PeopleImages

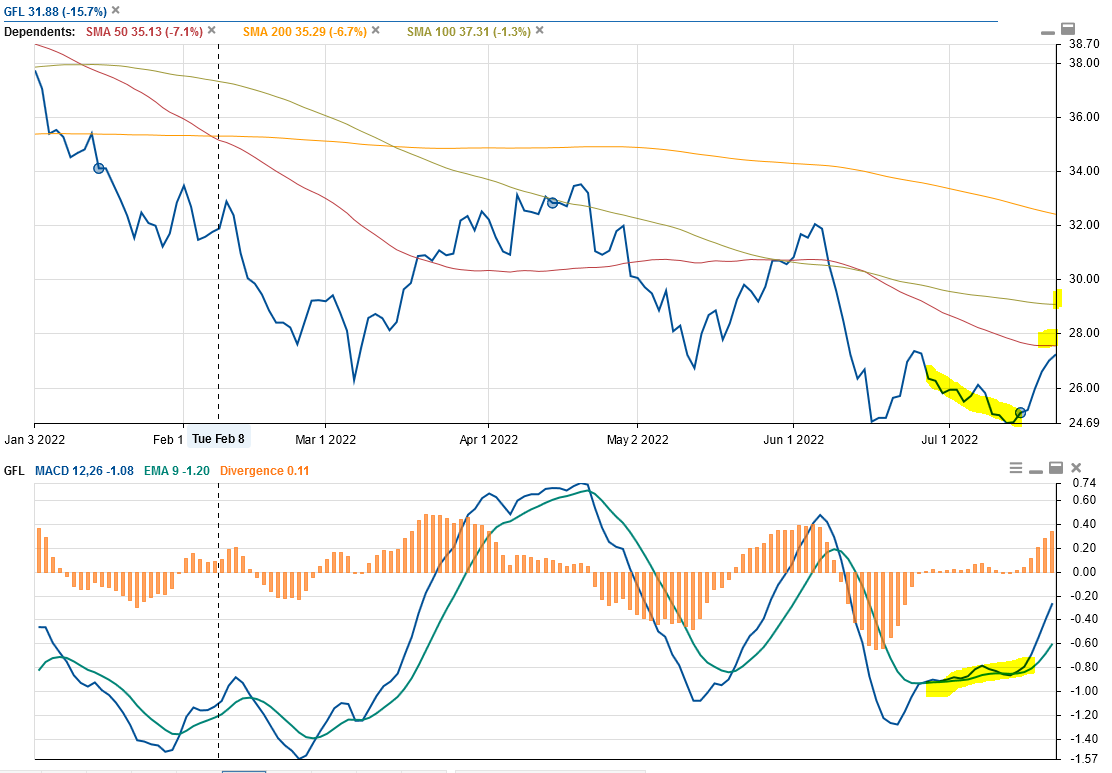

After falling to a technical bottom at around $26 in March 2022, GFL Environmental (NYSE:GFL) tried twice to rally. GFL stock rallied above $30 in April and again in June. Both times, the rally stalled. Investors are waiting for the waste management firm, which operates in all provinces in Canada, to post its second-quarter results.

Shareholders only have details of the first-quarter report to evaluate the stock’s prospects.

GFL’s Stock Scores

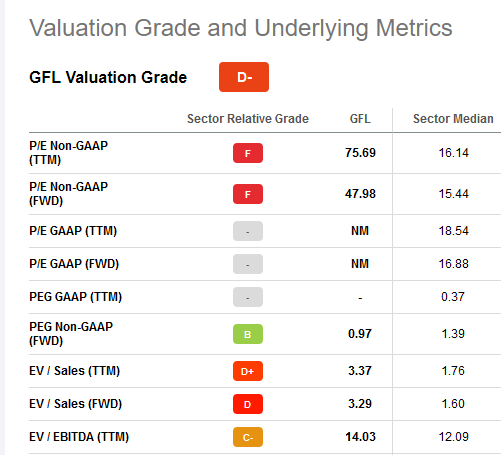

GFL scores poorly on valuation. During a bear market, markets are not going to overpay for stocks regardless of their growth and profitability profile.

SA Premium

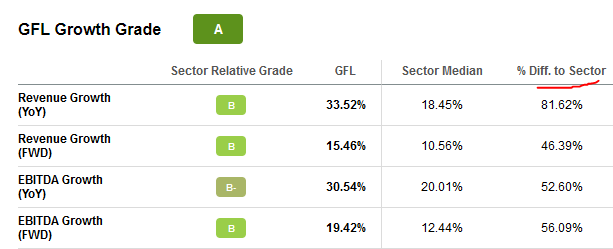

GFL’s value score is the same as that of Waste Management (WM). Both stocks also score the same on price/cash flow. GFL is a compelling growth investment because its revenue will grow faster than the sector:

GFL scores an A on growth (SA Premium)

The company sustained growth over the years through acquisitions. For example, it completed 21 acquisitions in 2022. This represented around $300 million in incremental annualized revenue. In the first quarter, Founder & Chief Executive Officer Patrick Dovigi pointed to the positive impacts of price, volume, acquisitions, and portfolio rationalization in exceeding its growth objectives.

Investors should expect customer service excellence is a requirement. This user’s comment on his experience is worth noticing. Investors also contributed to the red flag signals when they shared their poor customer service experiences on Voyager Digital (OTCPK:VYGVQ). Although 3AC is the reason for its bankruptcy, investors should scrutinize companies whose managers oversee poor customer service quality.

Fortunately, GFL anticipated a full recovery of its Environmental Services sector. Customers re-engaged in its services after the pandemic. This resulted in revenue exceeding its expectations by over 15% and growing to CAD 1.4 billion.

Strong First Quarter Results and Outlook

GFL earned six cents a share (non-GAAP). Organic revenue grew by 11.3%. Solid Waste price and surcharges of 6.6% are the highest in GFL’s history. Adjusted EBITDA increased by 19% Y/Y.

For the fiscal year of 2022, GFL expects revenue of CAD 4.59 billion. Its adjusted EBITDA range is between CAD 1.68 billion and CAD 1.72 billion. This is above its previous guidance of between CAD 1.625 billion and CAD 1.665 billion. The company’s partners for the renewable natural gas (“RNG”) projects are deploying capital faster than thought. It will pull forward its 2023 free cash flow into 2022. In addition, GFL expects margins for Environmental Service to rise and Solid Waste margins to fall. Overall margins will be in the high 25% range.

GFL experienced higher cost inflation than expected. Looking ahead, it expects margins to expand through incremental price increases. GFL’s pricing power is a trait that investors should seek for any investment.

Opportunity

GFL credited its over 18,000 employees for its strong results. By comparison, Waste Management has 48,500 staff and a $63.9 billion market capitalization. Still, GFL demonstrated that it has the optimal staffing levels. Furthermore, employees are engaged with the community’s biodiversity. On Earth Day, employees increased their awareness of local at-risk species.

In GFL’s big eight primary markets of Vancouver, Edmonton, Calgary, Winnipeg, Toronto, Ottawa, Montreal, and Halifax, people are getting back to offices. When they return to a normal work schedule, the Solid Waste Canada unit will fully recover. This assumes that the country does not adopt an economically punitive Covid zero strategy.

GFL Environmental’s RNG project is a $115 million to $125 million gas opportunity as a baseline case. This could grow to between $150 million and $200 million. Gas prices may change when the project will come online in 2023 and 2024. Based on those data points, investors may forecast revenue growth in the next five years. In a five-year discounted cash flow model (revenue exit), assume revenue growing annually:

|

(CAD in millions) |

Input Projections |

|||||

|

Fiscal Years Ending |

21-Dec |

22-Dec |

23-Dec |

24-Dec |

25-Dec |

26-Dec |

|

Revenue |

5,526 |

6,162 |

6,716 |

7,522 |

8,124 |

8,530 |

|

% Growth |

31.70% |

11.50% |

9.00% |

12.00% |

8.00% |

5.00% |

|

EBITDA |

1,362 |

1,709 |

1,920 |

2,136 |

2,649 |

2,816 |

|

% of Revenue |

24.70% |

27.70% |

28.60% |

28.40% |

32.60% |

33.00% |

This would imply a fair value of $35, 31% above the $27.23 closing price on 7/22/2022.

Risks

The company’s RNG project may stall unexpectedly. This is unlikely since partners are delivering results ahead of schedule.

A Covid outbreak may emerge, forcing the government to lockdown. However, Omicron’s five sub-variant strains are less life-threatening. One of the latest variants eludes the immune system. This would not warrant another Covid lockdown.

GFL’s stock chart has mixed signals. The moving average convergence divergence sloped positively as shares fell. This signaled the recent rally. However, the stock rally may stall at the resistance levels. The 50-day and 100-day simple moving averages are both resistance levels for GFL stock;

MACD slope diverged when the stock fell, indicating a buy (Stock rover)

Your Takeaway

Buy and hold investors may ignore the stock fluctuation in GFL Environmental. The company has a conservative growth strategy through mergers and acquisitions. The stock has strong growth and profitability grades of A and B, respectively (according to Seeking Alpha Premium).

Investors may, as usual, wait for panic selling to create a better entry price.

Be the first to comment