Solskin/DigitalVision via Getty Images

Subscribers of Timing the Market received early access to this article.

Today, we want to look at a long position over Q4 earnings for Cabot (NYSE:CBT):

CBT is an underfollowed stock that specializes in profiting from the sale of specialty chemicals. The company benefits when the automotive industry is strong and when industrial companies are growing. Recently, the fear of a recession has pushed sentiment toward these two industries to the negative side, which has likewise pushed expectations for Cabot downward.

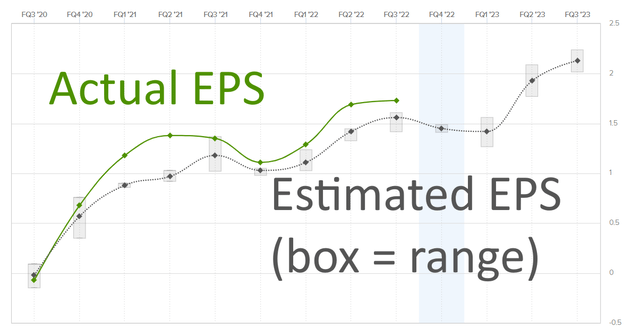

However, as we head into Q4 earnings, we have a strong opportunity to benefit from weak sentiment. Notably, CBT beats its EPS expectations consistently. And while Q4 estimates for EPS are set to a fall quarter-over-quarter, CBT doesn’t always publish negative growth from Q3 to Q4. Take a look at this trend:

Note that most of the time, Cabot not only beats the point EPS estimates but produces results outside of the range of estimates. That is, Cabot manages to surprise even the most optimistic analyst in most cases. This is a company that is constantly underestimated.

When we buy a stock prior to earnings, we are essentially saying that we think the gap between the market’s expectation and the “future reality” (i.e., the present reality revealed in the future, at earnings) is large enough to where we have an arbitrage opportunity should we buy the stock prior to the earnings report release. The EPS trends point to this opportunity. So does the valuation from a discounted cash flow analysis.

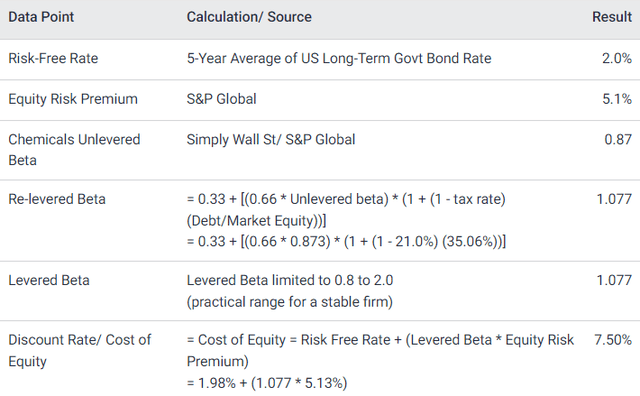

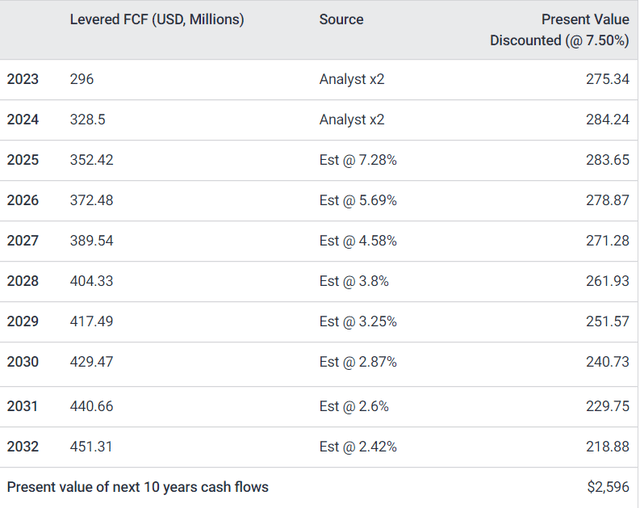

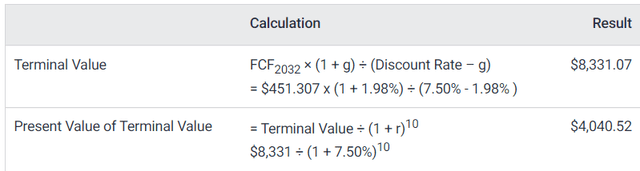

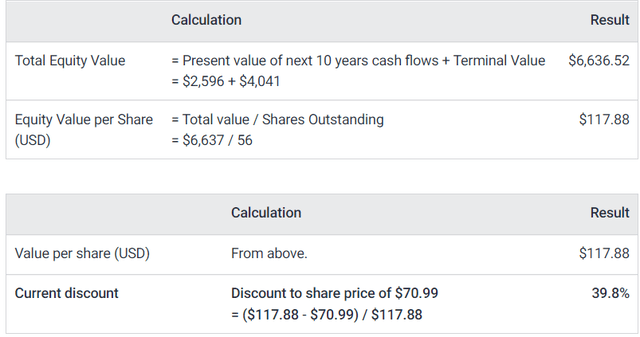

Assuming a discount rate of 7.5% (see below), the present value of the next 10 years of Cabot’s cash flow is $2.596B (also below).

We can then calculate the total equity value and divide it by the number of outstanding shares to arrive at a fair value for CBT at present, which is $117.88 per share, representing a 39.8% undervaluation.

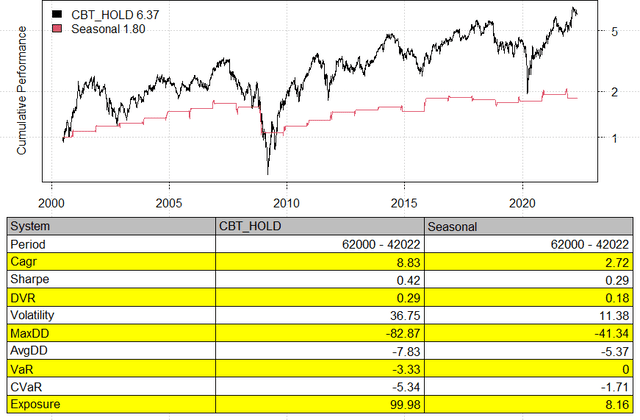

As for the performance of CBT over Q4 earnings, we have a statistically strong trade opportunity. CBT has risen 65% of the time over this time period. But more importantly, the rallies over Q4 earnings are two times the magnitude of the selloffs.

Hence, the backtest results of holding CBT over Q4 earnings show a significant alpha-seeking opportunity. The earnings-trade strategy (in red) accounts for nearly 1/5 of the total gains in CBT. That is, you can capture nearly 20% of CBT’s upside while holding for only one month out of the year – a clear advantage in terms of Mandelbrot’s market time.

In conclusion, from the analyses employing statistical, seasonal, financial, and sentiment data, a long position in CBT is warranted over the company’s Q4 earnings. While I would usually prefer a long call for such a play, so as to reduce downside risk, the bid-ask spread in options at the moment is prohibitively wide. Thus, I recommend just taking a long position in the stock.

Let me know if you have any questions.

Be the first to comment