Robert Way/iStock Editorial via Getty Images

Tesla (NASDAQ:TSLA) and BYD (OTCPK:BYDDF) (OTCPK:BYDDY) are both EV manufacturers that dominate their domestic markets. But beyond manufacturing EVs, BYD also supplies battery cells to customers, such as Tesla, for use in their own EVs. The chemistry that BYD specializes in is called lithium iron phosphate, or LFP for short, and it’s rapidly gaining in popularity. This article will examine the impact of LFP’s resurgence and why it looks to play into BYD’s growth and, perhaps, against Tesla’s.

Why LFP?

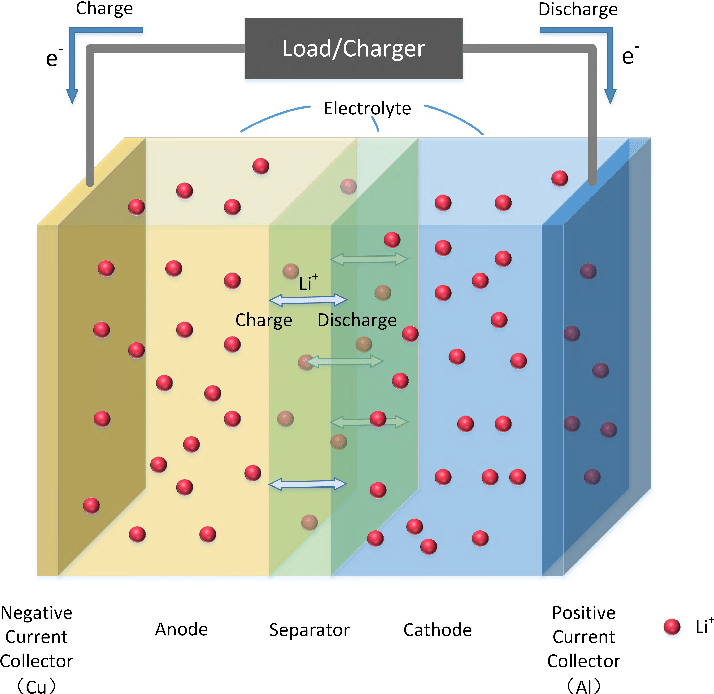

Before getting into why LFP is in the midst of a renaissance of sorts, it’s important for readers to have a basic understanding of battery chemistries. Let’s back up for a second and look at the three basic components of a battery. There’s the cathode, the anode, and the electrolyte. The cathode and the anode exist on two separate sides of the battery; lithium ions will transfer from the anode to the cathode during discharge and vice-versa during charging. The electrolyte is a semi-aqueous solution that facilitates the transfer of lithium ions between the anode and the cathode. There’s also a separator film that prevents the anode and cathode from touching and the battery short-circuiting.

ResearchGate

At the moment, battery anodes are all pretty much the same: graphite, a bit of silicon, and potentially some other additives. Electrolytes are also all pretty much the same. Cathodes are the source of battery discrepancy, with a number of different chemistries for manufacturers to choose from. As such batteries are often referred to by just the cathode chemistry, as it’s widely understood that the rest of the battery is fairly uniform.

For a while, NMC (nickel-manganese-cobalt) and NCA (nickel-cobalt-aluminum) were widely agreed upon as the best battery chemistries for EVs. Tesla stuck with NCA, while its competitors tended to favor NMC. There isn’t really a whole lot of difference between the performance of the two cathodes at this point, Tesla just found it easier to unlock greater energy density (a measure of storage capacity per unit of mass) early on with NCA cathodes.

The development of NMC 622 and 811 (a reference to the ratio of nickel to manganese to cobalt) was really the great equalizer in cathode performance between Tesla’s NCA and the rest of the market’s NMC, not reaching broad commercialization until about one and a half to two years ago. However, all of this was the Western way of thinking. Over in China, companies hadn’t stopped using the LFP cathode.

For those of us watching the market, it wasn’t all too surprising to see the West start to adopt LFP cathodes. While it can’t offer the same energy density as NMC or NCA chemistries, LFP is able to offer a much lower cost per kWh (unit of energy storage capacity). CATL, the world’s largest battery manufacturer, cites a cost-benefit of 43% per kWh for LFP cathodes versus their NMC 811 cathodes. For city cars, or entry-level EVs, this lower cost makes the chemistry the ideal fit.

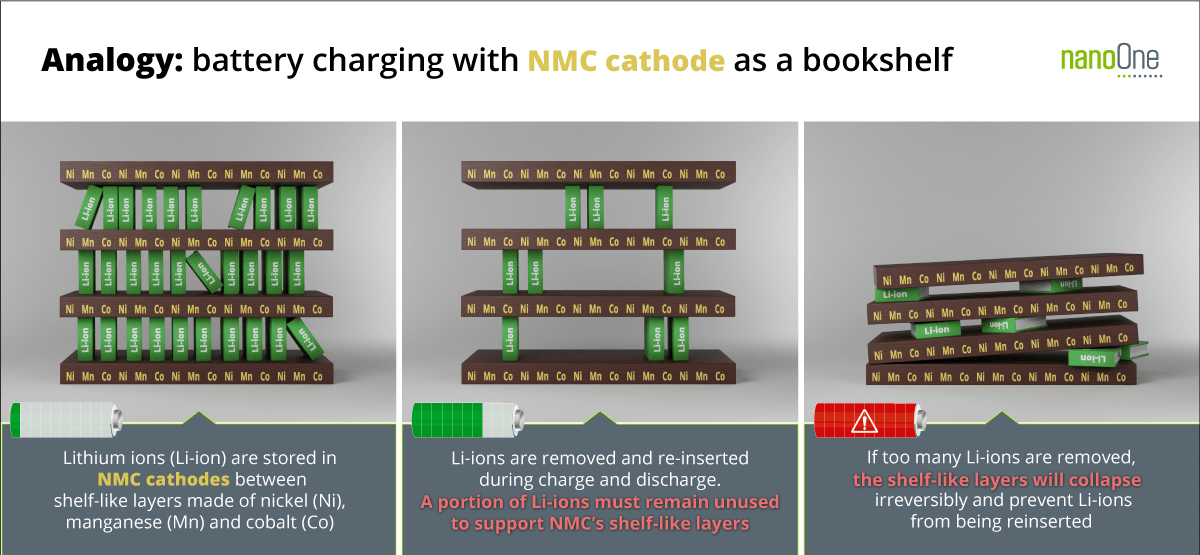

The other thing to consider, regarding LFP, is that it offers greater structural stability than NMC or NCA cathodes. This means that while, on paper, the gap in energy density between high-nickel and LFP cathodes is fairly significant, and it is, real-world applications bridge this gap a bit. Take the following as an example.

Tesla’s batteries have an estimated energy density of 260 Wh/kg, while Gotion just started commercial production of LFP cells with an energy density of 210 Wh/kg. Both are best-in-class and Gotion plans to have commercial LFP cells with an energy density of 230 Wh/kg by the end of the year. Say that the NCA cell’s capacity has to be artificially limited by 20%, whereas the LFP battery is maybe only limited by 10%. All of a sudden, 260 Wh/kg becomes 208 Wh/kg and 210 Wh/kg becomes 189 Wh/kg. Still a deficit, but certainly not as large. At 230 Wh/kg, usable capacity for LFP is 207 Wh/kg.

Nano One Nano One

Now, when really needed, the high-nickel cells can be stressed to produce significantly more range than a similar LFP, but this comes at the price of longevity. So, in day-to-day use, it’s unlikely that customers will experience this significant performance gap. With its greater stability, LFP does also offer a lower chance of fire. Though, to me, it’s pretty clear that cost is the driving factor here and range comes a close second.

What Does BYD Stand To Gain?

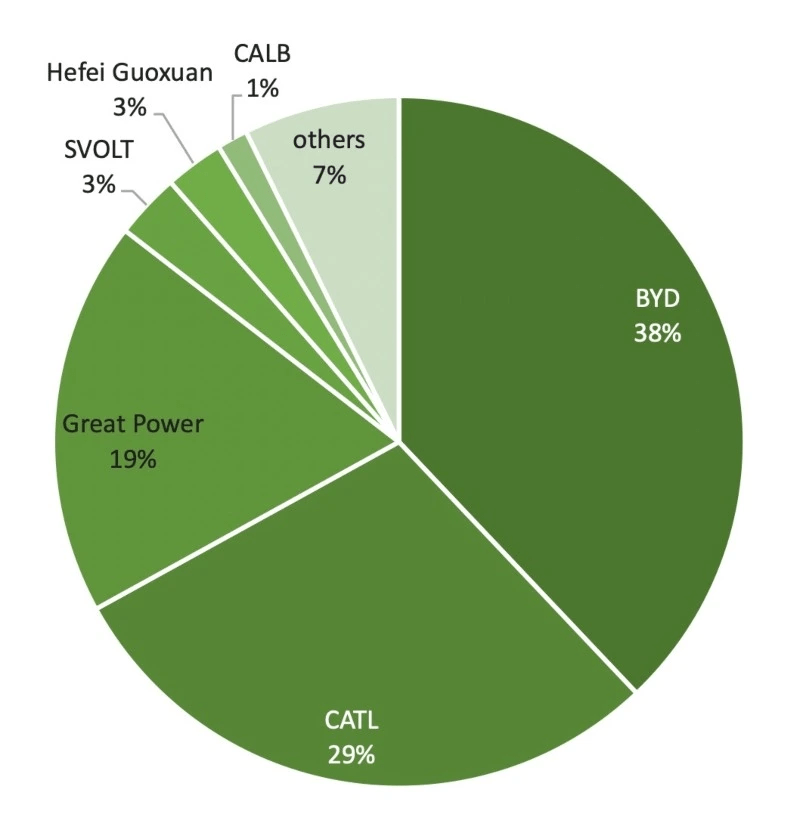

BYD is currently the world’s fourth-largest EV battery manufacturer, by volume, maintaining control of 8.8% of the market. But the company’s been growing faster than most of its rivals, increasing output from 65 GWh in 2020 to 91 GWh in 2021. This was largely due to the company’s ramping of its LFP production, which is now the only battery chemistry the company produces.

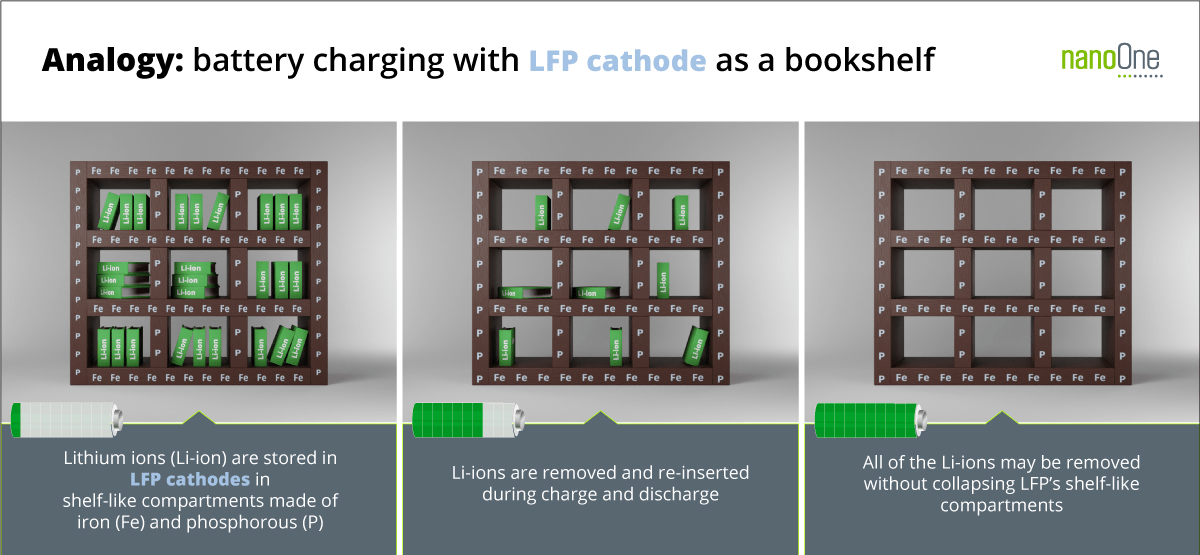

As of 2021, BYD dominated the LFP market. Responsible for 38% of the world’s LFP production, BYD even outpaces CATL, which holds 32.6% of the world’s overall EV battery market. This domination of the LFP market will prove incredibly profitable for BYD as the global demand for LFP batteries continues to expand.

Global LFP Market Share (EE Times)

In the beginning of 2020, LFP cells accounted for less than 1% of the global EV battery demand. Now, LFP cells are projected to be in 21.5% of the EVs sold this year. That meteoric rise shouldn’t be all too surprising either, when half of Tesla’s vehicles are now being manufactured with LFP cells. And, by the way, Tesla will soon be a customer of BYD.

While BYD’s lead in the market isn’t guaranteed to last, its dedication to expanding production and improving its technology will continue to contribute to its lead. While the energy density of BYD’s cells is unknown, I’ve seen a number of estimates that it reaches about 166 Wh/kg at the pack level. For reference, Gotion’s 210 Wh/kg LFP cells reportedly have an energy density of about 180 Wh/kg at the pack level.

On paper, this difference may not sound great for BYD, but the company has been focusing more on limiting volumetric energy density over the past few years. The company estimates that its Blade Battery pack design improves its volumetric energy by 50% compared to conventional designs. This lower volumetric density allows for a more contained battery pack, which could enable longer-range EVs. This prioritization of packaging is likely what gained the company favor with Tesla.

As it currently stands, over 99% LFP cathodes are produced in China. This certainly plays towards BYD, which is able to leverage this to get more supply deals with overseas manufacturers. Investors could be concerned to see this advantage dissipate, as LFP becomes a more global chemistry, but they need not worry.

100% of iron phosphate production is currently done in China. With a high initial capital cost, and fairly low profit margins, it’s unlikely that we will see iron phosphate production anywhere else in the near future. This supply bottleneck has effectively guaranteed China maintains control of LFP production. So, sans efforts from a small cathode developer called Nano One (OTCPK:NNOMF), there isn’t much to enable a transition of LFP production outside of China.

As demand for LFP cells continues to grow, BYD has been aggressively investing in growing its supply. Since December, the company has announced plans for five new battery manufacturing facilities across China. The first of these is a planned facility in the Fuzhou Hi-Tech Industrial Development Zone with a nameplate capacity of 15 GWh, with the option to add another 15 GWh in a second phase of construction. A 45 GWh plant, of which BYD will own 51%, is currently under construction in Changchun. A 30 GWh facility is planned in Xiangyang, a 22 GWh facility in Taizhou, and a 45 GWh facility in Nanning.

A report in May estimated that BYD’s current plans would leave it with 250 GWh of production upon completion of all projects. Following the two announcements in April, this would have risen to 317 GWh. 65 GWh in 2020, to 317 GWh by the end of 2023. Of course, these facilities will take a few years to ramp to nameplate capacity, but the pace at which BYD is ramping production, to keep up with demand, is staggering. The company’s lead in LFP chemistry also looks to translate favorably to its EV production, where it now dominates the Chinese market.

What Does Tesla Stand To Lose?

In short, market share. A global shift towards LFP cathodes in mass-market EVs could prove rather damaging to Tesla’s brand. At the moment, Tesla has the best EVs on the market. There’s really no arguing that. But they don’t have the best cars on the market.

Tesla’s early arrival to EV development put them years ahead on cathode technology and powertrain development. That’s a lead that they still hold today, but it’s a lead that doesn’t extend into LFP-equipped vehicles. The company hasn’t put any development into LFP cells, meaning it will utilize the same commercially-available cells as everyone else.

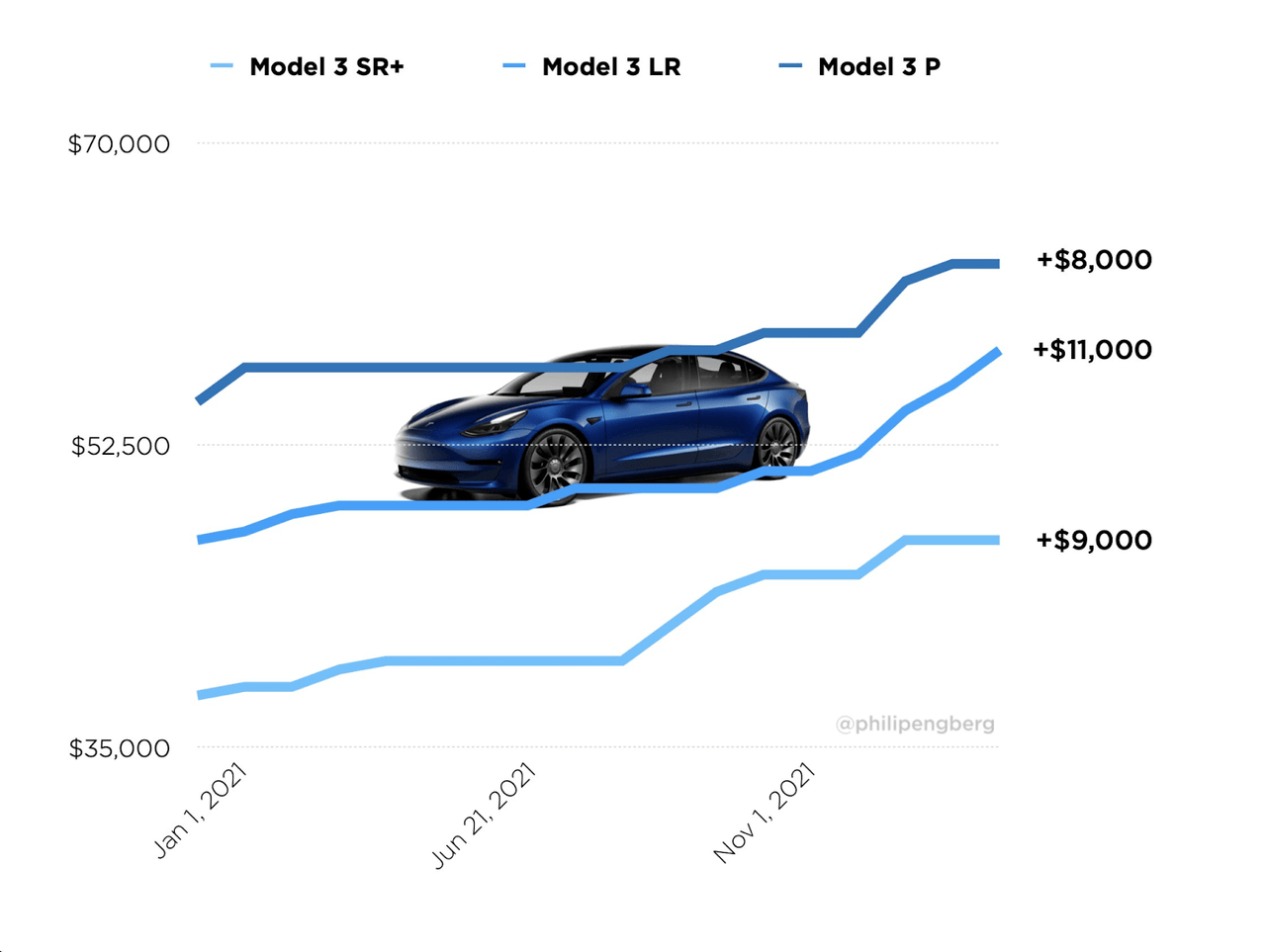

So, without the best powertrains on the market, let’s reexamine the Model 3’s competitive landscape. The first thing to consider is price and, while all cars have seen some significant price inflation over the past year, Tesla’s vehicles certainly haven’t been immune. The vehicle that was originally supposed to be a $35,000 car, now starts at $46,990.

Philip Engberg via Twitter

The 24% price hike of the Standard Range Plus since last January is quite extreme, putting it a few thousand dollars above a new Mercedes C-Class. But the C-Class isn’t shipped to customers with a list of quality issues and, objectively, has a higher-quality interior. I know, this is an old argument. But, as the car now ships with LFP cells, it can no longer hide behind its top powertrain performance.

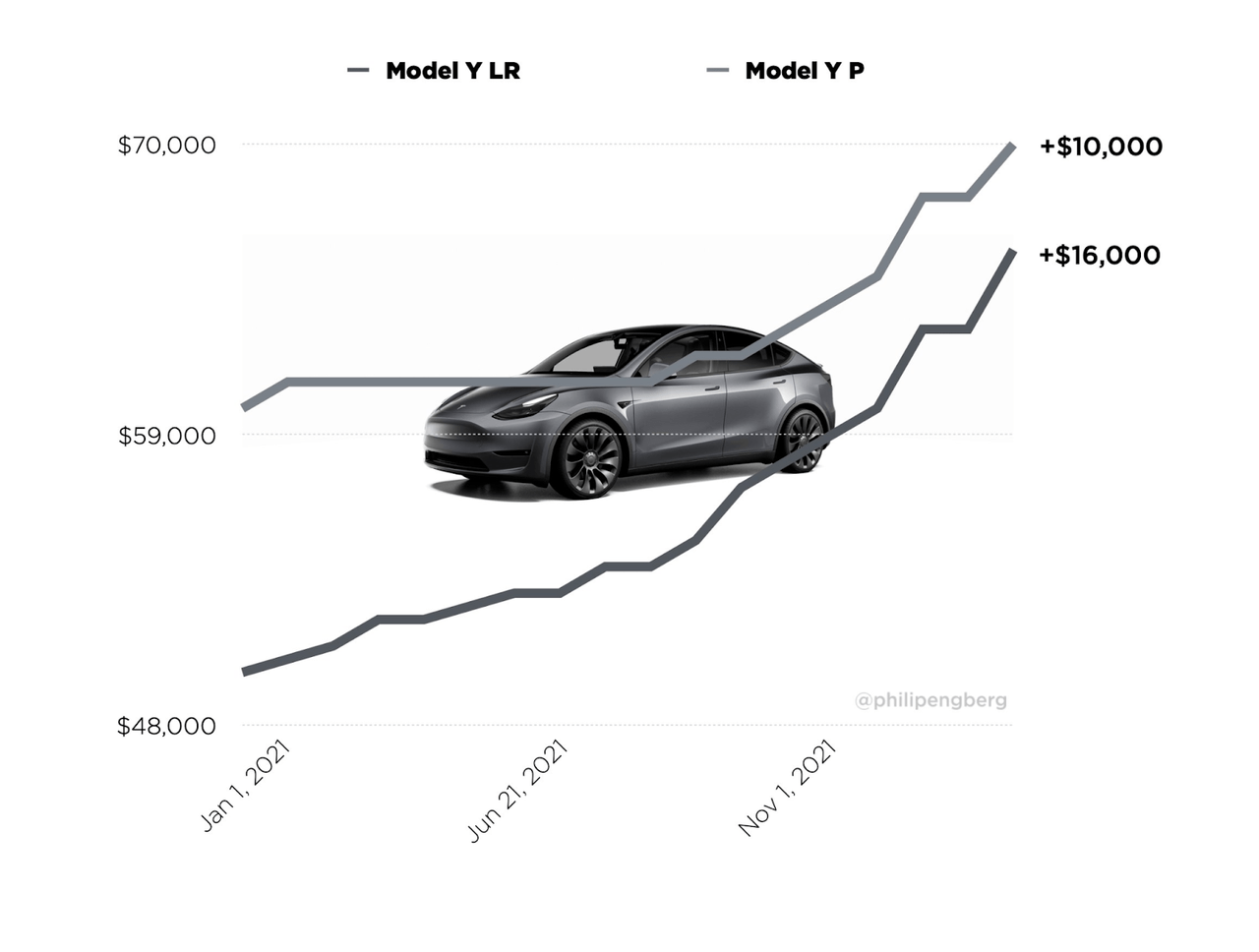

Instead, the vehicle is capable of traveling only 272 miles on a single charge. That’s just 13 miles more than Chevy’s new Bolt, which starts at just $26,595. But the point of this article isn’t to hammer you all with vehicle comparisons, you get the idea. Competition is finally here. With new EV models cropping up practically every week, Tesla is no longer the dominant player it once was. And, with the inevitable introduction of an LFP-equipped Model Y, Tesla may begin to struggle to justify its skyrocketing price more than it already is.

Philip Engberg via Twitter

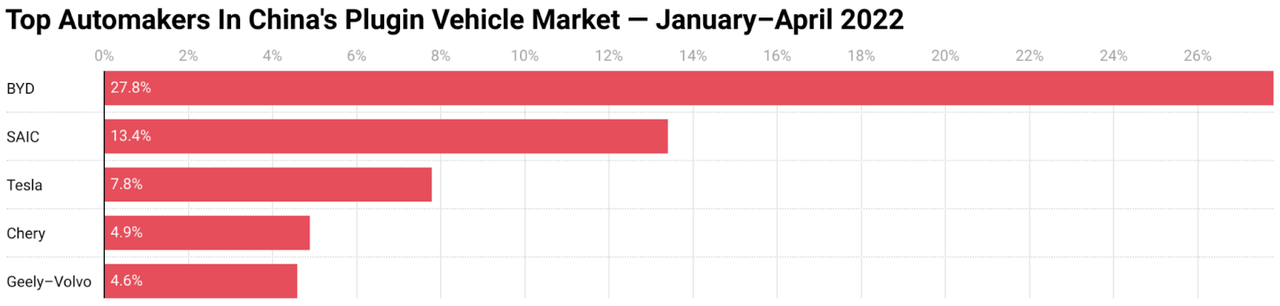

For those of you who may be skeptical, look no further than China. Where LFP dominates mass-market EVs, even more so this year, Tesla isn’t even close to being the top automaker. Take a look at the figure below.

CleanTechnica

While Tesla held the #2 spot in China’s EV market last year, it has consistently come in the third spot this year as monthly sales data is reported. BYD has also logged some incredible sales growth, boosted by the rising demand for cheaper EVs. Because China is a more mature EV market, effectively offering a window into what global EV markets may look like in the next few years, I include this to support the notion that Tesla’s market dominance will falter following a shift to LFP and greater competition.

Now, for some, the Supercharger network is reason enough to buy a Tesla. Even if its powertrain is no longer best-in-class, the most developed network of charging stations more than makes up for that. But that’s not an advantage that will remain exclusive to Tesla owners.

Already, Tesla has opened its Supercharger network to vehicles from other brands in 13 European countries. In the United States, Tesla plans to forfeit the network’s exclusivity in favor of receiving some of the $5 billion in federal funding going towards building out a national EV charging network. So, I don’t deny the incredible advantage the Supercharger network brings, but it is an advantage that will be coming to an end.

Comparison

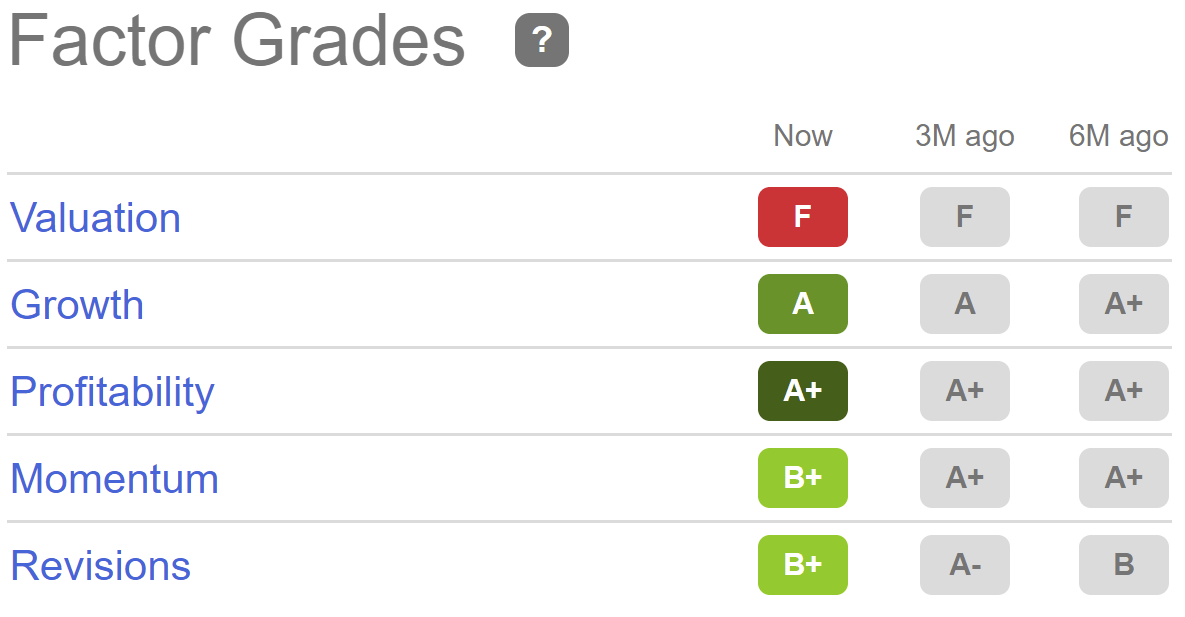

Despite falling almost 40% so far this year, Tesla remains dramatically overvalued. The company’s current value is incredibly dependent upon growth, which is why anything that could stunt that growth should be taken quite seriously. When we consider that the company is currently struggling to ramp its new manufacturing facilities in Germany and Texas, investors should expect disappointing earnings.

According to Elon Musk, the new factories are burning billions of dollars with “puny” output. In new battery manufacturing plants, the scrap rate of production can be as high as 50%. Because this is Tesla’s first independent battery manufacturing endeavor, initial rates could even be higher than this. With battery metals trading at, or near, all-time highs, this incredible burn rate is clearly not doing the company any favors.

Yet, analysts only project Q2 earnings to come in around $1 billion less than they were the previous quarter. I think this could be setting the company up for a massive disappointment for next quarter’s results. But even if growth does come in strong, Tesla’s fighting an uphill battle to justify its sky-high valuation. According to consensus earnings estimates, the company’s forward P/E ratio is 69.74. That comes in 480% higher than its peers.

Tesla has been a frustrating company for me to watch. Just take a look at Seeking Alpha’s quant ratings. It’s clear that Tesla has strong fundamentals, i.e., healthy growth and strong profitability. It’s a good company, just not for the price it’s being offered at.

Seeking Alpha

But let’s compare this to BYD. BYD trades at aggressive valuation ratios itself, as it too relies heavily on future growth expectations. It actually has an even higher forward P/E ratio, coming in at 79. The key difference is that BYD has the extraordinary growth to back it up.

Like it or not, Tesla is a maturing company. That may sound strange to say, but the company has established itself in all major automotive markets at this point. Yes, production is rising. And, yes, its future growth should still be impressive. But BYD’s expansions make Tesla’s look insignificant by comparison. Analysts expect BYD’s earnings to grow 5.86x from 2021 to 2024. Analysts expect Tesla to grow its earnings by 2.95x over the same period.

By no means am I saying that 2.95x growth is bad. But I also wouldn’t say it’s enough to justify its current value. More importantly, I just don’t see Tesla meeting that goal either. Assuming Berlin and Austin ramp successfully in the next two years, that would double the company’s total vehicle output. But, as we know, it’s likely that Tesla will face some difficulty in the ramping phase so it may take a bit more than two years for margins to be optimized. So, I think even 2x growth could be a bit optimistic.

Now, while I’m flagging Tesla for ramping issues, it may seem unfair that I’m not giving BYD the same treatment. Unlike Tesla, BYD has been an independent battery manufacturer for years. It also, unlike Tesla, has been mass-manufacturing plug-in vehicles since 2008. That’s not incredibly long, but it’s long enough for the company to demonstrate its competence.

I should also note that the concerns regarding raw materials, which are costing Tesla billions, don’t apply to BYD. While it does have to source lithium for its cells, that only accounts for ~6% of the battery’s overall mass. Iron phosphate, which is a far greater component of the battery, is still rather cheap.

At the end of the day, this is a story about growth. After selling just over 730,000 vehicles last year, BYD now aims to sell 1.5 million over the course of 2022, aided by a new automotive manufacturing plant. Tesla’s existing size makes it difficult for the automaker to post similar growth figures. Yet, it’s still priced as if it can while BYD remains underpriced given its own growth opportunities. For this reason, I caution investors away from Tesla while advising that, perhaps, BYD is worth a deeper look.

Be the first to comment