grandriver/E+ via Getty Images

It seems that the latest shortage to hit the markets is hot sauce. That and feminine products.

(Sorry, ladies.)

That’s what a June 18 Fox Business article explained. “Consumers, already pummeled by surging prices, now have to worry about product shortages,” it began.

I’ll admit that’s a rather puzzling statement considering how we’ve been experiencing shortages ever since the shutdowns began. It began with toilet paper, Clorox wipes, paper towels, and hand sanitizer…

And quite possibly your favorite small-brand food or drink as mom-and-pop-ish producers found themselves in sudden, dire, shutdown-specific straights.

In 2021 then, as Market Realist helpfully reminds us:

“Food products in short supply… included baby food, Hot Cheetos, cream cheese, strawberries, and… poultry products, including chicken wings.”

The computer chip shortage, I’m pretty sure, didn’t begin until 2021 as well. And, of course, there were all the “everything else” shortages that had people buying their Christmas presents in October. Or earlier.

Then there’s 2022. Well before that June 18 article was published, we were seeing:

- Baby formula shortages

- Beef shortages

- Worsening chicken shortages

- Continuing cream cheese shortages…

And I’m sure you can add to the list. Any of the lists above, for that matter.

Like it or not, shortages have been part of our lives for the past two years+. It’s our sad reality.

The Hot Sauce Situation

So, again, I’m not really sure what editor let that “Consumers… now have to worry about product shortages” story slip past him or her.

It’s not the best lead ever, to say the least. But I do have to say the actual article was pretty solid, especially when it came to describing the hot sauce situation:

“In April, Huy Fong Foods, Inc., the nation’s leading sriracha sauce manufacturer, sent a letter to customers about an impending shortage, which would directly impact retailers and restaurants.

“‘Unfortunately, we can confirm that there is an unprecedented shortage of our products,’ Huy Fong Foods told Fox News Digital in an email.

“‘We are still endeavoring to resolve this issue that has [been] caused by several spiraling events, including unexpected crop failure from the spring chili harvest,’ the email continued. ‘We hope for a fruitful fall season and thank our customers for their patience and continued support during this difficult time.”

Apparently, the issues first began in July 2020, when chili pepper inventory was first effected. And it’s only gotten worse since.

In that, it’s pretty standard for all the other shortages we’re dealing with at this point. By that I mean it’s not just one thing that’s causing the problem.

People want to blame the war in Ukraine for our have-not situation. And that definitely factors in. Others point out China’s ongoing lockdowns. And that factors in, too.

But so do numerous other issues, including inexplicable factory drama – such as planes crashing into production facilities – untimely weather events, and other world-stage dramas.

Essentially, it’s a complicated mess that we can’t seem to escape for the time being. Which means we have to deal with it appropriately.

Housing Remains Pretty Hot, Too

Here’s another category that’s in short supply: homebuilding materials. To quote MarketWatch from earlier this month:

“‘In the last three years, the cost to build a home in the U.S. has risen at an unprecedented rate,’ wrote the authors of Bank of America’s 2022 ‘Who Builds the House’ report, released June 8.

“A key driver of higher home prices is the shortage in building materials.

“‘The way homebuilders describe the supply chain right now is whack-a-mole,’ Rafe Jadrosich, an analyst at Bank of America and a co-author of the report, told MarketWatch, ‘where every time they find one thing that they fix, another one pops up… there’s always a new category that’s creating the bottleneck.’”

Now, you might have seen articles recently proclaiming that home prices are coming down. But that’s only some houses in some areas.

Consider this from The Wall Street Journal:

“Home-buying demand continues to exceed supply, buoying home prices to new highs. The median existing-home price rose 14.8% in May from a year earlier to $407,600, a record in data going back to 1999, NAR [National Association of Realtors] said.

“Economists surveyed by The Wall Street Journal had expected a 3.6% monthly decline in sales of previously owned homes, which make up most of the housing market.”

There might have been some slight slowing in demand. But not enough to change current supply issues.

That’s why I’m still more than willing to highlight these homebuilding bargains. Because I still see them making money from here.

Some Homebuilding Risks to Consider

Alrighty then. Here’s our current situation…

As buying become less affordable for more people due to rising rates, price gains will slow. 30-year mortgage rates have risen to almost 6% from 3% in 2021.

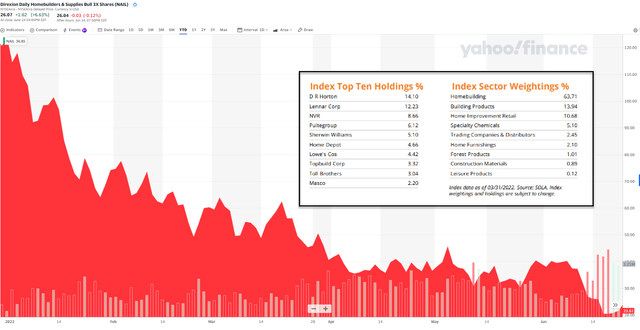

(Yahoo Finance: Ticker: NAIL)

After jumping 17.3% last year, home prices are expected to increase by “just” around 4% during 2022. As Jack Hough recently pointed out in Barron’s,

“Home equity is said to be hitting record highs.”

Moreover, “taking comfort there would be like slipping on a financial toupee – everyone knows that underlying conditions have deteriorated.”

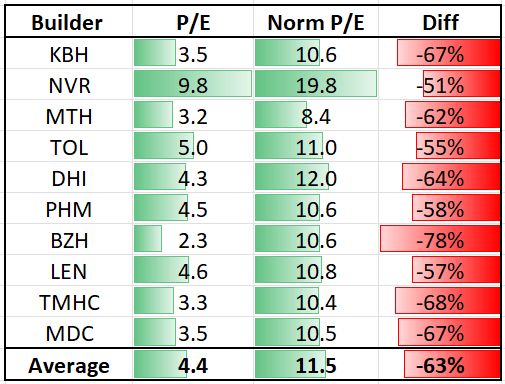

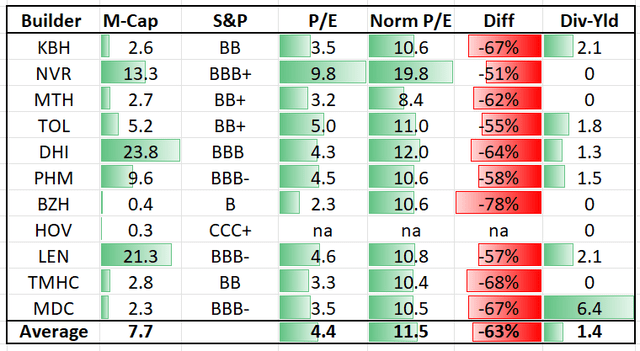

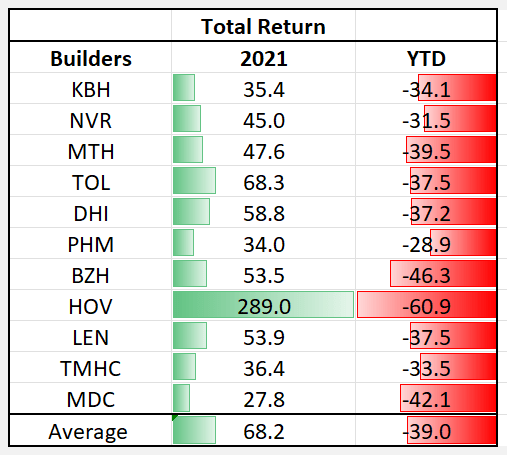

It’s true. Homebuilding stocks have been crushed as investors worry that surging rates will dampen activity in 2H-22 and 2023. The result is that the industry now has the lowest earnings ratio in the stock market, at about 4x projected 2022 earnings.

(Source: iREIT on Alpha)

They’re also the second-worst performing group in the S&P 500 Index this year. Only home-furnishing shares have done worse.

So this following fact Hough pointed out makes sense:

“This past week, a pair of online brokers with a good read on house searches, Redfin (RDFN) and Compass (COMP), announced layoffs.”

All things considered, homebuilders “now trade at 60% of projected book value, which is where they tend to bottom during recessions, ignoring the 2008 financial crisis.”

This makes these stocks too cheap to resist, especially since their land values should help put a floor under them. They’re currently trading well below their implied liquidation value.

Besides, demographics are favorable as millennials move out of city apartments in search of more space in the suburbs.

As you’ll soon see, the builder industry is in the best shape ever… with strong balance sheets and increasing capital returns to shareholders, mostly through stock repurchases.

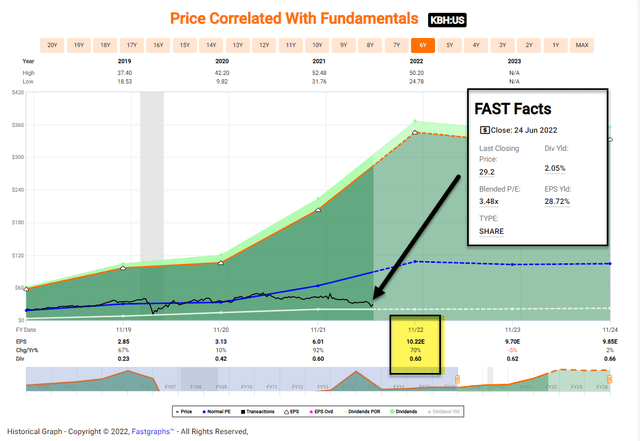

Screening for the Best Builders, Beginning With KB Home

KB Home (KBH) is a 64-year-old Los Angeles-based company that builds mainly in Sunbelt states such as Texas, North Carolina, and Arizona. Yet its portfolio is geographically diverse, with less concentration in the West Coast region.

Its shares traded at $38 in January 2020 and are now at $29.02, with a dividend yield of 2.1%. Shares returned 35% in 2021, yet they look cheap, trading at 3.5x price-to-earnings (P/E).

(FAST Graphs)

KBH significantly stepped-up profitability in Q2-22, expanding its homebuilding operating margin by more than 400 basis points (bps). That was a 15%+ increase, which helped grow diluted earnings per share (EPS) by 55% to $2.32.

The company has a backlog of more than 12,300 homes at a value of over $6.1 billion. And it’s already sold all it needs to achieve delivery and margin expectations for the year.

Over the past year, KBH returned nearly $300 million to stockholders. That includes dividends of over $53 million and nearly $240 million in stock buybacks. It repurchased over 6 million shares, or roughly 7% of shares outstanding.

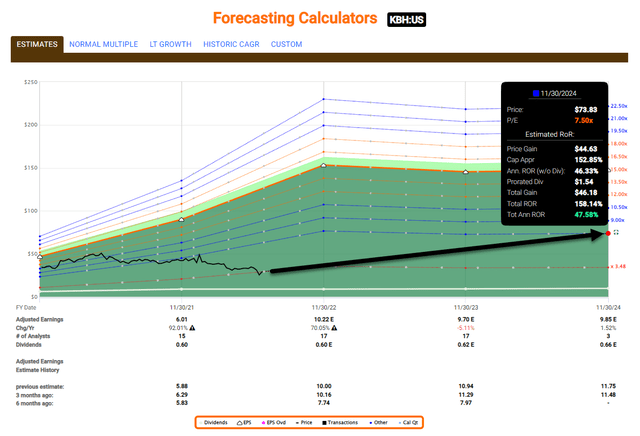

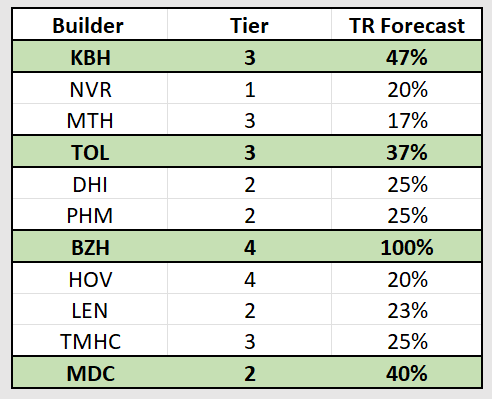

Given KBH’s BB rating from S&P, we rank the builder in our Tier 3 category. Yet our total return forecast is over 45% annually, making this builder one of our tip picks in the category.

(FAST Graphs)

Another 3-Letter Homebuilder

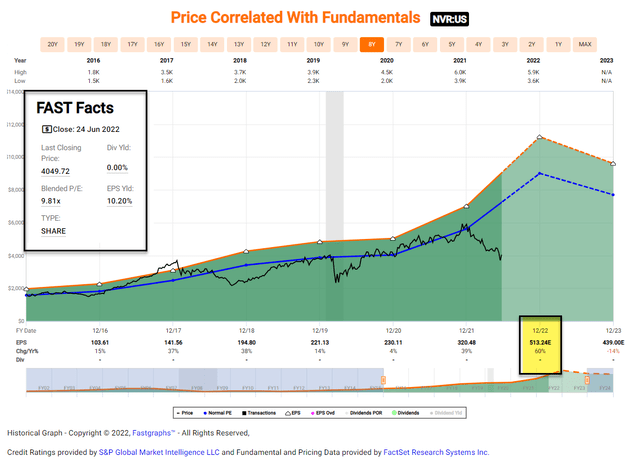

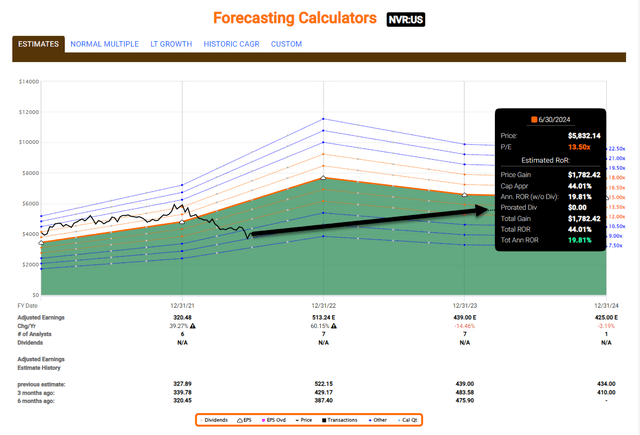

NVR, Inc. (NVR) is a best-in-class builder that’s fared much better than its peers so far, up 45% year-to-date. Its P/E of 9.8x is admittedly higher than many peers though, and it doesn’t pay a dividend.

The company builds under brands like Ryan and Heartland in the Carolinas, Tennessee, and Florida, as well as the mid-Atlantic.

(FAST Graphs)

NVR generally doesn’t engage in land development. Instead, it acquires finished building lots from various third-party land developers pursuant to fixed-price finished lot-purchase agreements.

Also, NVR constructs homes primarily on a pre-sold basis and utilizes a conservative acquisition strategy. This has led it to become the third-largest player in its market.

This homebuilder deserves a Tier 1 rating as the only one with a BBB+ rating. At the end of March 2022, it controlled approximately 124,600 lots under LPAs with third parties through deposits in cash and letters of credit totaling approximately $529 million and $8.8 million, respectively.

NVR’s consolidated Q1 revenue totaled $2.38 million, a 17% year-over-year increase. And net income was $426,100, or $116.56 per diluted share – increases of 71% and 84%, respectively.

Analyst forecasts for 2023 aren’t as strong as the others, we know though. So while we admire NVR’s health balance sheet, we believe there are better opportunities out there to look at.

(FAST Graphs)

Homebuilding for First Timers

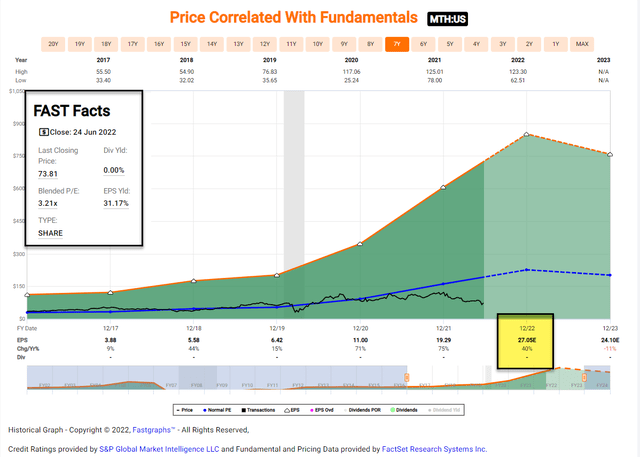

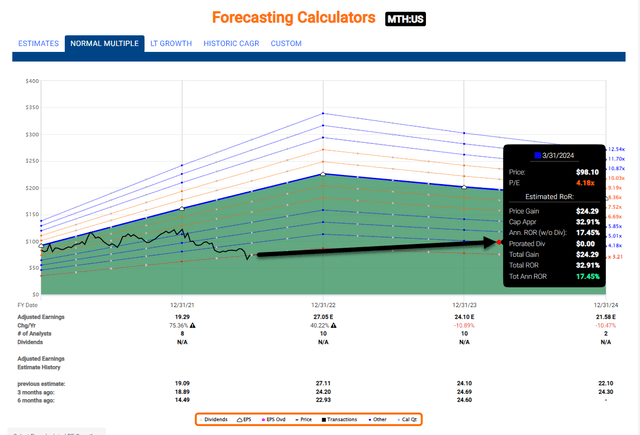

Meritage Homes Corporation (MTH) is a Sunbelt builder based in Phoenix, Arizona. It focuses on entry-level buyers with an average sales price of around $400,000.

The company is over 36 years old and is focused in Arizona, California, Colorado, Texas, Florida, Georgia, North Carolina, South Carolina, and Tennessee. And it recently announced expansion into Salt Lake City, Utah.

The stock has risen by more than 47% in the past year. But its P/E is now just 3.2x, about 62% below normal valuation levels.

(FAST Graphs)

In Q1-22, MTH set multiple company records:

- Highest quarterly sales order volume

- Second-highest first quarter of home closings

- Highest quarterly home closing gross margin

- Highest first-quarter of home closing revenue.

On its last earnings call, MTH said:

“We believe the underlying demand for these demographic groups will remain solid. We continue to sell homes shortly after releasing them so far in April, and we are still metering sales in many communities.

“We recognize that the recent surge in interest rates and six quarters of strong pricing power will eventually impact both buyer psychology and affordability. To alleviate some uncertainties for our customers, in March, Meritage purchased retroactive interest rate locks on all of the eligible floating-rate loans for homes in our backlog that are scheduled to close in the second half of 2022.”

MTH maintains a strong balance sheet and ample liquidity. Its cash balance is $520 million, down from $618 million at last year’s end, primarily stemming from land spend.

The company’s net debt to cap remains low at 16.9% compared to its maximum target in the high 20s. And it has no debt maturities until 2025.

We put MTH as Tier 3 based on its BB+ S&P rating and lower 2023 analyst estimates. Altogether, our total 12-month return target is 17%.

(FAST Graphs)

Another Big Builder

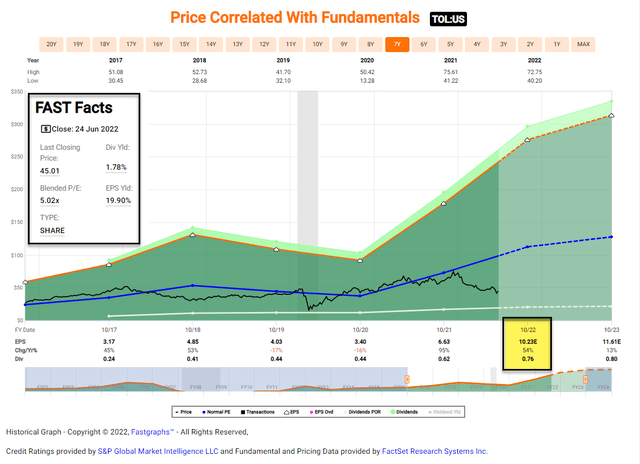

Toll Brothers, Inc. (TOL) was founded in 1967 and listed (on the NYSE) in 1986. Today, it’s the fifth-largest U.S. homebuilder (based on revenue) and is currently building in 24 states across about 60 markets.

Toll focuses on luxury assets with a strong presence in active adult markets and urban/suburban communities. Around 30% of its customers pay cash and therefore aren’t put off by high mortgage rates.

TOL returned 68% in 2021 but has dipped almost 38% in 2022.

(FAST Graphs)

In Q2-22, TOL delivered a record 2,407 homes at an average price of approximately $908,000. This resulted in record home sales revenue of $2.2 billion, a 19% increase over Q2-21.

The adjusted gross margin of 26.1% was a 170 bps improvement and 60 bps better than guidance. And TOL generated EPS of $1.85, up 83% compared to last year.

Based on the strong pricing and margin embedded in the backlog – with approximately half scheduled for delivery in fiscal year 2023 – TOL expects fiscal year 2023 adjusted gross margin to rise over 2022.

On its recent earnings call, the company said its houses:

“… are generally better insulated from affordability concerns. They tend to have higher incomes in net worth, and many have benefited from significant price appreciation in their existing homes. Approximately 20% of our customers pay all cash, and those who do take a mortgage average approximately 70% loan-to-value. Importantly, our buyers utilizing jumbo loans are benefiting from a rate that remains 0.75 point lower than the conforming rate.”

TOL’s balance sheet is rated BB+, Ba1, BBB- and finished the latest quarter with:

- A 33.1% net debt to capital ratio

- $535 million in cash and equivalents

- $1.8 billion available under its $1.9 billion revolving bank credit facility.

Also, executives and directors own about 9% of shares.

TOL is another Tier 3 pick, with shares trading at a bargain price of $45.0. Its P/E multiple is just 5x compared to the norm of 11x. And its dividend now yields 1.8%.

Analysts forecast growth of 13% in 2023, which supports our buy thesis and total annualized return expectations of 37%.

(FAST Graphs)

Homebuilder Horton Hears a Cha-Ching!

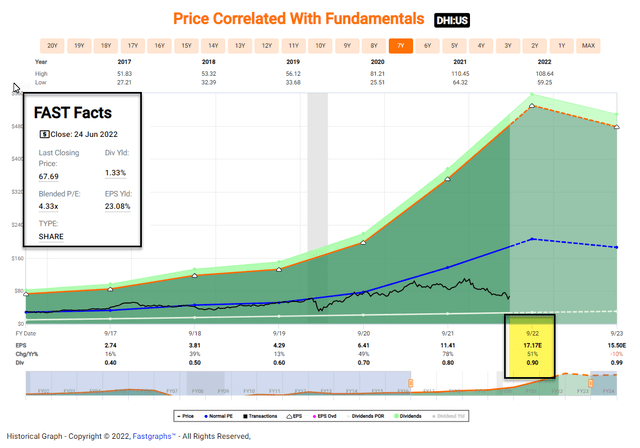

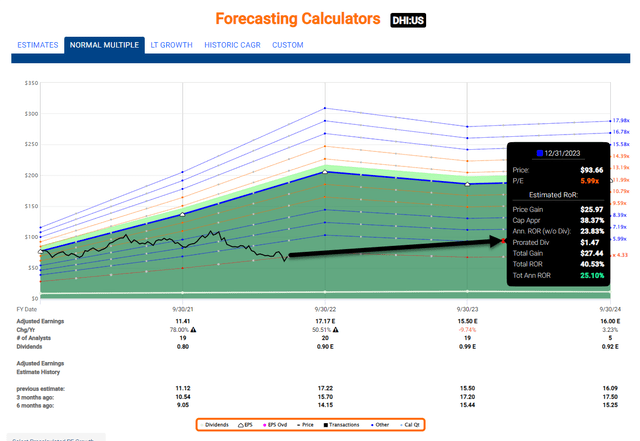

D.R. Horton, Inc. (DHI) has been the largest U.S. homebuilder by volume since 2002.

Founded in 1978 in Fort Worth, Texas, it sells entry-level, move-up, active adult, and luxury properties in 98 markets across 31 states. Over half close above $300,000.

DHI returned just under 60% in 2021 and has fallen around 38% year-to-date.

(FAST Graphs)

Yet last quarter, it saw a 59% increase in earnings to $4.03 per diluted share. Also, its consolidated pre-tax income increased 60% to $1.9 billion on a 24% revenue hike.

Homebuilding return on inventory for the trailing 12 months ended March 31 was 40.3%. And consolidated return on equity (ROE) was 34%.

After starting construction on 24,800 homes in Q2, DHI’s inventory increased 30% year-over-year, with only 600 unsold completed homes left. With 33,900 in backlog and 59,800 homes in inventory, DHI remains well-positioned for consolidated revenue growth above 25% in 2022.

Rental operations generated Q2 pre-tax income of $103 million on revenue of $223 million. It sold one 126-unit multifamily rental property for $50 million and three single-family ones totaling 368 homes for $173 million.

Rental inventory was $1.5 billion compared to $544 million a year ago.

DHI expects total rental platform inventories to grow by over $1.5 billion in fiscal 2022 based on current projects and a significant pipeline.

Its BBB balance sheet makes it a Tier 2 homebuilder. And it has $3.2 billion of liquidity – $1.2 billion of unrestricted cash and $2 billion of available capacity on its revolving credit facility – and just 16.4% in leverage.

Shares trade at $67.69 with a 4.3x P/E against a 12x norm. Their dividend yield is now 1.3%.

We maintain a Buy with a 12-month total return forecast of 25%. But…

We personally prefer the next Tier 2 pick.

(FAST Graphs)

Without Further Ado

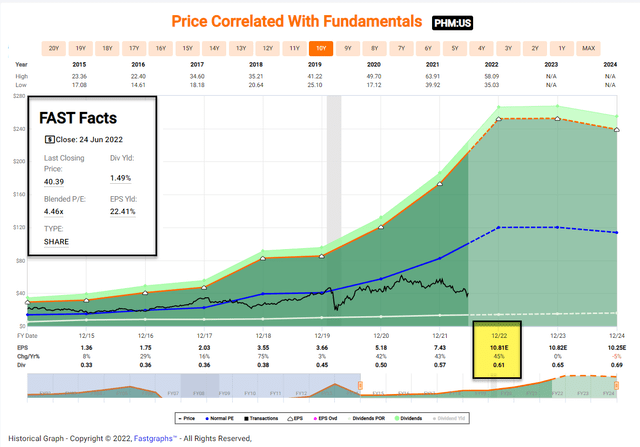

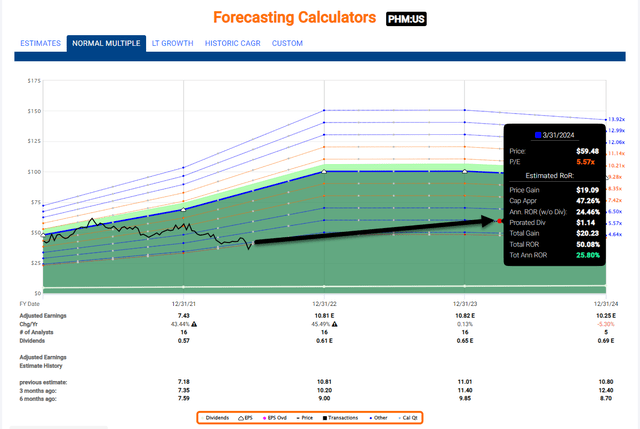

PulteGroup, Inc. (PHM), the nation’s third-largest homebuilder, was founded 70 years ago. It’s delivered almost 750,000 homes with operations in 23 states across 42 major markets.

The portfolio includes brands such as Centex, Pulte, Del Webb, DiVosta, John Wieland Homes and Neighborhoods, and American West. And while shares rose about $34 in 2021, they’ve since dropped by more than 29% year-to-date.

(FAST Graphs)

Even so, PHM Q1-22 results were outstanding, with 18% year-over-year growth and 43% in adjusted EPS. That reflects gains in higher selling prices, expanded gross margins, increased overhead leverage and an active share repurchase program.

As PHM explained on its earnings call:

“… it’s fair to say that the supply/demand dynamics of the first quarter were consistent with the trends the industry has been experiencing for the past year or more. In short, demand was strong, available inventory was scarce, and the incoming supply is limited.”

Higher Q1 revenue was driven by an 18% increase in average sales price to $508,000. While closings of 6,039 homes were consistent with 2021.

The company expects to deliver between 7,200 and 7,600 in Q2-22, and around 31,000 for the year. That would be a 7% year-over-year increase.

After allocating approximately $1.6 billion to business investments and share repurchases, PHM ended Q1 with $1.2 billion of cash and a 21.5% gross debt-to-capital ratio. And Moody’s recently noted its operations and overall financial position by upgrading its senior unsecured rating from Baa3 to Baa2.

PHM is rated Tier 2, and trading at just $40.39 with a P/E of 4.5x compared to its norm of 10.6x. Its dividend yield is 1.5% and while analysts are forecasting no growth in 2023…

Our total-return estimate is 25% over the next 12 months.

FAST Graphs

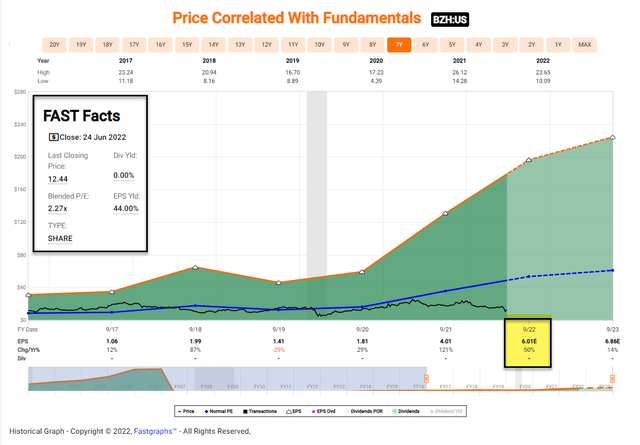

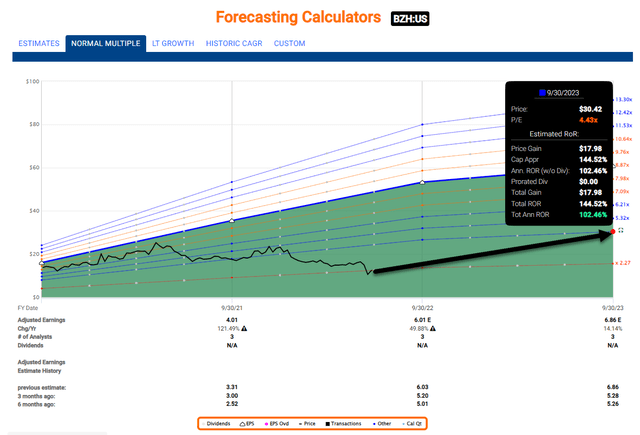

Beazer Builds Homes – Lots and Lots of Them for a Long Time

Beazer Homes USA, Inc. (BZH) has been building homes for over 50 years and has been listed on the NYSE since 1994.

Atlanta-based, it’s one of the nation’s top homebuilders, selling in Arizona, California, Delaware, Florida, Georgia, Indiana, Maryland, Nevada, North Carolina, South Carolina, Tennessee, Texas, and Virginia.

Shares returned over 53% in 2021, but have slid by 46% year-to-date.

(FAST Graphs)

On its Q2-22 earnings call, BZH said:

“The level of unsold inventory of both new and used homes is at historically low levels. In fact, there is only a quarter of the unsold inventory that existed in 2006, which helps explain the strength in the current pricing environment even as rates have risen.”

Though its CEO cautioned that “the risk of foreclosures, defaults, or the removal of liquidity… could disrupt the housing market.”

He added:

“The credit quality of the loan book is high, loan-to-value ratios are near historical lows and, importantly, there are almost no adjustable-rate loans with looming pricing resets.

“So considering demand, supply and the mortgage market, we think the multiyear context for new home activity, it’s pretty positive.”

Of course, “the obvious threat facing our industry is affordability.” There’s no point in building if consumers can’t pay for the product.

BZH expects return on total ’22 equity to be greater than 22%, or nearly 30% excluding deferred tax assets. It ended Q2 with over $400 million of liquidity comprised of unrestricted cash of approximately $164 million. And there was nothing outstanding on its revolver, with no bond maturities until 2025.

BZH anticipates its net debt to earnings before interest, taxes, depreciation, and amortization (EBITDA) will be in the low-2s and net debt to net cap in the 40s. Rated B by S&P, it’s a Tier 4 pick, with analysts forecasting 14% EPS growth in 2023.

Though trading at just 2.3x, it is one of the riskiest we’re listing today: more of a “cigar butt” pick. Shares are trading at $12.44, and we forecast it could easily grow to $20 a year from now.

(FAST Graphs)

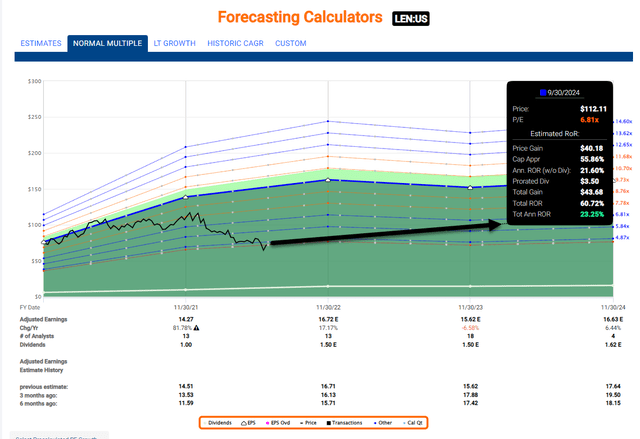

Miami-Based Homebuilding

Lennar Corporation (LEN) was founded in 1954 as a Miami homebuilder. It completed its IPO in 1971 and listed shares on the NYSE in 1972.

This is the largest U.S. homebuilder based on revenue and net earnings. And in addition to homebuilding, it originates residential and commercial mortgage loans, provides title insurance, and develops multifamily rentals.

LEN grew by almost 54% in 2021 and has since swung back by over 37%.

(FAST Graphs)

Last week, it reported Q2 earnings that were better than expected. Its Q3 guidance shows that its homebuilding margins are holding up even as mortgage rates continue to rise.

In addition, it sees signs of supply chain issues starting to ease, with Co-CEO and Co-President Jon Jaffe saying:

“Our cycle time during the quarter increased only slightly sequentially. So it appears that the well documented supply chain issues have started to subside.”

LEN’s gross margin was 29.5%, and net margin was 23.4%. And it continues to drive very strong cash flow and bottom-line results.

The homebuilder ended Q2-22 with $1.3 billion in cash… no borrowings under its $2.6 billion revolver… and homebuilding debt to capital of 17.7%. Rated BBB- by S&P, LEN is a Tier 2 pick that should further benefit from the pending sale of a real estate technology unit.

Shares trade at $71.93 with a 4.6x P/E against a 10.8x norm. Its dividend yield is 2.1%, and we forecast shares to return north of 20% annually.

(FAST Graphs)

A Definite Old-Timer

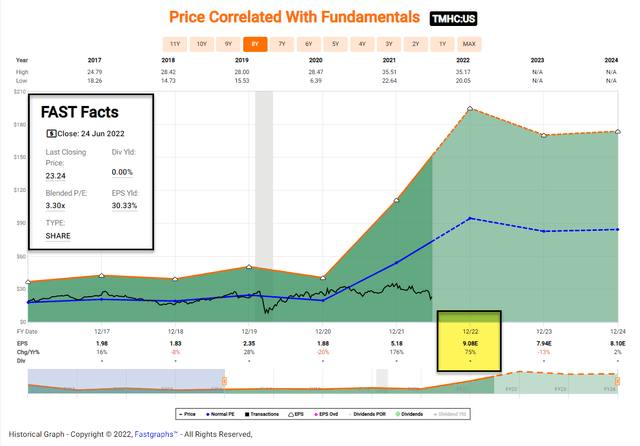

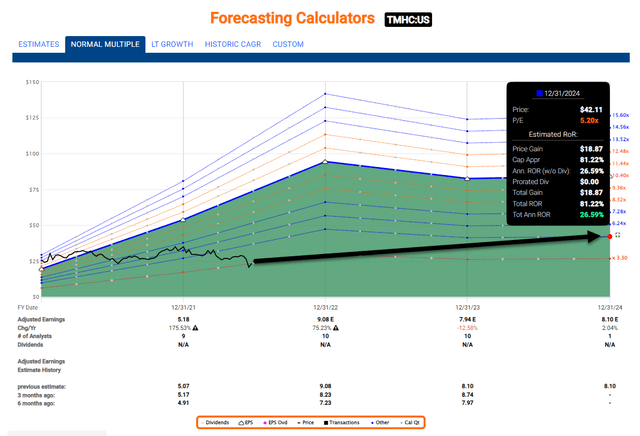

Taylor Morrison Home Corporation (TMHC) dates back to 1880 and has been recognized as America’s most trusted homebuilder. Today, it enjoys a top-10 market position in 18 of its 21 markets, including top five in 11.

It traditionally operates under the Taylor Morrison and Darling Homes brand names. And during 2020, it acquired William Lyon Homes, including the William Lyon Signature brand name.

Taylor also provides:

- Financial services through its wholly owned mortgage subsidiary, Taylor Morrison Home Funding

- Title insurance through Inspired Title Services

- Homeowner’s insurance policies through Taylor Morrison Insurance Services.

Shares returned over 35% in 2021 but have fallen by 33% year-to-date.

(FAST Graphs)

In Q1-22, its home closings gross margin improved 450 bps year-over-year to the strongest level since 2013. It reaffirmed its 2022 home closings guidance of 14,000-15,000 deliveries. And it raised its 2022 home closings gross margin guidance to at least 24.5%.

Similar to TOL, TMHC focuses on higher-end borrowers. Its last reported backlog involved 82% of borrowers qualifying for conventional loans with strong financial positions so they can absorb higher rates.

TMHC is a Tier 3 homebuilder rated BB by S&P. Its solid balance sheet has over $1.4 billion of total liquidity – including $569 million of unrestricted cash and $847 million of undrawn capacity on the revolving credit facilities.

The company’s net debt to capitalization is 35.7%. And it remains on track to reduce net debt to capital to the mid-20% range by year-end.

Personally, we prefer TOL as the Tier 3 pick, and THMC doesn’t pay a dividend. But it’s trading at $23.24 with a P/E of just 3.3x.

Note, for REIT diehards, STORE Capital (STOR) Non-Executive Chairman Tawn Kelley is also executive VP and president of TMHC’s financial services unit.

(FAST Graphs)

I Like This One

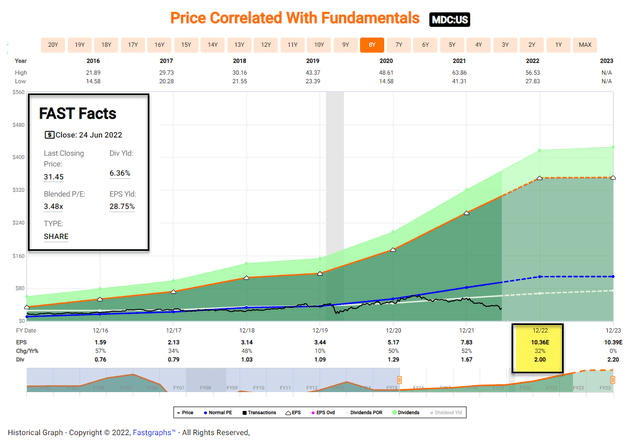

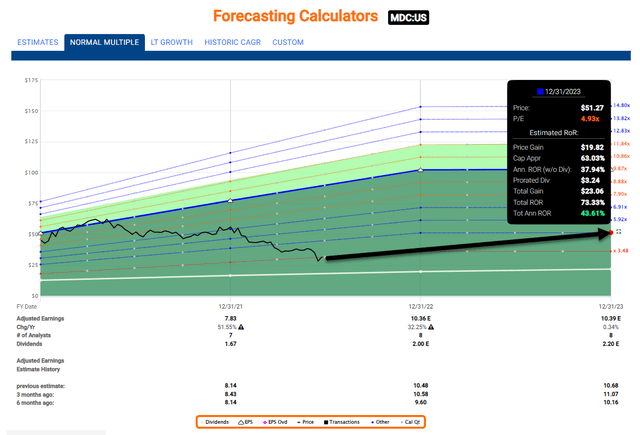

M.D.C. Holdings, Inc. (MDC) was founded in 1972 and is one of the leading homebuilders in the U.S. Through its Richmond American Homes subsidiaries, it’s helped over 220,000 buyers move into new quality homes across the country.

MDC has paid an “uninterrupted” cash dividend since 1994, with a 25% increase in October 2021. That’s up 35% year-over-year.

It’s also the highest-dividend-yielding homebuilder at 6.4%.

Shares returned over 27% in 2021 but have dropped by over 42% since.

(FAST Graphs)

In Q1-22, MDC generated net income of $148.4 million, or $2.02 per diluted share. This was a 34% increase from Q1-21.

Pretax income from the homebuilding operations increased $75 million, or 66%, from Q1-21 to $188.5 million – driven by home sale revenues, which rose 19% year-over-year to $1.24 billion. And gross margin from home sales improved 380 bps to 25.7%.

Also, in Q1-22, the average selling price of homes delivered rose 16% to about $556,000. This was the result of:

- Price increases implemented over the past year

- A shift in the mix of closings from Nevada to Northern California markets.

MDC expects Q2 home deliveries of between 2,400 and 2,600 units, with an average selling price of $560,000-$570,000. Full-year guidance stands at 10,500-11,000 deliveries.

The company’s credit ratings are among the industry’s best, further demonstrating its disciplined approach and strong financial position. Rated BBB- by S&P and Fitch, and Ba1 by Moody’s, MDC is our top Tier 2 pick.

We forecast shares to return around 40% over 12 months.

(FAST Graphs)

I Remember 2008…

As many of you know, I was a real estate developer for over 30 years. And I’ve lived through recessions and now a global pandemic.

While I’m confident the next recession won’t be nearly as devastating as the “great” one… I want to reflect on losses to determine my appetite for homebuilder risk.

(iREIT on Alpha)

In 2008, I was working alongside some very close friends and business partners who were constructing hundreds of homes across South Carolina. So I witnessed firsthand the tsunami that wiped out their entire business and left banks saddled with losses.

As such, I won’t go all-in. The homebuilder market is somewhat hard to predict right now, since consumers are the one’s holding all the cards.

(iREIT on Alpha)

I can see how many entry-level buyers are feeling priced out as gas, food, childcare, and clothing costs rise. Yet there are many advantages to owning a home, especially in America as part of the “dream.”

I’ve personally owned six houses since graduating from college. And the current roof over my head remains a valuable asset.

After studying the complete list of builders, I’m going to begin buying up shares in certain names. Though I’ll limit my purchases so no more than 5% of my stock portfolio is in homebuilders. And my initial purchases will be less than 2%.

Clearly, the market we’re in now is nothing like 2008. And the U.S. consumer is in much better shape to weather the storm.

I like what I see, and I’m going to start to slowly allocate capital to the sector with hard fast rules…

(iREIT on Alpha)

In Conclusion…

Another way to take advantage of homebuilders is to sell put options on attractive stocks.

Selling put options proportional to the amount of shares you want to own can be a powerful tool. Just make sure you understand the risks involved.

For example, if you like DHI around current levels but want an even better entry point… the DHI August 19, 2022, $67.50 put sells for about $5. That would give you an effective entry point of $62.50 if you were put the shares.

Each put equates to 100 shares. And if the stock doesn’t trade lower through August, you keep the $5 per option sold.

Here are the numbers in context?

That $5 premium equates to an immediate 8.0% yield on capital at risk – the strike price adjusted for the cash premium received, or the comparable yield to a regular stock investment.

That’s over six times DHI’s common dividend yield for a contract expiring in mid-August.

If we were to theoretically repeat this over and over again for one year, the annualized yield would be well over 50%.

That’s the power of puts… when done right.

Be the first to comment