhaps an additional nominal payment).

The latter possibility likely represents the worst-case scenario. Despite the property’s slow start, Fashion District Philadelphia is almost certainly worth more than the $194.6 million term loan balance. Thus, Macerich should be willing to take on the modest downside risk of being fully responsible for the property’s debt to capture all of the long-term upside potential.

From PREIT’s perspective, this wouldn’t be a huge loss. After accounting for the term loan and the additional high-interest loan from Macerich to the JV, PREIT’s equity in Fashion District Philadelphia has a carrying value of just $16.3 million.

Charting a path to refinancing

PREIT ended 2021 with $2.25 billion of debt on its books, putting gross debt at more than 11 times the REIT’s trailing NOI of $200.5 million. That’s way too high a leverage ratio to permit refinancing when the company’s credit agreement matures in late 2023. (The initial maturity is in December 2022, but I expect PREIT to qualify for a one-year extension.)

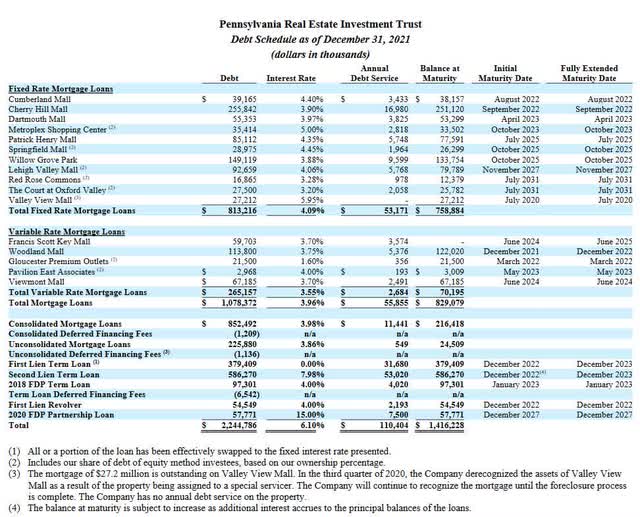

Source: PREIT Q4 2021 Supplemental.

However, trailing NOI will likely improve to around $215 million once PREIT closes the books on Q1 2022, as the pandemic-impacted first quarter of 2021 drops out. Meanwhile, the recently-completed foreclosure process on Valley View Mall has wiped $27.2 million of debt off the books. As a result, PREIT likely ended the quarter with roughly $2.22 billion of debt.

If PREIT sells Exton Square Mall, the Valley View anchor space, and the residential land at Moorestown Mall during Q2 as planned, it will raise about $38 million. Turning Fashion District Philadelphia over to Macerich (the worst-case scenario outlined above) would wipe another $155 million of debt off the books. This would cut PREIT’s debt to approximately $2.03 billion while reducing NOI to around $207 million on a pro-forma basis.

In short, PREIT has a clear path to reducing leverage to below 10 times NOI within months. Between organic NOI growth (PREIT already has new leases signed for $8.8 million of annual rent), sales of outparcels and other single-tenant assets, and a few additional multifamily and hotel land sales that could be completed within the next year or so, leverage could improve to around 9 times NOI by mid-2023.

That’s probably still too much debt to refinance on reasonable terms: I would put the magic number at roughly 8 times NOI. But PREIT is closer to being able to refinance than it might appear based on its current headline leverage number. With a fairly modest number of asset sales beyond the transactions described above (and potentially a small equity offering if the stock price recovers), PREIT should be able to refinance at a much lower rate than the approximately 8% it is paying under its current credit agreement. That would in turn provide a cash flow boost that PREIT could use to reduce debt further over time.

Balancing upside against risks

PREIT reported funds available for distribution of -$16.4 million for 2021, as FFO was negative. However, I expect NOI to improve by $25 million or so in 2022, excluding the impact of future asset sales. Near-term asset sales and the potential handover of Fashion District Philadelphia could provide an incremental FFO boost of over $5 million by reducing interest expense. This would put funds available for distribution back in positive territory at roughly $15 million.

Assuming modest NOI growth beyond 2022 and that PREIT can refinance its term loans at 5% by completing additional asset sales in 2023, funds available for distribution would reach roughly $40 million-$50 million by 2024. PREIT has multiple potential avenues for achieving the necessary level of debt reduction, whether by selling JV interests in one or two top malls, completing additional land sales, or disposing of additional non-core properties.

In the near term, it would be prudent to retain most of that cash so that PREIT can continue reducing its debt and interest expense. But as PREIT completes additional asset sales (especially future phases of its multifamily land sale program, which management estimates could be worth $137 million), it would have the flexibility to catch up on its preferred dividends, which are accruing at a rate of $27.4 million annually.

Source: PREIT June 2021 Investor Presentation, slide 49.

PREIT’s preferred shares have been trading at around $5 recently. If PREIT’s financial position improves as described and the REIT resumes preferred dividend payments, the preferred shares would likely quadruple in value in short order.

The outlook for the common shares is murkier. Even if PREIT catches up on its accrued preferred dividends and funds available for distribution (excluding preferred dividends) reaches $45 million, that would leave under $20 million for common shareholders: less than $0.25 per share. That might boost the stock price to $2, but this would be a smaller gain than preferred shareholders stand to realize (and with greater risk).

M&A could eventually offer a better exit strategy for common shareholders, but that’s a highly speculative outcome. As a result, the preferred shares seem like a superior option to the common shares at current prices.

On the flip side, investors in PREIT shares (common or preferred) are taking on substantial risks. Most immediately, the company could fail to reach a resolution with Macerich on Fashion District Philadelphia in the coming months, leading to a default. There’s also a modest risk that it would fail to qualify for the one-year extension on its credit agreement if its properties appraise at lower values than I expect.

Also of note, PREIT has disclosed problems with its management controls over accounting. This implies an increased risk of financial reporting errors.

The biggest risk is that PREIT doesn’t sell enough assets by late 2023 to refinance its debt. As noted above, it didn’t make much progress in 2021. Plus, the company’s shaky finances and its need to raise a lot of cash quickly won’t help it in negotiations.

That said, it’s encouraging to see PREIT zeroing in on less-ambitious asset sales that can be completed relatively quickly. Additionally, if management chooses to exit the Fashion District Philadelphia project, it should be feasible to do so at a price close to the property’s book value.

Most importantly, a more active market for high-quality malls is likely to develop over the next year, catalyzed by Unibail-Rodamco-Westfield‘s (OTCPK:UNBLF) decision to sell virtually all of its U.S. malls in 2022 and 2023. PREIT has several properties that could be candidates for new JVs (or even a full sale) as the market unfreezes, so it has multiple options for achieving the required deleveraging.

Based on all of these factors, I continue to rate PREIT as a speculative buy, with the preferred shares looking more attractive than the common stock. However, it is only a suitable investment for investors with very high risk tolerance, due to the continued bankruptcy risk stemming from PREIT’s weak balance sheet.

Be the first to comment