z1b/iStock via Getty Images

Right now, it appears increasingly likely that we will face high inflation for a while longer.

Russia’s invasion of Ukraine is causing great supply chain issues, and so is China’s latest lockdowns as they fight a new wave of Covid cases.

Unfortunately, right now, most inflation hedges are fairly expensive because there is unprecedented demand for such investments from fearful investors.

Therefore, you may end up paying a large premium to own a good inflation hedge, and the high valuation may negate the inflation hedging benefits.

Fortunately, a few opportunities remain in the overlooked small-cap segment of the REIT (VNQ) market, and in what follows, we will highlight two of our favorites:

Clipper Realty (CLPR)

Today, most major apartment REITs are expensively priced. Mid-America (MAA), Camden (CPT), and Essex (ESS) have all strongly recovered from their pandemic lows and now trade at near all-time highs.

But one apartment REIT still didn’t recover. Clipper Realty is still priced at a steep discount and we believe that it is possibly the cheapest inflation hedge in today’s market.

For those of you who aren’t familiar with CLPR, it is an apartment REIT that owns properties exclusively in Brooklyn and Manhattan.

Here are a few of the properties that they own:

Tribeca House:

Tribeca House (Clipper Realty)

Flatbush Gardens:

Flatbush Gardens (Clipper Realty)

Clover House:

Clover House (Clipper Realty)

These markets were some of the worst impacted by the pandemic, and even now, NYC still has one of the lowest office usage rates in the nation.

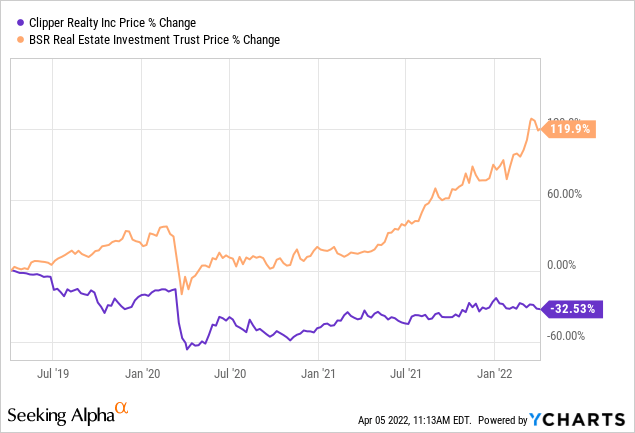

As such, it’s not terribly surprising that the market is pricing CLPR at a discounted valuation. The market hates anything NYC-related, and as a result, it has priced CLPR at a 40% discount to its net asset value, an exceptionally low valuation for an apartment REIT in today’s inflationary world. Here is how its 3-year performance compares with BSR REIT (OTCPK:BSRTF / HOM.U), our largest apartment REIT investment:

Clipper Realty vs. BSR REIT (YCHARTS)

We think that this huge disparity is an opportunity for active REIT investors.

We know by now about the population migration trends from New York City to Sunbelt states. But the market is well aware of that narrative as well and has thoroughly priced it into REITs like BSR. Meanwhile, CLPR has suffered on the negative side of that narrative.

But the biggest exodus of urbanites from NYC has already taken place, and people are coming back to the city. “Migration to the Sunbelt” was yesterday’s narrative. What will be the narrative of tomorrow? We think it will be “the resurgence of big cities” – especially the Big Apple. The commercial and cultural world of NYC has only just begun to be revived and this trend will benefit CLPR.

In fact, it is actually already benefiting it. In the last quarter, the management noted that its occupancy rate was trending higher as people return to NYC and it was starting to hike rents, in some cases, quite substantially. As an example, their second biggest asset, Tribeca House, which represents 1/4 of total revenue, is now signing new leases at 15% higher rates than pre-pandemic. Yet, its average rents remain well below market at $64 vs. $80+ for new leases. Similar rent hikes are starting to take place at other properties as they reach higher occupancy levels. Here is what the management commented in the most recent conference call:

“We expect rent per square foot levels to continue to grow steadily higher as our one and two year leases entered into last year and the year before turnover.”

This rapid expected rent growth makes CLPR a particularly strong inflation hedge because it has a lot of fixed-rate, asset-level, non-recourse debt with no maturities until 2027.

The $1.14 billion of debt is now being inflated away at a rapid rate even as the value of its assets is rising. The leverage is high relative to the company’s $386 market cap, but this is a big plus in today’s inflationary world as it is expected to turbo-charge the NAV per share growth in the coming years.

A 15% rent hike has a much greater impact on the equity value of a REIT when it is 65% leveraged than if it is just 30% leveraged, and CLPR has managed to structure its debt in a way that’s actually quite conservative.

The rent growth combined with the high leverage makes CLPR a particularly good play in today’s inflationary world because the market is still sleeping on it. As noted earlier, CLPR is priced at a steep discount to NAV, which only compounds its inflation hedging benefits.

Just to return to its NAV, the shares would need to appreciate by 65%+, and while you wait, the NAV keeps on rising due to the high inflation, and you also earn a 4.2% dividend yield. That’s what makes CLPR a fantastic hedge against inflation and we want to own more of it.

Finally, there are two additional points that make us even more bullish:

- 1) Development opportunities: The management is good at developing properties, which is very lucrative right now. They are developing properties at a ~6% cap that are worth closer to a 3.5% cap. They have been in the real estate business in NYC for decades and it gives them a competitive advantage in identifying new development opportunities.

- 2) High insider ownership: The management owns 40% of the equity, which assures that the company is managed in the best interest of shareholders, and it also increases the likelihood of a potential buyout. If the management cannot earn the valuation that they deserve, they will eventually need to consider strategic alternatives. After all, it is their personal capital that’s undervalued.

After this latest addition, our position represents nearly 3% of our Core Portfolio. If it dips below $8.5, we expect to buy more of it, and later this month, I will travel to NYC to visit their biggest properties.

Dream Industrial (OTC:DREUF / DIR.UN)

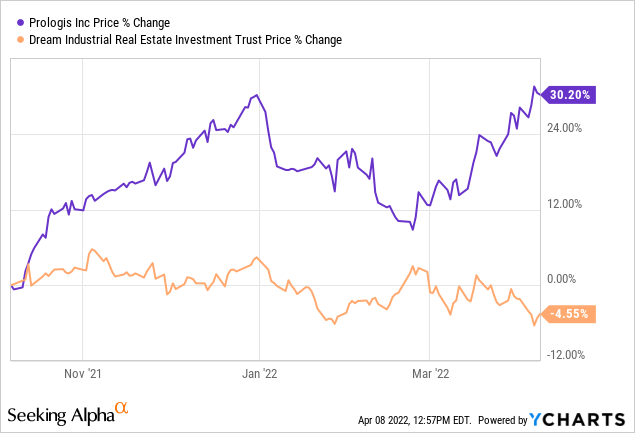

Unlike our other Industrial REIT holdings, Dream Industrial has been trending lower since the beginning of the year. It is our only Canadian holding that wasn’t immune to the recent volatility. It is down 7% year-to-date.

Is this a buying opportunity?

I believe so. Since October, Dream Industrial has massively underperformed its US industrial peers without any good reason:

Dream Industrial vs. Prologis (YCHARTS)

Prologis (PLD) and other US industrial REITs have performed very well as the pandemic accelerated the growth of Amazon-like (AMZN) companies and also pushed a lot of companies to bring back larger portions of their supply chains to the US.

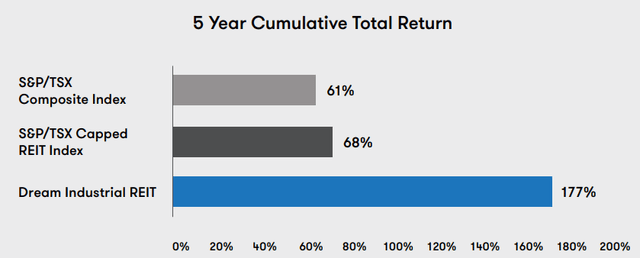

But the same applies to Dream Industrial up north in Canada. The company has a great track record, and as you will see below, 2021 was a particularly strong year for the company:

Dream Industrial past track record (Dream Industrial)

In 2021, it grew its FFO per share by 15.4% and its NAV per share by 20%.

This rapid growth was the result of near-20% releasing spreads and new development projects. The management expects to push for similar rent hikes across the portfolio as leases gradually expire. Today, its weighted average lease term is just over 4 years so it positions the company for strong growth in the years ahead.

We are also very pleased to see Dream Industrial focus more heavily on the European market. This makes sense because that’s where it earns the best spreads and can target the most accretive deals.

The REIT is able to develop new assets at ~6% unleveraged yields, and it recently accessed debt at a 0.4% interest rate in Europe. That’s essentially free money and Dream Industrial should be able to take on more of it since it has a strong BBB-rated balance sheet. That all bodes very well for Dream Industrial in 2022 and beyond.

Why did it then underperform recently?

I suspect that many Canadian investors sold Dream Industrial when Russia began its invasion of Ukraine because they got scared that it would negatively impact the company’s European assets.

We view this as an opportunity because its assets are all in NATO countries and we don’t expect a significant long-term impact on them.

It is interesting to note that European industrial REITs have materially outperformed Dream industrial over the past 6 months. Perhaps European investors have a better understanding than Canadian investors of what the war in Ukraine really means for these REITs.

Right now, you can buy shares of Dream Industrial at right around its NAV and enjoy a 4.4% dividend yield while you wait for long-term growth. We expect an additional ~10-20% upside as investors slowly move past their fears of the recent crisis. That makes it a great inflation hedge.

Bottom Line

The most obvious inflation hedges are today priced at expensive valuations. But if you know where to look, opportunities can still be found in the small-cap segment of the REIT market.

That’s where I am investing most of my capital at the moment.

It is hard to lose money in the long run if you are buying quality real estate at a discounted price.

Be the first to comment