Denis Doyle/Getty Images News

Cadre Holdings, Inc. (NYSE:CDRE) will likely benefit from the fact that many NATO members decided to increase their defense expenditures. Management also announced an incoming generation of holsters and new high-margin e-commerce and direct-to-consumer capabilities. Yes, a significant number of risks come from regulatory policies or failure in the negotiation of new contracts. However, I believe that there is still upside potential in CDRE’s price mark.

Cadre

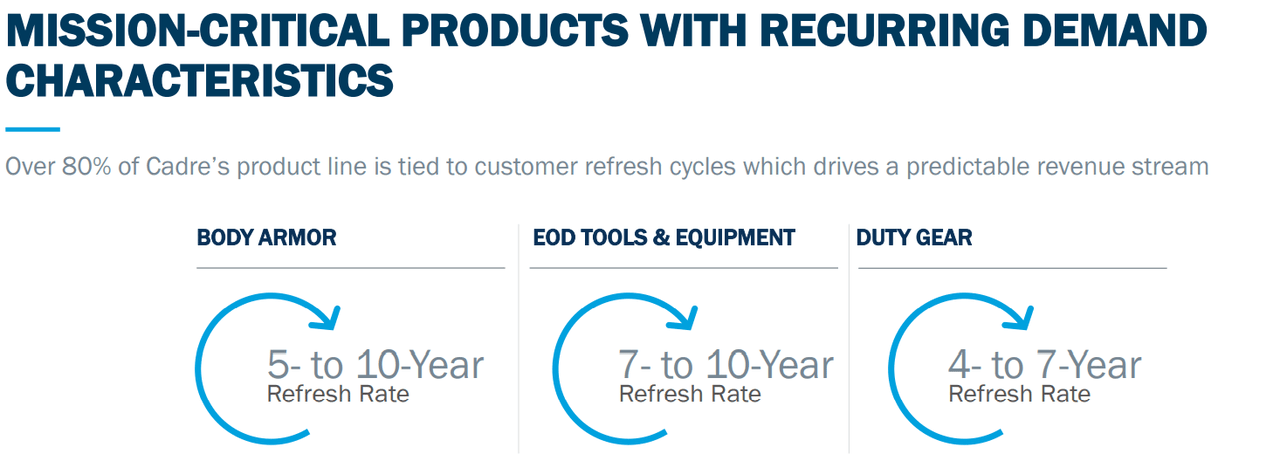

Cadre manufactures and distributes safety and survivability equipment. Cadre’s equipment offers critical protection in life-threatening situations. In my view, the most interesting thing about the company’s business model is its clients. Cadre works with large governmental agencies from the United States and elsewhere. We are talking about large budgets, recurrent revenue, and good visibility about future free cash flow.

CDRE Investor Presentation

Federal agencies including the U.S. Department of State, U.S. Department of Defense, U.S. Department of Interior, U.S. Department of Justice, U.S. Department of Homeland Security, U.S. Department of Corrections and numerous foreign government agencies. We have a large and diverse customer base, with no individual customer representing more than 10% of our total revenue. Source: 10-K

CDRE Investor Presentation

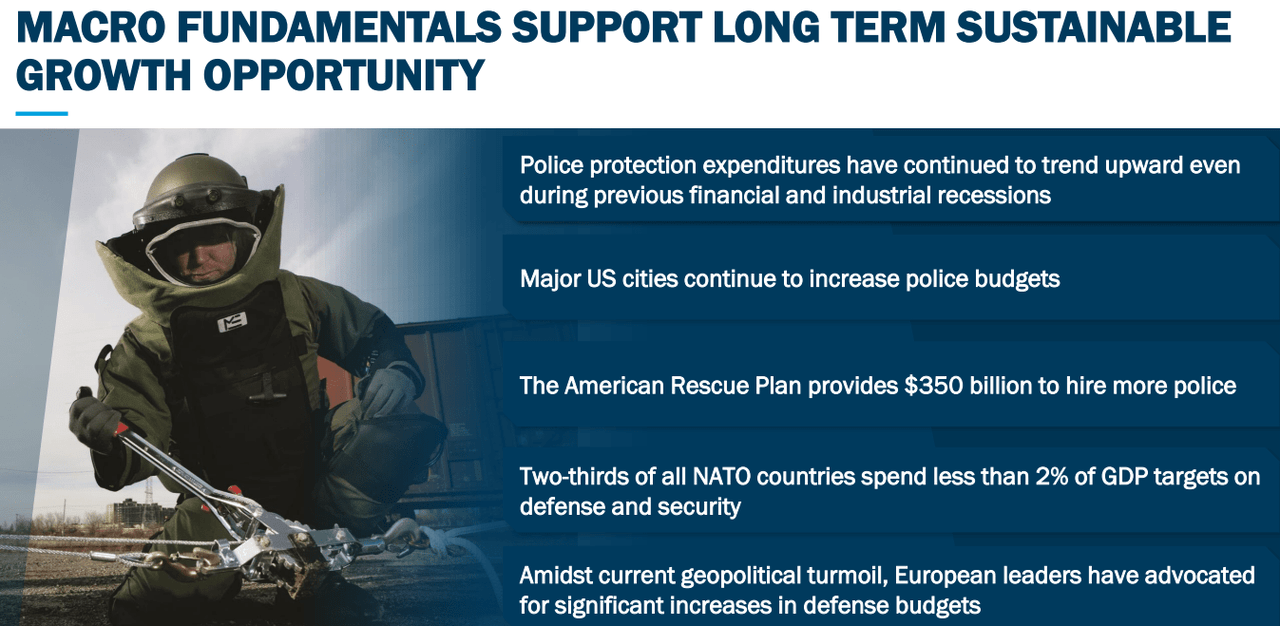

With that about Cadre’s clients, there are several macro factors, which may represent catalysts for the stock price. Two-third of all NATO members are expected to spend close to 2% of GDP, which will likely enhance Cadre’s sales growth. Besides, the American Rescue Plan expects to include $350 billion to hire more police.

CDRE Investor Presentation

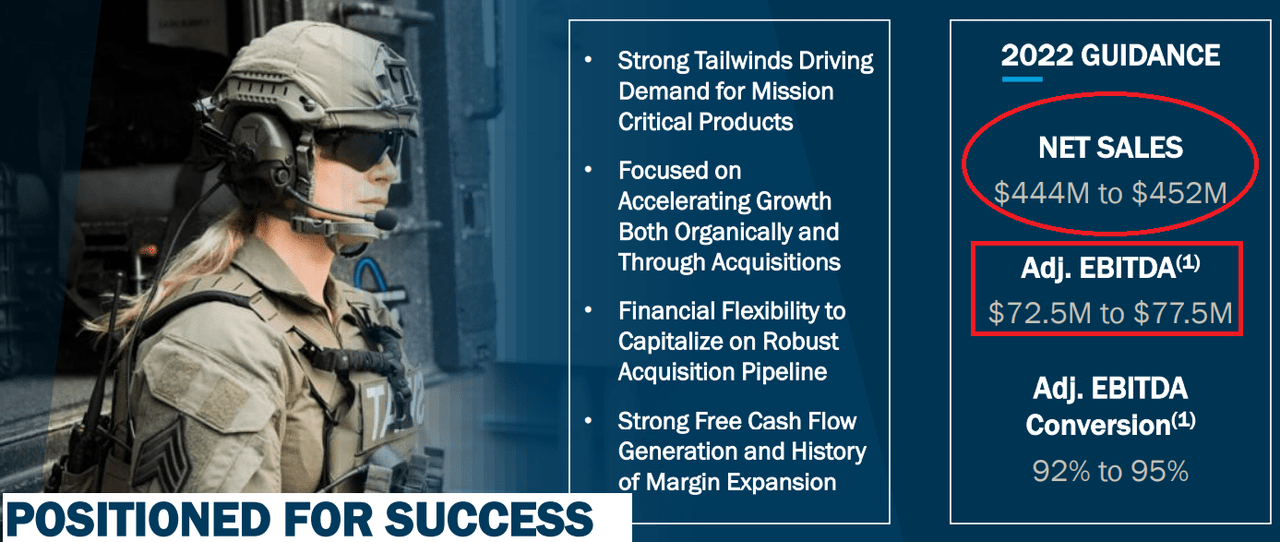

Finally, I believe that most investors would feel interested about the new guidance given for the year 2022. Management expects total sales of close to $444 million, adjusted EBITDA around $72 million, free cash flow generation, and margin expansion.

CDRE Investor Presentation

Base Case Scenario

Cadre expects to make new product launches, new agreements, and may soon announce new high-margin e-commerce and direct-to-consumer capabilities. Besides, I believe that the recent 3D body sizing solutions and the next generation of holsters that were recently announced could accelerate sales growth.

Besides, I also believe that the company’s international expansion will likely bring more revenue growth opportunities. With presence in more target markets, the likelihood of finding more clients increases. Management has discussed these risks in the annual report:

We are also committed to increasing our market share internationally. Given our leading domestic market position and our products’ high-quality standards and performance, we believe we are well positioned to take advantage of the growth in international demand. Source: 10-K

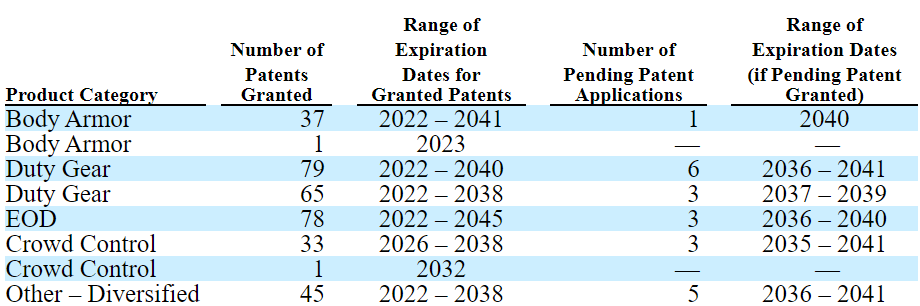

Finally, Cadre owns a significant number of patents with expirations ranging from 2032 to 2041. In my view, CDRE will be able to use these patents to generate revenue for some years until expiration.

10-k

Considering that the global defense market is expected to grow at a CAGR of 6.8%, CDRE will likely grow at the same pace under good conditions:

The global defense market size is expected to grow from $452.69 billion in 2021 to $483.47 billion in 2022 at a compound annual growth rate (OTC:CAGR) of 6.8%. Source: Defense Market Analysis, Size And Trends Global Forecast To 2022-2030

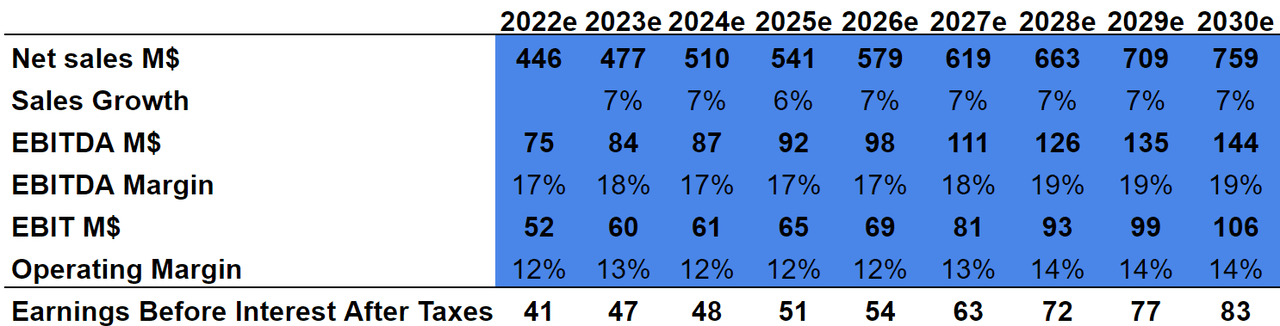

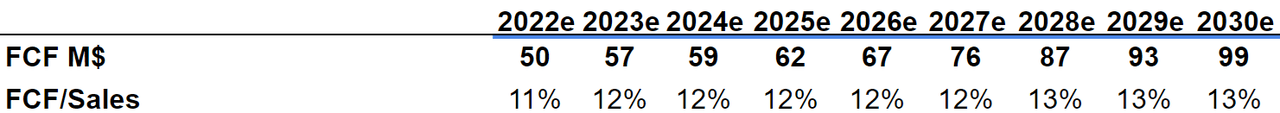

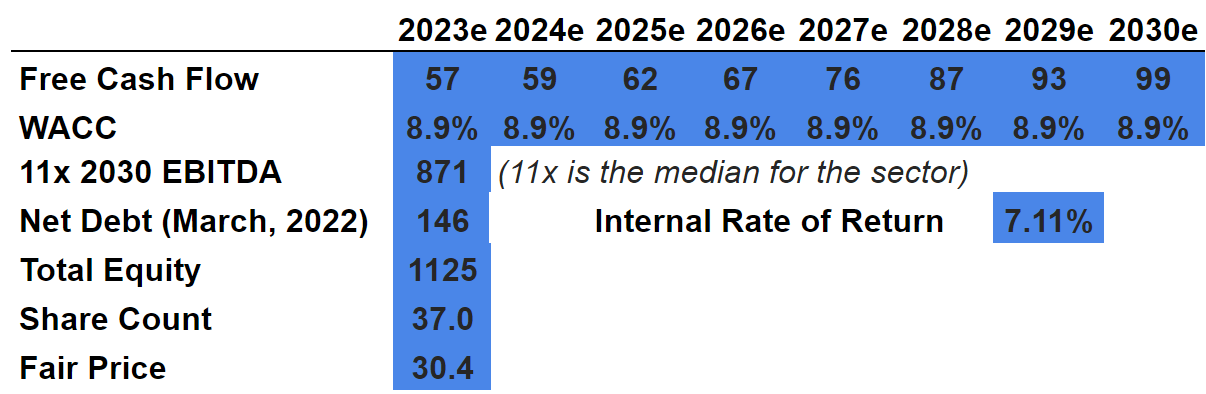

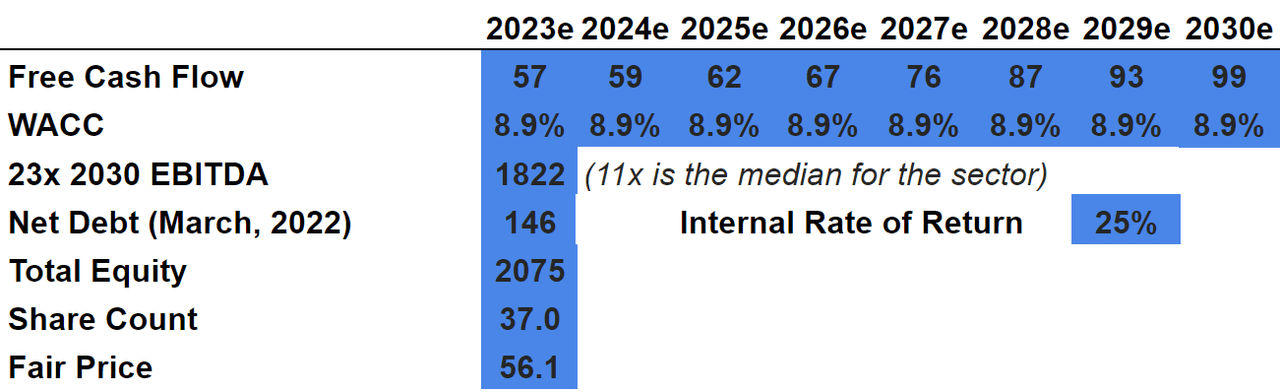

With sales growth of 6.8%-7%, EBITDA margin of 17%-19%, and operating margin around 12%-14%, 2030 EBIAT would stand at $83 million. I believe that my figures are quite reasonable in this case.

Hohaf

Considering a conservative amount of working capital and D&A, and subtracting capital expenditures, I obtained 2030 free cash flow of $99 million.

Hohaf

Like other analysts out there, my CAPM model includes a weighted average cost of capital of 8.9%. I also executed cases with an exit multiple of 11x EBITDA and 23x EBITDA. Under both cases, the fair price would stand somewhere between $30 and $55 per share. With a DCF model from 2023 to 2030, the internal return would stay close to 7% and 25%.

Hohaf Hohaf

Worst Case Scenario

The company operates in an industry in which personal injury occurs often. If management suffers lawsuits, the company may see its EBITDA growth diminished, and FCF expectations could decline. Besides, CDRE could also suffer reputational damage, which may lead to value destruction. Management offered an explanation about these risks in the annual report.

The products that we manufacture are typically used in applications and situations that involve high levels of risk of personal injury. Failure to use our products for their intended purposes, failure to use or care for them properly, or their malfunction, or, in some limited circumstances, even correct use of our products, could result in serious bodily injury or death. Given this potential risk of injury, proper maintenance of our products is critical. Our products include: body armor and plates designed to protect against ballistic and sharp instrument penetration; explosive ordnance disposal products; police duty gear; and crowd control products. Source: 10-K

CDRE’s financials could be affected by changes in the regulations issued by the U.S. Bureau of Alcohol, Tobacco and Firearms, or the U.S. Department of Transportation. If the company does not receive approvals from governments and agencies, revenue would decline significantly.

The U.S. Bureau of Alcohol, Tobacco and Firearms also regulates our manufacturing and distribution of certain destructive devices, firearms, and explosives. We also ship hazardous goods, and in doing so, must comply with the regulations of the U.S. Department of Transportation for packaging and labeling. We are also required to comply with the Controlled Goods Directorate Registration regime in Canada for explosive ordnance disposal products. Additionally, the failure to obtain applicable governmental approval and clearances could materially adversely affect our ability to continue to service the government contracts we maintain. Source: 10-K

Under this case scenario, I assumed that domestic and foreign government agencies may lower their budgets. As a result, CDRE could see a decrease in its sales expectations, which may have an impact on future sales growth. Management discussed these risks in the last annual report:

Customers for our products include domestic and international first responders such as state and local law enforcement, fire and rescue, explosive ordnance disposal technicians, and emergency medical technicians. Many domestic and foreign government agencies have in the past experienced budget deficits that have led to decreased spending in defense, law enforcement and other military and security areas. Source: 10-K

It is somewhat likely that CDRE suffers from a shortage of raw materials. Keep in mind that the company faced shortages in the past. It is also relevant noting that certain orders have priority over others, which may damage future free cash flow growth. Shortages and production issues may diminish future financials, and may lower the company’s implied valuation.

The supply of the materials and components that we use to manufacture our products may be constrained by a number of factors, including a supplier’s need to prioritize the manufacture of rated orders issued under the Defense Production Act of 1950. We cannot predict when the United States government will invoke the DPA, and in the past we have faced shortages from our sources of materials and components when the DPA has been invoked, including shortages in the raw materials and components that we use in manufacturing ballistic resistant garments. Source: 10-K

Finally, if CDRE fails to predict the costs involved in certain fixed-price contracts, they may not be as profitable as expected. I would expect a decline in free cash flow, which may diminish CDRE’s implied valuation. Let’s note that more than 10% of the total amount of 2021 net sales were represented by fixed-price contracts:

As it relates to our Products segment, fixed-price contracts represented less than 10% of annual net sales in 2021. For our Distribution segment, we estimate that fixed-price contracts represented approximately 55% of annual net sales in 2021.

Typically, we assume more risk with fixed-price contracts since we are subject to rising labor costs and commodity price risk. Fixed-price contracts require us to price our contracts by forecasting our expenditures. When making proposals for fixed-price contracts, we rely on our estimates of costs and timing for completing these projects. Source: 10-K

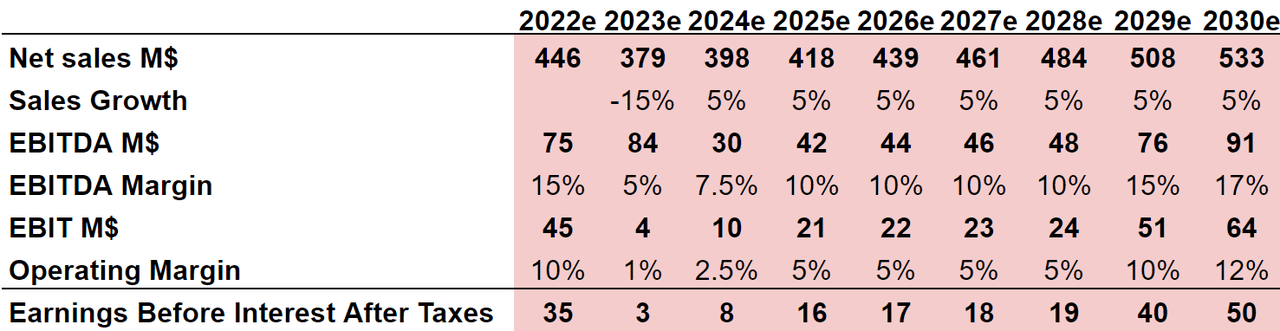

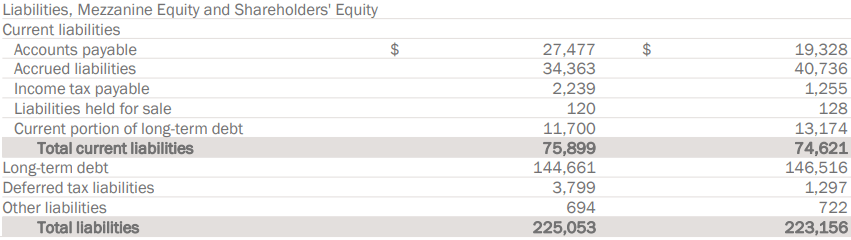

In my bearish case scenario, I used sales growth of -15% in 2023 and around 5% from 2024 to 2030. I also included an EBITDA margin between 5% and 17.5%, which implied 2030 EBITDA of $50 million.

Hohaf

Under the previous conditions of sales growth and EBITDA margin, in my view, the weighted average cost of capital may be a bit higher than that in the base case scenario. I used a cost of capital around 10% and 9%, which implied an equity valuation close to $560 million and an IRR around -4%.

Hohaf

Balance Sheet

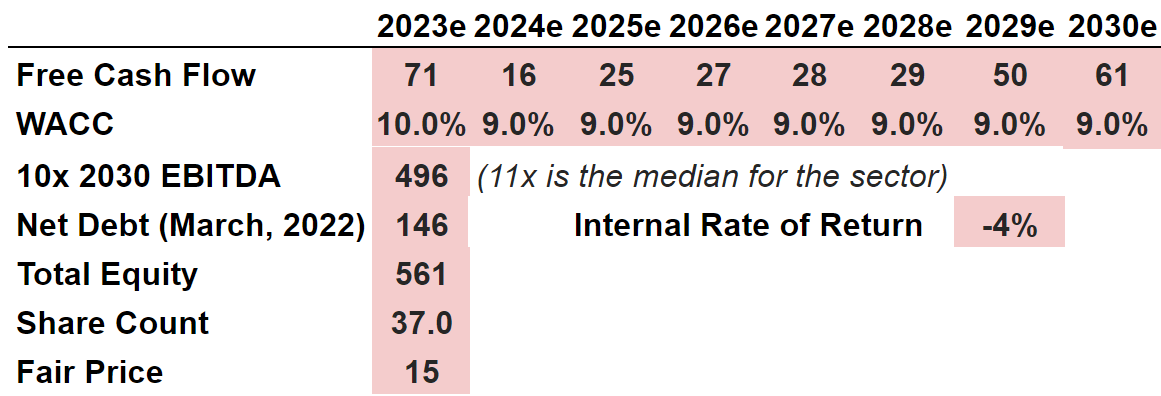

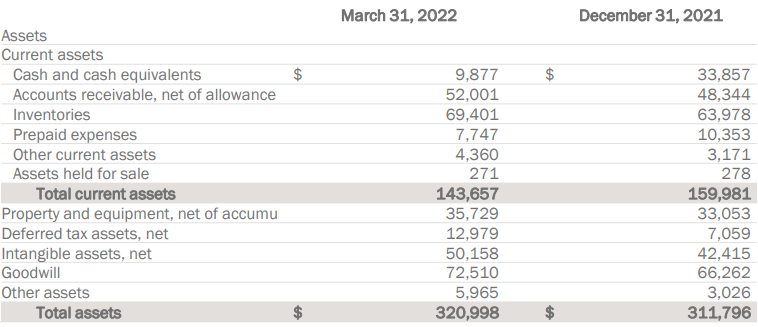

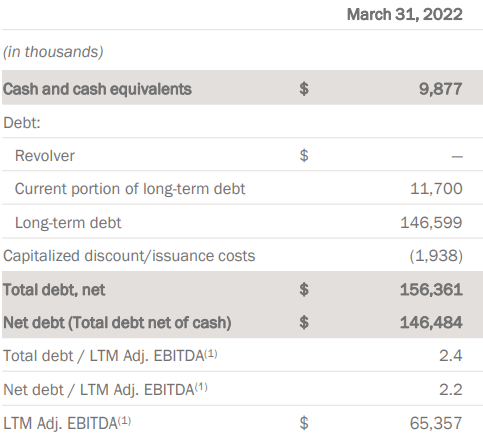

As of March 31, 2022, Cadre reports $9.8 million in cash, total assets worth $320 million, and liabilities worth $225 million. I believe that the company’s balance sheet appears stable.

CDRE Investor Presentation

With long-term debt worth $144 million and short term debt worth $11.7 million, the net debt/adjusted EBITDA stands at 2.2x, which is not worrying. With that, I wouldn’t expect large acquisitions because bankers may not accept increasing the leverage even further.

CDRE Investor Presentation CDRE Investor Presentation

Conclusion

With many OTAN members increasing their defense budgets and the United States increasing police expenditures, Cadre’s sales growth may increase. Besides, if management delivers new products, and agreements as promised, revenue growth will likely increase. I see a significant number of risks related to public regulations, shortage of raw materials, and forecasting failure. With that, I think that the upside potential in the stock price appears more significant than the downside risk.

Be the first to comment