Tim Boyle

Few brands in the golf industry have the same prestige as Callaway Golf (NYSE:ELY). In recent years, the company has made some rather interesting moves aimed at achieving rapid growth on both its top and bottom lines. So far, those efforts have proven beneficial for shareholders from a fundamental perspective. But over the past year, shares of the company have suffered, even compared to the pain experienced by the broader market. After seeing its share price plummet, shares of the business do look to be trading at levels that are cheap on an absolute basis and, if management does achieve their targets, upside for investors could be tremendous. Due to these factors and in spite of recent market turbulence, I have decided to retain my ‘strong buy’ rating on the company for now.

A fundamental disconnect

Back in July of 2021, I wrote a bullish article about Callaway Golf. In it, I said that if management could achieve the kind of growth they were forecasting, that shares would ultimately look cheap in retrospect. This followed the company’s decision to acquire Topgolf in what ultimately proved to be a transformative transaction. This maneuver merged the rapidly growing Topgolf franchise with the more traditional brands under the Callaway Golf name. Because of how shares were priced at that time and because of management guidance for the next few years, I ultimately rated the business a ‘strong buy’, reflecting my belief that the firm should significantly outperform the broader market for the foreseeable future. Since then, things have not gone exactly as I had planned. While the S&P 500 is down by 11.2%, shares of Callaway Golf have generated a loss for investors of 34%.

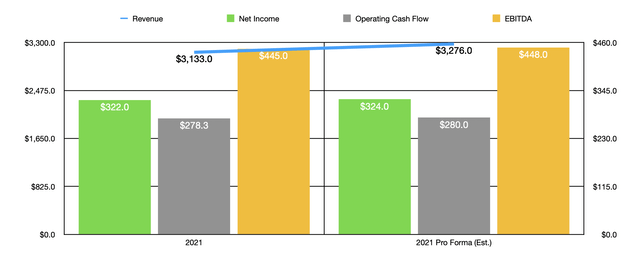

Given this performance, you might think that the company had suffered a great deal from a fundamental perspective. But that couldn’t be further from the truth. Consider how the company performed in the 2021 fiscal year. Revenue came in at $3.13 billion. That’s nearly double the $1.59 billion generated in 2020, with the substantial majority of that growth attributable to its acquisition of Topgolf. Had the company owned Topgolf for the entirety of its 2021 fiscal year, performance would have been even better, with revenue totaling $3.28 billion.

Strong performance was not limited to just the company’s top line. Net income of $322 million was far stronger than the $127 million loss generated in 2020. Cash flow also improved, jumping from $228 million in 2020 to $278 million last year. Another metric that fared well was EBITDA. It ultimately came in at $445 million for the year. That compares favorably to the $165 million the company generated in 2020. On a pro forma basis, we do know that EBITDA would have been $448 million for 2021. If we assume the same improvement there would apply for other profitability metrics, then net income would have been $324 million, while operating cash flow would have been $280 million.

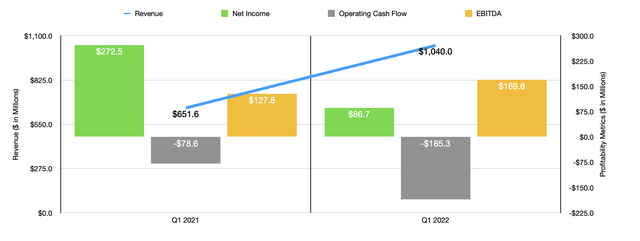

Fortunately for investors, the company continues to generate strong performance this year. Revenue in the first quarter came in at $1.04 billion. That’s 59.6% higher than the $651.6 million reported the same quarter one year earlier. Even if we assumed that the Topgolf acquisition had been completed at the start of 2021, sales then would have only been $794.6 million, indicating a year over year increase of 30.9%. The company also benefited from strong organic growth, with its Golf Equipment segment experiencing revenue expansion of 25.1% and its Apparel, Gear, and Other segment seeing revenue rise by 34.6%. Clearly, as the COVID-19 pandemic started to ease up, demand for golf products rose materially.

Profitability, meanwhile, has been somewhat mixed. Net income in the latest quarter was just $86.7 million. That’s down from the $272.5 million reported one year earlier. Operating cash flow dropped from negative $78.6 million to negative $185.3 million. But EBITDA improved from $127.8 million to $169.8 million. This picture does change a little bit if we rely on pro forma adjustments. Net income in the first quarter of 2021 actually would have been lower at $22.5 million, indicating a strong year-over-year improvement for the company in 2022. And estimates for EBITDA and operating cash flow would have been $130.1 million and negative $76.3 million, respectively. Despite these mixed figures, management did recently announce a $100 million share buyback program.

Despite these somewhat mixed results, management has high hopes for the company’s 2022 fiscal year. When they reported results for the first quarter of the year, they increased guidance across the board. Revenue should now be between $3.935 billion and $3.97 billion. That compares to the prior expected range of $3.78 billion to $3.82 billion. At the midpoint, it would also translate to an increase over the company’s pro forma results for 2021 of 20.7%. Meanwhile, EBITDA should come in at between $535 million and $555 million. That stacks up against the prior expected range of between $490 million and $515 million. At the midpoint, this would represent a year-over-year improvement of 21.7%.

This is not a one-time expectation for the company either. Between 2021 and 2025, the company expects to see revenue rise by between 10% and 12% per year. This should be driven by revenue growth of at least 18% per year associated with Topgolf, combined with growth associated with the company’s other properties at a rate in the high single digits. Meanwhile, EBITDA should grow at a rate of between 15% and 18% per annum. That would be driven by a 25% annual increase associated with Topgolf and a 10% annual increase associated with the company’s other assets.

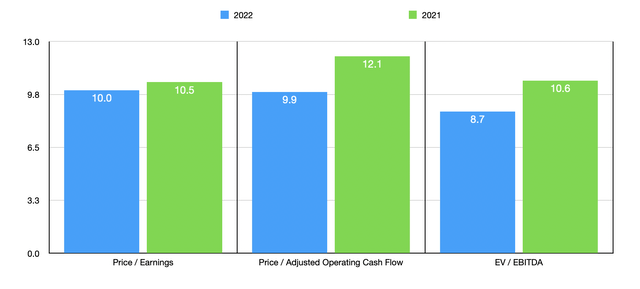

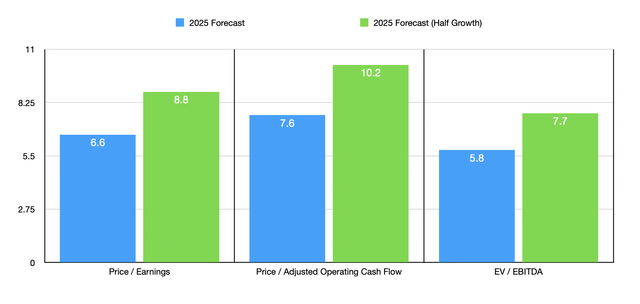

Even if we ignore the prospect of future growth, shares of the business look quite cheap right now. Using our 2021 results, the firm is trading at a price-to-earnings multiple of 10.5. The price to operating cash flow multiple should be 12.1, while the EV to EBITDA multiple should come in at 10.6. For the 2022 fiscal year, management has not provided guidance when it comes to net income or operating cash flow. But if we assume that those will increase at the same rate that EBITDA should, we can anticipate readings of $394 million and $341 million, respectively. This would result in a price-to-earnings multiple of 10, a price to operating cash flow multiple of 9.9, and an EV to EBITDA multiple of 8.7. This is already cheap, but the picture could look far better in a couple of years. If management hits their targets, the company should be trading, in 2025, at a price-to-earnings multiple of 6.6. The price to operating cash flow multiple would be 7.6. And the EV to EBITDA multiple should be 5.8. Even if the company hits half of this growth rate, these multiples would be 8.8, 10.2, and 7.7, respectively. Assuming the company does hit its targets, and assuming that price to earnings and price to operating cash flow multiples for the company, at fair value, should be 13, upside for investors would be between 70.6% and 97.4% over the next few years. But I would make the case that multiple far higher than that, for a quality industry leader with attractive growth, would be warranted.

Takeaway

Right now, the market seems to not be a fan of Callaway Golf. Unfortunately, part of investing involves being wrong for a period of time. But at the end of the day, it’s important to focus on fundamentals over price. And the data shown so far and management’s own guidance for the near future suggest that shares have significant upside potential. Because of this, I have decided to retain my ‘strong buy’ rating on the company for now.

Be the first to comment