Spencer Platt

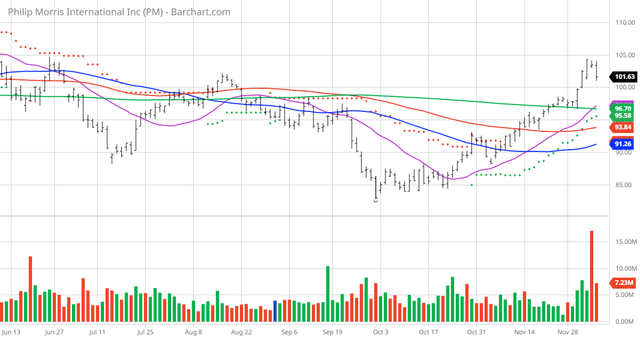

The Chart of the Day belongs to the tobacco company Philip Morris (PM). I found the stock by sorting the S&P 100 Index stocks first by the most frequent number of new highs in the last month and having a Trend Spotter buy signal, then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Seeker first signaled a buy on 11/8, the stock gained 9.87%.

Philip Morris International Inc. operates as a tobacco company working to deliver a smoke-free future and evolving portfolio for the long term to include products outside of the tobacco and nicotine sector. The company’s product portfolio primarily consists of cigarettes and smoke-free products, including heat-not-burn, vapor, and oral nicotine products that are sold in markets outside the United States. The company offers its smoke-free products under the HEETS, HEETS Creations, HEETS Dimensions, HEETS Marlboro, HEETS FROM MARLBORO, Marlboro Dimensions, Marlboro HeatSticks, Parliament HeatSticks, and TEREA brands, as well as the KT&G-licensed brands, Fiit, and Miix. It also sells its products under the Marlboro, Parliament, Bond Street, Chesterfield, L&M, Lark, and Philip Morris brands. In addition, the company owns various cigarette brands, such as Dji Sam Soe, Sampoerna A, and Sampoerna U in Indonesia; and Fortune and Jackpot in the Philippines. The company sells its smoke-free products in 71 markets. Philip Morris International Inc. was incorporated in 1987 and is headquartered in New York, New York. (Yahoo Finance)

Barchart’s Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart Technical Indicators:

- 40% technical buy signals

- 12.18+Weighted Alpha

- 11.20% gain in the last year

- Trend Seeker buy signal

- Above its 20-, 50- and 100-day moving averages

- 14 new highs and up 12.95% in the last month

- Relative Strength Index 67.30%

- Recently traded at $101.63 with 50-day moving average of $91.26

Fundamental Factors:

- Market Cap $160 billion

- P/E 17.62

- Dividend yield 4.91%

- Revenue expected to decrease by 2.20% this year but be up another 2.00% next year

- Earnings estimated to increase 4.50% this year. an additional 2.82% next year and continue to compound again at an annual rate 4.97% for the next 5 years

Analysts and Investor Sentiment — I don’t buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it’s hard to make money swimming against the tide:

- Wall Street analysts have 7 strong buy, 3 buy, and 8 hold opinions in place on this stock

- Analysts have price targets from $86.00 to $127.00 with an average of $102.64

- The individual investors following the stock on Motley Fool voted 2,775 to 83 for the stock to beat the market with more experienced investors voting 546 to 12 for the same result

- 122,500 investors are monitoring this stock on Seeking Alpha

Ratings Summary

Factor Grades

Quant Ranking

Sector – Consumer Staples

Industry – Tobacco

Ranked Overall – 1425 out of 4754

Ranked in Sector – 69 out of 193

Ranked in Industry – 5 out of 9

Quant Ratings Beat The Market »

Dividend Grades

Be the first to comment