The Good Brigade/DigitalVision via Getty Images

Co-produced with Beyond Saving

Introduction

What are your investing goals? Why do you have a large sum of money invested in the stock market? Sure, you want that sum to grow. But for most of us, the primary reason for investing is not to “get rich.” That might sound weird on the surface, but the reality is that very few have aspirations of actually using the market as a career.

Most of you had a career in a field that had nothing to do with the stock market. You went to work, and you worked hard. Some of you rose to the top of your particular field, and some of you might have made a living prioritizing other aspects of life.

Regardless of your background, whether you were a blockbuster star in Hollywood or a manager at the local fast-food joint, you are probably looking for the same thing in your retirement. Namely, the ability to support your current lifestyle without going to work every day. You’ve had your career, you funded a particular lifestyle, and you want to maintain the trappings you have grown used to having in retirement.

Ultimately, what most of us are looking to get out of our retirement portfolio, is enough cash flow to make up for the sudden loss of income that occurs when you retire. For your working years, your goal might be to build that nest egg as large as possible, but once retired, what matters is how much income you can comfortably and safely withdraw.

This income needs to be:

- Enough: How much is enough? Well, that will vary. Many will work to pay off major debt like their mortgage so that their cash-flow needs are less in retirement. Cutting your essential monthly expenses, especially debt can go a long way towards a secure retirement. You might also start receiving Social Security, a pension, or other income. On the other hand, you will have a lot more time, and for many people, the more time you have available, the more you spend. Don’t forget to account for needing to fill your time and the reality that filling time often costs money.

- Reliable: You are retiring from a career, and once you retire, it will become increasingly challenging for you to return to work. From physical impediments as you age to the reality that your experience becomes less relevant as time changes everything. If you are forced or voluntarily choose to return to work, most retirees discover they can’t simply get back on the ladder at the same level they were before. Often, they can’t even get employed in the same field. Instead, they end up at entry-level or just above entry-level positions that pay much less than they retired at. The longer you are retired, the less practical it is for you to return to work. You don’t need money just for next year. You will need income 10, 20, maybe even 40+ years into the future. You need to have confidence that your income will continue.

- Growing: You need income for decades, but $20,000 thirty years ago was a lot more money than $20,000 today. Even benign inflation will eat away at the practical value of your income. Since you can’t simply return to work when you’re 95 years old and the past thirty years of inflation has diminished the buying power of your dollars, it is crucial that your income grows at least as fast as inflation.

Note that the goal is not to have the “most” income in a particular year. So how do we create an income portfolio that is enough, reliable, and growing? Let’s look at the Income Method and the types of dividends we use at High Dividend Opportunities (HDO) to ensure that we achieve these goals.

Fixed-Income: Preferreds/Bonds

Pros:

- The dividend is pre-determined and predictable.

- Receiving priority payments over common dividends makes the income more stable even in adverse conditions.

- Ideal for pairing with fixed essential expenses.

Cons:

- Since dividends are pre-determined, the dividends do not grow with the company.

- Capital gains are usually limited and lower than potential gains with common equity.

- Low liquidity might make frequent trading a challenge. These investments are best held for a long time.

Fixed income is an important base for an income portfolio. For HDO, we focus our fixed-income investments in baby bonds and preferred equity. These investments pay out dividends based on a pre-determined agreement between investors and the company. These investments are particularly important during times of uncertainty. When companies are slashing their dividends, fixed income can be a source of stability.

I typically recommend having your portfolio 35-45% allocated to fixed-income. How do you know how much you should have? One great way to do it is to pair your fixed-income dividends with your non-negotiable expenses.

In everyone’s budget, there are the things that you must pay for. Any debt payments like a mortgage, property/vehicle taxes, utility bills, etc. The bills that absolutely need to be paid and you have little to no ability to be flexible on. It is a good idea to have these bills covered by the most stable and predictable income sources. If you have relatively high essential bills, you probably want to be more conservative and higher-weighted towards fixed-income.

We like preferred stocks as a fixed-income solution because it allows us to collect enough. At an average of 8% yield, the HDO preferred portfolio will provide reliable income at a high yield.

Stable Dividend Payers: Common Equity

Pros:

- These stocks have predictable dividends as the company has a history of paying out certain amounts that it intends to maintain.

- Dividends are frequently raised in conjunction with the growth of the company.

- Investors can also enjoy substantial capital gains potential.

Cons:

- Dividends are at the discretion of management and the Board. A change in strategy or conditions can impact the trajectory of dividend growth.

- Unexpected dividend cuts can damage both income and price.

- Some companies might overpay the dividend to attract investors. Overpayment can result in an increased risk of future cuts or the deterioration of the capital base, so capital losses offset the oversized dividend.

The next part of an income portfolio is the stable dividend payers. By stable, I mean common equity stocks that will set a dividend and be biased towards keeping it the same every quarter. Some might have had the same dividend for a decade. Others might raise at regular intervals, like once a year. You can expect the company to maintain or raise the dividend unless something goes wrong. However, unlike “fixed-income,” where the dividend is pre-determined, these dividends are subject to the Board of Directors deciding what is appropriate. They are stable because of tradition and consistent performance, not an agreement with investors.

These are the most common dividends, and you can track a company’s performance over the years. Some, like W. P. Carey (WPC), have developed a track record of raising the dividend every single quarter. An entire segment of investors focuses on “dividend aristocrats,” companies that have raised their dividends every year for 25 years – an impressive testament to the stability of a company through various market cycles.

For income investors, these opportunities are wonderful because you get a known dividend today and the potential for dividend growth in the future. If you see a company that has maintained or grown its dividend for many years, that can create confidence that the trend will continue.

However, do not forget that past results do not project future success. Stable dividend payers can turn south very quickly if a dividend is cut. Investors have come to expect the dividend and to expect it to be reliable. If circumstances force the dividend to be reduced, the company’s valuation will be impacted, causing both a loss of income and value.

We have also seen companies that overpay, attracting investors with an unsustainable dividend to the detriment of the company’s performance. Investors need to be wary and do their due diligence to ensure that the dividend is covered by cash flows and is not a “sucker yield.”

Stable dividends are great, but they must also be watched closely for any risks of a dividend cut. The best way to protect your income is to have diversity. With about 2% allocation to any single ticker, you will be insulated from the negative impacts of any single ticker having a surprise cut.

A well-diversified portfolio of stable dividend payers is the bread and butter for most income investors. You receive a generally predictable flow of income, frequent dividend growth, and potential for capital gains.

Variable Dividend Payers

Pros:

- The dividend directly reflects the profits of the company or fund. The dividend amount is usually calculated systematically and will go up or down with the results.

- The investment is never “overpaying” or “underpaying” the dividend.

- Since the dividend adjusts frequently, reductions or raises quarter to quarter do not have an outsized impact on the share price.

Cons:

- Variable dividends can make personal budgeting more challenging since you don’t know how much you will receive next quarter.

- Most sources of dividend data do a very poor job reporting variable dividends. Reported yields and amounts often do not reflect the likely reality.

- The best time to invest is when the dividend is the lowest.

We have a few holdings in the HDO portfolio that pay out an explicitly “variable” dividend. This means that the dividend changes quarterly based on some pre-determined criteria. For example, Tekla Healthcare Investors (HQH) pays out a dividend equal to 2% of NAV (net asset value) each quarter. In the past ten years, its quarterly dividend has ranged from $0.31 to $0.71. That is quite a range!

A CEF (closed-end fund) like HQH is required to distribute substantially all of its taxable gains. Yet overdistributing can eat away at a CEF’s assets and diminish its ability to pay out dividends in the future. By setting the dividend policy at 2% of NAV each quarter, HQH ensures it is distributing enough to meet its distribution requirements while ensuring it will never distribute too much.

From the income investor’s standpoint, you can be assured that the dividend policy is sustainable indefinitely. The fund will never overdistribute. At the same time, you can be assured during tough times that when the market recovers, you will share in the upside with a higher dividend. You are not reliant on waiting for management to decide when it is safe enough to raise the dividend back up, instead, it is raised automatically!

We often talk about the importance of “stability.” In retirement, it is crucial that you have enough stability in your income to never worry about covering your essentials. Once those essentials are met, there is a list of wants. The things you would like to do if you had some “extra” money.

This is where variable dividends come in, providing some upside to your income. You might have received a “bonus” from your employers during your working years. A little surprise check that was above and beyond your “normal” income. This is a great way to think of variable payers. Sometimes the dividends will be larger than others.

Some make the mistake of trying to chase variable dividend payers. For example, they will sell when the declared dividend is lower and buy when the dividend is higher. Their plan is that they are cleverly holding it only when it is paying more. However, the problem is that usually, the best time to buy is when the dividend is the lowest!

Why? Investing 101: You want to buy low. A CEF like HQH is paying out based on a percentage of NAV. A lower dividend means that the price is low. A higher dividend means that the price is high.

Variable dividend payers are excellent investments to buy and hold for the super long-term. Their dividend policy is sustainable indefinitely, and you know that the dividend will match the long-term performance of the company/fund. The year-to-year volatility might be significant, but the dividends will be immense in the long term.

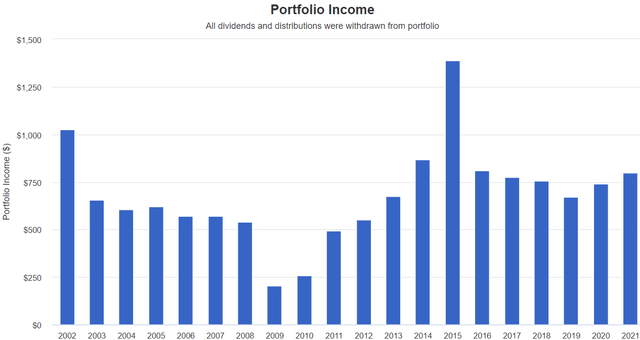

Here is a look at HQH over the past 20 years.

HQH Dividends Received $10k Investment No Reinvestment (Portfolio Visualizer)

Some years were higher than others, with the cumulative dividends exceeding 135% of the original investment, and the investor would still have the same number of shares producing a healthy income.

Getty

Conclusion

When you are in retirement or preparing for retirement, it is important to keep the main goal in focus. The goal of The Income Method is that you will never be forced to sell a share of stock to fund your cash needs. We build a stream of cash flow that is substantial enough to fund our regular cash needs, with excess to reinvest allowing our income to grow and increasing the number of shares we own even when we are withdrawing cash to fund our lifestyles.

When constructing your portfolio, make sure you are taking into account the types of dividends you are collecting. Make sure your essential bills are covered by the most secure dividends you can find. Fixed-income investments are great options to play this role, providing very predictable and stable cash flow.

You also want a component that is going to have growth potential. After all, many of your bills are going to go up with inflation. Your income will grow from reinvestment, but having some chronic dividend raisers in your portfolio will cause your income to compound more quickly – common equity investments that provide stable dividends provide dividend growth opportunities and capital gains opportunities. They are often the workhorse of an income portfolio, that you can buy when they are cheap and swap out into higher-yielding opportunities when they become popular.

Finally, consider some variable payers. These are companies or funds that will payout a variable dividend based on the performance of a particular metric such as NAV or core income. The dividend will rise and fall with the economic conditions, which means that the investors are always being paid a “fair” amount. When the investment does better, your income goes up immediately. When the investment slows down, your income goes down.

Should you limit your exposure to variable payers? Well, that depends on your personal budget. Some of you might have worked in commission-only sales, so the prospect of your income varying year to year is something you are comfortable dealing with. Others might be bothered by not being able to accurately predict what the dividend might be over the next year. Only you can answer the question of what is appropriate for you.

At the end of the day, the essential thing is to ensure that you are spending less than your income, that you have enough to reinvest (I suggest a minimum of 25%, but the more the better), and that you are not relying on selling shares to fund your retirement. You want to focus on growing your portfolio, not cannibalizing it to fund your lifestyle.

Be the first to comment