Joe Maher/Getty Images Entertainment

U.K. fashion house Burberry (OTCPK:BURBY) is on a solid post-pandemic recovery course, with an attractive business strategy. I think it is a buy.

Business Has Recovered

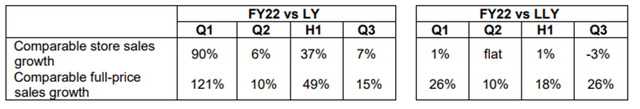

The company’s third quarter trading update showed that compared to pre-pandemic (“LLY” or “last last year” – an odd usage in English language), comparable store sales were up 1% in the first half of the year. That suggests that sales have recovered to pre-pandemic levels.

Burberry third quarter trading update

Something else worth noting here, which I think could bode well for the future profitability of the business, is that the most recent quarter saw a decline in sales compared to the equivalent quarter pre-pandemic, but a sizeable increase in full-price sales. That reflects a conscious move by the company to stop markdowns in its mainline stores and online. I think that is always the right move for a premium brand, as discounting simply trains shoppers to buy on deal and reduces the pricing power of the branding. One reason brands like Burberry tend to discount, in my view, is because they lack the cachet of a true luxury brand like Hermès or Floris, so try to build luxury cachet while sometimes also falling back on price discounting. To build a luxury brand for the long-term – with the attractive profit margins that entails – I think it is necessary to avoid price discounting and instead invest in the brand itself. Burberry has been moving away from discounting and focusing on brand building, with 50 new concept stores expected by the end of this year. I see this strategic shift as positive for the business and hope it will be reflected in the form of higher profit margins in coming years.

Even ongoing pandemic restrictions in Asia have not posed a big challenge for the group. Asia Pacific same store sales growth in the most recent quarter was flat compared to two years previously, while in the Americas it was up 8%. The problem area geographically is in Europe, the Middle East, India and Africa, where there was a 17% fall. That is not as bad as the 25% fall seen in the first half but is still concerning. The company pinned this primarily on a continued fall in the number of tourists in those regions, as they accounted for around 40% of pre-pandemic revenues there. With outbound Asian tourism likely to remain vastly reduced for the foreseeable future, I expect this to continue.

The Dividend is Likely to Increase in Future

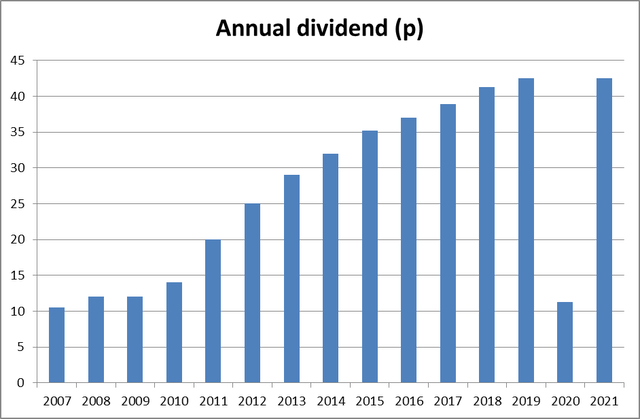

Having reduced the dividend during the pandemic, the company restored its most recent annual dividend to its pre=pandemic level of 42.5p per share. At the current share price that equates to a yield of 2.7% which I regard as attractive. Last year the dividend was covered 2.2 times by basic earnings per share. Free cash flow coverage of the dividend is around 1.4 times.

Although the dividend simply returned to its prior level, I am optimistic that the company will return to healthy dividend growth. It has raised this year’s interim dividend by 2.6%.

The company has a history of dividend raises prior to the pandemic. Given its coverage, I see room for the company to continue growing its dividend in the years to come.

author, based on data from company website

I would not buy Burberry just for its dividend as I see much better income options elsewhere in the market. But given the other positive attributes to the company’s investment case, I see its dividend yield and potential for ongoing dividend growth is attractive to me.

Valuation Looks Cheap

My last note on Burberry was just over a year ago, when in Burberry: Continued Signs Of Turnaround I rated the company as a buy. Since then, the company has lost around a fifth of its value.

Based on its most recent earnings per share, the company currently trades on a P/E ratio of 17. I regard that as cheap given Burberry’s strong brand and promising market outlook. If the current strategy succeeds in raising profit margins, earnings should rise. That means that the prospective P/E ratio will in fact be lower.

The Burberry share price has added only 2% in five years. But it continues to build its brand, has attractive profits and the potential for dividend growth. At the current price, I see it as a buy.

Be the first to comment