imaginima/E+ via Getty Images

Callon Petroleum (NYSE:CPE) is issuing $600 million in new 7.50% unsecured notes due 2030. The proceeds of this offering plus its ability to generate close to $900 million in positive cash flow in 2022 should put it in good shape with regard to its note maturities. I project that Callon can redeem all of its 2024 and 2025 note maturities this year.

Callon would then be left with $300 million in credit facility debt at the end of 2022, and no more note maturities until 2026. It should also be able to generate $1.1+ billion positive cash flow in 2023 at current strip prices.

Debt Moves

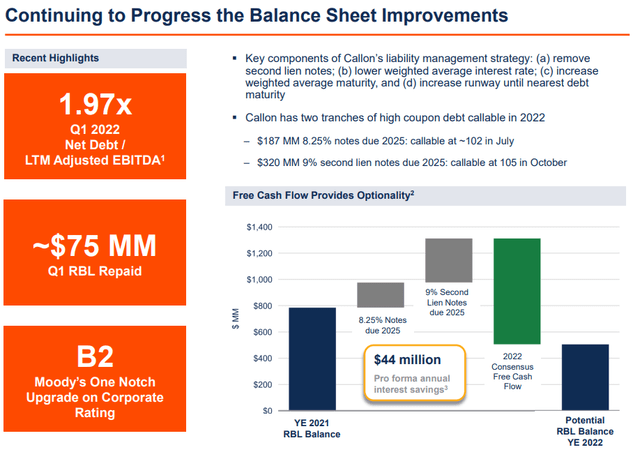

Callon is issuing $600 million in new 7.50% unsecured notes due 2030. The proceeds are going towards redeeming its $460.2 million in 6.125% unsecured notes due 2024 (at 101.531% of par) along with its $319.7 million in 9.00% second-lien notes due 2025 (at approximately 106.5% of par).

Callon’s credit facility debt will increase by around $220 million as part of these transactions as well. Callon’s annual note interest costs will go down by $12 million as a result of these transactions, while its total interest costs will go down by approximately $6 million per year.

Callon had also previously mentioned potentially calling its $187.2 million in 8.25% unsecured notes due 2025 (inherited from Carrizo). The call price would be 102.063% of par in July 2022.

Callon’s Credit Facility Debt (callon.com)

My current estimate is that Callon can generate $886 million in positive cash flow at current strip prices in 2022. This would result in it having the following outstanding debt at the end of 2022 if it redeems its 8.25% unsecured notes due 2025 sometime this year.

| Projected End Of 2022 Debt | $ Million |

| Credit Facility due 2024 | $300 |

| 6.375% Unsecured Notes due 2026 | $321 |

| 8.00% Unsecured Notes due 2028 | $650 |

| 7.50% Unsecured Notes due 2030 | $600 |

| Total Debt | $1,871 |

Callon would have approximately $125 million in annual interest costs, down from approximately $166 million at the start of 2022. It would also have significantly improved its note maturities by taking out its 2024 and 2025 notes.

Updated 2022 Outlook

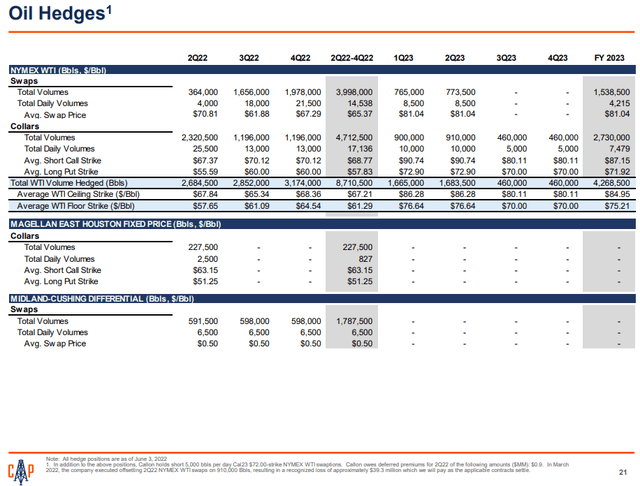

At current 2022 strip of $108 to $109 WTI oil and $7.50 Henry Hub natural gas, Callon is now projected to generate $3.142 billion in oil and gas revenues before hedges. Callon’s 2022 hedges have an estimated value of negative $658 million.

| Type | Barrels/Mcf | $ Per Barrel/Mcf (Realized) | $ Million |

| Oil | 24,060,000 | $107.00 | $2,574 |

| NGLs | 7,143,050 | $42.00 | $300 |

| Natural Gas | 38,346,900 | $7.00 | $268 |

| Hedge Value | -$658 | ||

| Total Revenue | $2,484 |

Callon has bumped up its capital expenditure budget for 2022 up to $800 million, while maintaining its cost guidance in other areas. It had originally budgeted $725 million, which reflected 10% inflation from 2021 levels, but is now expecting 20% inflation.

| $ Million | |

| Lease Operating Expense | $285 |

| Gathering, Processing, and Transportation | $80 |

| Production and Ad Valorem Taxes | $189 |

| G&A and Other (Cash Basis) | $90 |

| Cash Interest | $154 |

| Operational Capital Expenditures | $800 |

| Total Expenses | $1,598 |

At current 2022 strip prices, I now project that Callon will generate $886 million in positive cash flow.

Updated 2023 Outlook

Callon has approximately 25% of its 2023 oil production hedged, including 5,000 barrels per day in WTI swaptions with a $72 strike price. These 2023 hedges are also at a better price than its 2022 hedges, so Callon may be able to generate $1.1+ billion in positive cash flow in 2023 at current strip prices (high-$90s WTI oil).

This would allow Callon to pay off its remaining credit facility debt, redeem its $321 million in outstanding 6.375% unsecured notes due 2026 and have approximately $500 million in cash at the end of 2023.

Based on current strip prices, there is a solid chance that Callon can return capital to shareholders in 2023 since its next note maturity would then be in 2028.

Notes On Valuation

With Callon potentially generating around $2 billion in positive cash flow in 2022 and 2023 combined (at current strip), I estimate that it would then be worth approximately $77 per share in a scenario where long-term WTI oil prices then averaged $70 after 2023.

Callon’s leverage could be reduced to under 0.4x by the end of 2023 at current strip, leaving it in good shape with regards to its debt.

Conclusion

Callon is pushing out its note maturities and has a clear path to addressing its 2024 and 2025 note maturities this year and its 2026 note maturity in 2023. At current strip prices, it could end 2023 with leverage of 0.4x and no note maturities until 2028.

Callon does need oil prices to stay high in 2022 and 2023 so that it can generate the cash flow it needs to pay down its credit facility debt and call its notes. If that happens, then Callon could be worth $77 per share even in a scenario where oil prices averaged $70 after 2023.

Be the first to comment