imaginima

In the last year, Cambium Networks (NASDAQ:CMBM) lost nearly 65% of its value. Markets ended the unstoppable uptrend when CMBM stock peaked at over $50. When the stock finally bottomed in the teens, investors accumulated shares ahead of Cambium’s second-quarter results. The company’s earnings and revenue beat consensus estimates.

Did Cambium’s prospects improve enough to rate the stock a buy?

Cambium Second-Quarter Results

Cambium is a wireless infrastructure provider. It sells fixed wireless and Wi-Fi to broadband service providers. In the last quarter, it exceeded consensus estimates by posting non-GAAP earnings per share of 18 cents. Revenue fell by nearly one-quarter (-25.2%) Y/Y to $69.3 million. The widest non-GAAP to GAAP adjustments are in the operating margins:

|

GAAP |

Non-GAAP |

|

|

Q2 2022 |

Q2 2022 |

|

|

Revenues |

$ 69.3 |

$ 69.3 |

|

Gross margin |

48.3 % |

48.9 % |

|

Operating margin |

3.8 % |

9.1 % |

|

Adjusted EBITDA margin |

11.3 % |

In millions, except percentages

In the table above, the firm posted an operating margin that is more than double GAAP figures. The latter numbers exclude a share-based compensation of $2.52 million. Still, the company tightened its costs and cut spending.

On the conference call, Chief Executive Office Atul Bhatnagar said that the company’s technology roadmap and strategy continued to strengthen. Its products are at the start of new growth on the S-curve. Q3/2022 results will signify the start of accelerated growth for broadband network products. The firm adjusted prices last year. It ended Q2/2022 with a backlog growing by 5% Q/Q and up 29% Y/Y. Specifically, Cambium recorded record Wi-Fi 6 revenue. Demand for enterprise solutions rose by 31% Y/Y.

In the calendar year 2022, the company expects enterprise business growth of 45% Y/Y.

Opportunity

Cambium offers a cloud-managed wireless solution. This integrates multiple communication standards on emerging broadband technologies. Dubbed “Cambium 1 Network,” customers are initiating wireless infrastructure projects.

The firm benefited from strong orders for enterprise Wi-Fi. For example, WhiteSky Communications, a managed service provider, ordered Cambium’s cnMaestro X. This is a flagship subscription network management solution.

It announced that National Defense Communications selected it for its fixed wireless broadband technology.

In Eastern Europe, many nations want to upgrade their military communications infrastructure. They want Cambium’s PTP 700 technology. This would upgrade their infrastructure with the same equipment that the U.S. defense uses. Investors building a portfolio that embraces the war economy will look at PTP as a catalyst. According to CFO Andrew Bronstein, the government business for PTP will uptick starting in the third quarter.

CEO Atul Bhatnagar said that the company’s fixed wireless broadband product entered the S-curve two quarters ago (Q4/2021). It introduced its 6 GHz product back then. Currently, this in beta testing, so investors should anticipate orders increasing from here. The company is starting to convert the 28 GHz product into deals.

Rural Digital Opportunity Funds (or RDOF) and the Broadband Equity, Access and Deployment (or BEAD) program are long-term opportunities. In the next 10 years, this market is worth $20 billion. Cambium will post contract awards for wireless by later this year or by early next year. At the latest, the company will announce deals by the first half of 2023.

Investors should not doubt that Cambium would deliver on growth from BEAD and RDOF. The firm offers an affordable solution. It is not targeting the very high-end and high-performance market. At the mid-tier network level, the company has an attractive business model. Customers who have lower spending budgets will consider Cambium’s products.

Risks

In Q2, Point-to-Multi-Point products fell by 53% Y/Y. Cambium needs to pivot away from its sluggish legacy PMP 450 product first. The stock price may not move higher until it ramps up sales for its 5G fixed solution and 6 gigahertz products in Q4/2022.

Cambium’s Wi-Fi business has uneven demand. Although the company expected this business will grow by 45% for the year, demand has yet to stabilize. Chief Financial Officer Andrew Bronstein said, “we do think that there will be a continued downtick because of the product cycle that we’re in.” However, new product introductions in the fourth quarter should strengthen revenue growth.

Covid and China’s lockdown risks are disrupting the supply chain. This may harm the company’s enterprise business. Fortunately, the freight situation is improving. This will help its product availability.

Stock Score

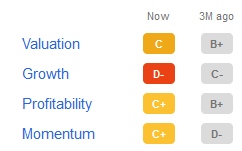

According to Seeking Alpha Premium, CMBM stock scores worsened where it mattered. Valuation fell as the stock price increased. The growth and profitability scores fell from three months ago:

SA Premium

Cambium’s momentum score improved after the stock rallied from the mid-teens to nearly $20. Bearishness against the stock is minimal at a 3.91% short interest. Investors cannot time the perfect bottom on the stock. Consider starting a small position from here. Increase the allocation only when the company posts strong results for the current quarter.

Be the first to comment