da-kuk/E+ via Getty Images

It’s been about 28 months since I wrote my cautious piece on Coty Inc. (NYSE:COTY), and in that time the shares have dropped about 20% against a gain of ~48% for the S&P 500. I thought it might be a good idea to revisit this trade, and determine whether or not I should add to my stake here. I’ll make that determination by looking at the financial history here, and by looking at the stock as a thing distinct from the underlying business. Also, as the song says, “I gotta be me”, and so I’m going to write about put options as they’re quite relevant here. In my previous missive on this name, I recommended eschewing the shares that were trading around $12, but I recommended selling the May 2020 puts with a strike of $10. Given what happened in early 2020, it’s not surprising that the shares were thus “put” to me at a net price of $9.50, so that trade deserves some commentary.

In case you’re the sort of person to not want to waste time on reading article titles, or bullet points, but somehow want a quick and easy summary of the contents, this second paragraph is for you. I know we’re already several hundred words in at this point, but better late than never. It’s time to give you the “thesis statement”, so you can avoid my admittedly sometimes tiresome writing. I think shares are unreasonably cheap at current levels, especially given the most recent financial performance. Additionally, my optimism is boosted by the insider buying activity of late. While I don’t think the common dividend will be reinstated anytime soon, I’m of the view that there’s definitely value here. In case you’re particularly risk-averse, I’ve got a trade for you, too. The November puts with a strike of $8 offer an 11% yield for eight months of, uh, let’s call it “work.” In my view, the only thing better than buying a cheap stock is buying a cheap stock and selling high yield puts on that stock. Here ends the thesis statement.

Financial History

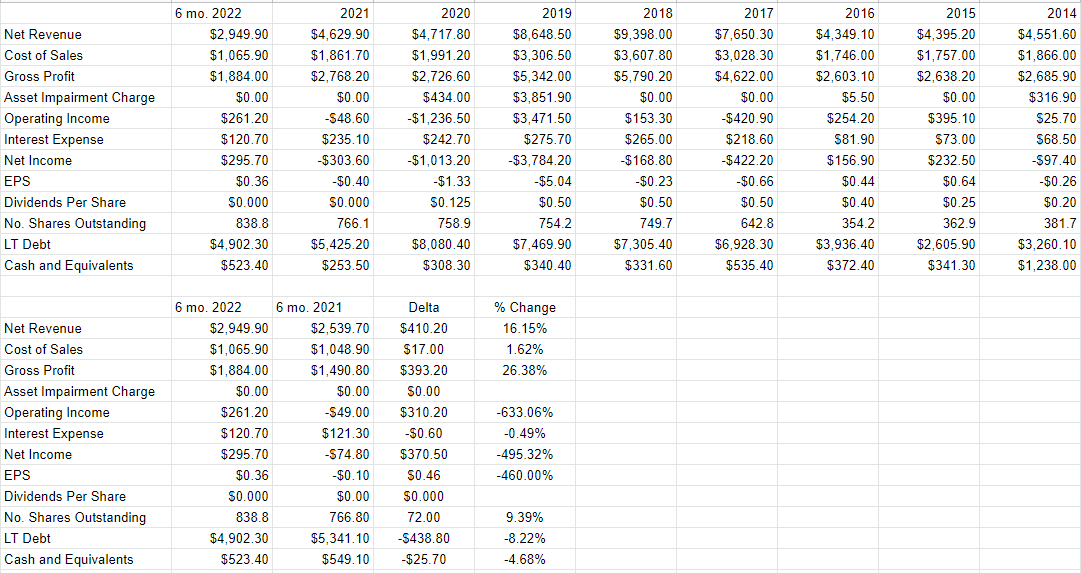

I think Coty has actually had a fairly good time as of late. In particular, the top and bottom lines over the two most recent quarters have improved dramatically relative to the same period a year ago. Revenue is about 16% higher, and net income has swung from a loss of just under $75 million to a profit of just under $296 million. At the same time, the capital structure has improved nicely, as evidenced by the fact that debt has declined by about $439 million while cash is down only about $26 million. There’s a reason for investors to be optimistic here in my view.

The Difference Between Optimism and Pipe Dream: Return of the Common Dividend

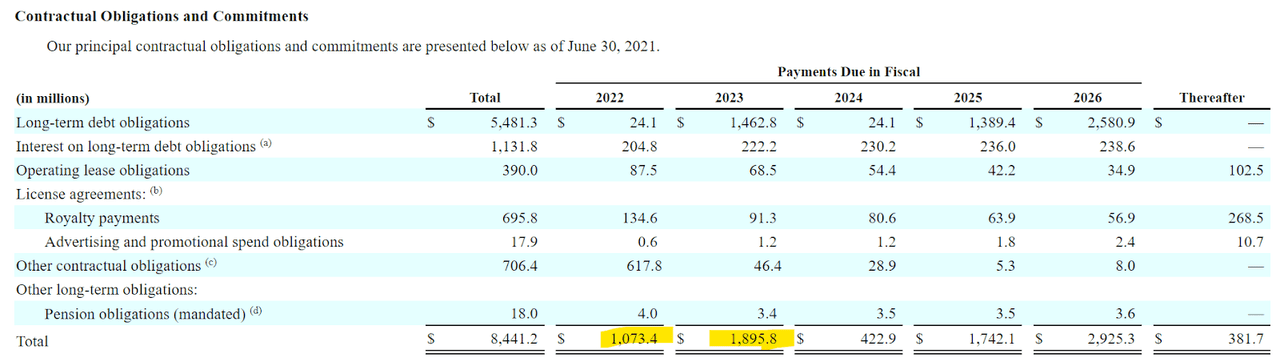

I think one of the things that might compel investors to pile into this name would be for the dividend on the common stock to be reinstated. In my view, in order for that to happen, the company would need sufficient cash or cash generating capacity. I know that statement is about as insightful as “water is wet”, but please stick with me here. When it comes to looking at dividend sustainability, or the chance that it will be cut, I review the current and likely future sources of cash, and compare that to the size and timing of upcoming contractual obligations. I’ve plucked the contractual obligations from the latest 10-K for your enjoyment and edification, and I’ve highlighted each of the next two years. We see from the table that in 2022, the company is on the hook to pay about $1.07 billion, and in 2023, contractual obligations balloon to just under $1.9 billion.

Coty Contractual Obligations (Coty latest 10-K)

Against these obligations, the company currently has about $523 million in cash. Additionally, they’ve generated an average of $302 million cash from operations over the past three years. During the same time period, they spent about out $406.5 million in cash for investing in ongoing operations. I write “ongoing”, because I’ve pulled out the $2.374 billion from CFI that the company made on proceeds from sale of discontinued business. All of this leads me to suggest that the company won’t be restarting a dividend until 2024 at the earliest. Just because I don’t think the dividend is going to be reinstated anytime soon, I would be willing to buy at the right price based on the recent financial performance.

Coty Financials (Coty Inc. investor relations.)

The Stock

Some of you who follow me regularly for some reason known only to you know that it’s at this point in the article where I turn into a real downer because I start yammering on about how a great company can be a terrible investment at the wrong price. I repeat this often because I want to drive home the point that the price paid for a given investment is probably the single most important variable to determine whether the investment is “good” or “bad.” The more you pay for a stream of future dollars (which is what you can distill a business down to), the lower will be your subsequent returns. Rather than try to demonstrate this point abstractly, I’ll use Coty itself to demonstrate the principle. The company released its latest quarterly report on February 8th. If you bought this stock on that day, you’re up just under 1%. If you bought two days later, you’re down about 3% since. Not much changed at the firm over these two days to warrant a 4% swing in returns. The investors who bought virtually identical shares more cheaply did relatively better. This is why I try to avoid overpaying for stocks.

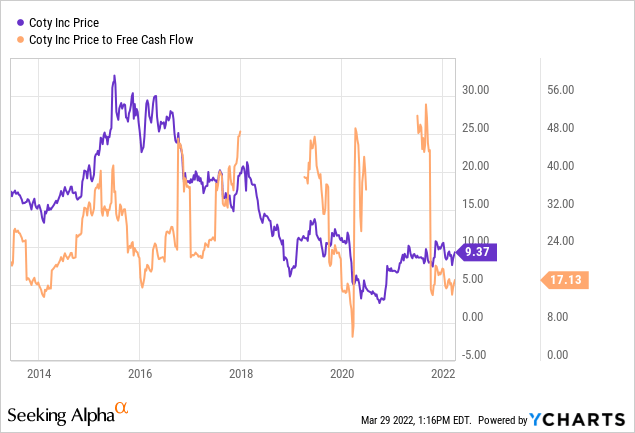

I measure the cheapness (or not) of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of price to some measure of economic value like sales, earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both its own history and the overall market. One of the reasons I decided to avoid the shares previously was because they were trading at a price to free cash flow of just under 25 times. They’re now about 32% cheaper, per the following:

Insider Activity

I’ve written it, spoken it, shouted it, and whispered it on occasion. All investors are equal, but some are more equal than others. When I think “great investors”, I divide the various groups into different categories. In one camp might be Buffett and Greenblatt. In another camp might be Pelosi. One camp in particular is of interest to us here, though, and that’s the “insider” camp. In my view, when the people who know a business better than any Wall Street analyst ever will put their own capital to work in a business, the rest of us should pay attention.

With that in mind, I’d like to point out that insiders are buying aggressively. This month alone, Sue Nabi bought another 304,786 shares for $2.525 million. Beatrice Ballini purchased 7,000 shares for $55 thousand. Gordon Von Bretten bought another 38,776 shares for just over $300 thousand. In my view, if the people who know this business best are willing to put $2.883 million of their own capital to work by buying shares, the rest of us would be wise to take note. It dramatically improves my feeling of confidence to know that the people who know the business best are on the same side of the table as me.

Options Trade

When I last looked at Coty back in November of 2019, the shares were trading at ~$12 each. I didn’t want to buy at that level, but I was comfortable buying at a net price of $9.50, so I sold the May 2020 puts with a strike of $10 for $.50 each. If you needed yet another example of how these can reduce risk while enhancing returns, I think this trade offers it. I avoided paying the then market prices, and locked in a buy price ~21% better than the people who bought the day my article was published. Had the shares remained above $10, I would have simply pocketed the premium. This is why I characterise such trades as “win-win.”

I like to try to repeat success when I can, and so I’m going to do yet another trade here. In particular, I like the November 2022 puts with a strike of $8. These are currently bid at $.90, which represents an 11% yield for eight months of, uh, “work.” if the shares remain above $8 over the next eight months, I’ll simply pocket a generous premium. If the shares fall 14% from here, I’ll be obliged to buy, but will do so at a very reasonable price in my view.

Now that you’re hopefully excited about the prospects of finding a “win-win” “trading system”, it’s time for me to indulge in one of my favourite pastimes, and that is spoiling people’s moods. Here’s the lesson: just because some high functioning alcoholic on the internet declares these to be “win-win” trades doesn’t make it so. Just like investors themselves, not all short puts are created equal. The short puts I characterise as “win-win” are actually a small subset of all puts. In order for one to be compelling, it must be on an attractive stock and at an attractive strike price. So, I’ll only ever write a put on a company that I would be happy to own at a price at which I’d be happy to buy. So, not all puts are “win-win” trades. If the strike price is a terrible entry price, for instance, that’s a very bad trade in my view.

I should also state that I think the risks of put options are very similar to those associated with a long stock position. If the shares drop in price, the stockholder loses money, and the short put writer may be obliged to buy the stock. Thus, both long stock and short put investors typically want to see higher stock prices.

Some put writers don’t want to actually buy the stock – they simply want to collect premia. Such investors care more about maximizing their income and will be less discriminating about which stock they sell puts on. To be very clear, I am not such an investor. I like my sleep far too much to sell puts based only on the income I can generate. I’m so much of a coward that I’m only willing to sell puts on companies I’m willing to buy at prices I’m willing to pay. I wasn’t always so disciplined, but after painful losses, I decided to only ever sell puts on quality companies at prices I was willing to pay.

I should also write that I think put writers take on risk, but they take on less risk (sometimes significantly less risk) than stock buyers in a critical way. Short put writers generate income simply for taking on the obligation to buy a business that they like at a price that they find attractive. This circumstance is objectively better than simply taking the prevailing market price. This is why I consider the risks of selling out of the money puts on a given day to be far lower than the risks associated with simply buying the stock on that day.

I’ll conclude this rather long discussion of risks by looking again at the specifics of the trade I’m recommending. If Coty shares remain above $8 over the next eight months, I’ll simply pocket the premium and move on. If the shares fall in price, I’ll be obliged to buy, but will do so at a price that lines up with a very nice valuation in my view. All outcomes are very acceptable in my view, so I consider this trade to be the definition of “risk reducing.” Weird of me to end a discussion of risk by writing about how these things can reduce risk. I hope the shock of learning that I can be weird doesn’t send you into palpitations.

Conclusion

I think Coty is a few years away from reinstating the common dividend, but I think the shares are attractively priced. They’re turning around nicely in my view, and the capital structure is much better than it was this time last year. For that reason, I’ll be adding to the shares that were “put” to me at a net price of $9.50. In addition to buying shares, I’ll be selling the puts described above, because the only thing better than buying a cheap stock is buying a cheap stock and then selling puts on the same. If you’re comfortable selling puts, I’d recommend this or similar trade. If you’re not into puts, I think the current price for the common is fairly good.

Be the first to comment