Panuwat Dangsungnoen

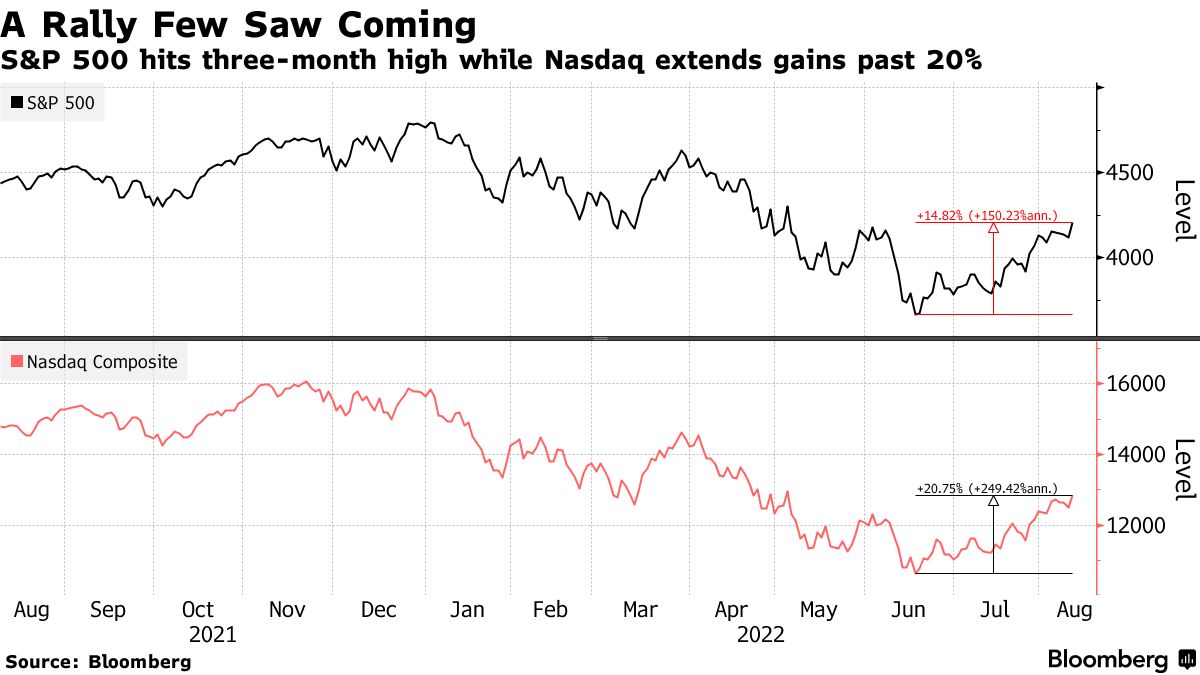

The war may not be won, but the bulls had a decisive victory on the battlefield of inflation yesterday, which ignited a ferocious rally in risk assets. The Nasdaq Composite has now risen 20% from its bear-market low, while the S&P 500 managed to close above its June high in a bullish technical breakout. It is now close to retracing 50% of its bear-market losses, which would have an even more bullish implication. Much the same way last Friday’s jobs report ended the debate about recession, I think the Consumer Price Index (CPI) report ended the debate about peak inflation. It is clearly behind us.

Finviz

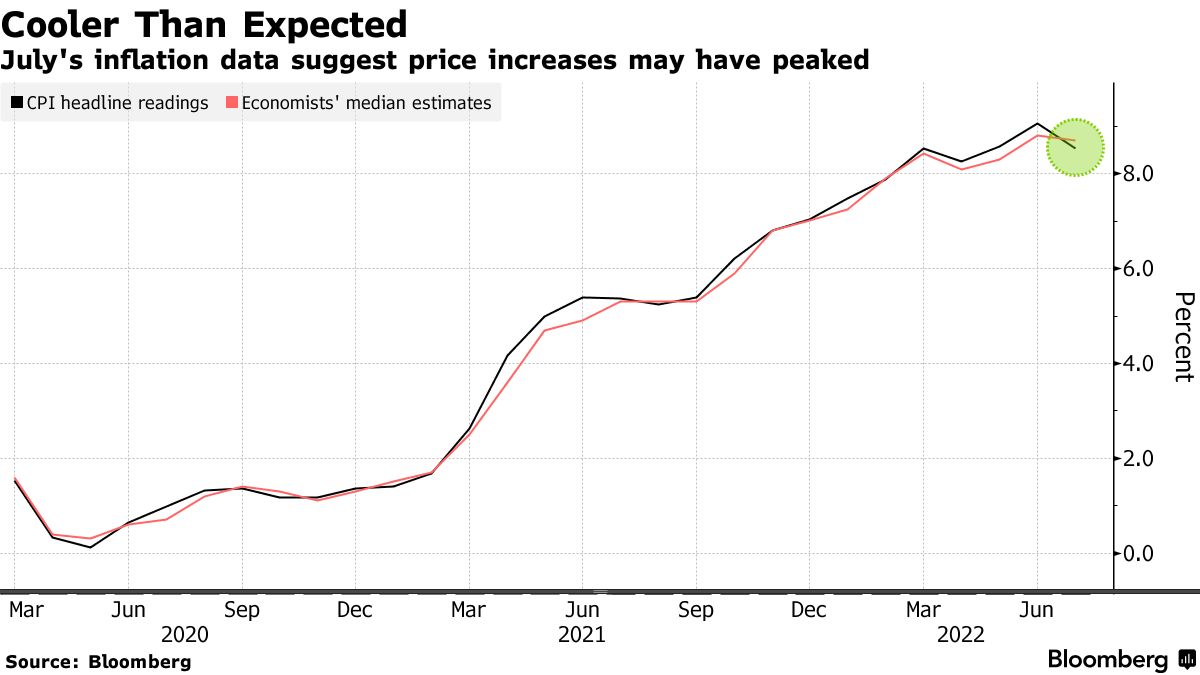

The CPI was unchanged in July, which was below the consensus estimate for an increase of 0.2%, while the core rate that excludes food and energy rose 0.3%, which was below the 0.5% expected. Prices are up an annualized 8.5% compared to 9.1% the month before, and the core rate remains at 5.9%. As expected, lower energy prices drove the lower comparison. Inflation hawks pointed to the fact that food prices are still rising, but lower energy prices will feed into lower food prices through lower transportation costs. I expect the headline number to be halved by year end before falling into a range of 3-4% in 2023.

Bloomberg

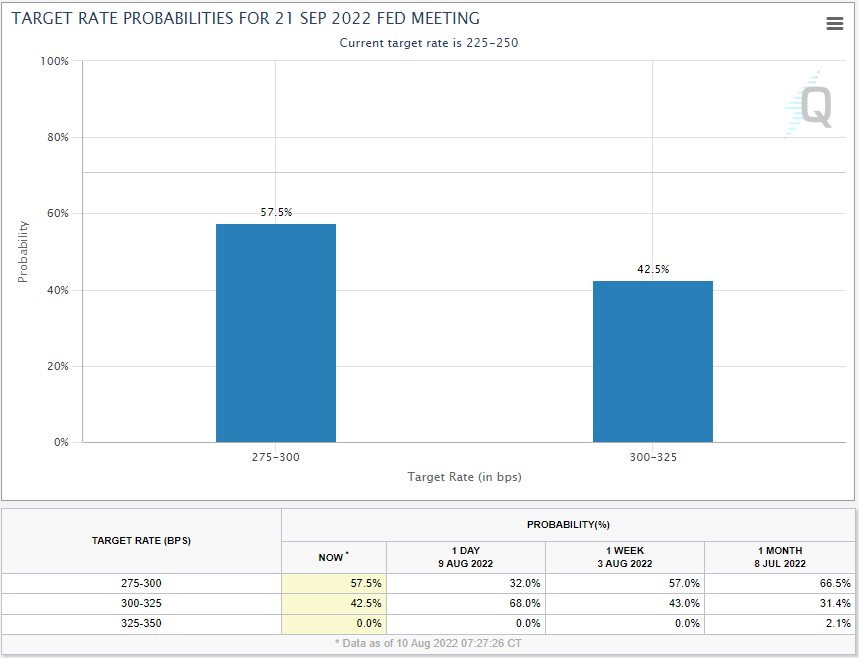

This good news reduced the probability for a 75-basis-point rate increase in September from 68% to 42%, while 50 basis points now holds the highest probability at 57% in the Fed funds futures market. I never thought 75 basis points was realistic, even after the strong jobs report, anticipating that a better-than-expected inflation number would convince the Fed that it is on track.

CME

An added bonus to the downside surprise in inflation was the first increase in real wages in 10 months. Real wages, which are adjusted for inflation, increased 0.5% in July. Real wages are still down 3% over the past year, but I think this monthly increase is the turning point whereby wage growth becomes less negative each month before turning positive on an annualized basis by year end. That will give consumer spending the lift it needs to navigate the soft landing I expect for the economy and continue the expansion that started in 2020.

The bears on Wall Street are already lining up a defense built around the fact that 8.5% is still an unacceptably high inflation level, which may be true. The point they are missing is that markets respond to rates of change more so than absolute numbers, which is a truism my father taught me 30 years ago at the beginning of my career. Thanks dad! Inflation is now receding, while corporate earnings are rising more than expected, and investor sentiment is becoming less negative. These are all positive rates of change that explain the markets ascent over the past three months.

Yesterday saw the S&P 500 close at 4,210 with a higher high than the June peak. That is the first thing we need to see in a trend reversal, which I think is upon us. Yet we don’t want to see too rapid a recovery in stock prices, because it loosens financial conditions, which puts upward pressure on prices through the wealth effect. This is why we saw Fed officials warn of continued rate increases in 2023 after the report, seemingly ignoring the good news on inflation. Fed President Neel Kashkari said he wants short-term rates as high as 3.9% by year end and 4.4% by the end of 2023. He has no more of a clue where rates will be a year from now than we do. He is simply a troop deployed to send a hawkish message that dampens the enthusiasm for risk assets. That is ok by me, as I would prefer to see a more gradual and sustainable market recovery.

Bloomberg

The bears will really be cornered if the S&P 500 can close above 4,232, which is mere 20 points away. That would be a 50% retracement of the bear-market decline, which never occurred in any of the prior 13 bear markets dating back to 1946. If we close at that midpoint, it suggests that the low for the bear market is behind us. It is no coincidence that the low would coincide with the peak in inflation. Rates of change are at work again.

Bloomberg

Be the first to comment