Vivien Killilea

Dating has never been easier – simply swipe right or left, and find the love of your life. Just kidding, of course. However, the last decade has brought on massive shifts in how people meet and connect – from e-mails to social media to online dating, the world continues to create friendships, or even marriages, through the click of a button or a swipe on a smartphone screen. In this article, I’ll briefly explain the online dating industry by analyzing publicly traded Bumble Inc. (NASDAQ:BMBL), explain why I find the business attractive, and review the company’s most recent Q2’22 earnings.

A Quick Overview

Launched in 2014, Bumble’s mission, per its 10-K, is to create a world where all relationships are healthy and equitable. The popular online dating app operates as a platform to connect individuals looking for relationships. Through the operation of two apps – Bumble and Badoo – the company boasts over 40 million users on a monthly basis, allowing new people to connect with each other.

Bumble

Bumble offers three core features in its app – Bumble Date, Bumble Bizz, and Bumble BFF. Unlike Tinder and many other dating apps, Bumble was built with women at the top of mind. Thus, women make the first move on Bumble (sorry guys), solving problems such as harassment and discrimination witnessed on competing platforms.

Why I Am Interested In Bumble

Sticky, Attractive Business Model & Growth

Many who have read my previous articles should know my preference for platform-focused companies. Some of my favorite businesses include Etsy (ETSY), Upwork (UPWK), Fiverr (FVRR), and Airbnb (ABNB), all of which operate as a platform connecting one group of people to another group. Further, platform-oriented businesses tend to benefit from network effects – in that the more users there are on the aforementioned platforms, the more valuable they become. This results in significant organic growth and sometimes, in the case of social media giant Meta Platforms (META), a multi-billion dollar enterprise.

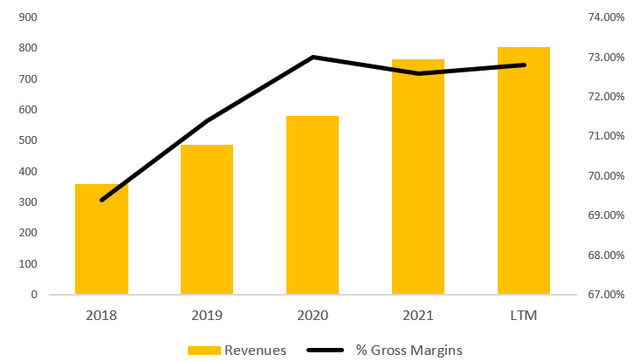

While Bumble will likely never obtain the size and scale of Meta, platform-focused businesses typically have strong unit economics. As depicted in the image below, Bumble boasts a 73% TTM gross margin and a high revenue growth rate.

Author Created (Company Filings)

Furthermore, Bumble’s freemium model offers users a taste of the basic app features for free, then enticing users to pay for more premium app features. As of Q2’22, Bumble and Badoo apps boasted a combined 3 million paying users, approximately 7.5% of total users. Rather than immediately requiring users to pay, Bumble’s freemium model gives users the option for more premium features, resulting in a loyal customer base with less churn.

Total Paying Users for Bumble and Badoo

| 2019 | 2020 | 2021 | Q2’22 |

| 2,050 | 2,505 | 2,893 | 3,020 |

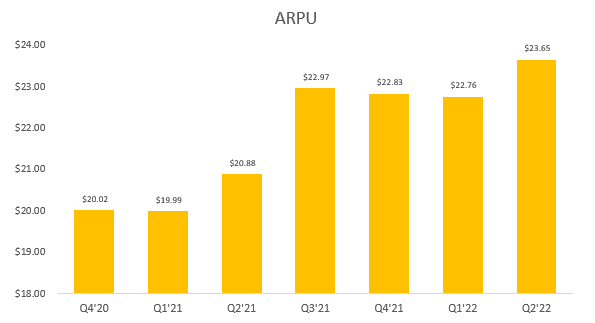

The data above also shows the platform is sticky, growing its paying user base and retaining plenty of users. Based on the below ARPU data and robust growth rates, it is clear that Bumble creates consistent value for its users and engages them, resulting in stickiness.

Author Created (Company Filings)

Industry Tailwinds & Cultural Shift

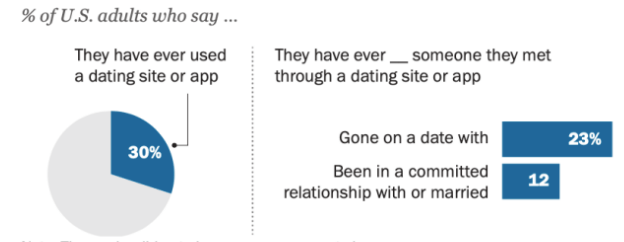

As screen times rise, the gamification of dating and swiping on profile pictures and “About Me” one-liners has risen in popularity. According to a PEW study, 30% of Americans have used a dating app, and 12% have been married or in a committed relationship via online dating (see below).

PEW

Another interesting statistic to keep in mind is that 34% of dating app users say they are on the app because they want to do something fun. The gamification of dating itself gives users a new “hobby” in their spare time. While this may sound odd, it is prudent to think of social media as an apples-to-apples comparison. What was once a simple tool to connect with friends and family across the world is now America’s favorite pastime. Scrolling through Instagram feeds and reels and liking random peoples posts isn’t abnormal. Initially, it was simply a tool to reconnect with existing family and friends abroad and create an online community of people you know. While I don’t have hard evidence of this, it is safe to say that many people you follow on Instagram are individuals you rarely or never speak to in person.

As of late, social media is a part of daily life where randomly scrolling through your Instagram feed and double tapping on every post is part of the appeal. The below table shows a glimpse of frequent social media usage by age cohort in the United States as of year-end 2021.

| 18-24 months | < 1 |

| 2-5 years | 1 – 3 hrs |

| 6-17 years | 2 hrs |

| 18+ | 2 – 4 hrs |

Research from multiple sources indicates that anywhere from 7-12% of the U.S. population has a social anxiety disorder. Hence, a preference among this cohort is to begin their search for a partner on a dating app rather than in the neighborhood bar. A 2019 study indicated why people are more prone to using dating apps than face-to-face interactions:

preference for online social interaction is a cognitive individual-difference construct characterized by beliefs that one is safer, more efficacious, more confident, and more comfortable with online interpersonal interactions and relationships than with traditional FtF social activities

Many participants in the study mentioned that they feel safer starting a conversation on a dating app and are usually nervous around other people in a physical setting. Ultimately, the cultural shifts in how individuals are willing to interact with one another will act as a strong tailwind for Bumble, propelling growth in its user base and revenue.

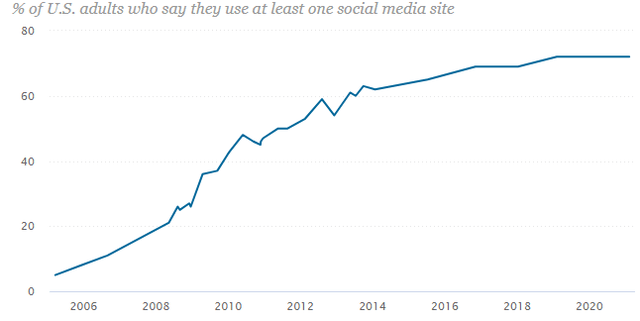

Further data depicted below exhibits the massive growth in the percentage of U.S. adults that use at least one social media app, about 78% (majority are under the age of 40).

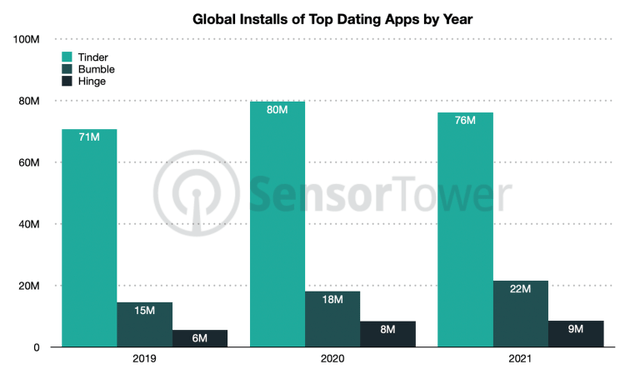

While social media is a more widespread form of connecting with people and dating apps are more so focused on one aspect (dating), it is safe to say that social media growth over the last 2 decades can be used as somewhat of a proxy to forecast the growth in dating apps – which have already seen their fair share of downloads and usage (see below).

The generation that grows up with dating apps will only increase usage over time. As the algorithms continuously improve and the user base increase, online dating will become the new norm.

Overall, the combination of consumer preferences and strong demand for dating apps result in favorable industry dynamics for Bumble. The growth in total paying users and app downloads proves that the online dating market is expected to grow, whether people want to meet others or just need a hobby swiping right in their spare time.

Q2 Earnings Review

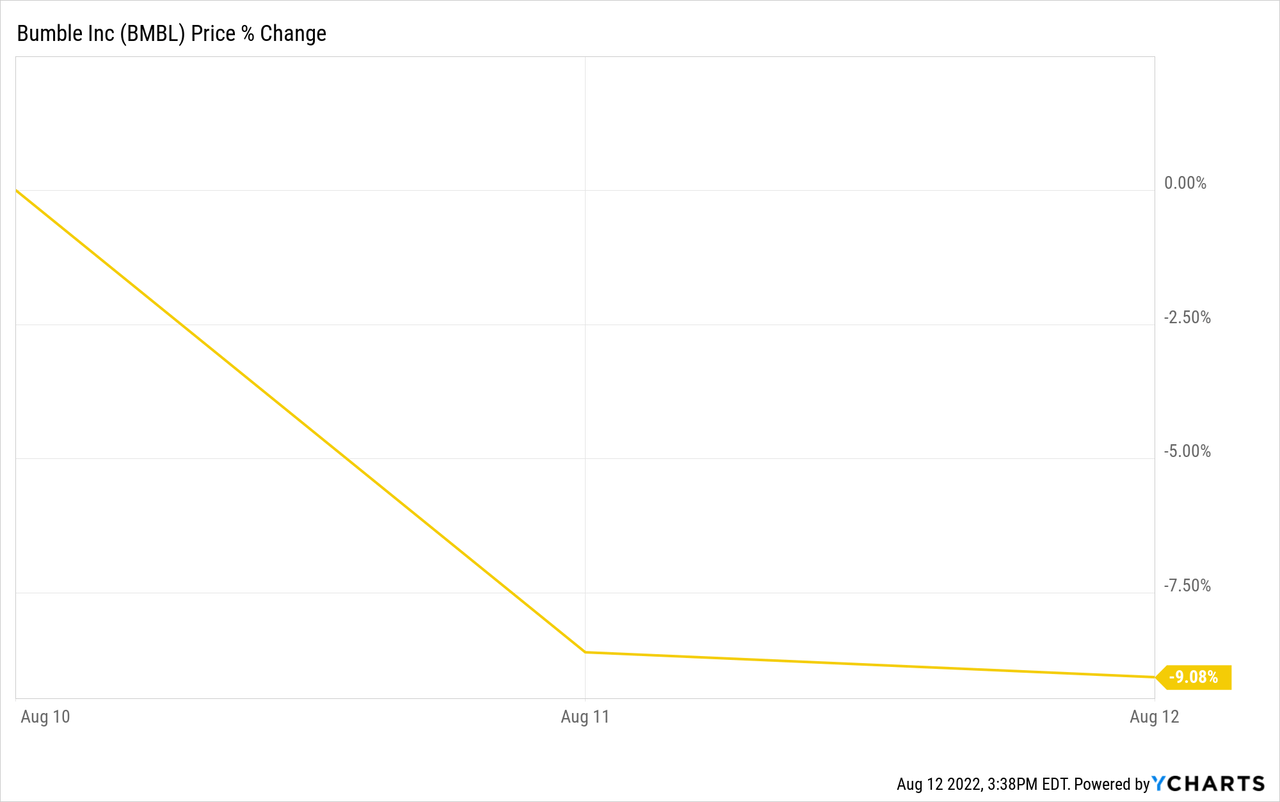

I’ll briefly touch on the Q2 earnings that Bumble released on August 10th. After earnings, Bumble is down about 9.8% as the Street wasn’t happy with the company’s results and guidance.

Bumble posted EPS of $-0.01 (miss by $0.11) and revenue of $220.45 million (beat by $1.09M and 18.4% YoY growth). However, it was the change in full-year guidance that worried the Street. Initially, Bumble forecasted full-year revenue of $934M – $944M. Two days ago, management slightly slashed guidance to $920M – $930M due to the crisis in Ukraine and FX impacts.

So, if the midpoint of the device changes most of the reduction is really as a result of the FX. Additionally, as we’ve been working on the second half roadmap we’ve been thinking about the timing of when some of these features will launch. And based on a lot of the testing and user feedback that we’ve done, we’ve moved some things around from between Q3 and Q4.

So to give you an example, we’ve talked a lot about college bundles and we were originally hoping to launch college bundles before students were back on campus. But again based on the feedback that we’ve received from the users, we believe that they will be better served to start getting these bundles once they’ve settled down on campus.

Additionally, the rollout of some new Bumble features such as college bundles will be pushed to Q4, negatively impacting Q3 revenue.

Why I haven’t pulled the trigger yet

While Bumble does seem to have a strong business model, I haven’t swiped right on the popular dating app as an investment just yet. To date, Bumble’s largest public competitor, Match Group (MTCH), is triple the size of Bumble in terms of market capitalization. Additionally, MTCH has a significantly broader portfolio of dating apps including fan favorites such as Hinge, Tinder, and OkCupid (see below).

Match Group Filings

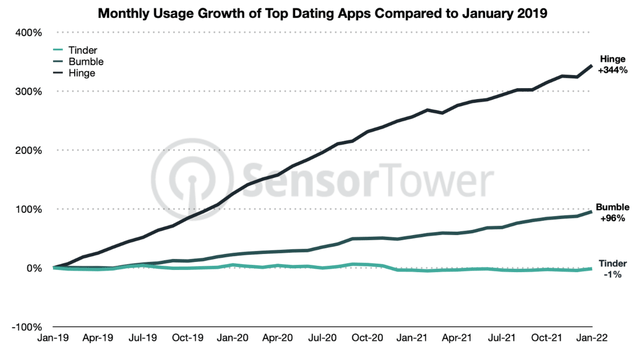

Despite this, Bumble managed to find a niche in the online dating industry competing with the likes of Match Group’s suite of dating apps. As depicted by the chart below, Hinge acts as a high-growth heavy competitor based on app usage.

Nevertheless, with a slightly lofty valuation and lack of clarity heading into FY’22, I have not yet had the gumption to pull the trigger and add BMBL to my portfolio.

With that being said, I will implement a “buy” recommendation and advise investors to keep this stock on the watchlist or initiate a starter position. I will be observing Bumble closely for the next 2-4 quarters and perhaps swipe right very soon.

Be the first to comment