carterdayne/iStock Unreleased via Getty Images

British luxury goods player Burberry (OTCPK:BURBY) (OTCPK:BBRYF) was already facing some uncertainty when I last covered it in September. The business was actually doing fine, putting in a robust recovery from COVID that exceeded my initial expectations, but the resignation of ex-CEO Marco Gobbetti and the potential implications of China’s ‘common prosperity’ goals were weighing on its stock.

In a sense, that ‘two steps forward, one step back’ feeling has carried over to today. The business continues to put in solid results, and while the firm now has a new CEO – with former Versace head Jonathan Akeroyd stepping into the role – the war in Ukraine and COVID containment policies in China are providing the near-term headwinds. As a result, these shares have continued to languish, falling around 10% (including dividends) in London trading since my last update. The stock is broadly flat in GBP terms (again with dividends) since I initiated coverage back in January 2021.

How the above issues play out in the near term remains to be seen, though I continue to think the long-term story remains rosy here, principally on account of China’s economic growth runway and management making the right moves with respect to brand perception. With the shares currently priced in the £16.40 area, high single-digit annualized free cash flow growth implies significant upside to fair value. Buy.

Trading Continues To Impress

Burberry was already well on its way to pre-COVID performance levels when I last covered it, and full-year results released last month confirmed it.

Revenue for fiscal 2021/22 came in at £2.82B, good for 23% year-on-year growth at constant exchange rates and 10% growth versus fiscal 2019/20. Comparable store sales in the Retail segment (around 80% of total group sales) increased 18% versus fiscal 2020/21 and 6% on a two-year basis. Within that, previously soft areas like EMEIA (Europe, Middle East, India and Africa), heavily reliant on tourism, showed sequential improvement throughout the year, with Q4 comparable store sales up 10% in the region on a two-year basis.

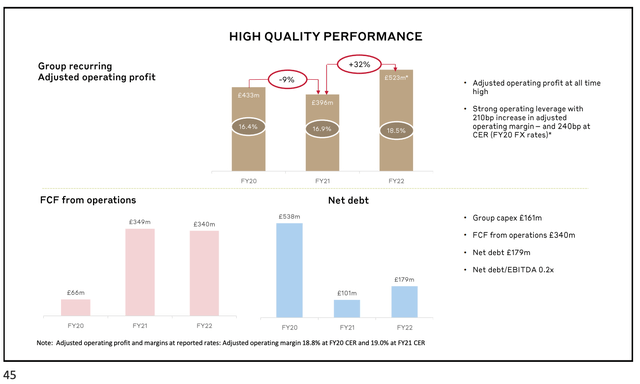

Source: Burberry FY21/22 Results Presentation

Adjusted operating profit growth was likewise very strong, increasing around 40% to a record level of £523m on the back of aforementioned sales growth and higher margins. Free cash flow was around £330m under my definition, with the firm bumping the annual dividend to 47p (up around 10% on pre-COVID levels) and initiating a £400m share buyback to be completed in fiscal 2022/23 (good for around 6% of shares outstanding at the current price). The balance sheet remains in excellent condition, with net debt ending the year at around £180m.

Making The Right Moves As Near-Term Headwinds Grow

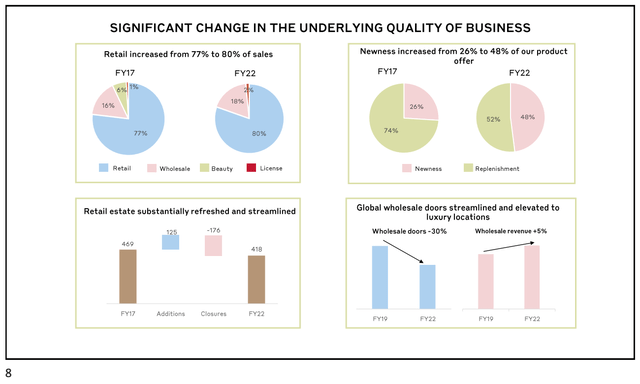

I mentioned last time that the departure of now ex-CEO Marco Gobbetti raised the question as to whether Burberry would alter its current corporate strategy. Put simply, the company has been aiming to elevate its brand up the luxury chain, a process which has involved reducing discounts on its physical/digital store products and reducing its wholesale exposure (e.g. by closing non-luxury accounts).

Source: Burberry FY21/22 Results Presentation

That has been a slight headwind to revenues, with markdowns a high-single-digit drag on comparable sales last year versus fiscal 2019/20, but given the long-term potential for higher unit prices, margins and greater control over the brand, it’s an overall positive. There’s no reason to think that the new CEO will change things, although we will get more color with a strategic update later in the year.

While Burberry’s business is putting in good numbers and management is making the right long-term moves, there are some near-term headwinds to deal with. First up is China, where authorities have been implementing strict lockdown measures in an effort to suppress COVID cases. Revenues derived from customers in the country came in at over £760m last year, while Chinese consumers make up around 40% of the business in total (i.e. business on the mainland plus traveling tourists abroad).

Lockdown effects were already starting to show up in Q4 figures, with management noting its China business declined around 13% year-on-year in that quarter (the broader Asia Pacific region was down 7% in the same period). This will bleed through into the current fiscal year, with management further noting that around 40% of its distribution on the mainland was disrupted as of mid-May.

The other issue is surging inflation and the resulting cost of living squeeze on consumers, made worse by the Russian invasion of Ukraine. Of course, it’s typically the least affluent that are most affected by this, and that isn’t really Burberry’s customer base, but note that trading conditions are sensitive to the wealth effect, as pointed out in the most recent earnings call:

We’re much more impacted by real estate prices and the stock market. In terms of the correlation with various macro factors, those are the two main factors that we need to keep an eye on.

With real estate and equity markets currently looking pretty shaky, the above is definitely something to bear in mind.

Decent Upside To Fair Value

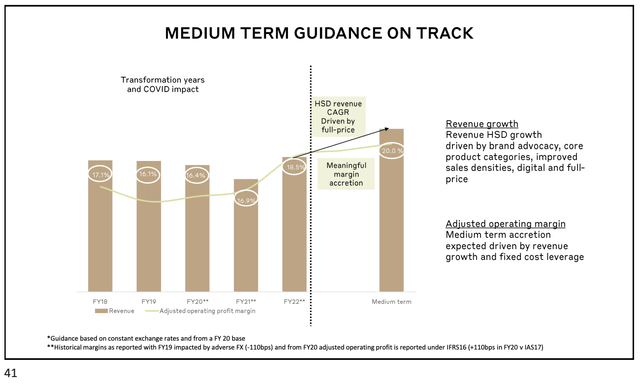

While the firm is facing some near-term issues, I would cautiously note that management affirmed its medium-term targets of high single-digit annualized sales growth and “meaningful” margin accretion. In the long run, I continue to think that China can power above-average growth on account of its economic development potential (GDP per capita remains well below regional peers like South Korea, for example).

Source: Burberry FY21/22 Results Presentation

More importantly, that growth doesn’t really appear to be baked into the stock price right now. Discounting 7-8% long-term (i.e. the next decade) annualized free cash flow growth gets me to a fair value in the £21-£22 per share region, or circa 30% upside from the current price in London trading. With a 3% dividend while you wait, these shares look attractive to longer-term oriented value investors that don’t mind some potential near-term volatility. Buy.

Be the first to comment