Harry Collins/iStock via Getty Images

Remember this age-old question?

If you could pick three people to invite to dinner, who would they be?

Now, imagine this question with a wild twist:

If you could pick forty people to travel with on a five-day fishing trip to Maine, who would they be?

This second question helps define my experience over the last week. I had the honor to attend Camp Kotok this year at Leen’s Lodge in Grand Lake Stream, Maine. What is Camp Kotok? It is an invitation-only event where well-known economists, central bankers, politicians, investment managers, researchers, philanthropists, and journalists come together for several days of fishing, food, and discussion on the key issues of the day under Chatham House Rule.

Needless to say, my time at Camp Kotok was an extraordinary experience. Rarely does one have the opportunity to come together with so many thought leaders that you admire and respect all in one place. While those that have read my articles over the years know that I am never at a loss for expressing an opinion, Camp Kotok was a great opportunity for me to sit back and listen to the insights and perspectives from so many experts.

The following are just a few of the many key takeaways from the stay:

1. The Fed is likely to stay the course with rate hikes. While the stock market has gotten itself all aflutter this summer over the prospects that the Fed may have the flexibility to start lowering interest rates as soon as the end of the year with inflationary pressures starting to abate. The view of many attendees was that such an abrupt shift toward easing was highly unlikely any time soon. If anything, it was more likely that the Fed will continue raising interest rates through the end of the year and into at least early 2023 to fully extinguish any lingering pricing pressures even if the headline and core rates come back to earth.

It is important to emphasize that the art of central banking is much more complex than it may first appear on the surface, particularly when it comes to the keeper of the global reserve currency in the U.S. Federal Reserve. As we learned from the Great Financial Crisis more than a decade ago, the global financial system is an intricate mesh of various players and forces all interconnected to keep the engine running smoothly. As a result, it’s not as simple as the Fed turning on a dime the moment inflationary pressures come off a few percentage points. It is also critical to point out that the Fed is not only increasingly struggling with a credibility problem, particularly in the wake of the recent scorching inflation outbreak, but we are living in a highly polarized and politicized environment more broadly.

Thus, it may be best to keep your Fed easing expectations in check for any time soon. The fact that CME Fed Fund futures are currently pricing in less than a 3% probability for at minimum a 25 basis point rate cut between now and the FOMC’s July 2023 meeting roughly a year from now provides added confirmation to this view.

2. China invading Taiwan may be much easier said than done. It is understandable for armchair geopoliticians to contemplate the possibility that China may soon take military action to bring Taiwan fully back into the mainland fold. This is particularly true given how easily China threw the “one country, two systems” agreement overboard in Hong Kong and in the wake of Russia’s invasion of the Ukraine. But just as Russia’s experience so far has reminded us that “amateurs discuss tactics, professionals discuss logistics”, some key factors related to Taiwan that are not often widely discussed may meaningfully complicate China’s ability to successfully conquer Taiwan.

First, unlike Russia invading Ukraine, which still is not going well for Russia, where crossing an adjoining land border was all that was required, China will need to travel at least 80 miles or more across water with their forces to invade Taiwan. That’s A LOT of lumbering sailing vessels and aircraft bringing military equipment as well as supplies and food and soldiers and all the other things needed to make fighting a war happen. The element of surprise this is not. And remember, for all of the rapid expansion of the Chinese military forces, they have little to no recent experience in engaging in actual live conflict.

This leads to the next issue. Let’s just assume the Chinese are able to successfully make this journey that includes passing Taiwan’s Penchu islands off the western coast and get everything set up into place. Then there is the issue of Taiwan’s topography once the invading force arrives. Taiwan is effectively a big mountain ridge covered by a dense forest. As for its largest cities where the vast majority of its 23 million people live, they are spread out from the north end to the south end along the west side of the island with complex waterways offshore and very few locations suitable for troop landings. What if China resorted to carpet bombing Taiwan ahead of the invasion? Even this proves challenging given how sprawling the Taiwanese population centers are.

And none of this so far even begins to consider the actions taken by the defending Taiwanese military that has been long preparing for such an episode (as the events in Ukraine have reminded us, invading and occupying a country, even one that is considerably smaller in population and not nearly as well armed, is a tall order) or the global response to such aggression against Taiwan including most importantly from the United States.

Put simply, for all of the justifiable talk and concern about a potentially imminent China invasion of Taiwan, the actual execution is a far more complex and uncertain circumstance. As a result, the response by risk asset markets to this potential threat should be measured and well-considered to avoid any knee jerk reactions.

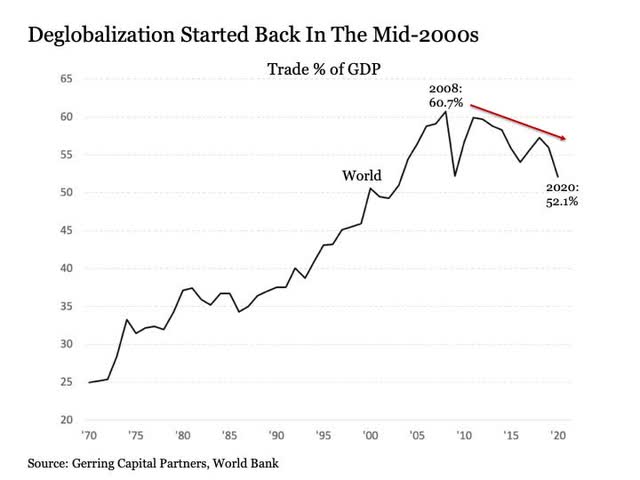

3. The start of deglobalization is so mid-2000s. While it seems like it is a relatively new theme for investors to consider in the wake of the COVID pandemic, the reality is that a deglobalization trend has been underway since the onset of the Great Financial Crisis. If anything, COVID along with the increasing trend toward nationalization across many parts of the globe have provided added juice to a trend that got started more than a decade ago.

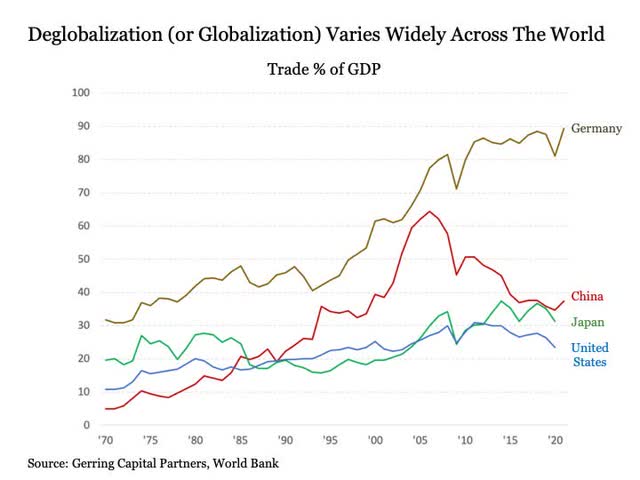

Moreover, it is notable that this deglobalization trend is being driven in part by China. This is important to emphasize, for while many countries including the United States have indeed been shifting toward deglobalization, other major economies like Germany are continuing to increasingly globalize, while others like Japan are holding generally steady.

This leads to some key takeaways for investors to consider going forward.

First, the view from some expert attendees is that deglobalization is likely to continue, but it is unlikely to be a broadly investable theme. Instead, deglobalization (or continued globalization) is likely to play out differently across regions and countries, each with its own unique impact that should be considered more specifically. This leads to potential opportunity for those willing to take the time to understand the specific deglobalization dynamics playing out in a given region or country at any point in time.

Next, resist painting with a broad brush when it comes to the potential inflation impacts associated with deglobalization. While the reasonable summary conclusion is that whereas globalization is inherently disinflationary while deglobalization is thus inflationary, the reality according to expert attendees is that each development will come with its own specific pricing impacts. Same goes for related currency effects including the U.S. dollar.

4. Dig deeper for opportunities in emerging markets and beyond. It is also tempting to paint with a broad brush when considering the investment opportunity set in emerging markets. This is particularly true given its -33% peak-to-trough return since early 2021 on the MSCI Emerging Markets Index.

But it is important to recognize that China makes up a major part of the market with an over 31% weighting to the entire index. Taking this one step further, the three countries of Taiwan, India, and South Korea, all of which are closely connected to China in various ways, make up another 40% of the emerging market index weighting. The fact that these four markets making up more than 70% of the index have fallen anywhere between -20% and -55% peak-to-trough since early 2021 has made it tough for any other countries in the space to stand out to investors.

This provides opportunity for those investors willing to investigate selected emerging, frontier, and non-index countries that might otherwise be overlooked in part due to the dominant weighting of the four countries in the emerging market space.

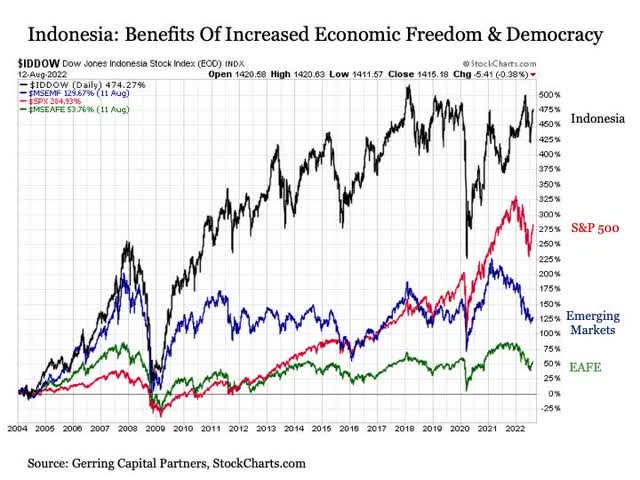

So where exactly is an investor best to focus their research efforts in seeking such opportunities? One expert attendee identified a few key factors to consider when pursuing excess returns in emerging markets. These include countries that rise from a low level of economic freedom according to the Fraser Institute and prioritize democracy over autocracy that have equity markets that have shown a propensity to outperform global equity indices over time.

Let’s consider Indonesia for example (I should note that this country is not an example provided by the expert attendee, but one that I came up with separately when seeking to apply the stated criteria – the expert may disagree with this country example). Since 2000, Indonesia has seen their Fraser Institute Economic Freedom summary rating steadily increase from 6.06 in 2000 to 7.26 in 2019, causing their country ranking to rise fifteen spots from 85 to 70. This time period began not long after the end of Suharto’s 32-year presidency and the fall of the New Order in 1998 with major democratic oriented reforms to Indonesia’s three branches of government that followed. In the process, Indonesia has seen measurable gains in its scoring for Legal System and Property Rights (3.33 in 2000 to 4.90 in 2019), Sound Money (6.20 in 2000 to 9.64 in 2019), and Regulation (5.61 in 2000 to 6.58 in 2019).

Along the way during this transformation, the Indonesia stock market, as measured by the Dow Jones Indonesia Stock Index, has generated a total return since the start of 2004 that has meaningfully outperformed not only the MSCI Emerging Market Index but also the S&P 500 and the developed market MSCI EAFE Index.

Thus, investors seeking attractive selected country total return opportunities across emerging, frontier, and non-index markets may be well served in identifying countries that are prioritizing increasing economic freedom from a relatively low level while also emphasizing democracy over autocracy.

5. Equity market opportunities. Several esteemed attendees focused on the equity markets emphasized their priority to overweight military defense and health care. Given that I am meaningfully overweight both of these industries, the presentations heard and conversations had with several thought experts provided reaffirmation to these allocations in my portfolio strategy.

At the same time, a number of expert attendees also highlighted some of the challenges confronting the financial sector that require increased selectivity over the coming 12 to 24 months. With that said, the notion that JPMorgan Chase (JPM) remains among the most critical players in the financial arena was meaningfully reinforced along the way.

Bonus takeaway. Fishing in Maine is absolutely pristine. While I have travelled to Maine in the past (my last visit was all the way back in 2004), this trip was my first time to the fishing regions of Washington County. And what a remarkable experience it was. Imagine carving out a hole as deep as 125 feet spread across 25,000 acres; filling it up with crystal clear spring water; and throwing in an abundance of bass, white perch, salmon, and pickerel among other fish. If you have not been and you like to fish (or even if you have no idea how to fish!), visiting the Grand Lake Stream area of Maine is an absolute must for your future itinerary.

Bottom line. It was a remarkable time in Maine, and it meaningfully enhanced my perspectives on the asset allocation process for the months ahead. As we progress through the second half of 2022, I continue to maintain a meaningful allocation to short-term bonds as a guard against further downside risk across capital markets in the months ahead. The stock rally this summer has certainly been welcome, but it may ultimately prove fleeting. As for my risk asset allocations, I continue to maintain a balanced allocation to long-term U.S. Treasuries and stocks that are almost exclusively based in the U.S. Within my equity allocation, I continue to overweight industry allocations to military defense, health care, integrated oil and gas, food, and financials. I also maintain a dedicated allocation to Treasury Inflation Protected Securities (TIPS) and gold.

Be the first to comment